How To Find Undervalued Stocks!

The Best Resources To Help YOU!

Introduction

We all want to find undervalued stocks and today we want to run through all the resources that we use ourselves to identify when stocks give us an undervaluation signal.

There are many factors that go in to identifying whether or not a stock is undervalued and there are different levels to which a stock shows this signal.

Stages Of Review

Stage 1 - High Quality Identification

Before we even look at whether a stock is undervalued, we need to understand if it is a high-quality stock that we want to add to our portfolio.

There are so many stocks that are available to buy in the market so looking for a high quality one can be difficult, which is why one of our resources today is a simple market screener.

Our first ever newsletter below can be a good place to start if you want an idea of some metrics to use.

Stage 2 - Undervaluation Signal

So you’ve identified a high quality stock that you want to add to the portfolio which brings us on to stage 2, and that is identifying whether or not this stock is undervalued.

Ultimately you want to pay a low price for high value.

Stage 3 - Margin of Safety

Margin of safety! So, you’ve found a stock you want to add and it has shown signs of undervaluation.

The next step is to apply your own margin of safety to get to your acceptable buy price.

For example:

We have Stock A which has passed stage 1 and 2 above and is priced at $169.

We have calculated our intrinsic value of the stock to be $210.

We then arrive at our 15% margin of safety (MOS level) and can see this would indicate a buy up to $179, therefore meaning that this undervalued high-quality stock we have identified is a buy up to $179 giving us a 15% margin of safety.

Resources

Similar to above we can break down the resources into the 3 stages.

Stage 1 - High Quality Identification

Resources to find out whether or not a stock is high quality:

Finviz Stock Screener - FREE

https://finviz.com/screener.ashx

Once you click on the link you can see four tabs, I would click on the fundamental tab and then use the drop downs to identify strong stocks.

If we were to do a quick example we could use the following criteria:

Sales growth over last 5 years > 10%

EPS growth over last 5 years > 10%

Gross margin > 30%

Return on investment > 10%

If we then sorted by largest market cap we would get the below:

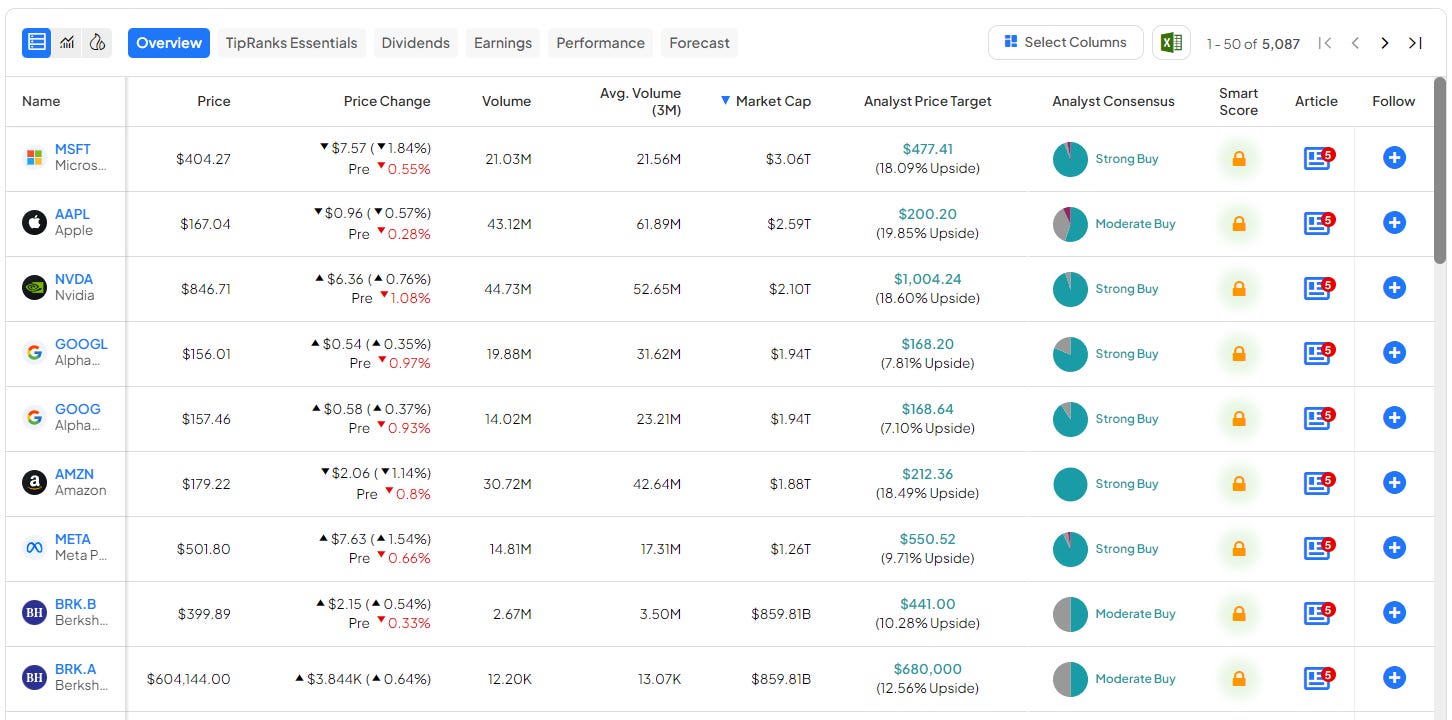

https://www.tipranks.com/screener/stocks - FREE (limited functionality)

Whilst my personal preference is finviz, you can also take a look at the tipranks version although the free version has a lot more restrictions.

Stage 2 - Undervaluation Signal

Resources to find out whether or not a stock is undervalued:

YouTube

The first link (which is FREE) is our own YouTube channel where we cover a wide range of stocks daily:

https://www.youtube.com/@DividendTalks?sub_confirmation=1

Insider Buying/Selling

As we always say in our stock episodes, insider buying is a bullish signal as management only buy if they believe the share price will go up.

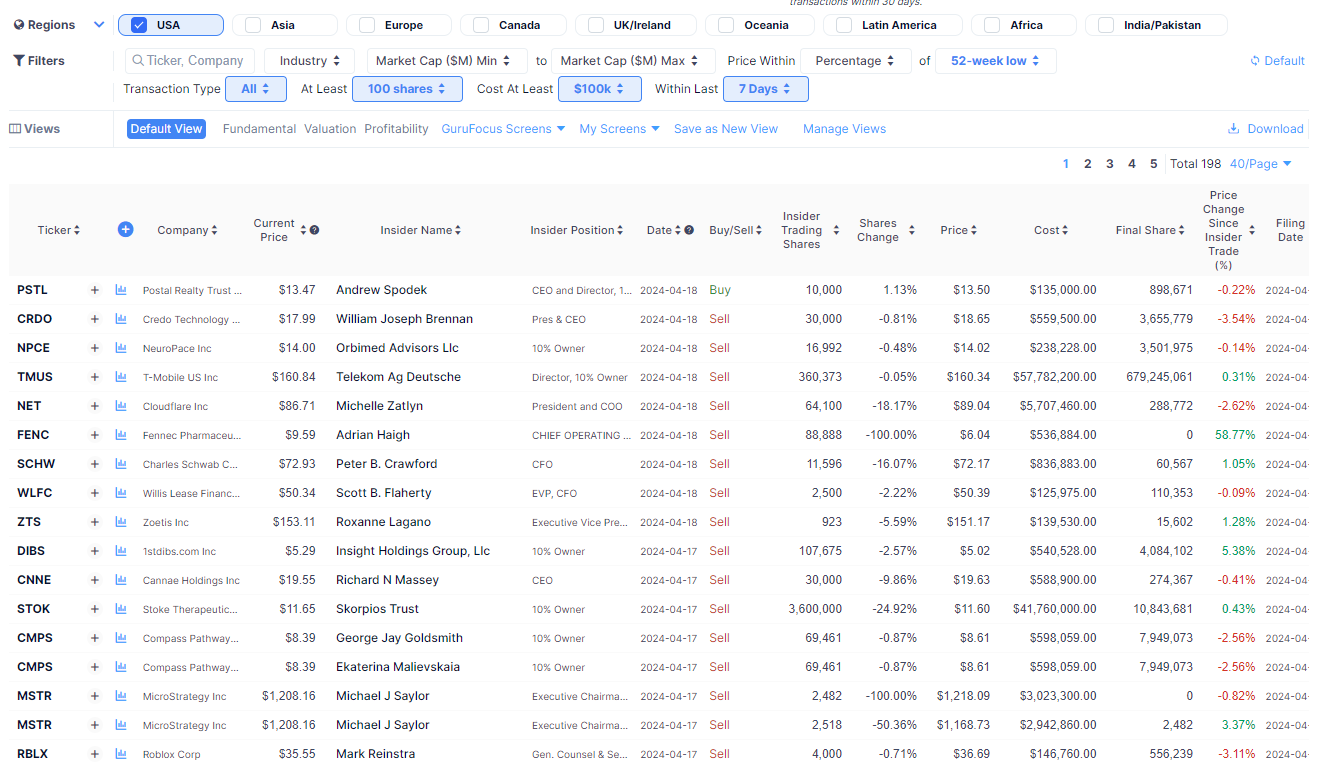

FREE screener for insider buys and sells:

https://www.gurufocus.com/insider/summary

As you can see below, using the filter we have put in all transactions (buys and sells), minimum buys of 100 shares with a minimum value of $100k over the last 7 days.

Institutional Ownership

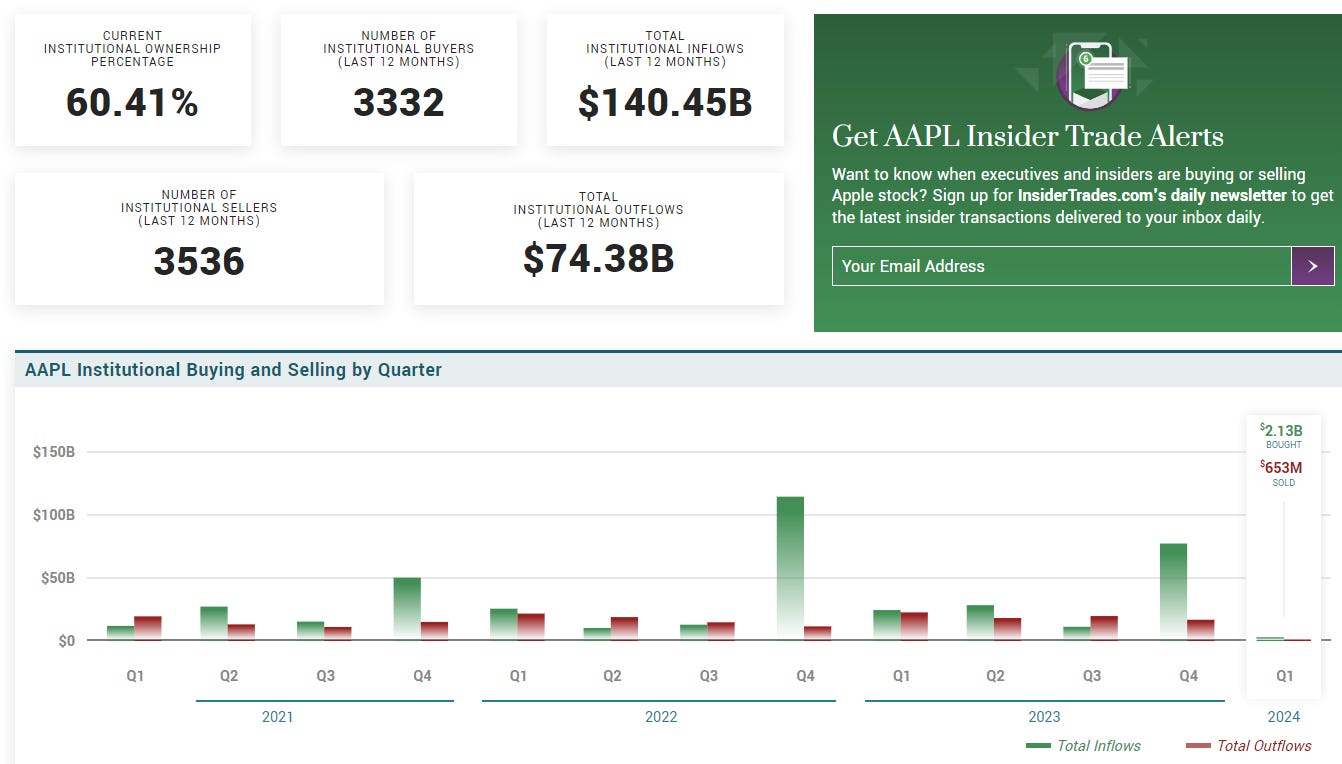

Whilst you may not consider institutional ownership a massive role to play in your investment thesis, it can be interesting to see if institutions are buying or selling more shares of a company over the more recent quarters.

FREE screener for institutional ownership (as well as buys and sells):

https://www.marketbeat.com/

Once you open the website you can select the company you want to analyse and click on ‘ownership’.

For example, we have done this for Apple:

Overall Analysis

If you are a subscriber to our YouTube channel then you know we like to use Seeking Alpha a lot.

We typically review their financials over the last 10 years, their performance vs their competitors and S&P500 as well as a lot more information.

The best part is that for a decent part of the website it is completely free.

However, if you want to gain access to all the information then you will need to pay a yearly subscription.

If you do decide you want a subscription you can get 20% OFF Seeking Alpha Premium: https://www.sahg6dtr.com/29N4DP9/R74QP

Please note this is an affiliate link.

If you want to see what type of additional information the premium gives you, feel free to check out my latest review of Altria Group (MO):

Overall Analysis

Another one of my favourites is Simply Safe Dividends, which I use in every episode.

This breaks down a lot of the information so it is easy to consume and also helps in identifying undervalued stocks through dividend yield theory.

PAID - https://www.simplysafedividends.com/

A few snippets of information, again for Apple:

Stage 3 - Margin of Safety

Resources to find out the margin of safety:

Every stock we review we always look at the margin of safety as you don’t want to buy a stock at its intrinsic value.

As above we have created a model where you can calculate your own intrinsic value of stocks to get to your own acceptable buy price given your own margin of safety.

You can grab a copy below:

Conclusion

As investors you want to ensure you are buying high quality stocks, that are undervalued with a margin of safety.

Hopefully these resources will help on your journey to achieving all of that.

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note: I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.