6 Investing Mistakes

+ Market Update

Market Latest

Last week we had the worst day in the market since December 2022, and we can see that the S&P 500 had a 1.76% decline.

This may have felt like a massive drop purely down to the fact that the S&P 500 was on the longest streak without a 2% decline for 350 trading days - the longest run in 17 years!

Some of the biggest losers last week included the magnificent 7, where approximately $1.7 trillion in value was erased just over the last 2 weeks.

Part of this sell off was inspired from the latest batch of earnings which included both Tesla and Google, the first two of the magnificent 7 to kick off the summer earnings season.

Visa also reported last week which showed us that there are some signs of a weakening consumer.

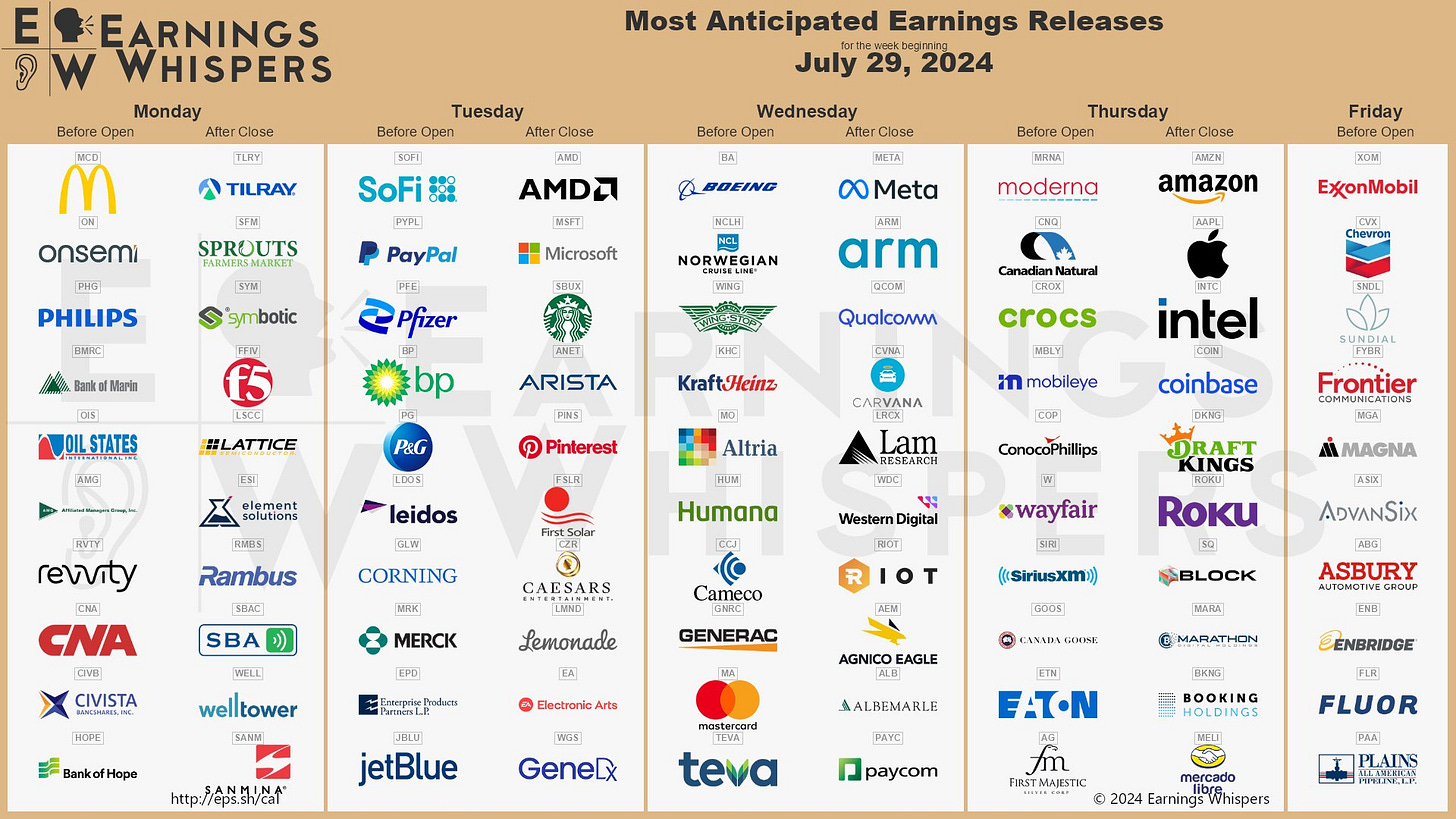

Earnings This Week

Looking ahead this week, earnings season continues with some very big names:

As always we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is nearing 50k.

6 Investing Mistakes

Investing is not easy, and there are many mistakes that can derail your journey to financial freedom.

By taking a look at some of the most popular mistakes that investors make today, it may help you to avoid them in the future.

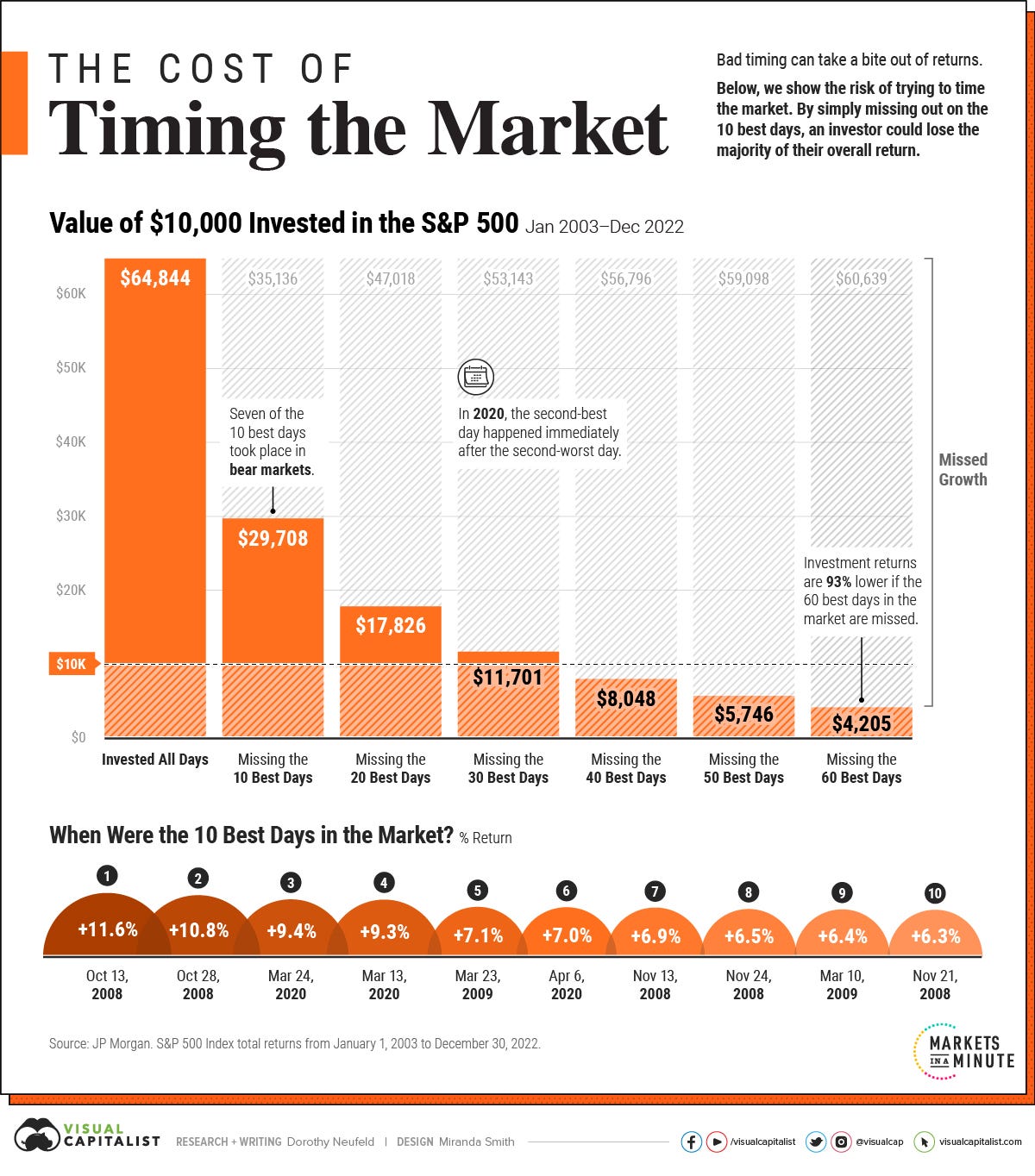

Timing The Market

You may of heard the phrase before, “time in the market, not timing the market” and the evidence shows us how truly important it is to stay invested.

Let’s dissect the graph below:

Over a 20Y period (Jan03-Dec22) if you had invested $10,000 into the S&P 500 without touching your investment, it would have returned you $64,844.

Now what if you had tried to time the market?

Just by missing the 10 best days in the market you would have earned $29,708. That is an incredible $35,136 less!

A 9.8% annual return just by staying invested is great, however by missing any of the best days that drastically reduces, in fact by missing the best 60 days over a 20Y period you would have had a negative annual return!

Remember, time in the market, don’t try and time it.

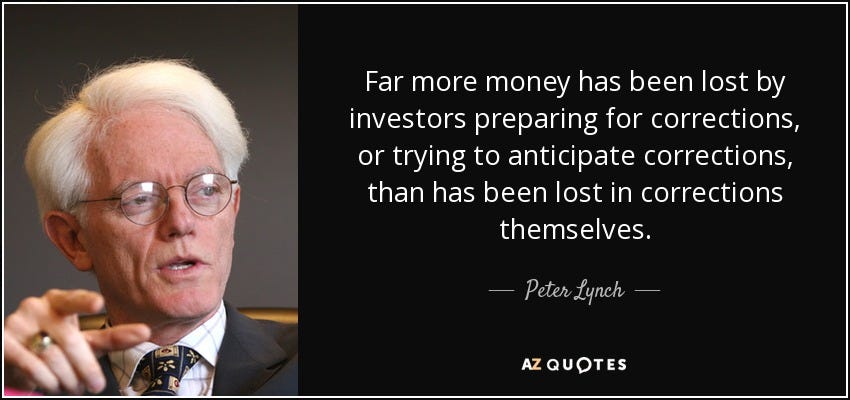

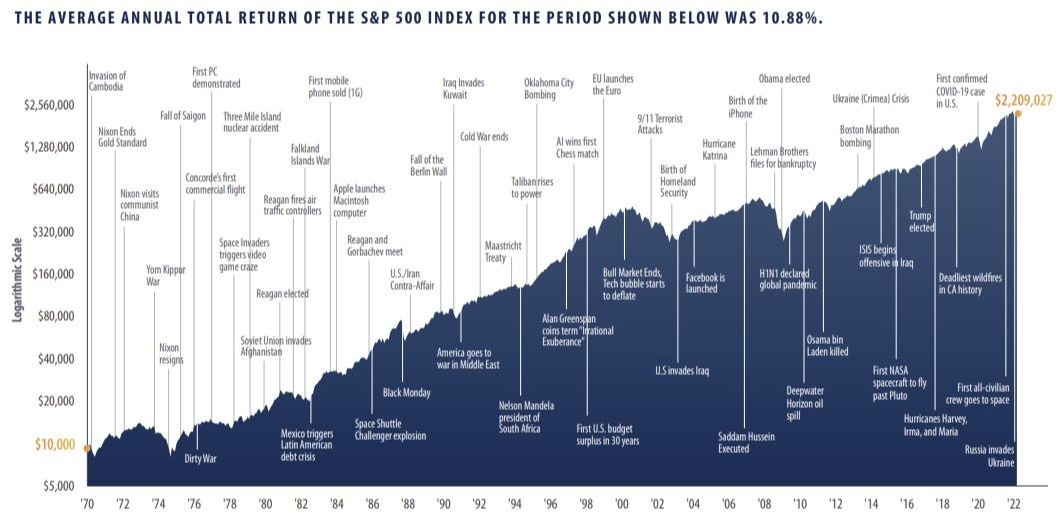

Listening To Outside Noise

Every day we turn on the news or scroll through social media, we can find a ton of reasons why we should not invest. However, this is not something new:

When we look back at 2023, there were so many articles and videos coming out about how a recession was inbound and that safety into cash was the way to go (see point 1 as to why you shouldn’t do this).

The benchmark (S&P 500) was up 24% in 2023.

Ultimately, you should have an investing plan and not let any short term emotional decisions get in the way due to the latest headlines.

The above really drives this home, from 1970-2022 there are a ton of events that could of deterred many investors, yet over this period the S&P 500 was up 10.88% a year on average.

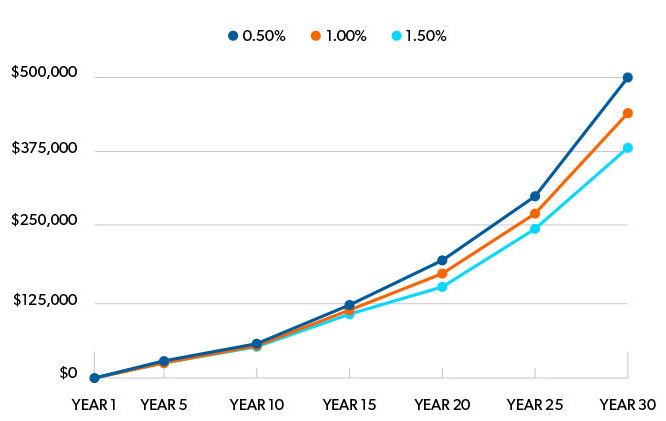

Paying Too Much In Fees

It is incredibly important to understand that if you invest in a high-cost fund it can ultimately have a significant impact on your wealth over the longer term.

In the short term you may not be able to see this, but let’s show you an example below:

Let’s say that you have $25,000 invested and you achieve an 11% average annual return rate and you don’t add any more money over the next 30 years.

0.50% = $500,000

1.00% = $436,000

1.50% = $380,000

Now imagine if you have more than $25,000 invested and add money frequently, the difference would be significantly more!

Forgetting About Inflation

The inflation rate shows us how quickly the prices of goods and services are increasing and ultimately leads to a loss of purchasing power for the consumer.

As we can see above the inflation rate is constantly changing, with the ideal rate set at 2% by the FOMC (Federal Open Market Committee) as they believe this rate over the longer term helps with maximum employment and price stability.

Over the last 40 years the average US inflation rate has been around 4%, so this means on a year on year basis, if you are not getting an increase in your dividends, salary or other income producing assets, you are ultimately getting a pay cut and losing your purchasing power.

So when you think about your returns as an investor, it is imperative to consider the rate of inflation.

As an example, if you have $100 today and over the next year inflation is at 10%, this means that your $100 is worth 10% less than it was a year ago. You would need $110 to buy what you could have a year earlier.

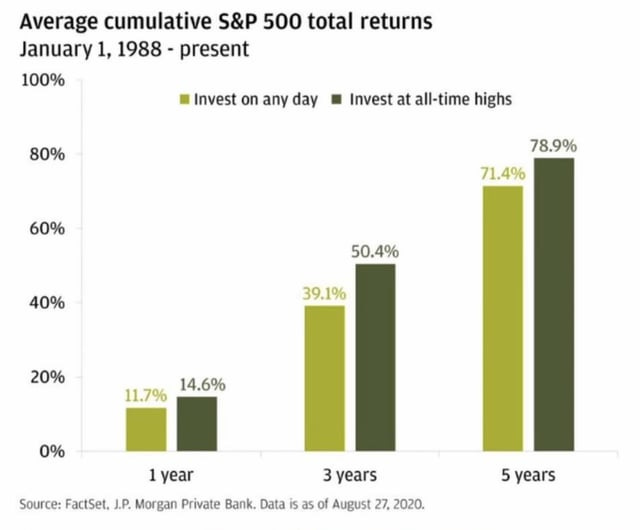

Not Investing At All-Time Highs

It can be great to see the market reaching all time highs, but at the same time if you have money to deploy in the stock market it may scare you off.

There is a behavioral tendency to believe it may come down soon and that it would be wise to wait for a pullback.

You don’t need to look far to see headlines like this which would make many investors think twice and likely deter them from putting money into the stock market.

So what does history tell us?

From 1998 to 2020 if you had invested at all time highs, over a 1 year, 3 year and 5 year period you would have had a greater return than investing on any other day.

The same is true when we look from 1990 to 2024 as per the above.

It is incredible to think that if you had invested at an initial 10% drop from all time highs, you would of underperformed someone who invested at all time highs!

Whilst looking at the past is great, do understand that past performance is not an indicator of future performance.

Ultimately though, we do believe that if you are a long term investor you should not let all time highs deter you from investing, especially if you have a long investing time horizon.

You may find the below article we wrote interesting discussing whether to just invest as a lump sum or to dollar cost average:

Focusing On Yield Instead Of Total Return

Dividends and the compounding effect is well known, and as we have mentioned in previous articles, they have historically made up a significant portion of the total returns of the S&P 500 over time.

In fact, from 2000-2020, 43% of total returns came from dividend re-investment and the compounding effect attached to this.

The issue that arises here is when an investor bases their sole strategy around dividends from high yield stocks.

You want to avoid Companies that are prioritising the dividend ahead of investing in the Company itself.

Which is why it is also recommended to review how a Company allocates their capital (this typically tends to be one slide in their investor presentation).

Also remember high yields are not always guaranteed, just look at the last 2 years:

2023

V.F. Corporation (VFC) - Yield was at 7.5% before a 70% dividend cut took place.

Intel (INTC) - Yield was 5.6% before a 65% dividend cut took place.

2024

Leggett & Platt (LEG) - Yield was 10.4% before an 89% dividend cut took place.

Walgreens (WBA) - Yield was 7.5% before a 48% dividend cut took place.

3M (MMM) - Yield was 6% before a 54% dividend cut took place.

And I am sure there are many more.

Ultimately we want to invest in Companies that will give us the best total return in the future and whilst having a nice yield is attractive, it shouldn’t be the focus of your attention.

As we can see above, historically those that grow their dividends tend to outperform.

One example is comparing Visa (V) performance over the last 10Y v Altria (MO).

V yield = 0.79%

MO yield = 7.98%

Latest YouTube Videos!

Some of the videos we have covered below on the YouTube channel:

I’m Buying Visa

6 Undervalued Dividend Stocks At 52 Week Lows (European Edition)

5 Beaten Down Stocks

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Conclusion

Hopefully you found these investing mistakes helpful and if there are any others please do share them in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.