Best Dividend Growth Stocks!

Some HUGE Increases!

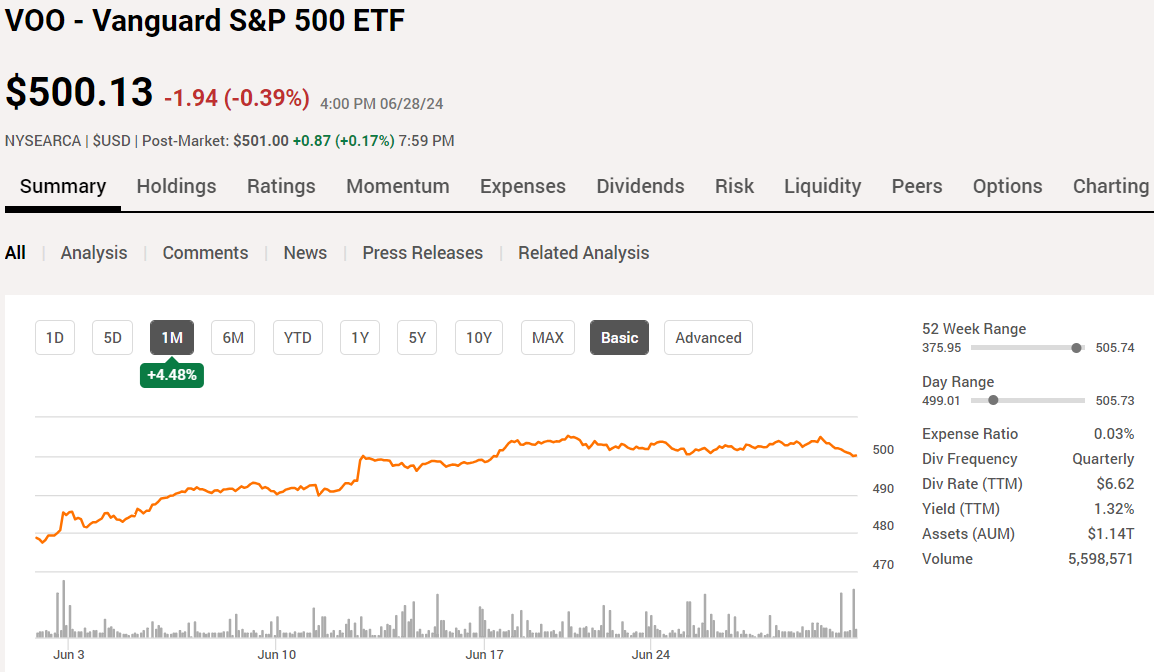

Market Latest

In the month of June, the S&P 500 is up 4.48% taking the YTD performance to 14.50%

As we can see from the below S&P 500 heat map, YTD the majority of the returns have come from the big names like NVDA (+149%), AVGO (+44%), GOOG (+30%) and a few more to name.

For those who like to look at historical data, we have some very bullish news for the month of July.

Since 1928, July has emerged as the best month of the year, on average, in terms of stock-market performance.

On top of that July has been positive for the S&P 500 nine years in a row. Over the last 10 years it has been up 3.1% on average.

Are we in for another bullish July month?

What Is Dividend CAGR?

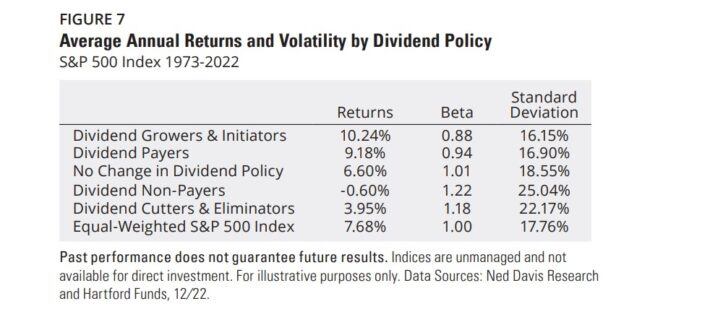

Now today’s focus is all about dividend growth stocks which we love, one reason being the below:

They tend to outperform other classes of stocks.

And as we can see from the above, they tend to historically have the better returns.

We are going to refer to Dividend CAGR through the article today which is the compounded annual growth rate for dividends.

So, if we say Company X has a 10% Dividend CAGR over the last 10 years, this means they increased their dividend on average, by 10% every single year for the last 10 years.

Ideally, we want to see 4% as a minimum so that the increase is keeping up with inflation at a bare minimum.

Top Dividend Growth Stocks

We are going to look at the Top 5 stocks that have historically had the best dividend CAGR.

While we know we cannot rely on past performance as an indicator for the future, it gives us confidence if a Company has increased their dividend at a fast rate, then it is likely they will continue unless there is any fundamental change in their business or significant changes to the economy.

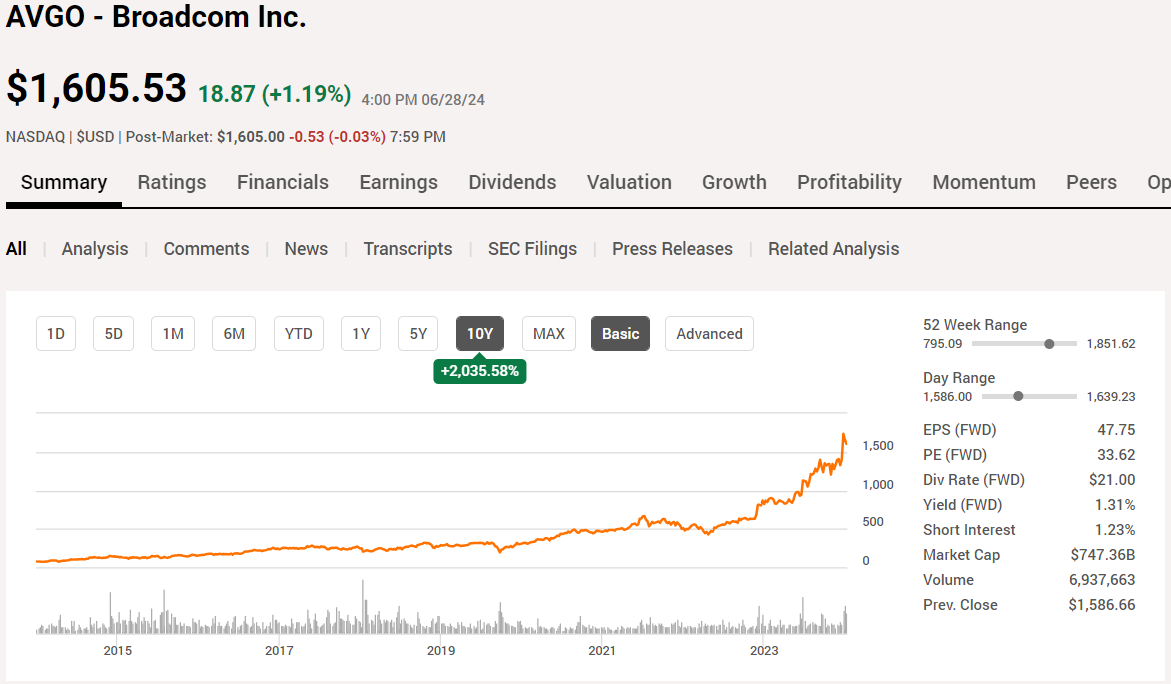

Broadcom (AVGO)

Over the last 10 years Broadcom has been on a phenomenal run up 2,036% significantly outperforming the S&P 500, and that is not all!

Over the last 10 years it has increased the dividend on average at 36% every single year!

As part of our stock analysis, we based on a 20% margin of safety we would consider this a buy at around $1,324. As of today’s price, wall street indicates this company has 17% upside.

You can see our latest deep dive on Broadcom below:

Visa (V)

Over the last 10 years Visa outperformed the S&P 500 with a respectable 385% return.

Over the last 10 years Visa have increased the dividend on average at 18% every single year!

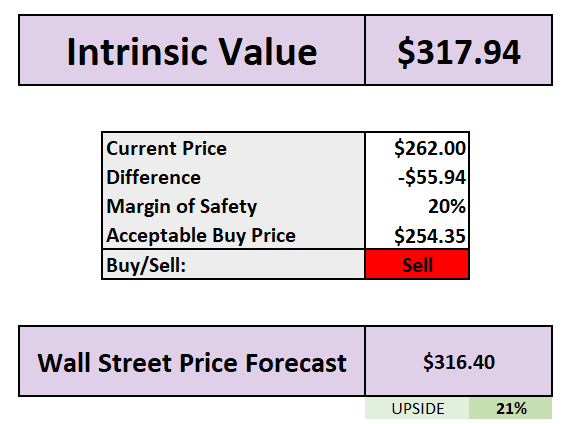

As part of our stock analysis, we based on a 20% margin of safety we would consider this a buy at around $254. As of today’s price, wall street indicates this company has 21% upside.

UnitedHealth (UNH)

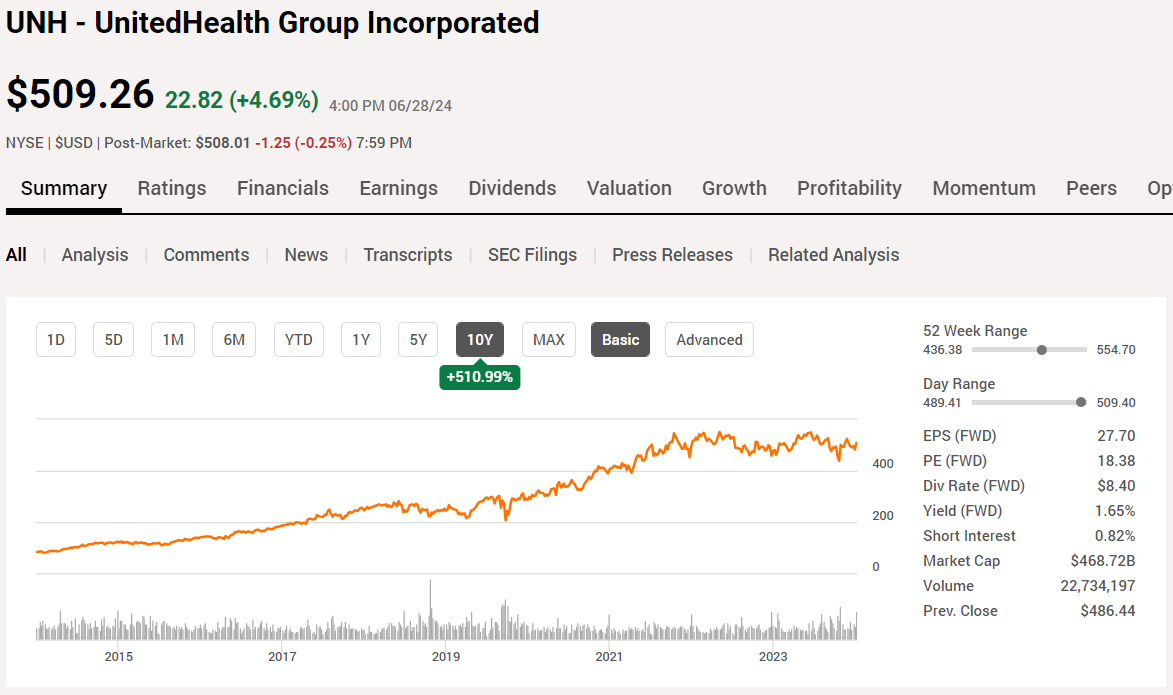

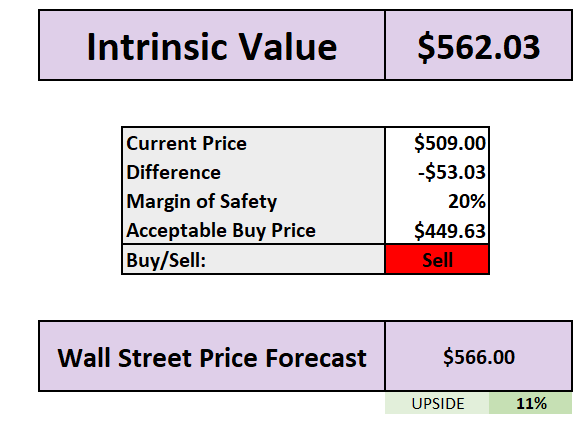

Over the last 10 years UNH outperformed the S&P 500 with a strong 511% return.

Over the last 20 years UnitedHealth have increased the dividend on average at an astounding 41% every single year!

As part of our stock analysis, we based on a 20% margin of safety we would consider this a buy at around $450. As of today’s price, wall street indicates this company has 11% upside.

You can watch our latest UNH deep dive below:

MasterCard (MA)

Over the last 10 years MA outperformed the S&P 500 with a strong 475% return.

Over the last 10 years MasterCard have increased the dividend on average at 23% every single year!

As part of our stock analysis, we based on a 20% margin of safety we would consider this a buy at around $424. As of today’s price, wall street indicates this company has 17% upside.

Lowe’s (LOW)

Over the last 10 years Lowe’s outperformed the S&P 500 with a strong 357% return.

Over the last 20 years Lowe’s have increased the dividend on average at 24% every single year!

As part of our stock analysis, we based on a 20% margin of safety we would consider this a buy at around $212. As of today’s price, wall street indicates this company has 18% upside.

June Dividend Increases

In case you missed it, these Companies increased their dividends in June:

KR - Kroger +10%

GIS - General Mills +1.7%

NFG - National Fuel Gas +4%

CAT - Caterpillar +8.5%

TGT - Target +1.8%

FDX - FedEx +9.5%

UNH - UnitedHealth +12%

WELL - Welltower +9.8%

ARE - Alexandria +2.4%

BAC - Bank of America + 8%

C - Citigroup +5.7%

GS - Goldman Sachs +9%

MS - Morgan Stanley + 8.8%

USB - U.S. Bancorp +2%

WFC - Wells Fargo +14%

JPM - JP Morgan +8.7%

Latest YouTube Videos!

Over the last week we have covered a few videos looking at undervalued dividend stocks as per below:

5 Dividend Stocks On Sale To Buy In July:

How I Would Invest $1,000 Now:

5 Best Dividend Stocks Under $100:

5 High Quality REITs To Buy Now:

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up:

For those who are also interested Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a 20% off discount for your first year.

This also includes a 7-day free trial for new users too!

Conclusion

We have gone through 5 high quality dividend growth stocks that have managed to increase their dividend over the last 10-20 years at a very rapid rate.

We have also gone through what price we would expect to pay for them with a 20% margin of safety.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a fantastic week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.