Every Super-Investor Just Bought These 3 Stocks — Are You Missing Out?

Rate cut bets, cooling inflation, and a broader rally — this is the backdrop behind super-investors’ latest moves.

Market Update

S&P 500 Record Highs on Rate Cut Hopes

The S&P 500 climbed to fresh all-time highs last week, lifted by optimism that the Fed could cut rates as soon as September.

While tech stocks helped push the index higher midweek, small-caps stole the spotlight with their best run against the S&P since April, giving the rally a broader base before momentum cooled slightly into Friday’s close.

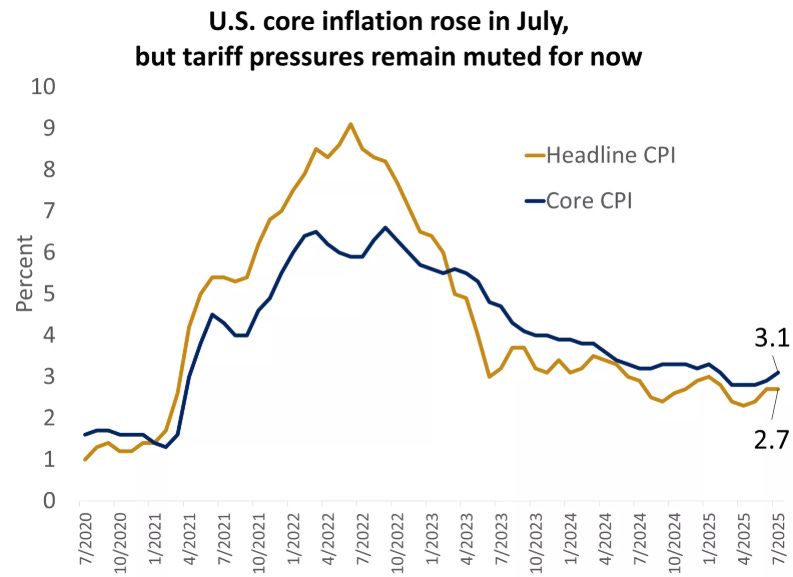

July Inflation: Cooler Headlines, Sticky Details

Inflation data for July came in largely as expected, with overall CPI steady at 2.7% and core inflation edging up to 3.1% - its highest level since February.

Cheaper gas helped keep the headline in check, but rising costs in areas like travel, healthcare, and auto repairs showed that some price pressures are proving harder to shake.

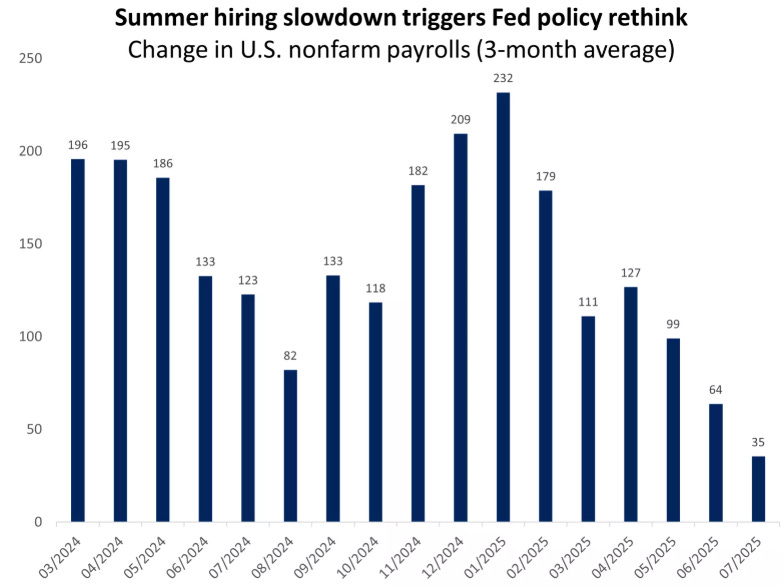

September Rate Cut Chatter Grows

The Fed kept rates steady in July, but signs of a softer labour market and cooler inflation have since pushed market odds of a September cut up to 85%.

While some are even whispering about a bigger half-point move, the more likely outcome is a cautious quarter-point trim- though upcoming jobs and CPI data could still sway the final call.

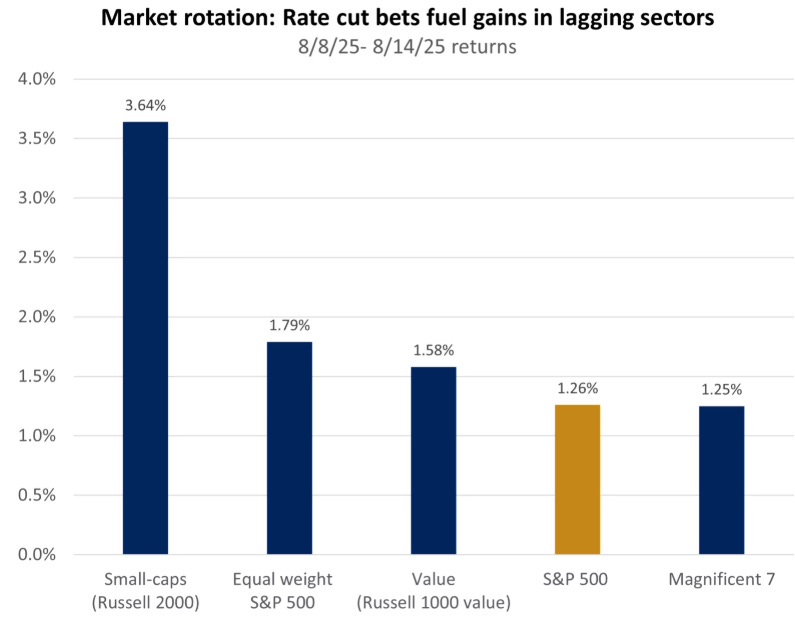

How Markets May React to Fed Cuts

Last week offered a glimpse of what a September Fed pivot could mean: small-caps jumped more than 3% and value stocks outpaced big tech, hinting at a broader rally.

If cuts prove to be “insurance” rather than recession-driven, history suggests equities could benefit - particularly sectors like financials, consumer discretionary, and even mid-caps.

On the bond side, shorter maturities may offer stability while the 10-year yield likely stays in the 4%–4.5% range.

With Powell set to speak at Jackson Hole, investors are watching for confirmation that rate cuts are finally back on the table.

Winners and Losers This Week

Top performers:

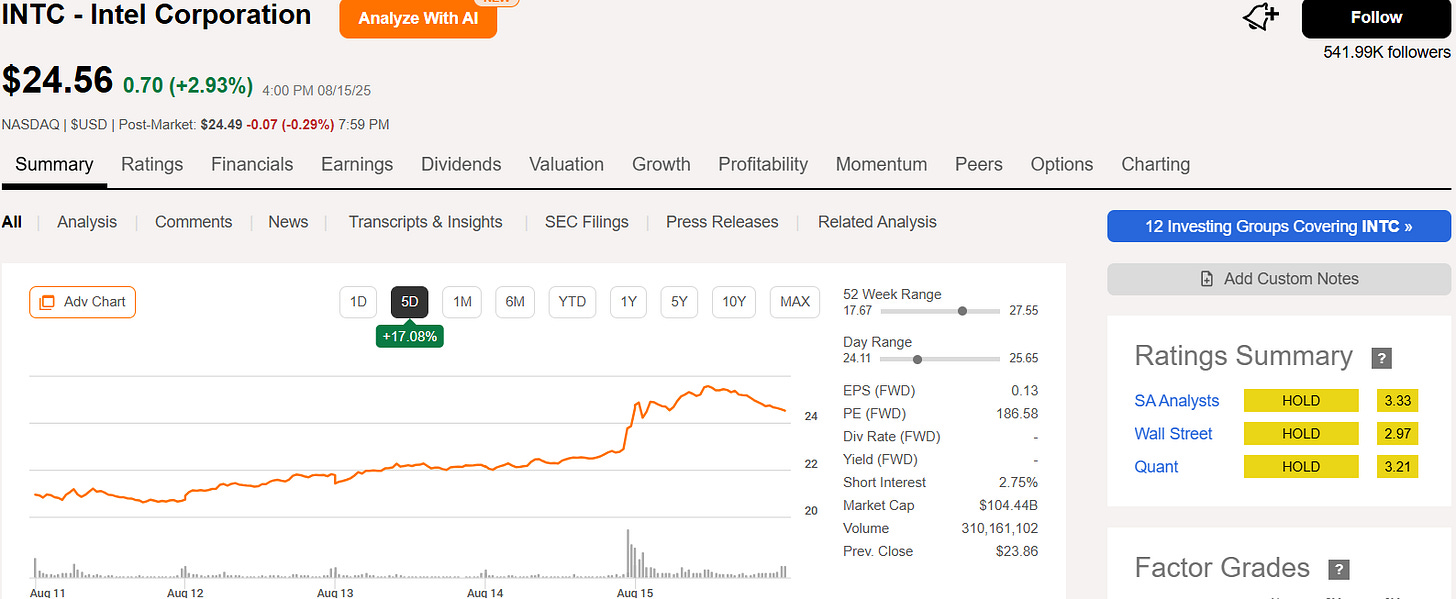

Intel (+23%)

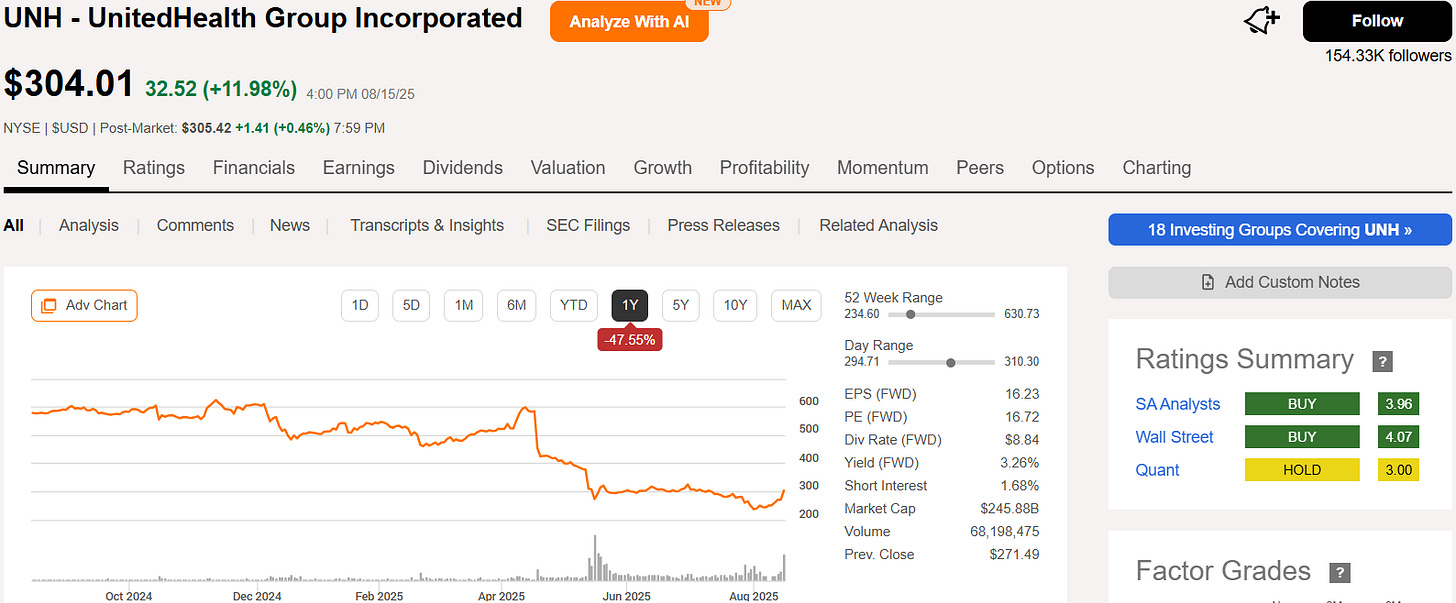

United Health (+21%)

Eli Lilly (+12%)

CNC (+11%)

Qualcomm (+7%)

Biggest drops:

Applied Materials (-13%)

Cisco (-8%)

Kroger (-6%)

Palantir (-5%)

Intuit (-4%)

Notable News

Intel's Stock Surge: What’s Behind the Rally?

Intel’s shares jumped sharply this week after reports emerged that the U.S. government is considering taking a stake in the company. The potential investment would support Intel’s expansion of semiconductor manufacturing in Ohio, a strategic move to strengthen domestic chip production.

The news comes as part of broader efforts to boost the U.S.’s position in the global semiconductor industry. While the discussions haven’t been officially confirmed, the mere prospect of government backing sparked investor confidence and drove the stock higher.

This development could mark a turning point for Intel, helping it enhance manufacturing capabilities and remain competitive amid ongoing industry challenges.

Insiders Are Loading Up on This Growth Stock

Seven different company insiders recently bought shares of this fast-growing healthcare giant, including executives at the director and EVP level.

The purchases came despite the stock being down for the year, signaling strong confidence from those closest to the business.

We break down exactly who bought what, the average prices they paid, and what it could mean for the stock’s outlook in our YouTube deep dive below.

Morgan Stanley “Stocks for 2027” Fact Card

This PDF below provides a detailed look at a curated portfolio of 30 U.S. stocks selected by Morgan Stanley Research for potential growth through 2027.

It highlights companies chosen for strong business models, competitive advantages, and long-term capital appreciation potential.

The document also outlines the investment strategy, fees, risks, and the methodology behind stock selection, making it a useful reference for investors who want insight into a professionally researched, thematic approach to equities.

Earnings This Week

Join 108,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

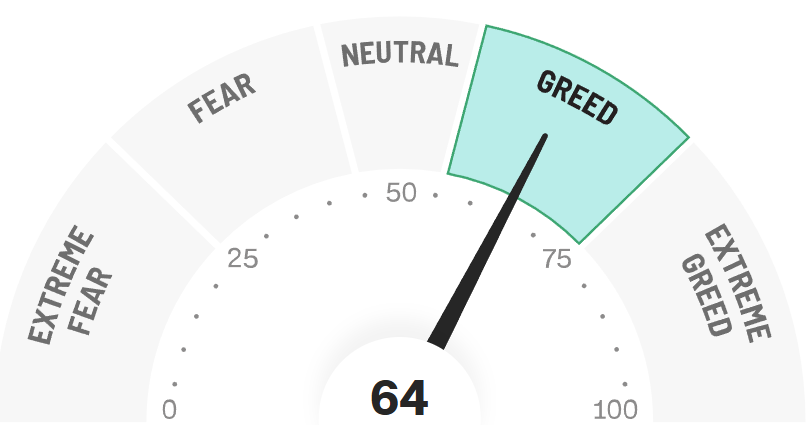

Fear & Greed Index

Top 3 Stocks Super Investors Have Been Buying

Why Super-Investor Moves Are Public

When the biggest investors buy or sell, the law requires them to disclose their holdings through filings with the SEC.

These investors - think fund managers, directors, and top executives - are closely watched because they often have access to deep insights about the companies they invest in.

The filings reveal not only how much they own, but also when they buy or sell, giving the rest of the market a rare glimpse into their thinking.

While it’s not a guaranteed signal of future performance, following these moves can highlight trends and opportunities that might otherwise go unnoticed.

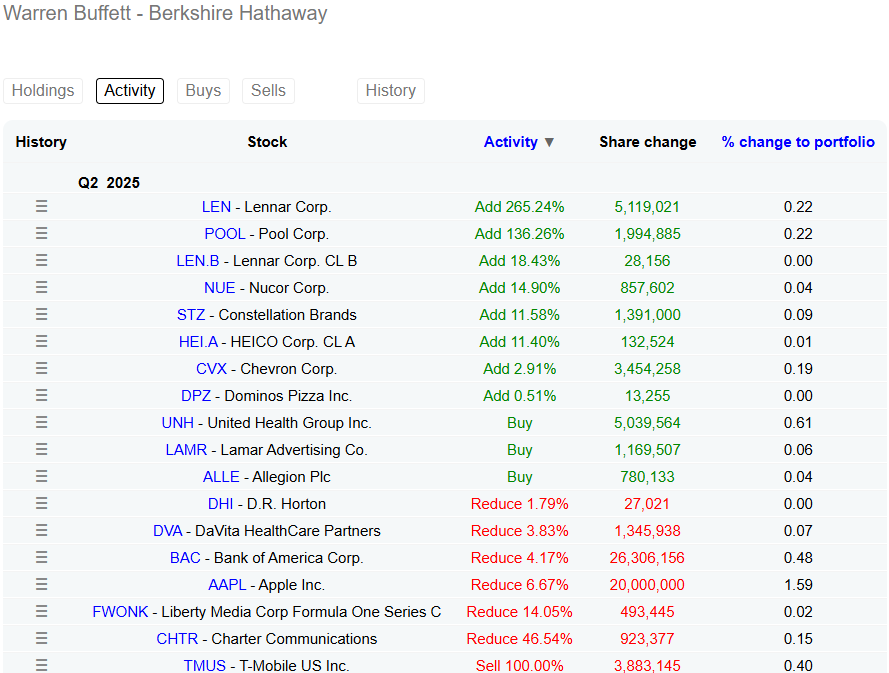

Top 20 Stocks Super-Investors Bought Last Quarter

We’ve sifted through the list and are going to highlight the three stocks that were bought the most, sharing not just who bought them and at what prices, but also our take on why these names are attracting so much attention.

Along the way, we’ll touch on market context, potential catalysts, and what this might mean for investors looking to follow the trends without blindly copying every trade.

UnitedHealth Group: The Most Bought Stock by Super-Investors

UnitedHealth Group has emerged as the most purchased stock among top investors this quarter, with 13 super-investors - including Warren Buffett’s Berkshire Hathaway - buying in.

Berkshire’s $1.6 billion stake, acquired during a period of market volatility, underscores confidence in the company’s long-term prospects.

Who’s Buying?

Berkshire Hathaway’s investment is the most notable, but other prominent investors have also increased their holdings.

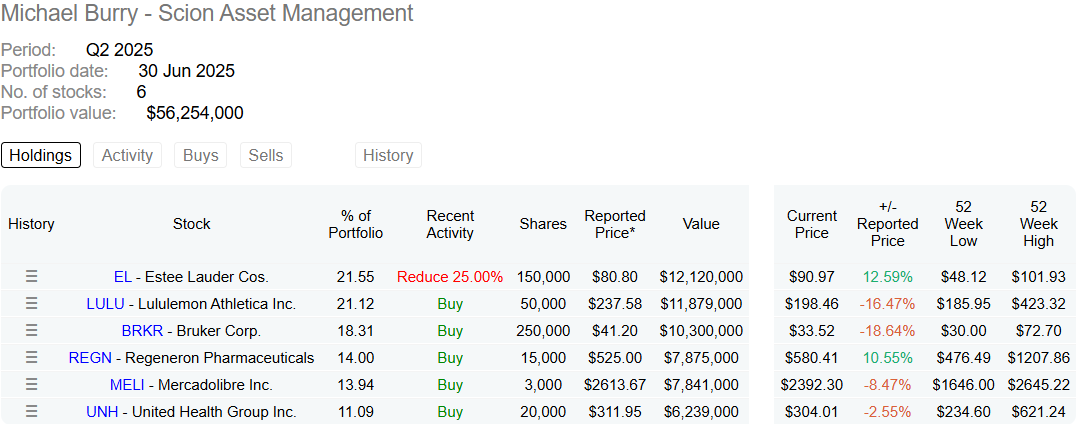

Michael Burry recently added to his stake in this growth stock, bringing it to 11% of his overall portfolio. The move signals strong conviction from the famed investor, who is known for making high-conviction, often contrarian bets.

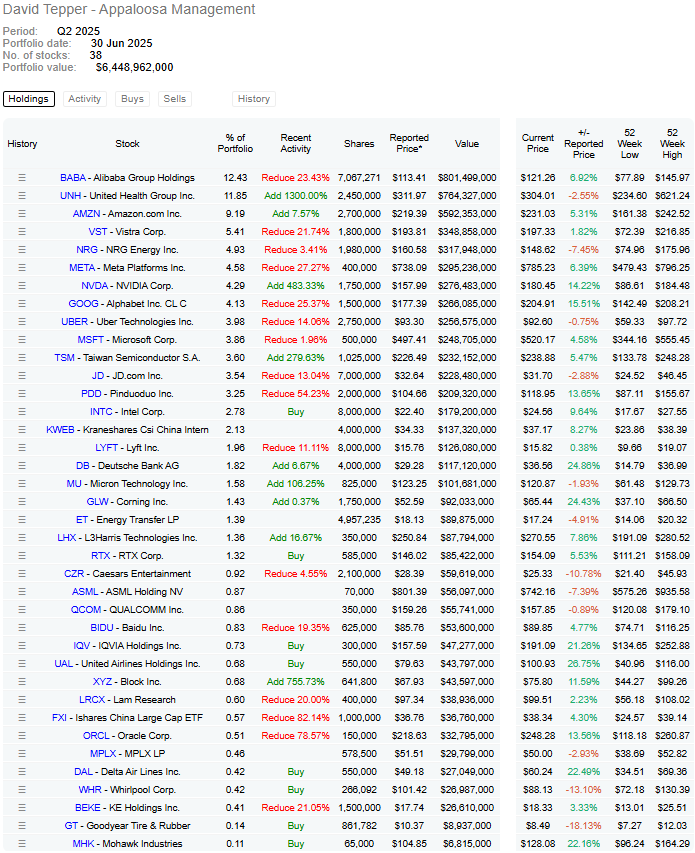

Billionaire investor David Tepper recently increased his stake in this stock, making it his second-largest holding at 12% of his portfolio.

Tepper, known for bold, opportunistic moves, appears confident in the company’s growth potential, signaling that he sees it as a core part of his investment strategy going forward.

Challenges Facing UnitedHealth

Regulatory Scrutiny: The company is under investigation by the Department of Justice for potential Medicare issues.

Operational Issues: Rising medical costs and a significant cyberattack have impacted profitability.

Leadership Changes: Recent executive turnover has added uncertainty to operations.

Potential Catalysts for Recovery

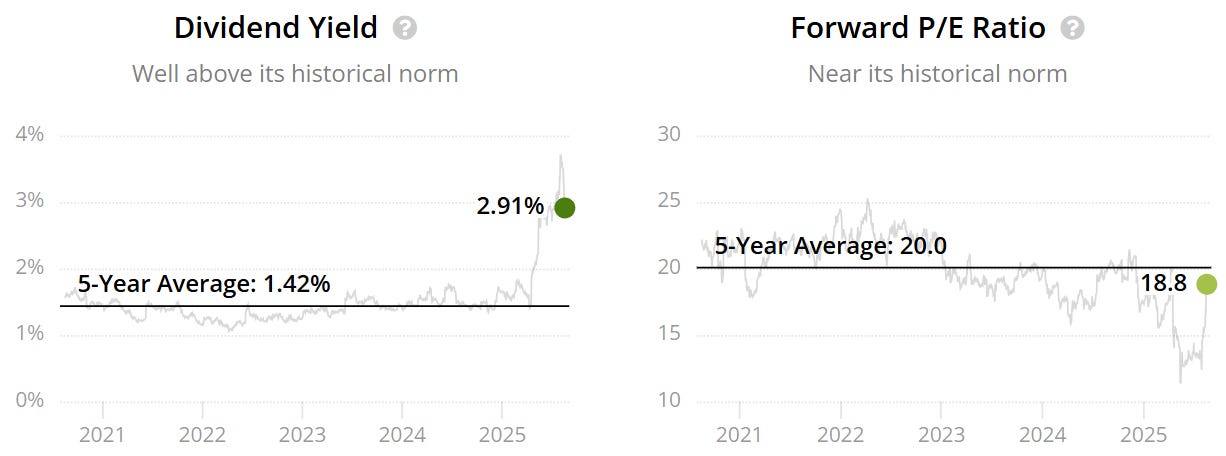

Valuation: The stock is trading below its five-year average forward P/E, suggesting potential undervaluation.

Earnings Outlook: UnitedHealth projects a return to earnings growth in the coming year, which could restore investor confidence.

Strategic Investments: Berkshire Hathaway’s move may signal a vote of confidence, potentially attracting other investors.

Valuation

It currently trades at a Forward P/E of 18.8x vs it’s historical 20x.

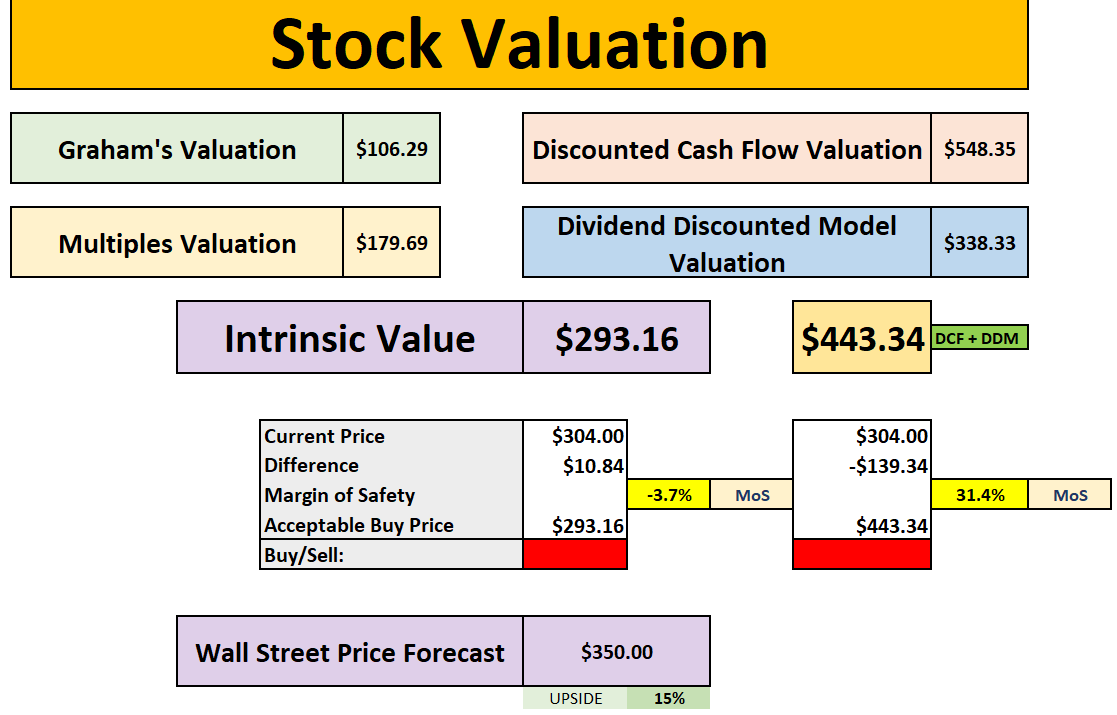

As you can see, our valuation incorporates a lot of moving parts, so we’ve laid out two scenarios.

Scenario 1: For investors who view the company’s challenges as longer-term, we combine all four models, arriving at an intrinsic value of $293. This suggests the stock is currently trading at a modest 4% premium.

Scenario 2: For those who see the issues as short-term, we focus only on the DCF and DDM models, which produce an intrinsic value of $443, implying a 31% margin of safety at current prices.

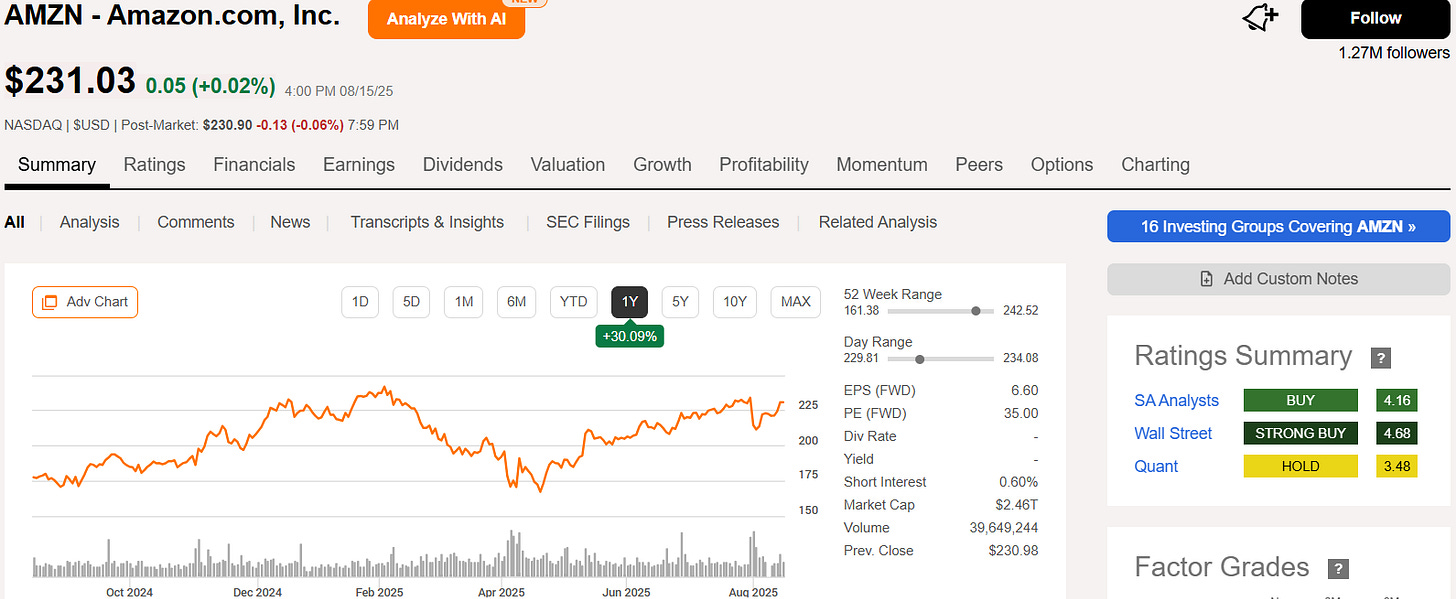

Amazon: The Second-Most Bought Stock by Super-Investors

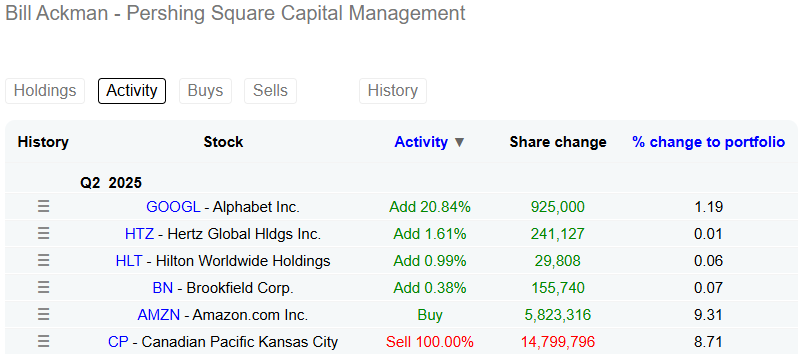

Amazon was the second-most purchased stock last quarter, with 12 super-investors adding to their stakes.

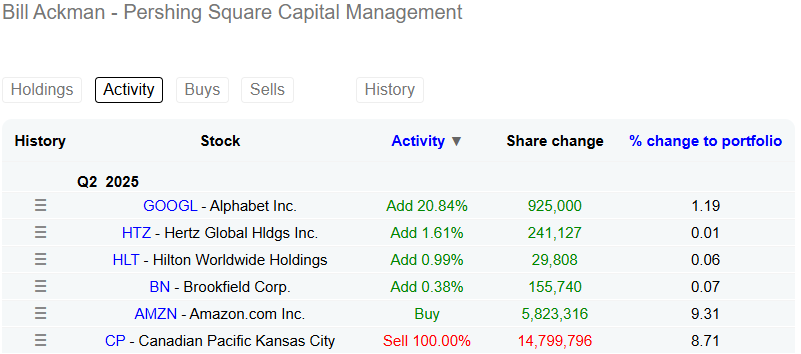

Notably, Bill Ackman made it a 10% position in his portfolio, signaling strong conviction in the company’s long-term growth prospects.

These moves suggest that despite recent market volatility, some of the smartest investors see Amazon as a core holding worth backing aggressively.

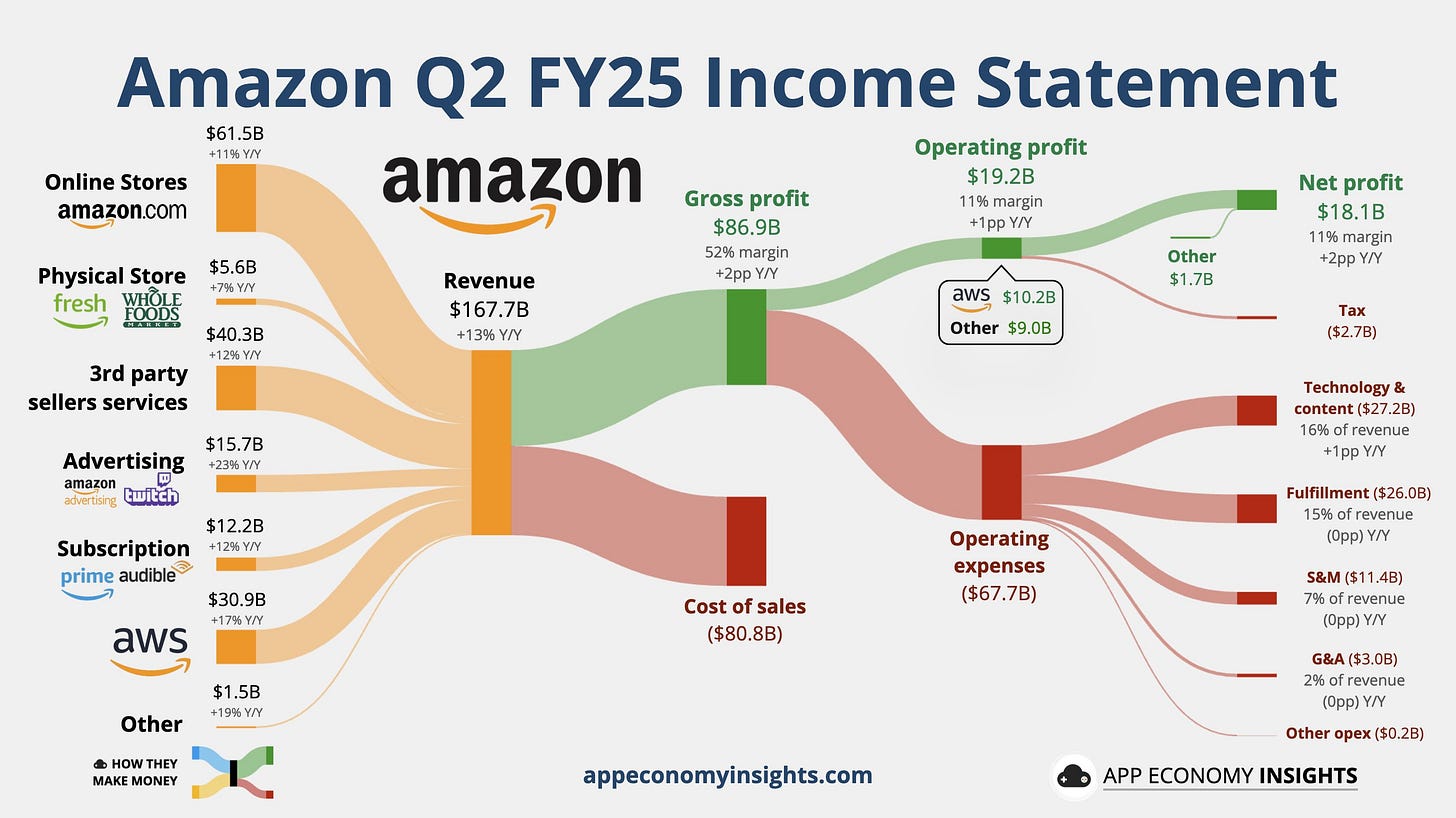

Amazon: Key Catalysts Driving the Stock

Several factors could help Amazon continue to attract investor attention and drive its stock higher:

E-commerce Growth: Despite macroeconomic uncertainty, Amazon’s core online retail business continues to expand globally, benefiting from strong consumer demand.

AWS (Cloud) Expansion: Amazon Web Services remains a major profit engine, with growth in cloud adoption and enterprise services supporting margins.

AI Integration: Amazon is increasingly leveraging artificial intelligence to improve logistics, personalization, and efficiency, giving it a competitive edge.

Prime & Subscription Revenue: Continued growth in Prime memberships and other subscription services provides predictable, recurring revenue.

International & New Ventures: Expanding in high-growth international markets and exploring new business lines (like advertising and logistics) could provide additional upside.

Overall, these catalysts suggest that even in a challenging macro environment, Amazon has multiple avenues to fuel revenue and profit growth, supporting long-term investor confidence.

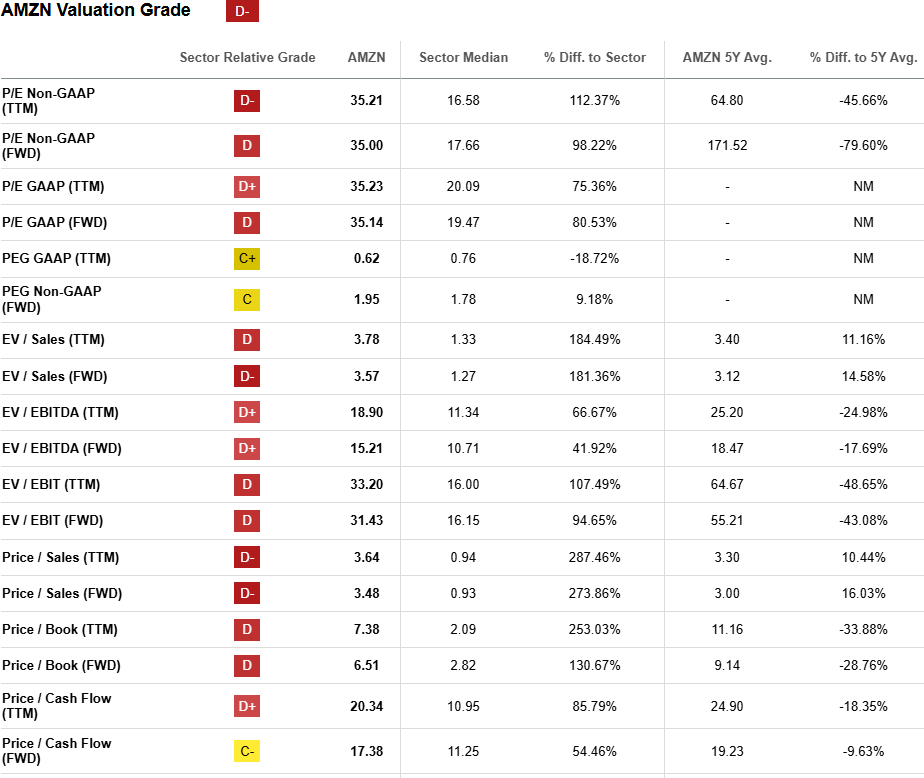

Valuation

Amazon currently trades above the sector median, reflecting its leadership position and strong growth prospects.

At the same time, it remains at a discount to its five-year average valuation, suggesting that, historically, the stock still offers room for upside relative to its long-term trends.

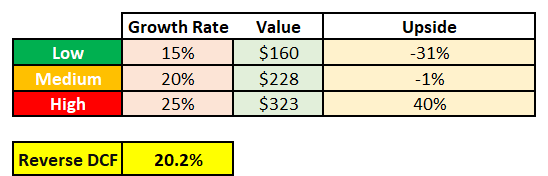

Using a growth rate of 15%, we see downside as the intrinsic value would be $160.

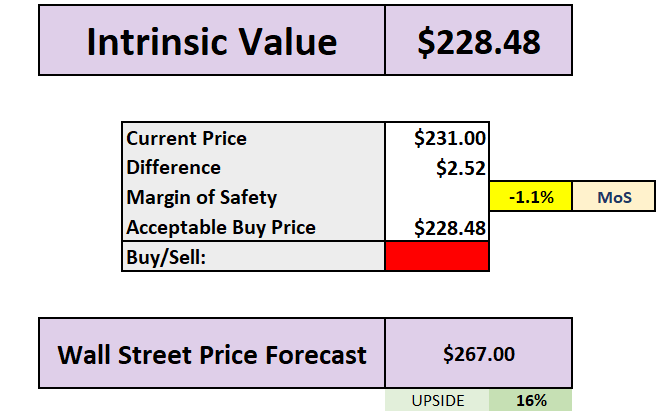

Using a growth rate of 20%, we see it in line with it’s intrinsic value at around $228.

Using a growth rate of 25%, we see upside of 40% with it’s intrinsic value at around $323.

Using a reverse DCF model we see 20.2% of growth already baked into the numbers.

Using the middle growth rate we see a 1% premium, with Wall Street seeing 16% upside into 2026.

Using a 20% Margin of Safety, it looks like a buy at around $183.

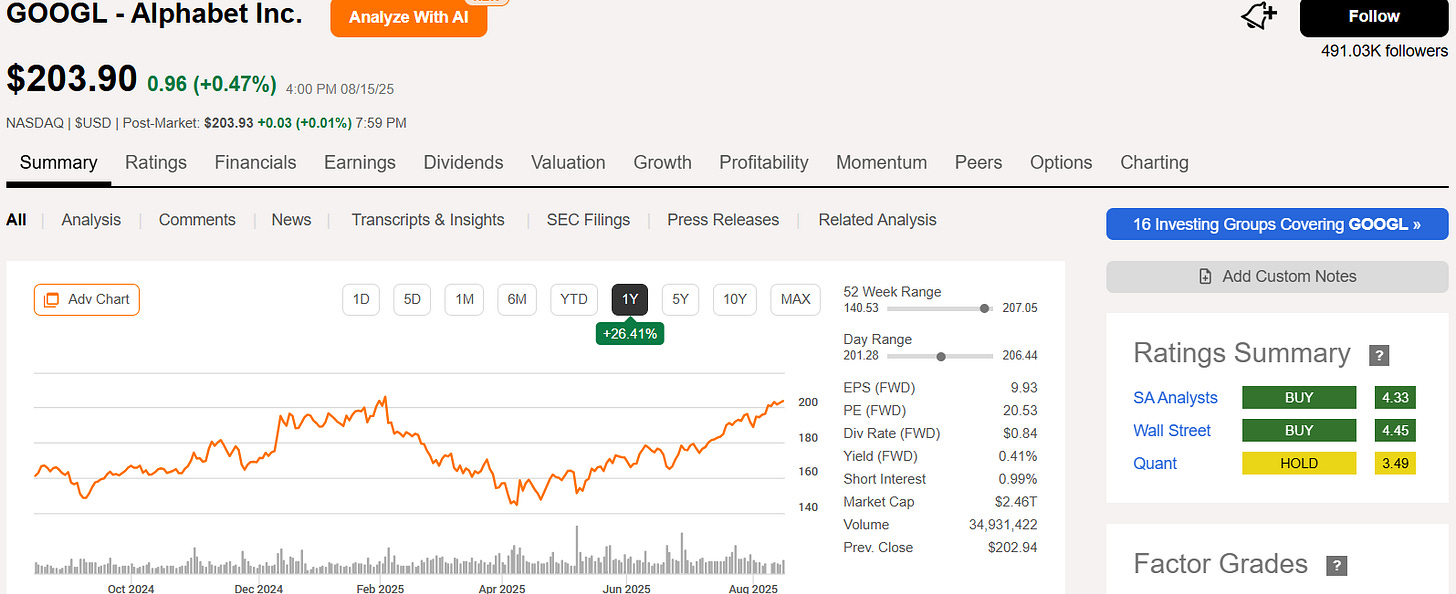

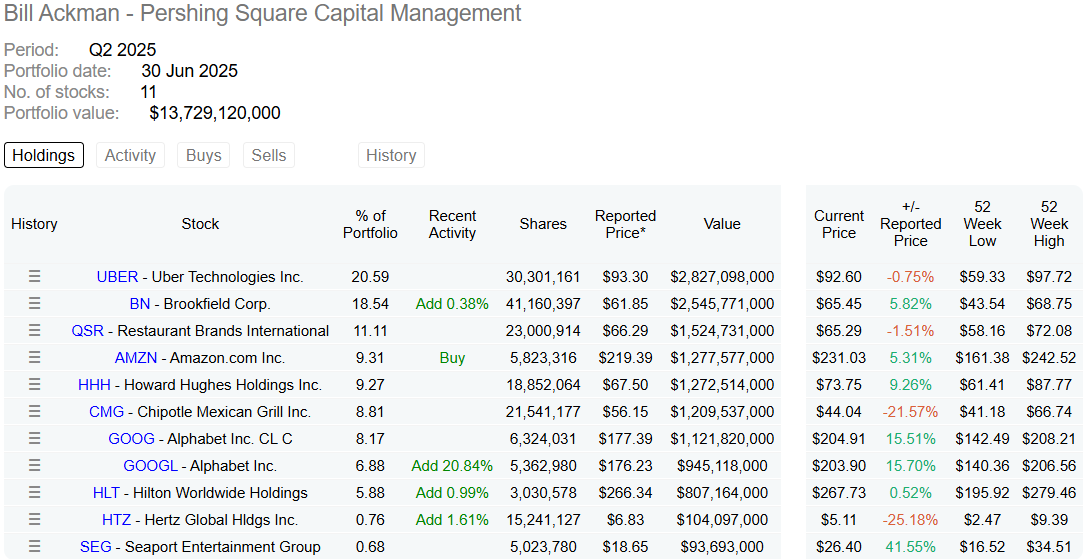

Google Joins Amazon as a Top Pick for Super-Investors

In the latest quarter, Alphabet emerged as one of the most favored stocks among super-investors, with 12 prominent investors increasing their stakes.

Bill Ackman continued adding to his position in Alphabet this quarter, bringing his total stake across both ticker symbols (GOOGL and GOOG) to 15% of his portfolio.

This makes it his third-largest holding, highlighting strong conviction in Google’s long-term growth prospects.

Ackman’s moves reflect confidence in the company’s dominant position in search, advertising, and cloud services, as well as its ability to innovate in AI and other high-growth areas.

Google: Navigating Legal and Competitive Headwinds

Alphabet Inc. faces several challenges that could impact its market position:

Antitrust Scrutiny: A U.S. federal judge recently ruled that Google holds an illegal monopoly in online search. Remedies under discussion include potential changes to its Chrome browser and default search agreements. While a forced sale is considered unlikely, the legal landscape remains uncertain.

Competitive Pressures: AI startups and emerging platforms are challenging Google’s dominance in search and browser markets, increasing competition for both users and advertising revenue.

Regulatory Compliance: Alphabet has committed significant resources to strengthen its global compliance framework in response to shareholder and regulatory concerns, aiming to address ongoing antitrust scrutiny.

These factors introduce uncertainties that investors should weigh alongside the company’s growth prospects in advertising, cloud services, and AI innovation.

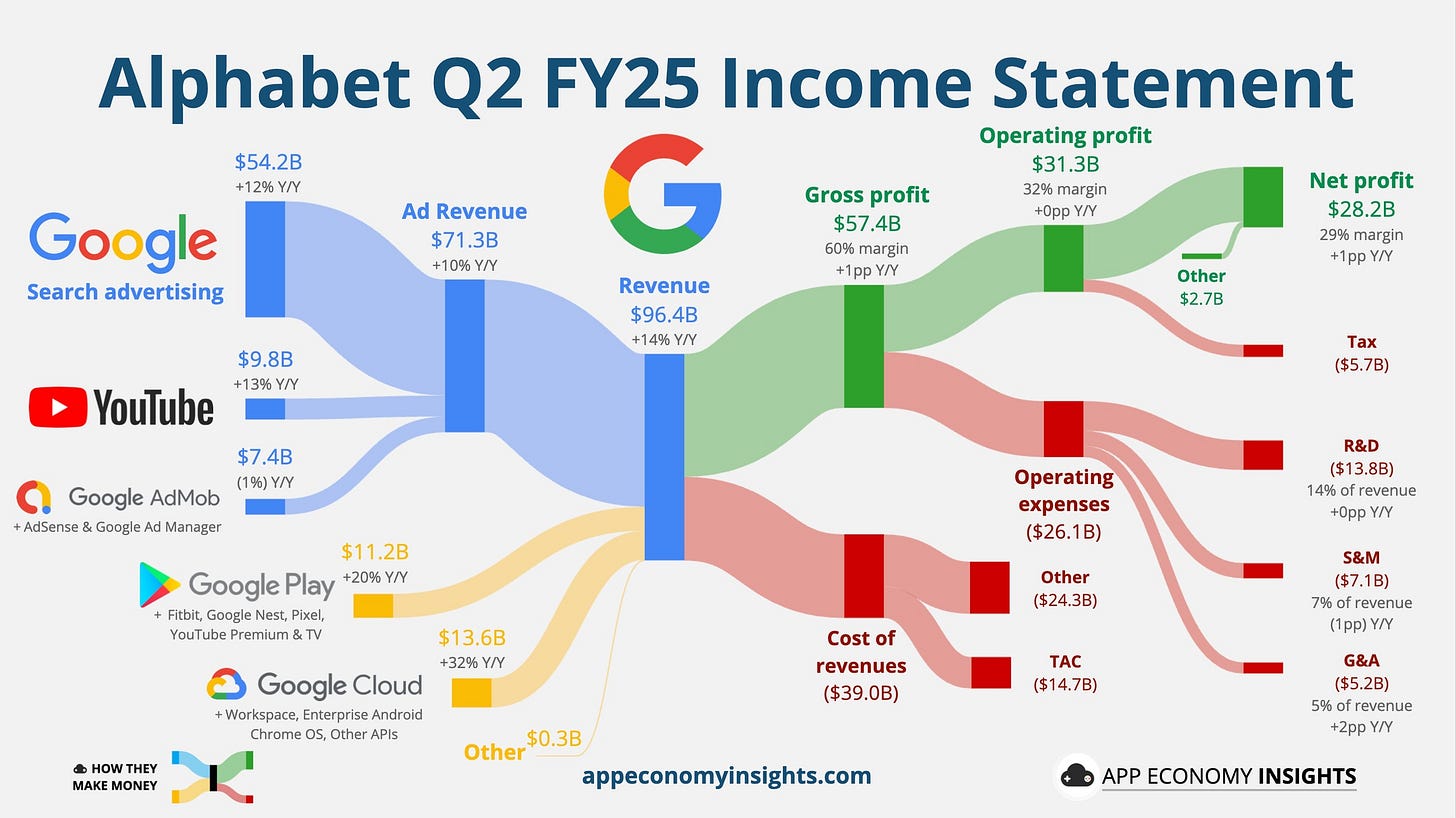

Google: Key Catalysts for Growth

Despite the challenges, several factors could support Alphabet’s stock and drive long-term upside:

Advertising Recovery: Google’s core ad business remains a major revenue driver, and any rebound in digital advertising spend could boost earnings.

Cloud Expansion: Google Cloud continues to grow rapidly, gaining enterprise customers and increasing margins.

AI Leadership: Alphabet is at the forefront of AI innovation, integrating advanced tools across search, advertising, and productivity products.

YouTube & Subscriptions: Growth in YouTube ad revenue and premium subscriptions provides recurring income.

Diversification & Innovation: Investments in new ventures, including AI and hardware, give Google multiple avenues for future revenue streams.

Together, these catalysts suggest that even amid regulatory and competitive pressures, Alphabet has multiple engines to sustain growth and attract investors.

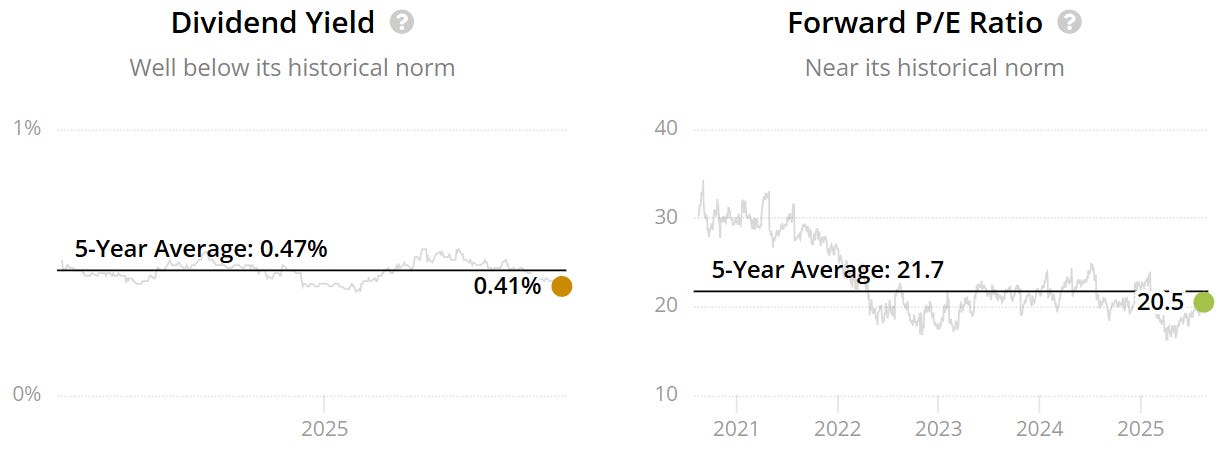

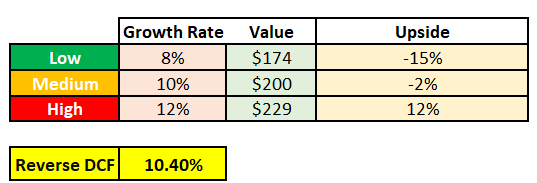

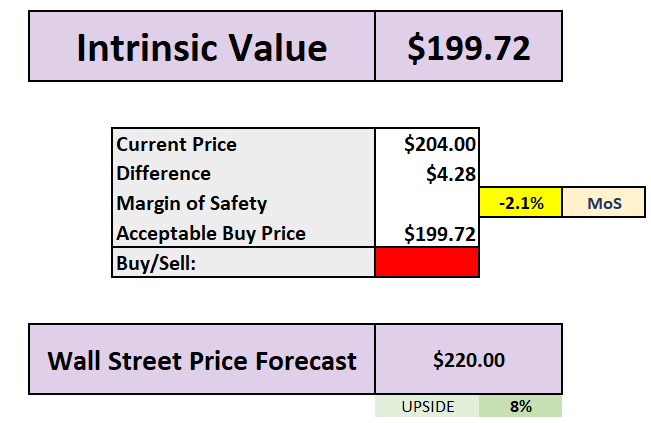

Valuation

It currently trades at a Forward P/E of 20.5x vs it’s historical 21.7x.

Using a growth rate of 8%, we see downside as the intrinsic value would be $174.

Using a growth rate of 10%, we see it in line with it’s intrinsic value at around $200.

Using a growth rate of 12%, we see upside of 12% with it’s intrinsic value at around $229.

Using a reverse DCF model we see 10.4% of growth already baked into the numbers.

Using the middle growth rate we see a 2% premium, with Wall Street seeing 8% upside into 2026.

Using a 20% Margin of Safety, it looks like a buy at around $160.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (40% off expert stock research tools)

YouTube 🎥 (Join 108,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.

Who are the Three Chinese Musketeers who bought/increase PDD at the same 2025 Q2 quarter?

.

The 3 Chinese Musketeers:

.

Li Lu (Li Buffett, Chinese Warren Buffett, titled by Charlie Munger)

.

Duan YongPing (Duan Buffett, Chinese Warren Buffett, titled by Chinese Investors)

.

Norbert Lou (Joel Greenblatt seeded money in his fund)