Dividends Are Very Important!

More Than You Think!

Introduction

Dividends play a crucial role in the financial ecosystem, serving as a significant factor for both investors and corporations.

For investors, dividends represent a tangible return on their investment, providing regular income and potentially signalling the financial health and stability of a company.

From a corporate perspective, the distribution of dividends can reflect a company's commitment to sharing profits with its shareholders, enhancing investor confidence and potentially leading to a more stable stock price.

Benefits

Income Generation: Dividends provide a consistent income stream for investors, particularly appealing to retirees or those seeking steady cash flow. This regular income can be reinvested or used to meet personal financial needs, offering flexibility and financial security.

Signal of Financial Health: A company's ability to pay dividends regularly is often seen as an indicator of its financial stability and profitability. Consistent dividend payments suggest robust earnings and strong cash flow, which can attract investors and support the company's stock price.

Total Return on Investment: Dividends contribute significantly to the total return on investment, especially in the long term. While capital gains from stock price appreciation are essential, dividends provide an additional layer of return, enhancing overall investment performance.

Inflation Hedge: Dividend-paying stocks can serve as a hedge against inflation. As prices rise, companies that generate substantial profits may increase their dividend payouts, helping investors maintain their purchasing power over time.

Tax Advantages: In many jurisdictions, dividends may be taxed at a lower rate than ordinary income, providing a tax-efficient way for investors to earn returns. This tax advantage can make dividend-paying stocks particularly attractive compared to other investment options.

Market Stability: Companies that pay dividends tend to have more stable stock prices. Dividend payments can reduce the volatility of a stock, as investors are often less likely to sell shares that provide a steady income, even during market downturns.

Encouragement of Long-Term Investment: Dividends encourage long-term investment by providing regular returns that reward patient investors. This can lead to a more stable shareholder base, as investors are more likely to hold onto dividend-paying stocks.

Importance Of Dividends

Dividends have historically contributed a significant portion of the total returns from the S&P 500.

While the exact percentage can vary depending on the specific time frame analysed, it is generally estimated that dividends have accounted for about 30-40% of the total return of the S&P 500 over the long term.

For instance, between 1926 and 2023, dividends contributed approximately 32% to 40% of the S&P 500's total return, depending on the specific period examined.

In certain decades, especially during periods of lower capital gains, the contribution of dividends to total returns can be even higher. For example, during the 1970s, a period characterized by relatively stagnant stock prices, dividends provided a much larger proportion of total returns.

If you look at 1980-2019, 75% of S&P 500 returns comes from dividends!

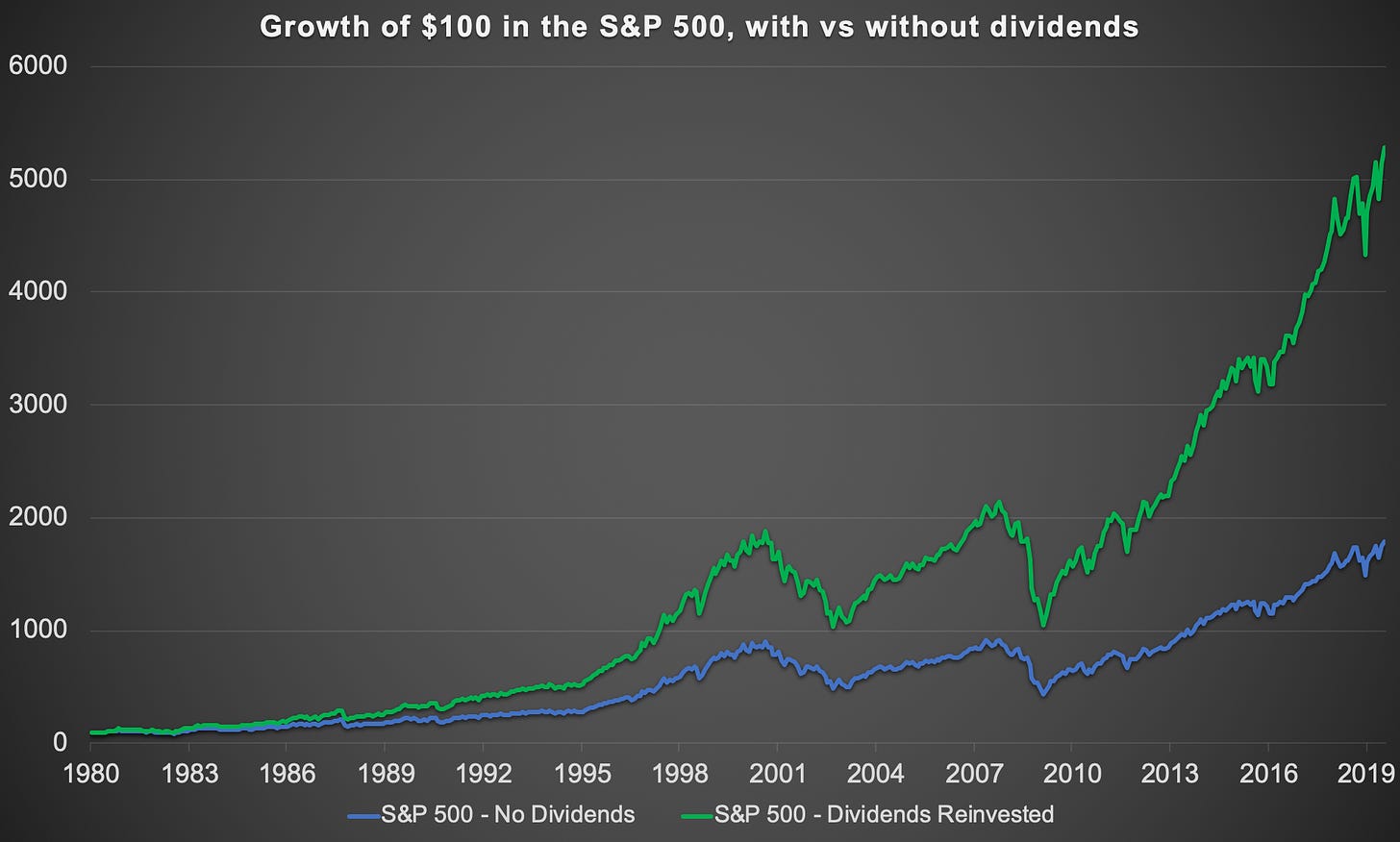

The chart above shows the growth of an initial $100 in the S&P 500 ignoring dividends vs with dividends reinvested.

The S&P 500 index has risen to 17.9x its 1980 value, but with dividends reinvested, $100,000 would have grown 52.9x to $5,285,910.

If you believe a 2% dividend yield is not much to get excited about, remember that unlike interest payments, dividends grow over time, as the part of a company’s earnings not paid out as dividends is typically reinvested which ultimately makes future dividends larger.

The chart above shows us the exact % of total return in the S&P 500 each decade that is made up solely by dividends.

Latest YouTube Videos!

Over the last week we have covered a few videos looking at undervalued dividend stocks as per below:

4 Dividend Stocks Under $50:

6 Dividend Stocks Near 52 Week Lows:

5 Dividend Stocks Under $100:

If you are interested in valuing stocks yourself we have created a valuation model below which you can pick up:

Conclusion

Dividends are a fundamental component of the S&P 500's total returns, underscoring their importance in a well-rounded investment strategy.

Over the long term, dividends have consistently contributed a significant portion of overall returns.

This substantial contribution highlights the value of dividends beyond mere income generation; they serve as a powerful tool for wealth accumulation through reinvestment and compounding.

As we navigate through various economic cycles, the enduring significance of dividends remains clear. They not only enhance total returns but also play a critical role in shaping investment decisions and maintaining financial stability.

Therefore, understanding and appreciating the power of dividends is essential for anyone looking to build a resilient and prosperous investment portfolio.

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.