Congress Is Buying These 5 Stocks - Should You?

Markets are hitting all-time highs, but is the real signal hiding in what politicians are buying?

Market Update

The S&P 500 and Nasdaq reached fresh all-time highs last week, both up ~5% year-to-date.

What’s behind the surge?

Three key drivers:

Easing geopolitical tensions (and falling oil prices)

A Fed still leaning toward rate cuts

A continued tech mega-cap rally.

While momentum is strong, key catalysts loom:

Trade/tariff developments

U.S. tax policy debates

Potentially weaker economic data.

On a granular level, we had some very strong performers just last week.

Biggest winners included:

Nike (NKE) up 20%

Advanced Micro Devices (AMD) up 12%

Nvidia (NVDA) up 10%

Uber (UBER) up 9%

Broadcom (AVGO) up 8%

Meta (META) up 8%

Booking (BKNG) up 7%

Notable News

Summer Rally Heats Up

With school out and markets cooling into summer mode, stocks rallied again last week - pushing both the S&P 500 and Nasdaq to new all-time highs.

Since the April 8 lows, the S&P is up ~24% and the Nasdaq has surged ~33%.

3 catalysts for this below:

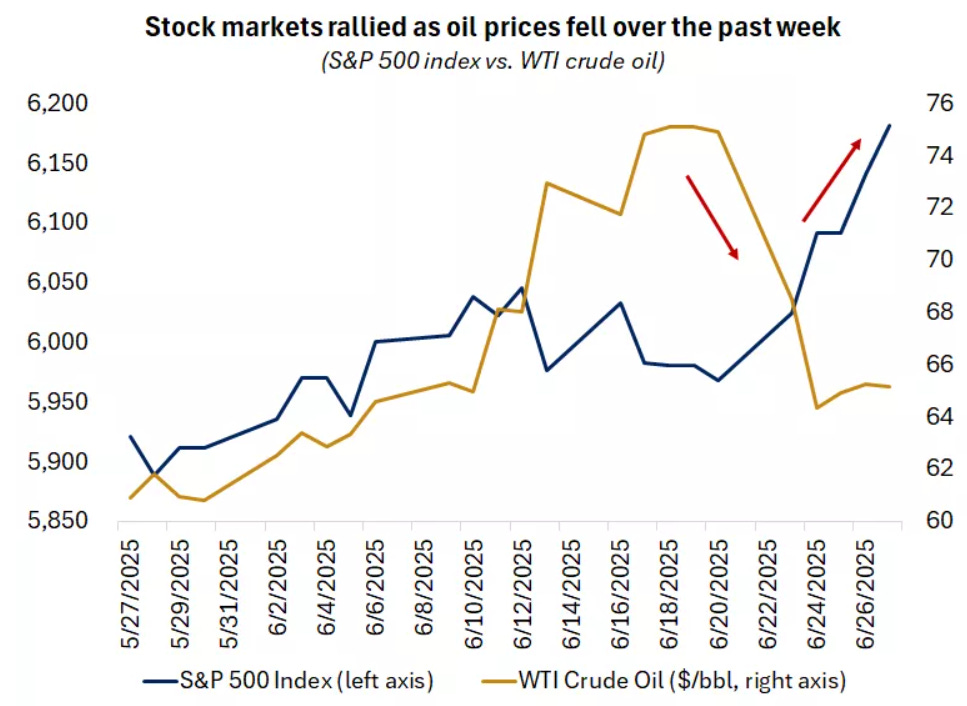

1. Easing Geopolitical Tensions, Falling Oil Prices

After a brief spike in Middle East conflict, tensions have cooled - with limited retaliation and no major disruption to oil flows.

As a result, oil prices dropped ~13% last week, easing inflation fears and boosting market sentiment.

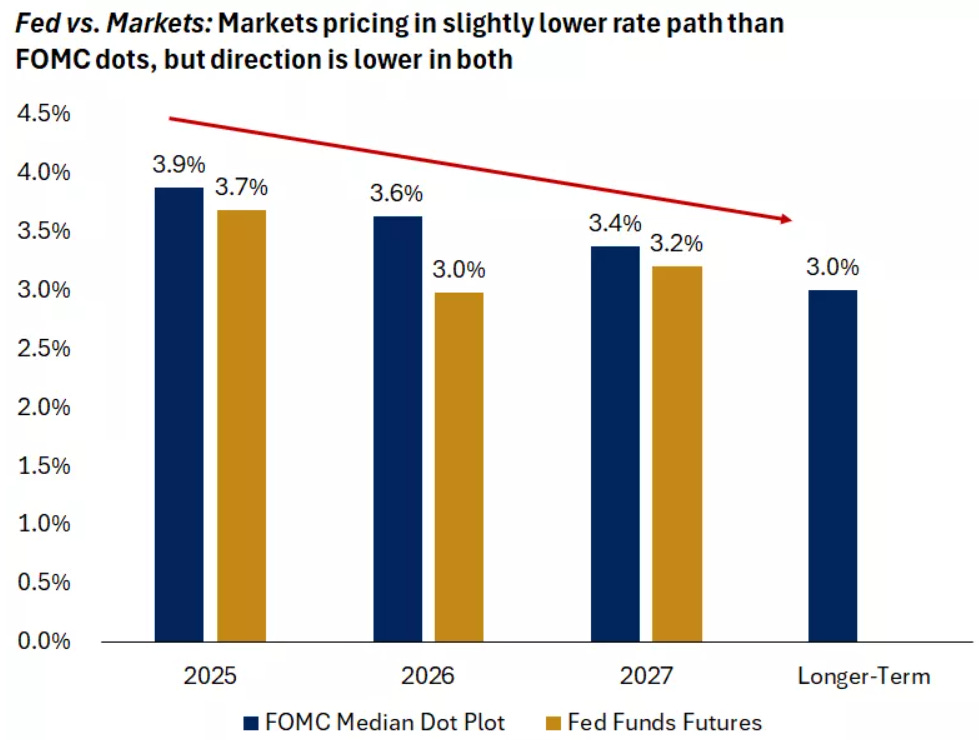

2. Fed Still on Track to Cut Rates

Markets are rallying on growing confidence the Fed will begin cutting rates by year-end.

Its latest projections point to two cuts in 2025, with more to follow in 2026–2027.

Falling oil prices and contained inflation - like last week’s PCE data - support this gradual shift lower.

3. Tech Keeps Powering the Rally

Growth sectors - especially tech, communication services, and consumer discretionary - are driving the market higher.

While the S&P 500 is up ~24% since April lows, these sectors have surged even more, fueling the summer rally.

Earnings This week

Join 98,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

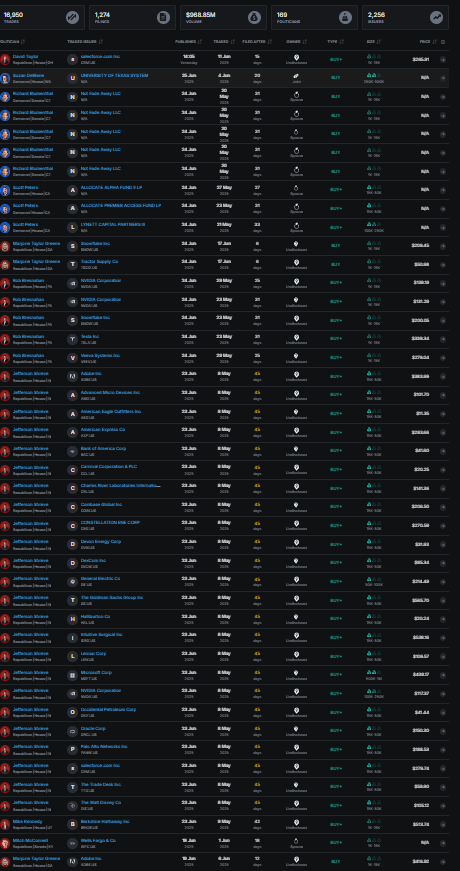

Congress Outperform S&P 500 Every Year

Every year like clockwork we see that congress members have outperformed the markets:

2024:

2023:

2022:

And this is the same result if you keep going back.

Therefore it is interesting to see what they buy (and sell) for our own knowledge.

Take Nancy Pelosi for example, in the last 10Y her portfolio was up 701% in comparison to the S&P 500 which was up 227%.

Stocks Congress Bought

We’ve had a look at the most recent buys from members in congress:

And picked out the 5 most bought stocks in the recent period.

Stock 1 - AbbVie (ABBV)

AbbVie is a global biopharmaceutical company that develops and markets advanced therapies for complex and chronic diseases.

Its key focus areas include immunology, oncology, neuroscience, and eye care. AbbVie is best known for blockbuster drugs like Humira, Skyrizi, and Rinvoq.

It has outperformed the S&P 500 over the last 10Y:

It trades at a forward P/E of 14.3x which is higher than it’s 5Y at 12.2x.

ABBV is offering a 15% Margin of Safety at $183.

Wall Street see this having 16% Upside over the next 12 months.

Stock 2 - Applied Materials (AMAT)

Applied Materials is a leading supplier of equipment, software, and services used to manufacture semiconductor chips and advanced displays.

Its tools are critical for processes like deposition, etching, and inspection in chip fabrication.

AMAT plays a key role in enabling cutting-edge technologies like AI, 5G, and advanced computing.

It has massively outperformed the S&P 500 over the last 10Y:

It trades at a forward P/E of 19.2x which is higher than it’s 5Y at 18.1x.

AMAT is offering a 15% Margin of Safety at $181.

Wall Street see this having 10% Upside over the next 12 months.

Stock 3 - NextEra Energy (NEE)

NextEra Energy is the world’s largest producer of wind and solar energy.

It operates through two main businesses: Florida Power & Light (a regulated utility) and NextEra Energy Resources (a clean energy leader).

NEE is a major player in the transition to renewable power across the U.S.

It has outperformed the S&P 500 over the last 10Y:

It trades at a forward P/E of 18.3x which is lower than it’s 5Y at 25.9x.

NEE is offering a 15% Margin of Safety at $70.

Wall Street see this having 11% Upside over the next 12 months.

Stock 4 - Gilead Sciences (GILD)

Gilead Sciences is a biopharmaceutical company focused on developing antiviral drugs and treatments for serious diseases.

It’s best known for its therapies in HIV, hepatitis C, and more recently, oncology.

Gilead also played a key role in COVID-19 treatment with its antiviral drug remdesivir.

It has underperformed the S&P 500 over the last 10Y:

It trades at a forward P/E of 13.6x which is higher than it’s 5Y at 10.5x.

GILD is offering a 10% Margin of Safety at $107.

Wall Street see this having 8% Upside over the next 12 months.

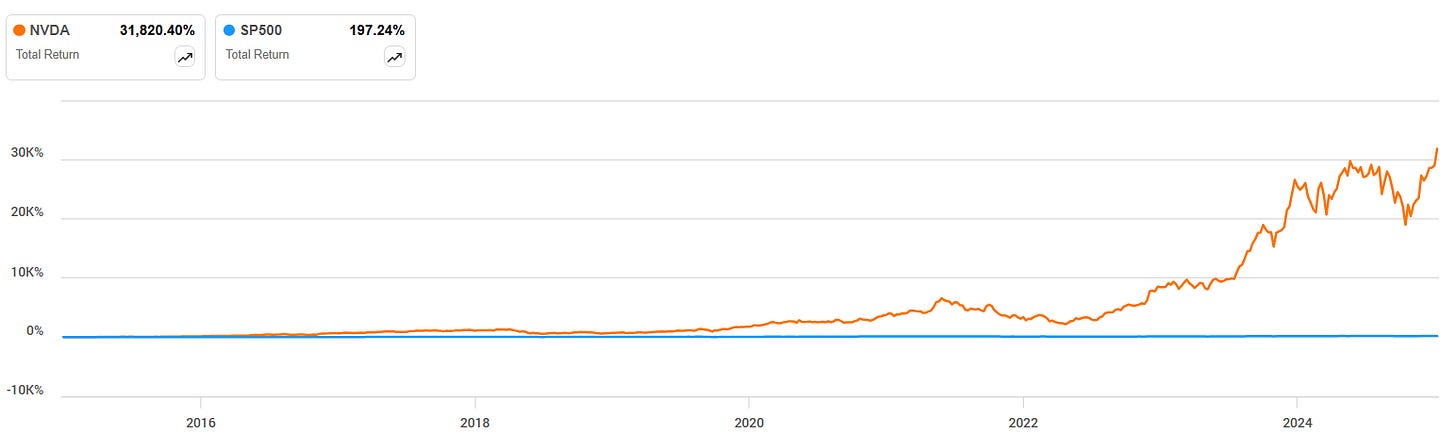

Stock 5 - Nvidia (NVDA)

NVIDIA is a global leader in graphics processing units (GPUs) and AI computing.

Its chips power everything from gaming and data centers to autonomous vehicles and generative AI.

NVIDIA is at the heart of the AI boom, with its GPUs being the gold standard for training large AI models.

It has massively outperformed the S&P 500 over the last 10Y:

It trades at a forward P/E of 32.9x which is lower than it’s 5Y at 42.5x.

NVDA is offering a 5% Margin of Safety at $156

Based on 20% growth rate as highlighted below:

Wall Street see this having 12% Upside over the next 12 months.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 98,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.