BUY Now or WAIT? The 4 Stocks I Won’t Ignore in This Market

Inflation is cooling, rate cuts are back on the table, and volatility is creeping in—these are the names I'm watching closely and why timing could be everything.

Market Update

The S&P 500 wrapped up the week with a 0.4% loss - dragged lower by Friday’s 1.1% plunge amid Middle East volatility and rising oil prices.

Recent stock moves have started to reflect better-than-expected economic and inflation data.

After dropping nearly 20% from mid-February highs, the S&P 500 has bounced back more than 20%, helped by strong earnings, a resilient economy, and the U.S. easing up on some planned tariff hikes.

That said, some ups and downs are expected as investors react to key developments in the weeks ahead.

On a granular level, we had some very poor performers just last week.

Biggest losers included:

Lululemon (LULU) down 10%

Adobe (ADBE) down 6%

Booking (BKNG) down 6%

Automatic Data Processing (ADP) down 6%

Salesforce (CRM) down 6%

Visa (V) down 5%

Mastercard (MA) down 5%

Notable News

Fed Cuts

Markets are currently pricing in two interest rate cuts by the Federal Reserve before the end of the year, with the first potentially coming as early as September.

This expectation is largely driven by recent signs of cooling inflation and a slightly softer labor market, which give the Fed more room to ease policy without reigniting price pressures.

However, the path remains uncertain, and any shift in economic data could quickly change that outlook.

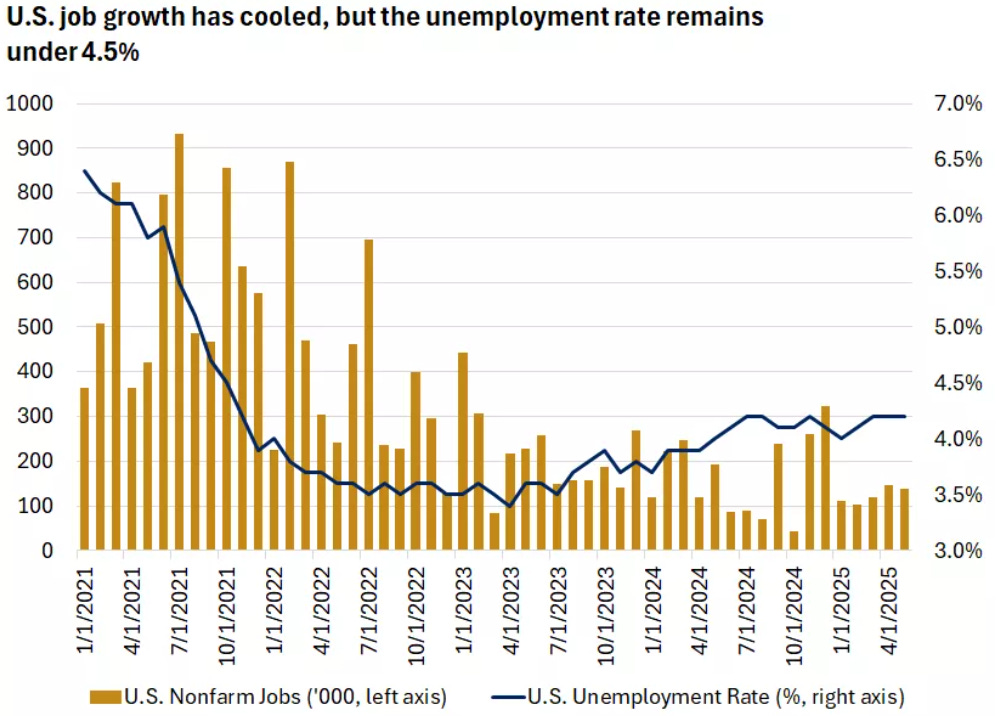

US Labour Market

Although job growth has slowed, the unemployment rate remains low at around 4.2% - well below the U.S. historical average of 5.5%. It's a labour market marked by cautious hiring but also minimal layoffs, as companies focus on retaining valuable employees.

Meanwhile, wages are growing at about 3.9%, outpacing inflation and giving consumers a boost in real income. When people feel secure in their jobs and see their pay rising faster than prices, they’re more likely to keep spending-something that continues to support the economy for now.

Inflation

Inflation has stayed in check so far in 2025, with both May’s CPI (2.4%) and PPI (2.6%) coming in below expectations - well down from their 2022 peaks.

So far, tariffs haven’t pushed up goods prices, likely thanks to strong inventories during the 90-day pause.

That could change later this year depending on how trade policy evolves.

Worth keeping an eye on energy prices, which jumped 5–7% last week amid Middle East tensions, though such spikes tend to be short-lived, especially with the U.S. now a net petroleum exporter.

Earnings This week

Join 96,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

4 Quality Stocks

Let us dive into these 4 Stocks.

I have used the following criteria to help identify these stocks:

1. Outperformed S&P 500 last 10Y

2. Free Cash Flow Margin 20%+

3. Net Debt to EBITDA <1.5

S&P Global (SPGI)

S&P Global is a financial information and analytics company that provides credit ratings, benchmarks, data, and insights for global markets.

It owns well-known brands like S&P Ratings, S&P Dow Jones Indices, and S&P Global Market Intelligence.

Investors, governments, and corporations use its tools to make informed financial decisions.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

Valuation

It trades at a forward P/E of 28.8x which is lower than it’s 5Y at 30.1x.

SPGI is offering a 20% Margin of Safety at $515.

SPGI is offering a 25% Margin of Safety at $483.

This is based on a growth rate to the free cash flow moving forwards at 12%.

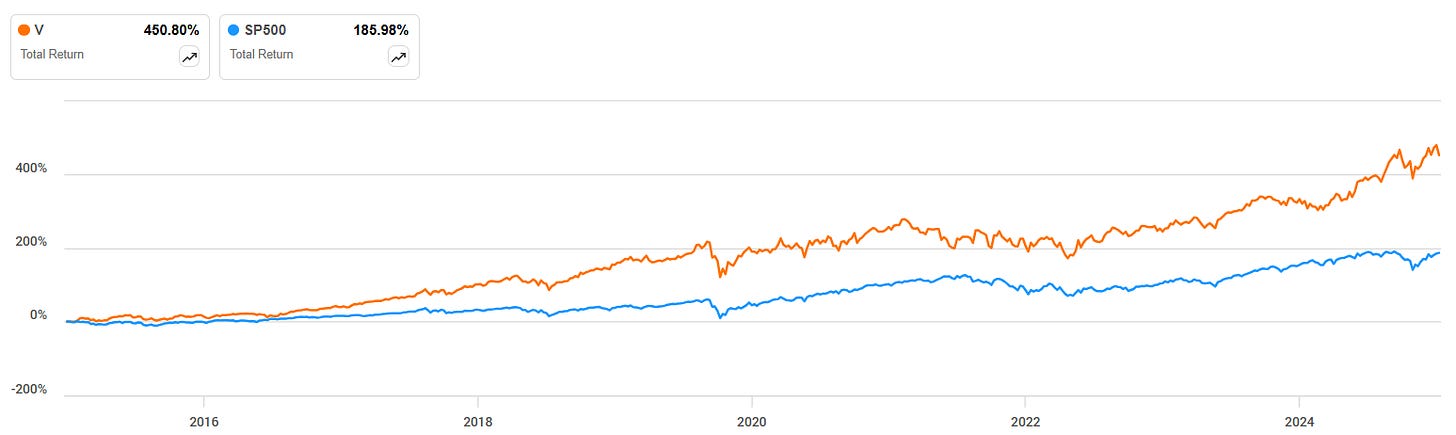

Visa (V)

Visa is a global payments technology company that facilitates digital payments between consumers, merchants, financial institutions, and governments.

It operates one of the world’s largest electronic payment networks. Visa doesn’t issue cards or lend money - it makes money from processing transactions.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

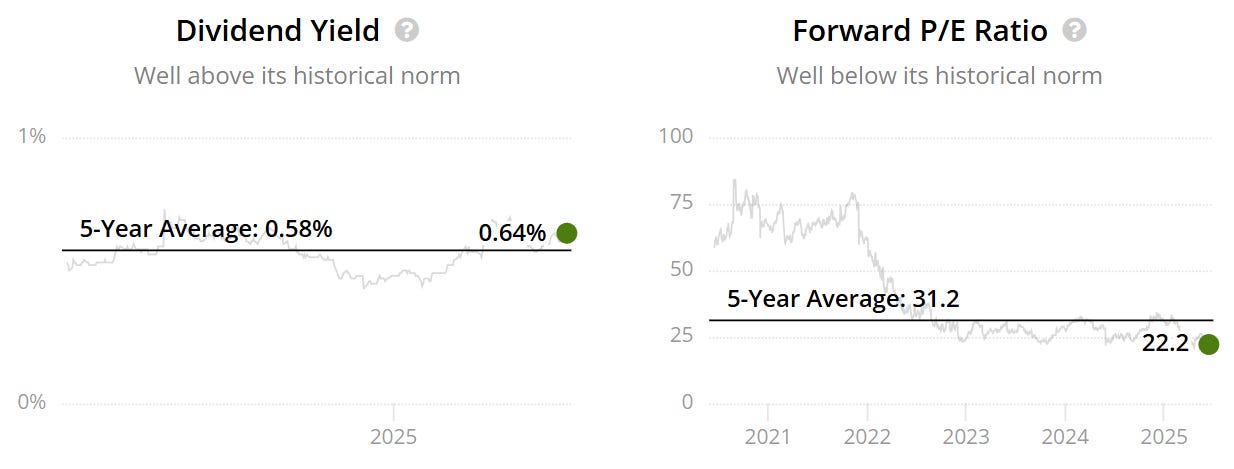

Valuation

It trades at a forward P/E of 29.4x which is higher than it’s 5Y at 27.6x.

Visa offering a 10% Margin of Safety at $341.

This is based on a growth rate to the free cash flow moving forwards at 10%.

Adobe (ADBE)

Adobe is a software company known for creative tools like Photoshop, Illustrator, and Premiere Pro, as well as digital marketing and document solutions like Adobe Acrobat and Adobe Experience Cloud.

It helps individuals and businesses create, manage, and optimize digital content. Adobe earns most of its revenue through software subscriptions.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

Valuation

Adobe offering a 30% Margin of Safety at $411.

This is if we use a growth rate of 10%.

If we use 8%, then there is a 20% Margin of Safety at $407

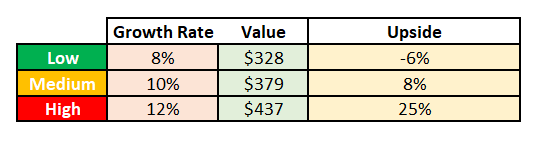

Salesforce (CRM)

Salesforce is a cloud-based software company that provides customer relationship management (CRM) tools to help businesses manage sales, marketing, and customer service.

Its platform allows companies to track customer interactions, automate workflows, and analyze data. Salesforce also owns Slack and expands through AI-driven and industry-specific solutions.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

Valuation

It trades at a forward P/E of 22.2x which is lower than it’s 5Y at 31.2x.

Salesforce offering a 30% Margin of Safety at $260.

This is if we use a growth rate of 8%

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 96,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.