Everyone Gave Up on These 3 Dividend Stocks. We Ran the Valuation.

Markets are broadening, rates are falling, and fundamentals are starting to matter again.

Market Update

The final trading days of the year were quiet, but not directionless. With markets closing early for the holiday, stocks drifted lower on light volume, even as 2025 wrapped up as another strong year overall.

2025 S&P 500 Heat Map (1YR Performance)

Top Performing Stocks 2025 in S&P 500

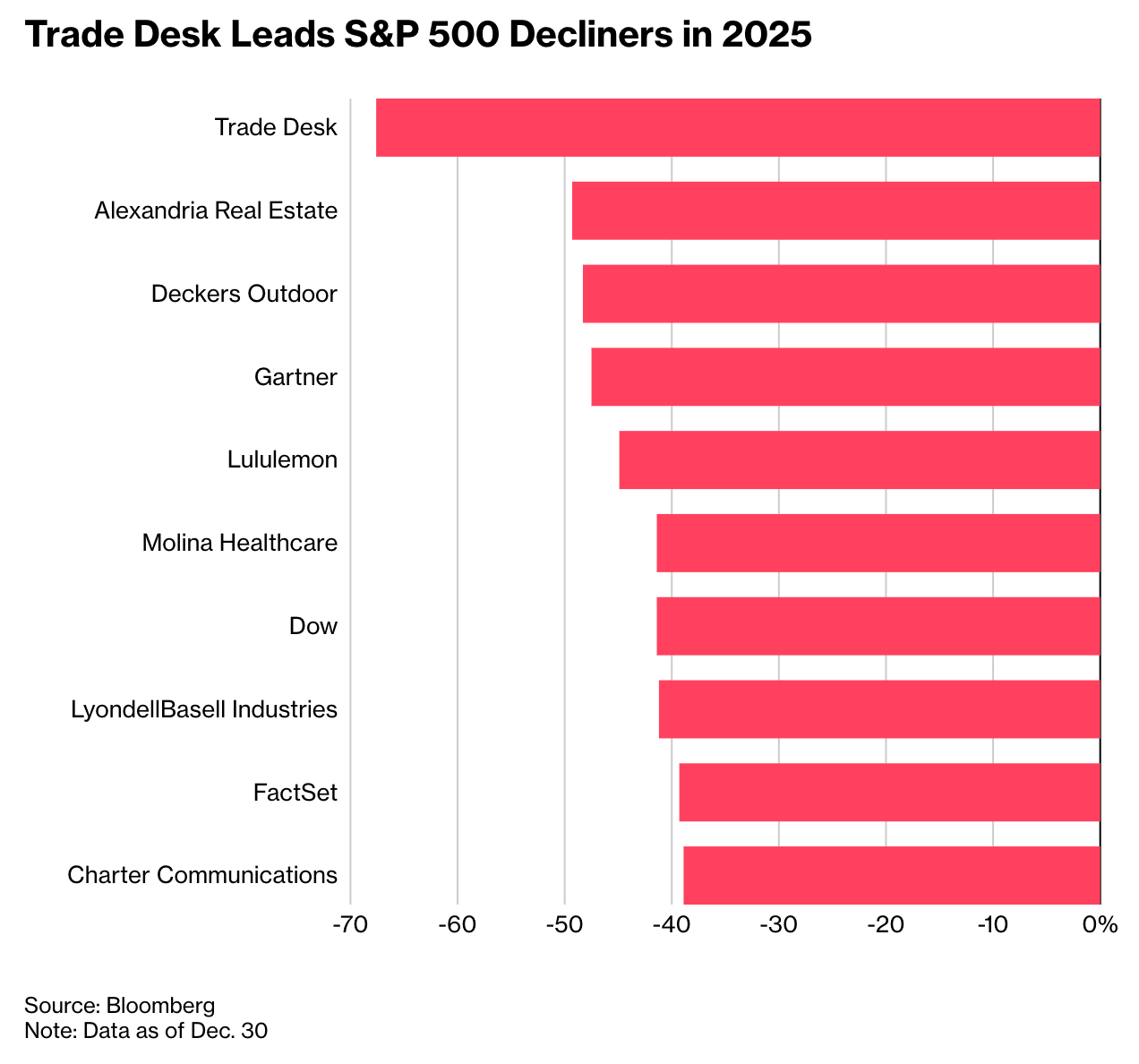

Worst Performing Stocks 2025 in S&P 500

Most major indexes finished the year with double-digit gains, though technology and smaller-cap stocks gave back ground during the shortened week. Energy was a rare bright spot, helped by rising oil prices as geopolitical tensions flared.

Attention also briefly turned to the Federal Reserve, where the latest meeting minutes showed policymakers still divided on what comes next. While the December rate cut went through, there was little urgency to signal more. Markets took it in stride, with rate-cut expectations for January remaining low.

Last Weeks Winners & Losers

Top performers:

Micron (+10%)

Molina Healthcare (+9%)

Intel (+9%)

Nike (+5%)

AMD (+4%)

Biggest drops:

Applovin (-15%)

Palantir (-14%)

Tesla (-10%)

Intuit (-7%)

Adobe (-6%)

Crowdstrike (-5%)

Notable News

Mega-Cap Tech Dominance - and the First Signs of a Shift

The dominance of U.S. mega-cap technology over this bull market has been hard to miss. Over the past three years, the so-called Magnificent Seven have surged more than 300%, leaving everything else far behind - from the broader S&P 500 to small caps, Europe, and even Japan. For a long stretch, owning anything outside that narrow group felt unnecessary.

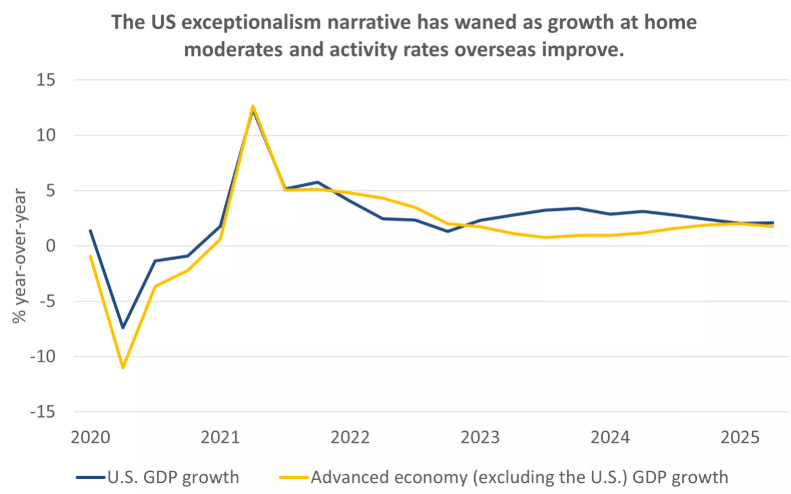

That run wasn’t an accident. Breakthroughs in AI drove real earnings momentum, while strong U.S. growth - and a rising dollar - pulled global capital toward American assets. U.S. exceptionalism became the trade, and mega-cap tech was its purest expression.

But those tailwinds are starting to fade.

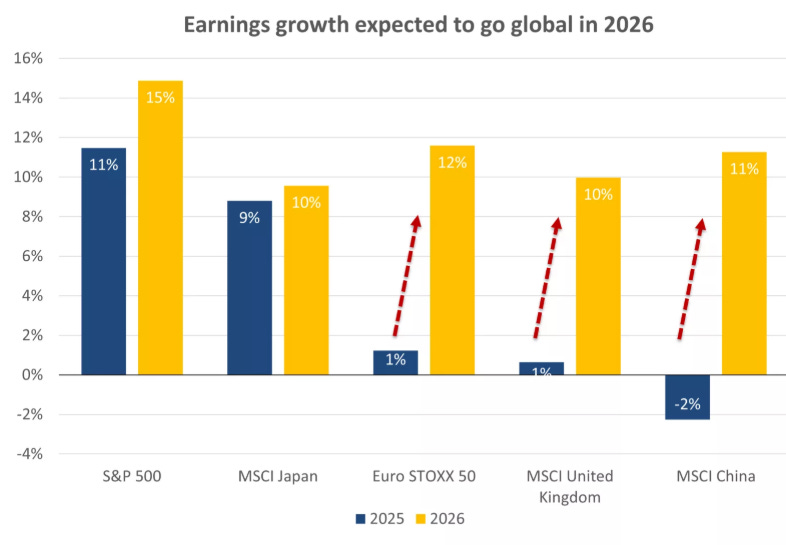

At home, earnings growth is broadening. All eleven S&P sectors are expected to grow profits, and while technology should still lead, the gap is narrowing. Financials, industrials, and consumer discretionary are now expected to deliver double-digit earnings growth of their own - a sign that leadership may be widening beyond the same familiar names.

Abroad, the picture is improving as well. The growth gap between the U.S. and the rest of the world has closed, helped by firmer international activity and some moderation in U.S. growth. That shift is expected to carry into 2026, with international earnings growth accelerating.

Currency trends are reinforcing the change. After years of acting as a headwind, the dollar turned into a tailwind for international equities following a meaningful decline last year. If the dollar stays flat or drifts lower, it strengthens the case for looking beyond U.S. mega-caps as the next phase of the cycle unfolds.

Politics, Volatility, and the Case for Staying Disciplined

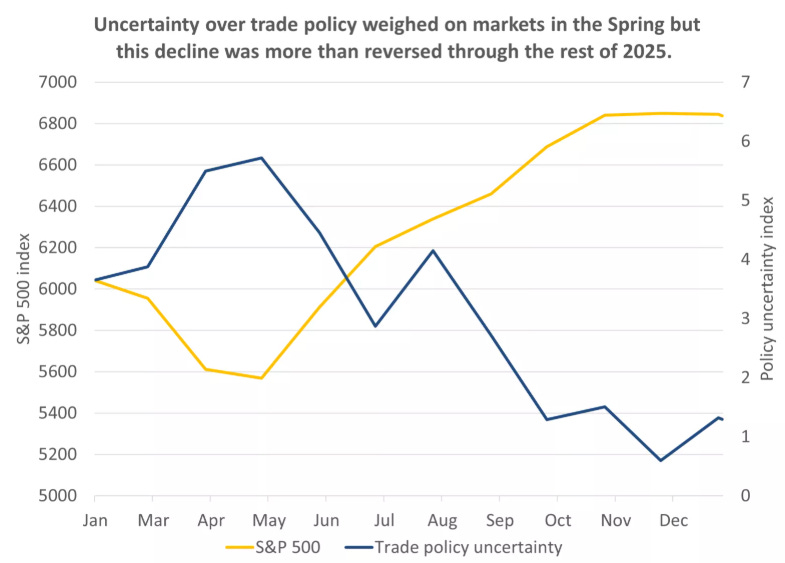

Politics played a larger role in markets last year than many investors expected. A wave of trade, tax, and immigration changes from the new administration injected real uncertainty into the system, at times rattling confidence and driving sharp swings in asset prices. The most memorable moment came in early April, when the S&P 500 briefly slid close to correction territory. Even so, markets ultimately shook it off and finished 2025 with strong gains.

Looking ahead, the policy environment may be calmer - at least relative to last year. Much of the heavy lifting on trade was already done with last year’s tariff reset, which should bring more stability even if occasional disputes flare up. On the fiscal side, talk of another major legislative push hasn’t gone away, but stretched public finances may limit how ambitious lawmakers are willing to be.

That said, this is still a midterm year, and political surprises are never off the table. Control of Congress remains a key variable, and any shift in power could raise the odds of policy gridlock - or reignite uncertainty if markets start to price in abrupt changes.

The bigger takeaway is not to let politics drive portfolio decisions. Policy noise tends to be loud and unpredictable, but it rarely changes long-term fundamentals. For investors, staying disciplined, diversified, and focused on long-term goals has historically mattered far more than trying to trade the political cycle.

Rates Are Falling - and the Cash Trade Is Fading

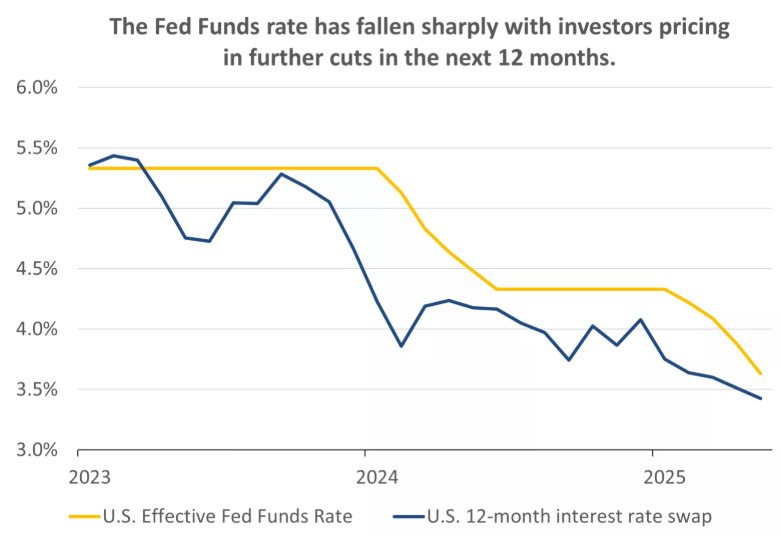

After peaking in 2024, U.S. interest rates have already come down meaningfully - roughly 175 basis points - and the direction of travel still appears lower. The debate now isn’t whether rates will fall, but how quickly and how far.

That call isn’t without tension. Inflation has proven stubborn, and as we head into 2026 it will have been nearly five years since price growth last sat comfortably at the Fed’s 2% target. Some policymakers remain uneasy about moving too fast, preferring to see clearer evidence that inflation is truly under control before cutting again.

But that caution isn’t universal. A growing share of Fed officials appear more comfortable with the inflation outlook, pointing to easing shelter costs and softer pricing behavior from businesses facing weaker demand. Even with tariffs expected to push some goods prices higher, the tone from the Fed suggests increasing confidence that these pressures will be temporary rather than persistent.

Taken together, the bias still leans toward lower rates. Markets are currently pricing in one to two additional cuts this year, which would bring policy closer to a neutral setting - neither stimulating nor restraining growth. That path feels reasonable. Barring an inflation surprise, the Fed looks likely to trim rates again, bringing them into the 3–3.5% range.

As a result, the era of easy returns on cash is likely fading. With yields set to drift lower, this environment may favor gradually reallocating toward bonds and equities where the potential for stronger returns in 2026 looks more compelling.

Earnings Season

Join 119,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

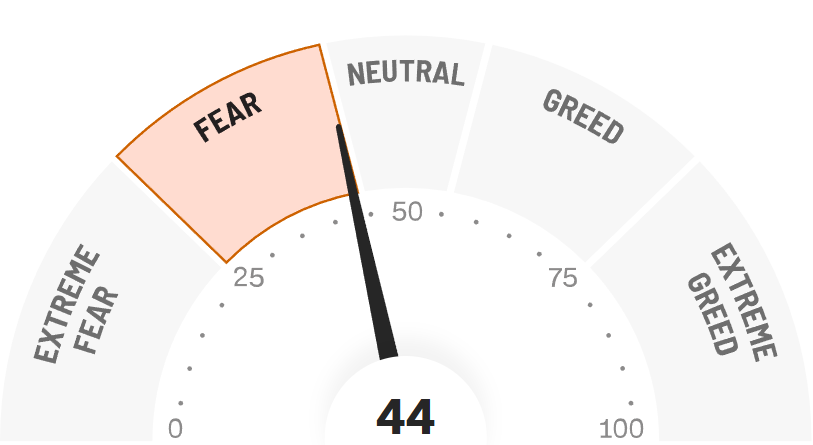

Fear & Greed Index

3 Dividend Stocks Investors Have Given Up On

1. Automatic Data Processing (ADP)

What does ADP Actually Do?

Every two weeks, millions of employees get paid on time without thinking twice about it. Taxes are withheld correctly. Benefits show up. Compliance boxes are checked. For most workers, it feels automatic.

That’s ADP.

Automatic Data Processing sits quietly in the background of the global economy, handling payroll and HR for businesses that don’t want mistakes, surprises, or downtime. From small businesses running their first payroll to multinational corporations managing workforces across dozens of countries, ADP provides the software and services that keep employees paid and companies compliant.

Over time, ADP has evolved far beyond basic payroll. Its cloud platforms manage hiring, time tracking, benefits administration, and labor law compliance - the unglamorous but mission-critical work companies can’t afford to get wrong. Once a business plugs into ADP, switching away is painful, risky, and rarely worth it.

That stickiness is the point. ADP isn’t flashy, but it’s deeply embedded - collecting recurring fees while quietly powering paychecks for tens of millions of workers worldwide.

Why ADP Struggled in 2025 and Is Now at a 52-Week Low

For years, ADP was the definition of slow-and-steady growth. Then something changed.

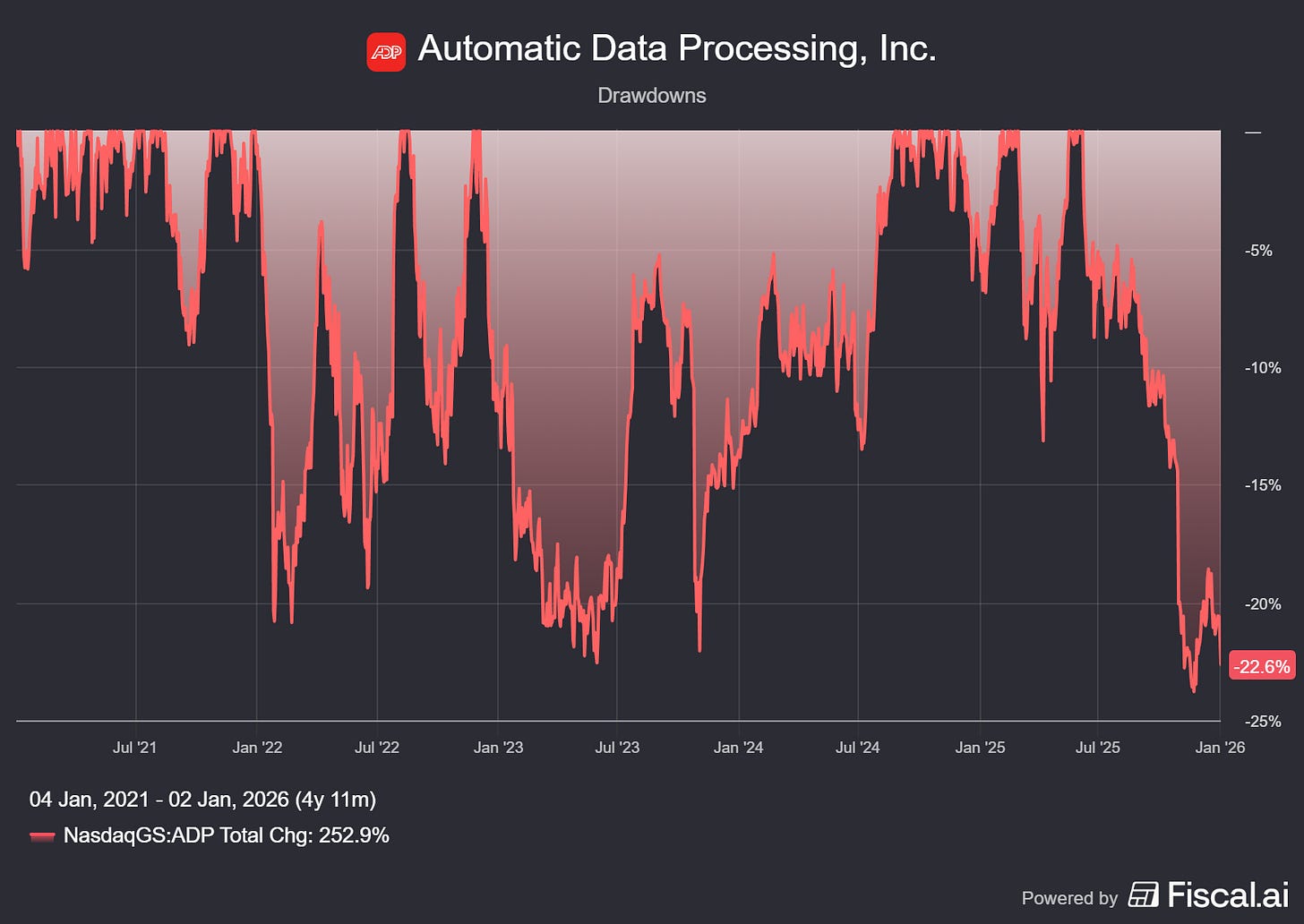

In 2025 ADP ran into the kind of headwinds that remind investors even the safest businesses can stumble and this saw the share price in it’s largest drawdown in the last 5Y down 23%.

A few of the biggest pressures:

• A tougher macroeconomic backdrop

As interest rates stayed elevated and hiring cooled across many industries, the very thing that feeds ADP’s business - payroll growth and workforce expansion - slowed. Fewer hires, slower wage growth, and tight budgets meant clients were more cautious with their spending.

• Slower sales in its core technology business

Investors had been betting on ADP’s cloud-based HCM platforms to drive the next leg of growth. But new client adds softened, partly because competitors like Paychex, Workday, and Oracle have been aggressive on pricing and product enhancements. ADP’s sales cadence lagged, and its growth metrics began to flag.

• Execution challenges and transition costs

Inside the business, ADP has been modernising legacy systems and integrating acquisitions. That transition has been messier and more expensive than expected, squeezing margins and slowing operating leverage - exactly the sort of thing that worries shareholders watching expenses climb while top-line growth stalls.

• Investor sentiment turned cautious

When a stock is priced for perfection - and ADP’s valuation had been rich relative to its own history - even a modest slowdown can lead to outsized multiple compression. As earnings guidance came in below expectations earlier this year, funds and quant models started trimming positions. That selling fed on itself, pushing the share price toward its 52-week low.

The result? A stock that’s no longer the model of steady appreciation but a company trading at depressed levels, not because its business is broken, but because growth paused when the market least wanted a pause.

Why Now May Be a Compelling Entry Point

The selloff matters - but so do the fundamentals underneath it.

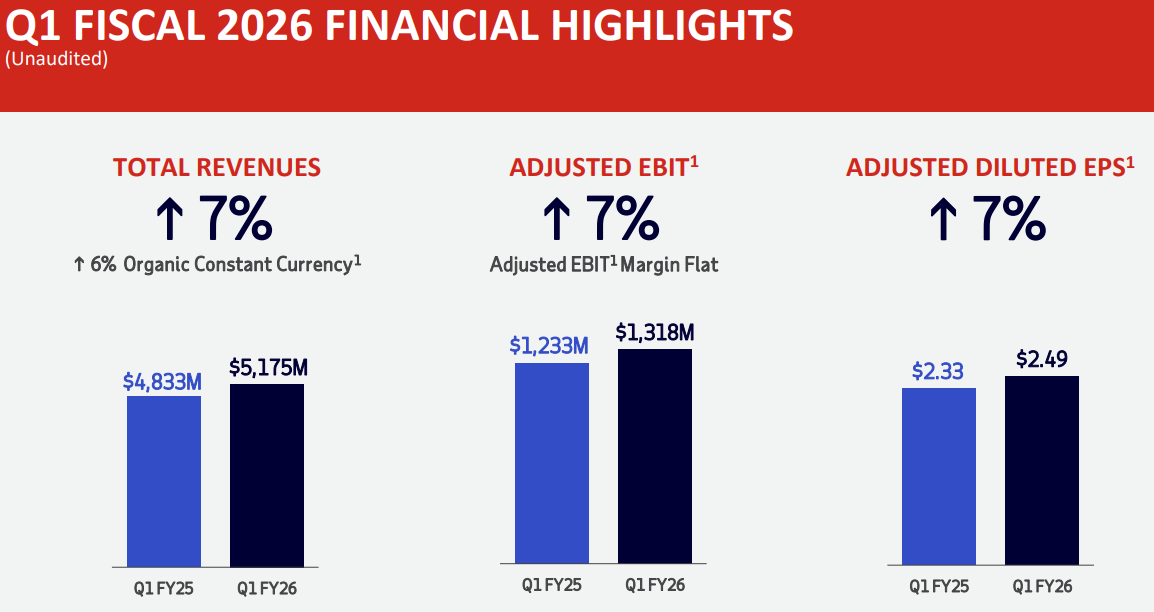

While ADP’s stock price has struggled, the business itself hasn’t. The most recent quarter told a very different story: revenue and EPS both grew 7%, reinforcing that demand for payroll and HR services remains intact even in a slower hiring environment.

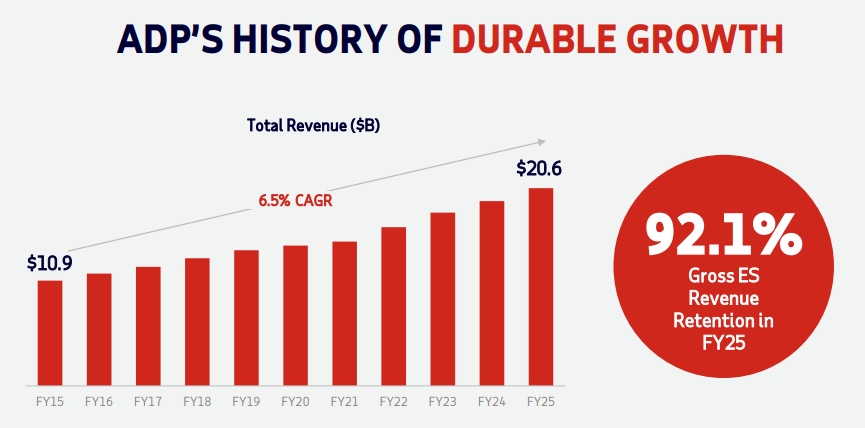

Zooming out, ADP’s consistency becomes hard to ignore. Over the last decade, revenue has compounded at roughly 6.5% annually,

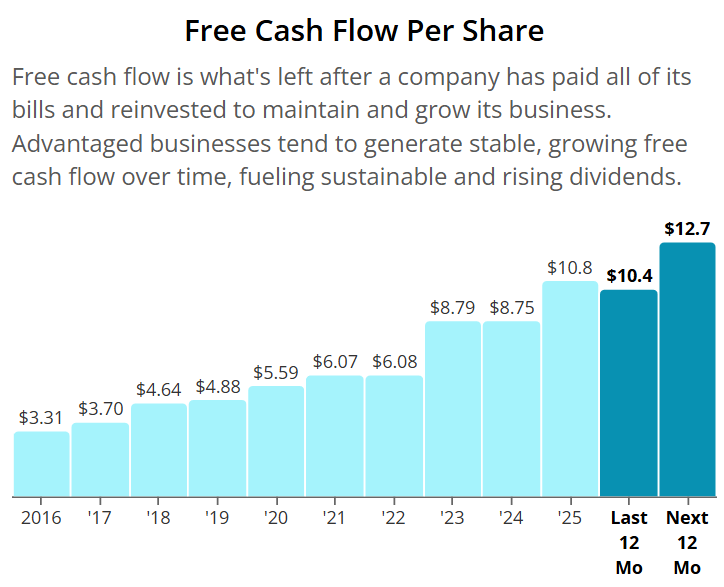

free cash flow has tripled,

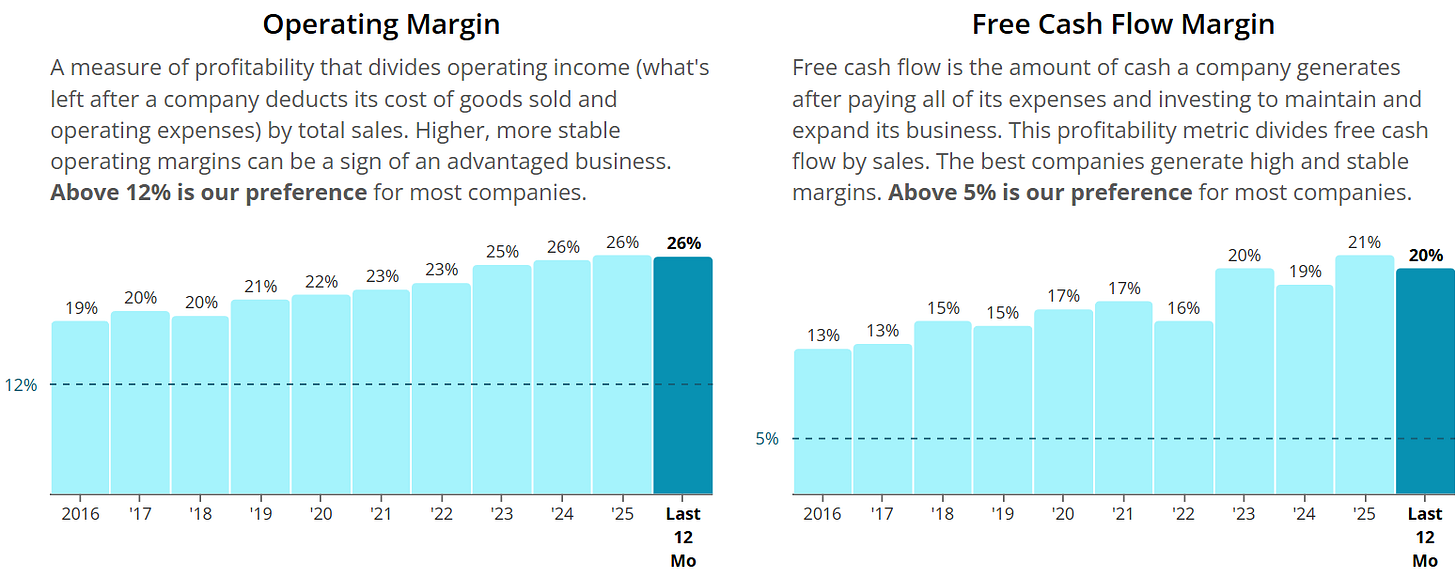

and both operating and free-cash-flow margins have continued to expand, a sign that scale and efficiency are still working in shareholders’ favor.

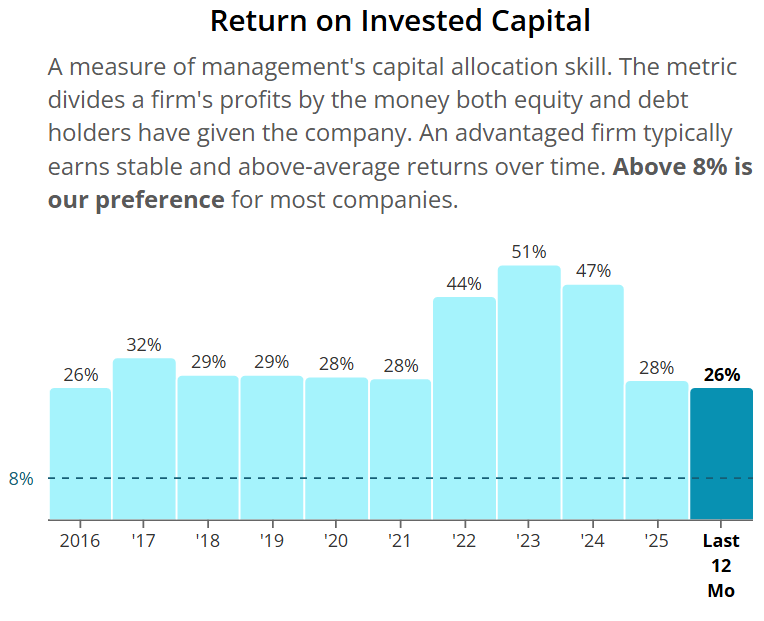

Today, ROIC sits around 26%, well above most large-cap software and services peers.

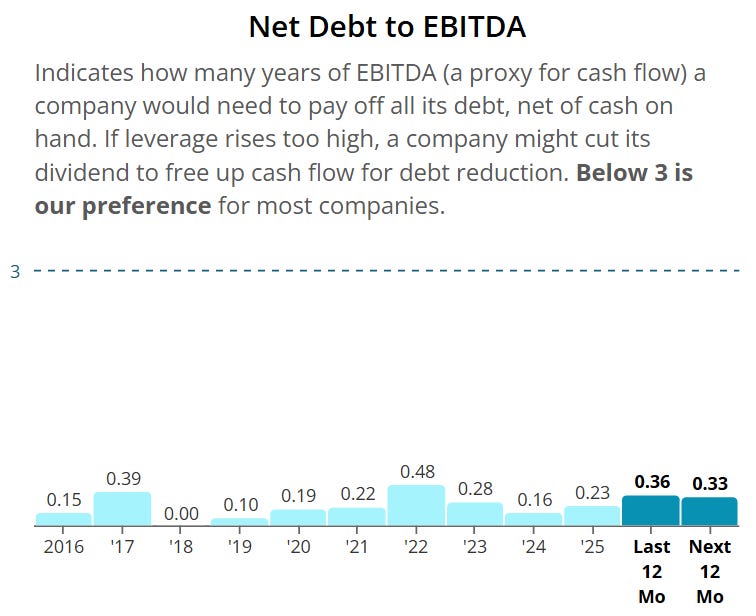

Balance sheet risk is minimal. Net debt to EBITDA is just 0.36, giving ADP ample flexibility to invest, buy back shares, and return cash to shareholders through the cycle.

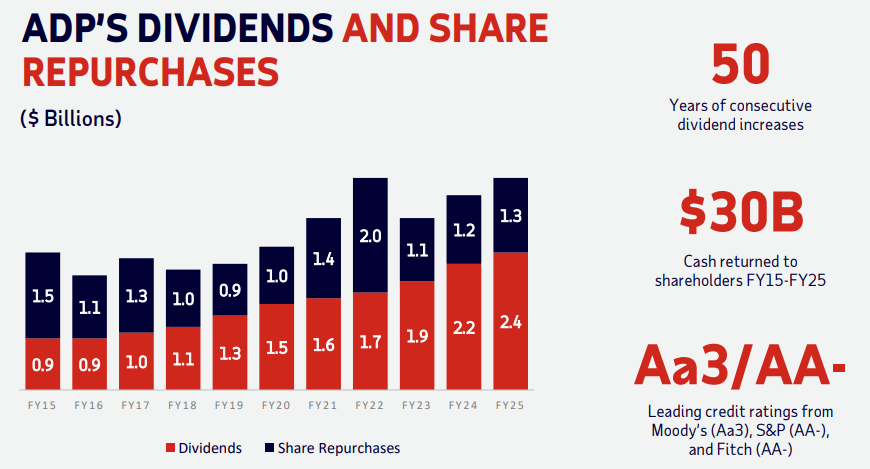

And that shareholder return matters.

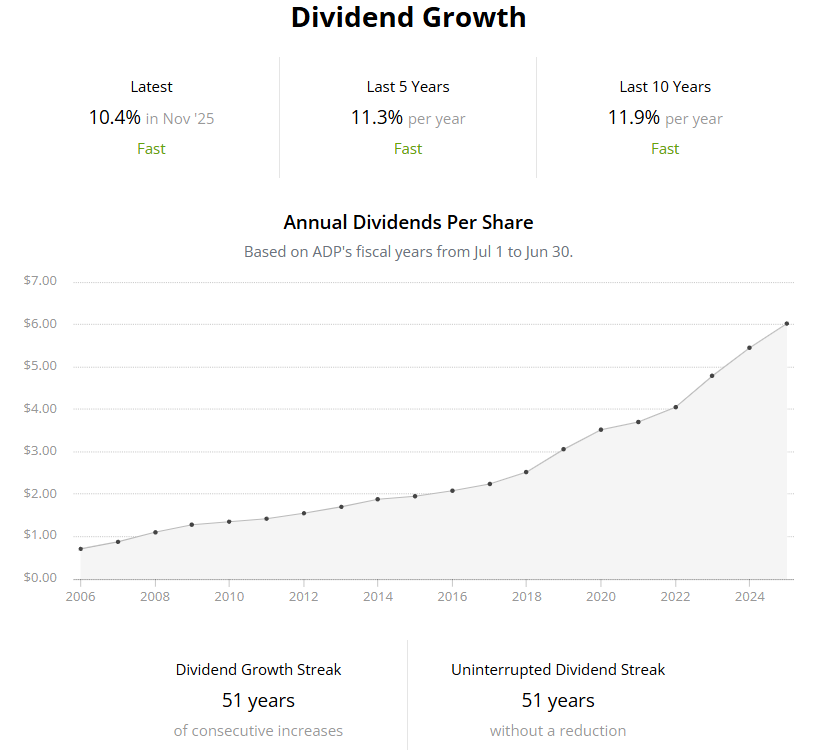

ADP is a Dividend King, with a long history of double-digit dividend growth, supported by steady cash generation.

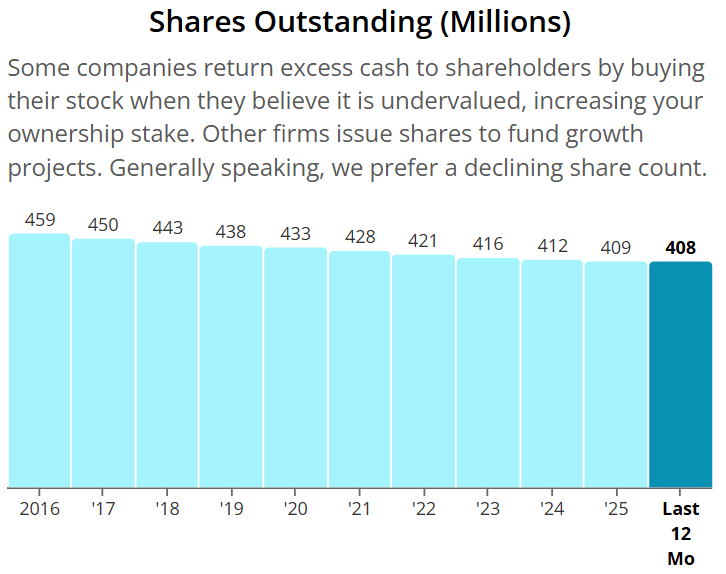

On top of that, the company consistently repurchases shares, quietly boosting per-share value year after year.

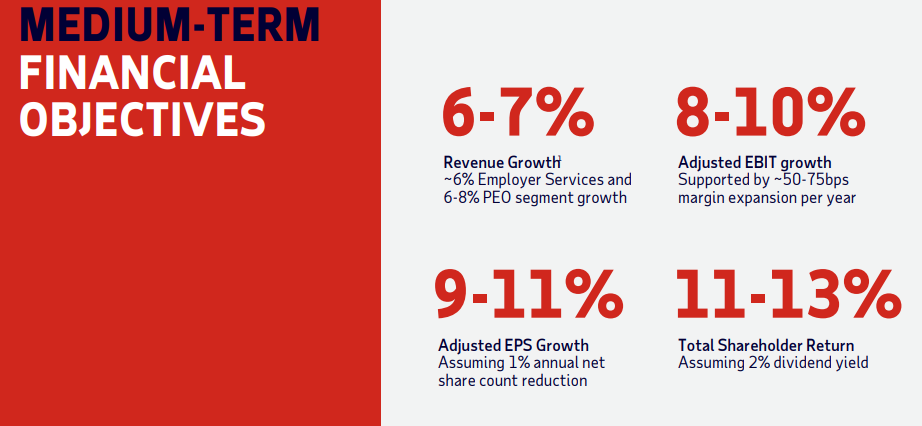

Management isn’t promising heroics - just execution. Medium-term targets call for 6–7% revenue growth, 9–11% EPS growth, and total shareholder returns in the 11–13% range, driven by organic growth, margin expansion, dividends, and buybacks.

When a business with this track record hits a rare drawdown - while fundamentals remain strong - it’s often when long-term investors start paying attention.

Valuation

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.