🔥 74 Top Dividend Stocks (September Update)

Spreadsheet included — undervalued, safe payouts, and ready to soar

Each month, our paid subscribers get exclusive access to a detailed spreadsheet showcasing undervalued stocks — carefully selected using multiple trusted metrics.

This September, 74 stocks passed all of our strict criteria below, offering promising opportunities for smart investors looking to buy quality bargains before the market catches on.

How We Pick Undervalued Stocks

When we talk about “undervalued,” we’re not just guessing - we use a set of proven filters that help us spot opportunities where income and growth come together.

Here’s what we look for:

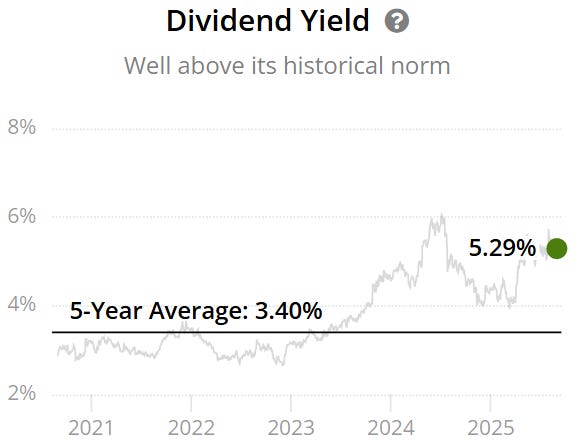

1. Dividend Yield Theory

A stock often looks undervalued when its current yield is higher than its 5-year average.

Example: A company with a 5.29% yield versus a 5-year average of 3.40% signals potential undervaluation.

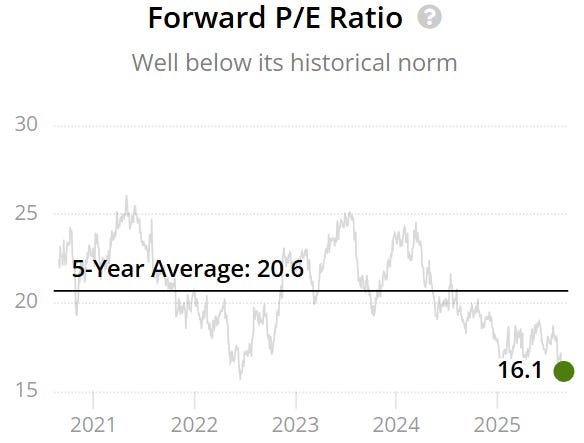

2. Attractive Valuation

We look for forward P/E ratios meaningfully below historical averages.

Example: A forward P/E of 16.1x compared to a 5-year average of 20.6x suggests the stock may be trading at a discount.

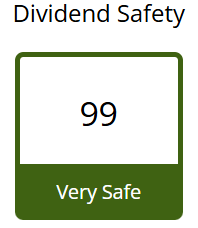

3. Dividend Safety (Score: 60+)

Dividends only matter if they’re sustainable. We focus on companies with strong safety scores to ensure payouts are reliable well into the future.

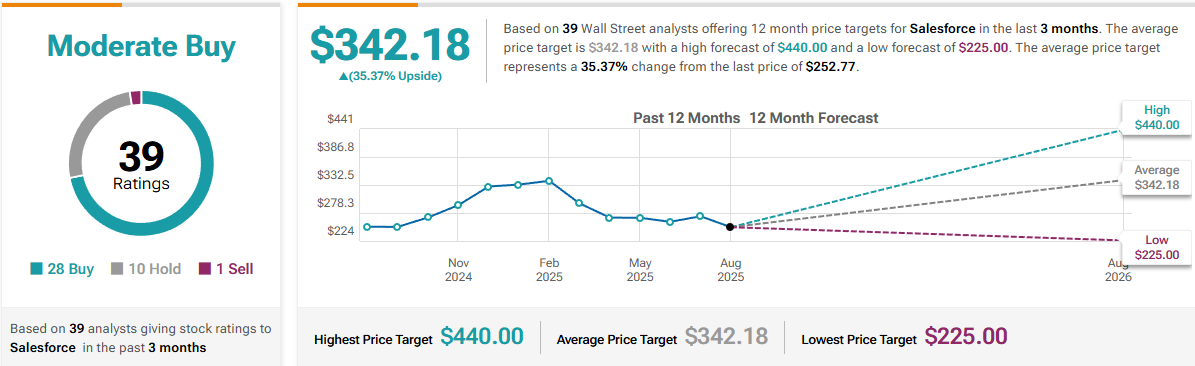

4. Upside Potential (15%+)

Dividends are great, but growth matters too. We look for stocks with at least 15% upside over the medium term, giving us a balance of income and capital appreciation.

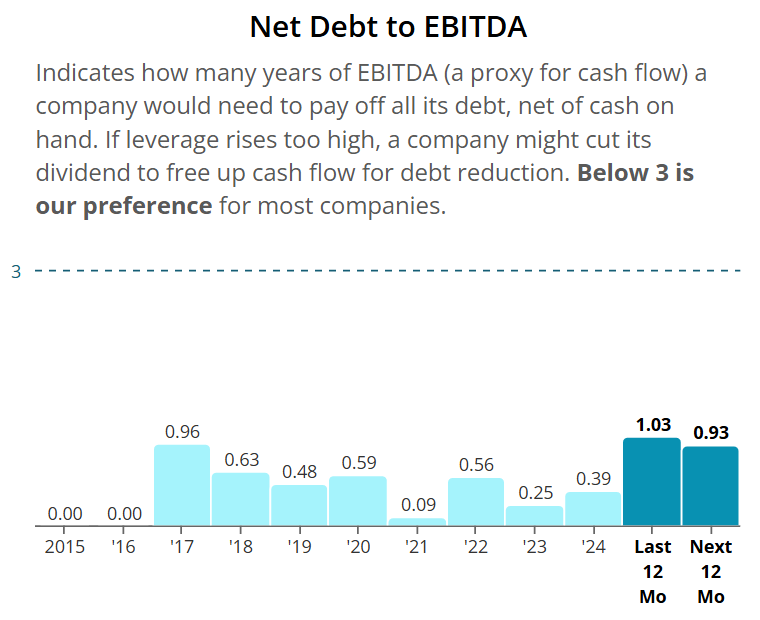

5. Strong Balance Sheets

Healthy financials are non-negotiable. We prefer companies with Net Debt/EBITDA below 3x, and for REITs, a threshold below 5.5x.

This ensures they can manage debt responsibly while still funding growth.

September Spreadsheet Below

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.