56 Undervalued Dividend Stocks to Buy Before 2026

Exclusive list of dividend bargains I’m tracking this month before the market re-prices them.

Every month, premium subscribers get exclusive access to my full dividend stock spreadsheet - a curated list of undervalued opportunities built on strict, time-tested metrics.

For December, 56 stocks made the cut. Each one screens as undervalued, income-producing, and positioned for strong upside. If you’re looking to pick up high-quality bargains before the market wakes up, this list shows you exactly where to look - but the full breakdown is available only to paid members.

How We Identify Undervalued Stocks

When we say a stock is “undervalued,” we’re not guessing - we’re applying a set of proven, repeatable filters that help us pinpoint opportunities where income and growth align.

Here’s the first pillar of our process:

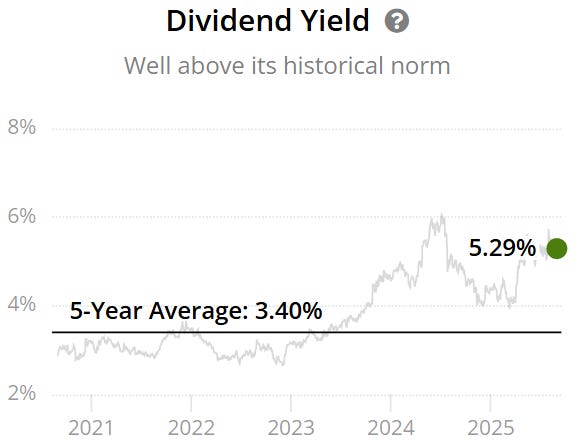

1. Dividend Yield Theory

A stock may be undervalued when its current dividend yield is meaningfully above its 5-year average.

Example:

A company yielding 5.29% today versus a 5-year average of 3.40% suggests the market is pricing it below fair value.

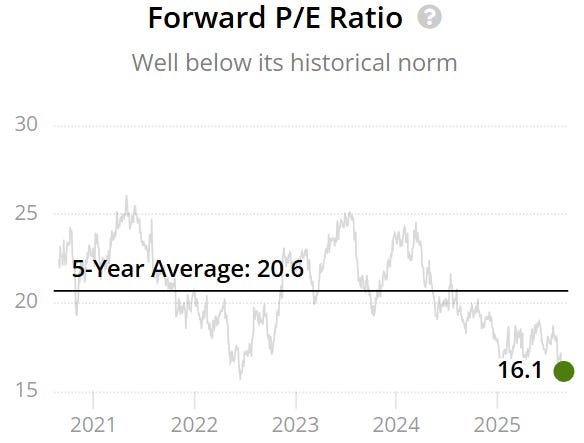

2. Attractive Valuation

We favor stocks with forward P/E ratios that sit meaningfully below their historical averages - a classic sign that the market may be undervaluing future earnings.

Example:

A forward P/E of 16.1x versus a 5-year average of 20.6x indicates the stock may be trading at a discount.

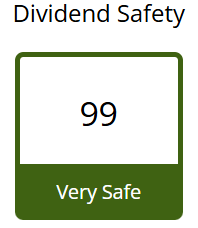

3. Dividend Safety (Score: 60+)

Dividends only matter if they’re built to last. That’s why we focus on companies with strong dividend safety scores - typically 60 or higher - to ensure their payouts are stable, well-covered, and sustainable over the long term.

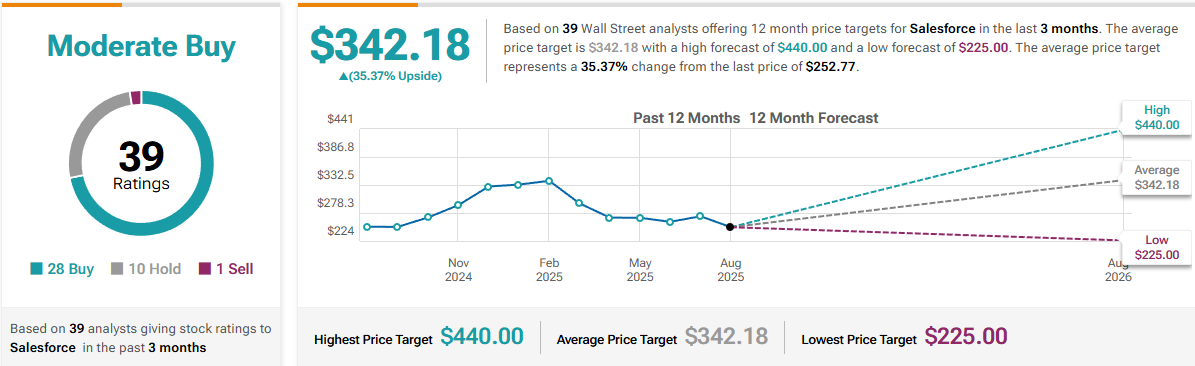

4. Upside Potential (15%+)

Dividends are great - but growth matters too. We target stocks with at least 15% medium-term upside, giving us a balanced blend of reliable income and meaningful capital appreciation.

5. Strong Balance Sheets

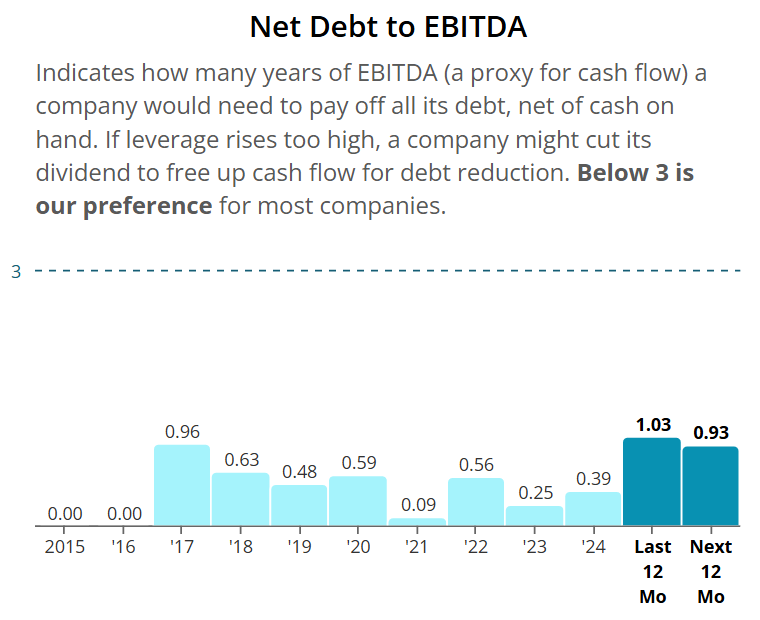

Healthy financials are non-negotiable. We prioritise companies with Net Debt/EBITDA below 3x, and for REITs, a slightly higher threshold of below 5.5x.

This helps ensure they can manage debt responsibly, maintain flexibility, and continue funding growth without putting dividends at risk.

December Spreadsheet Below

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.