I Bought 3 Stocks This Week. Here’s What the Market Is Missing.

Calm markets, loud headlines, and why I’m putting new money to work anyway.

Market Update

Markets, Meet the Noise Machine

The year barely got started before the news cycle went into overdrive. Geopolitics flared. The Fed found itself in the political crosshairs. Washington rolled out a grab-bag of policy ideas aimed at fixing affordability - some bold, some eyebrow-raising. By any measure, it’s been a lot.

And yet, markets have been oddly unmoved.

Stocks haven’t panicked. Volatility hasn’t spiked. Instead, prices have drifted, rotated, and - at times - pushed higher, as if investors are choosing to look past the headlines and focus on something sturdier underneath.

That tension - between an increasingly chaotic news tape and surprisingly resilient fundamentals - is the story of early 2026. And so far, fundamentals appear to be winning.

Two Weeks That Felt Like Two Months

In rapid succession, investors were forced to process:

The U.S. capture of Venezuela’s Nicolás Maduro

Escalating protests and a violent crackdown in Iran, followed by new sanctions and military threats

Comments from White House officials suggesting a potential U.S. takeover of Greenland

A Department of Justice criminal investigation into Fed Chair Jerome Powell

A proposal to ban institutional investors from buying single-family homes

Instructions for Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds

A proposed one-year, 10% cap on credit-card interest rates

Any one of these headlines could have rattled markets in a different era. Taken together, they read more like a stress test than a news roundup. And yet, equities largely shrugged.

Stocks Stay on Their Feet as Earnings Begin

Despite the political and macro noise, equity performance told a calmer story.

Major indexes finished the week mixed, but leadership trends remained intact. Small-cap and value stocks extended their year-to-date edge over large-cap and growth shares. The Russell 2000 and S&P MidCap 400 both touched fresh all-time highs, while large-cap indexes eased modestly off prior records. Value outperformed growth for a third consecutive week.

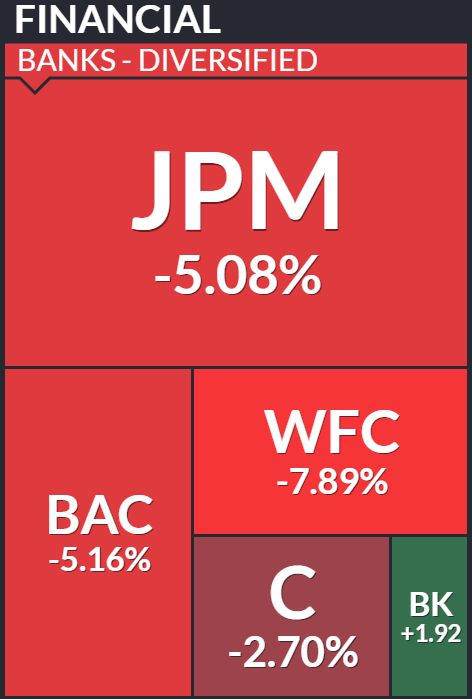

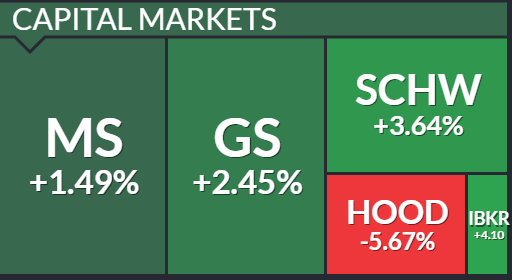

Earnings season added another layer - but not a shock. Early bank results were mixed: JPMorgan and Citigroup slipped after reporting lower quarterly profits,

while Morgan Stanley and Goldman Sachs rallied on better-than-expected numbers.

Later in the week, Taiwan Semiconductor posted a strong jump in profits, helping stabilize sentiment around AI-linked stocks.

Markets, it seems, were willing to sort through the details rather than react emotionally.

Inflation Cools, Consumption Holds Up

Under the surface, the data gave investors something solid to hold onto.

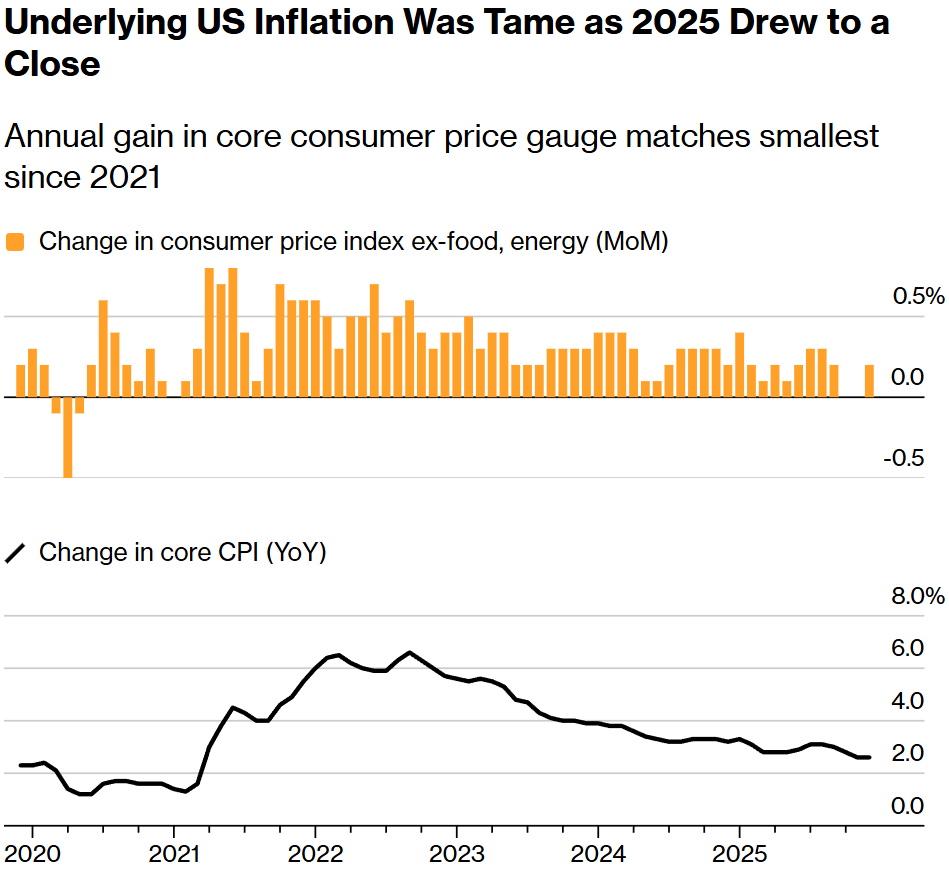

Core inflation continued to cool. December core CPI rose just 0.2% month over month and 2.6% year over year - the slowest pace since early 2021 and slightly below expectations. Headline inflation ticked higher but stayed well-behaved.

Producer prices told a more mixed story. November PPI rose 0.2% month over month and 3.0% year over year, driven largely by energy costs. Not ideal, but not destabilizing.

Meanwhile, the consumer is still spending. Retail sales jumped 0.6% in November, beating expectations, though growth in the control group that feeds into GDP slowed modestly. The message was familiar: demand is cooling at the margins, not collapsing.

Last Weeks Winners & Losers

Top performers:

AMD (+14%)

KLA Corp (+12%)

Applied Materials (+9%)

Johnson & Johnson (+7%)

Altria (+7%)

Biggest drops:

Intuit (-16%)

Salesforce (-13%)

Applovin(-12%)

Royal Caribbean (11%)

Adobe (-11%)

Notable News

Geopolitics Rarely Break Markets - Energy Usually Tells the Story

Markets have seen this movie before. Geopolitical shocks grab headlines, spark short-term fear, and then - more often than not - fade. History suggests the economic damage is usually limited, and market impacts tend to be brief.

When geopolitics does matter for markets, it almost always shows up through one channel: energy prices.

That dynamic played out again this month. Crude prices jumped on fears that a U.S. strike on Iran could disrupt supply, only to give those gains right back once officials signaled they were likely to stand down - for now. Today, WTI crude is hovering near $60 a barrel, close to five-year lows, while U.S. gasoline prices remain subdued around $3.35 a gallon. For consumers, that’s not a headwind - it’s a quiet boost.

Even if tensions flare again, the setup suggests price spikes may struggle to stick. Global oil supply looks plentiful. The International Energy Agency expects the oil market to be oversupplied in 2026, with rising OPEC+ production running ahead of relatively modest demand growth.

That surplus matters. Ample supply acts as a natural shock absorber, limiting the odds that geopolitical flare-ups turn into sustained energy inflation - or a lasting problem for markets.

Cooling Inflation Keeps the Fed on a Measured Path

The economic data has been messy in the wake of last year’s government shutdown, but December’s inflation report cut through the noise in a good way.

Both headline and core CPI came in right where markets hoped - 2.7% and 2.6%, respectively - easing concerns that inflation might be re-accelerating. It’s not enough to force the Fed’s hand at the January meeting, but if price pressures continue to behave as the data distortions fade, the door remains open for a gradual cut later this spring.

Politics, meanwhile, has grown louder. Pressure on the Fed has intensified, and the criminal investigation into Chair Jerome Powell has raised understandable questions about independence. Still, policy tends to follow data, not headlines. Powell has not been charged, removing him would be legally complex and time-consuming, and his term runs through May. He has also been clear about defending the Fed’s autonomy.

Just as important: the Fed is not a one-person operation. Even the next chair - whether it’s Kevin Warsh, Kevin Hassett, or someone else - will hold just one vote on a 12-member committee. Five votes rotate among regional Fed presidents selected by their local reserve banks, creating built-in checks on sudden policy shifts.

That structure matters. It helps explain why, despite political noise, the Fed’s path remains slow, deliberate, and data-driven - exactly the kind of environment markets tend to handle well.

Growth Is Slowing, Not Stalling

For all the anxiety in the headlines, the U.S. economy enters 2026 with real momentum behind it.

Growth ran hot through the middle of last year, and while the pace is cooling, it’s still firmly positive. Some of the late-2025 strength likely came from temporary factors like a swing in net exports, but the real engine of the economy - consumer spending - continues to hold up.

That resilience should carry into the early part of this year. Households are set to receive a wave of extra cash as tax refunds roll in, the result of retroactive tax cuts that weren’t reflected in last year’s withholding. Estimates suggest $100–$150 billion in additional refunds, a meaningful near-term tailwind for spending.

The labor market is helping too. Jobless claims remain low by historical standards, and December’s dip in the unemployment rate hints that conditions may be stabilizing after a softer stretch. It’s not a boom, but it’s far from a breakdown.

Trade is another potential swing factor. The Supreme Court is expected to rule this month on the legality of tariffs imposed under emergency authorities. Even if those tariffs are overturned and refunds are issued, I don’t expect a lasting shift in trade policy - similar measures would likely be reintroduced through other channels. More importantly, last year’s trade uncertainty is already fading, and incremental progress is being made. A recent agreement will lower Taiwan’s tariff rate on U.S. imports, with more bilateral deals likely to follow.

Put it all together, and the picture is fairly straightforward: consumers are spending, the labor market is steadying, fiscal cash is coming back to households, and trade headwinds are easing at the margin. That combination keeps the growth backdrop constructive as 2026 gets underway.

Profits Are Doing the Heavy Lifting

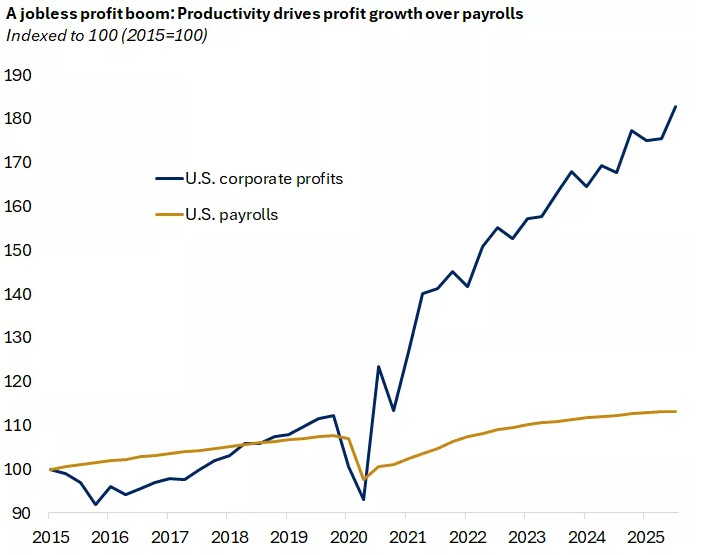

If there’s one force quietly carrying this market, it’s earnings.

Last year’s 16% gain in the S&P 500 wasn’t driven by runaway valuations. Most of the work was done the old-fashioned way: companies made more money. That momentum hasn’t faded. The index is on track to post its tenth straight quarter of year-over-year profit growth, with fourth-quarter earnings expected to rise around 8%.

What’s more interesting is what’s happening beneath the surface. Over the past six months, analysts have steadily raised their outlook for 2026. Consensus now points to nearly 15% earnings growth next year, with every major sector contributing. This isn’t a narrow story anymore - it’s broadening.

Notably, profits are rising without a comparable surge in hiring. Productivity gains, helped along by technology investment, are allowing companies to do more with fewer workers. It increasingly looks like a “jobless profit boom,” and markets tend to reward that dynamic.

Banks offered the first real look at earnings season, and while results were generally solid, stock reactions were mixed after a strong run in December. Higher expense guidance - much of it tied to tech upgrades - gave investors pause. So did renewed attention on a proposed 10% cap on credit-card interest rates, which would be a real headwind for card lenders if enacted.

Still, that proposal would require congressional approval, where momentum appears limited. Stepping back, the broader setup for financials remains constructive. M&A activity is picking up, deregulation is easing constraints, and loan growth is improving. Taken together, those forces suggest earnings momentum has more room to run.

Earnings Week

Join 119,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

Why I’m Putting New Money to Work Now

With headlines screaming and markets barely reacting, it’s easy to do nothing. Cash feels safe. Waiting feels prudent. That’s usually when opportunities start to quietly line up.

The setup right now isn’t about chasing momentum or calling a top or bottom. It’s about fundamentals reasserting themselves while attention is elsewhere. Earnings are growing, inflation is cooling, and market leadership is broadening - all in an environment where expectations remain surprisingly restrained.

Against that backdrop, I added exposure to three stocks this week. Each reflects a different expression of the same theme: resilient growth in a market that’s being priced as if something is about to break.

These aren’t trades built around a headline or a single catalyst. They’re positions sized for uncertainty, backed by cash flows, and supported by trends that look durable even if volatility picks up.

Below, I’ll walk through what I bought - and more importantly, why - so you can decide whether the logic holds, regardless of whether you follow the trades.

1. Visa (V)

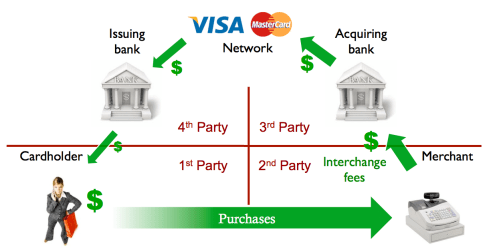

So… What Is Visa Really - and How Does It Actually Make Money?

Most people think Visa is a bank. Or that when you tap your card, Visa is lending you money.

That’s not how it works.

Visa doesn’t lend. It doesn’t take deposits. It doesn’t deal with missed payments or credit risk. All of that sits with the banks.

Visa’s business is simpler - and more powerful.

Visa is the invisible infrastructure behind global payments. It’s the system working quietly in the background every time you buy a coffee, order something online, or pay for a subscription. You don’t see it, but it’s there - authorizing, routing, and securing transactions in milliseconds.

Think of Visa as air traffic control for money. It doesn’t own the planes or carry the passengers. It just makes sure everything moves safely, instantly, and without disruption.

Here’s what actually happens when you tap your card:

You tap or click “pay.”

That request runs through the Visa network.

Visa checks with your bank to confirm the transaction looks legitimate.

The merchant gets approval.

Funds move from your bank to the merchant’s bank - without ever touching Visa’s balance sheet.

For orchestrating all of this, Visa collects a small fee from the banks and merchants involved.

Small - until you realize Visa processes hundreds of billions of transactions each year. At that scale, fractions of a dollar add up fast.

This is why Visa’s model is so compelling:

Asset-light: No branches, no loans, no credit losses

High-margin: Closer to software than traditional finance

Global: Every new card and digital payment adds volume

Hard to disrupt: Once a network becomes the standard, switching is costly

Visa doesn’t sell money.

It sells trust, speed, and reliability - at global scale.

And as the world continues to move away from cash toward taps, clicks, and subscriptions, Visa’s network just keeps getting busier.

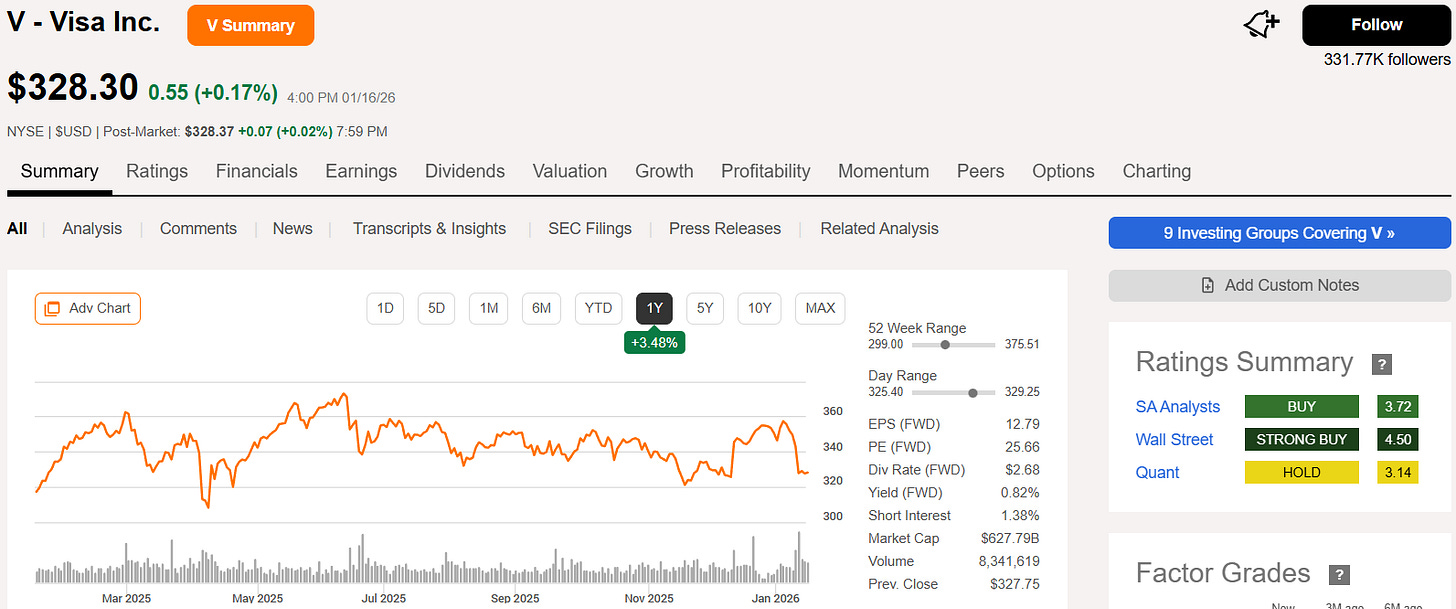

Why Visa Has Been Stuck — Even After a Strong Quarter

On the surface, Visa’s latest quarter looked exactly how you’d want it to. Revenue grew at a healthy pace. Transaction volumes stayed strong. Cross-border spending continued to climb. For most companies, results like that would have been enough to push the stock higher.

But Visa hasn’t really gone anywhere.

The reason comes down to what investors saw beneath the surface.

The biggest surprise showed up on the cost side. Alongside strong revenues, Visa booked a sizable legal charge that pushed operating expenses higher than expected.

Even if it’s a one-off, markets tend to react poorly to surprises - especially for a company known for pristine margins. When costs jump unexpectedly, investors start to ask whether it’s truly isolated or a sign of future risk.

At the same time, margin expansion is no longer as effortless as it once was. Visa is spending more on technology, security, talent, and partnerships - all sensible, long-term investments. But they also mean profitability isn’t widening at the same pace. When a stock is priced as a near-perfect compounding machine, even slight margin flattening can cause the market to pause.

Competition adds another layer. Visa still operates one of the most powerful payment networks in the world, but the noise around alternatives has grown louder. Digital wallets, buy-now-pay-later providers, and bank-backed payment rails aren’t existential threats - but they remind investors that growth won’t be linear forever. Ongoing pressure from merchants and regulators around fees only reinforces that caution.

Policy uncertainty hasn’t helped either. The proposed 10% cap on credit-card interest rates doesn’t directly impact Visa - banks take the credit risk, not Visa - but it could have second-order effects. If such a cap were ever enacted, card issuers might tighten credit availability or scale back rewards programs, which could slow transaction growth at the margin. Even the possibility is enough to keep sentiment in check.

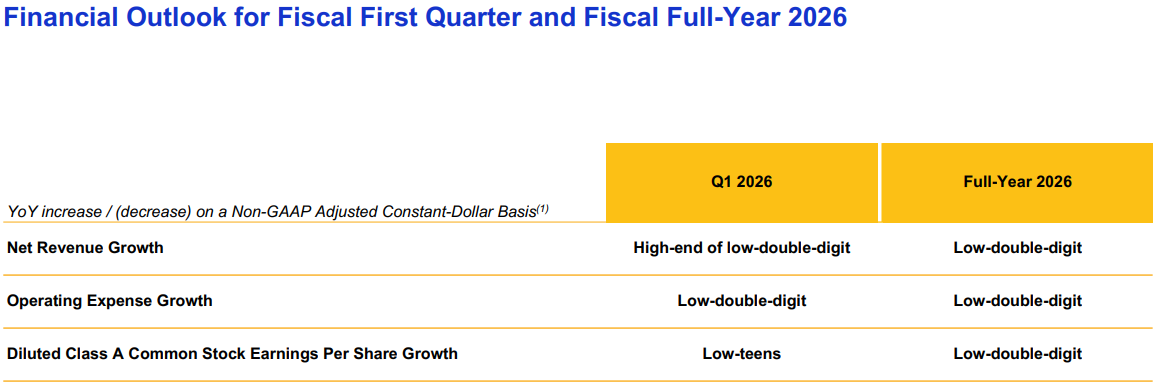

Finally, there was no obvious catalyst in the outlook. Management guided for steady, not accelerating, growth. For a company as large and well-owned as Visa, “steady” is often interpreted as “already priced in.” When the present looks solid but the future sounds like continuation rather than inflection, stocks tend to drift.

Taken together, Visa’s recent stagnation makes sense. The business remains healthy, but expectations are high - and for now, the market is waiting for a clearer reason to re-rate the stock higher.

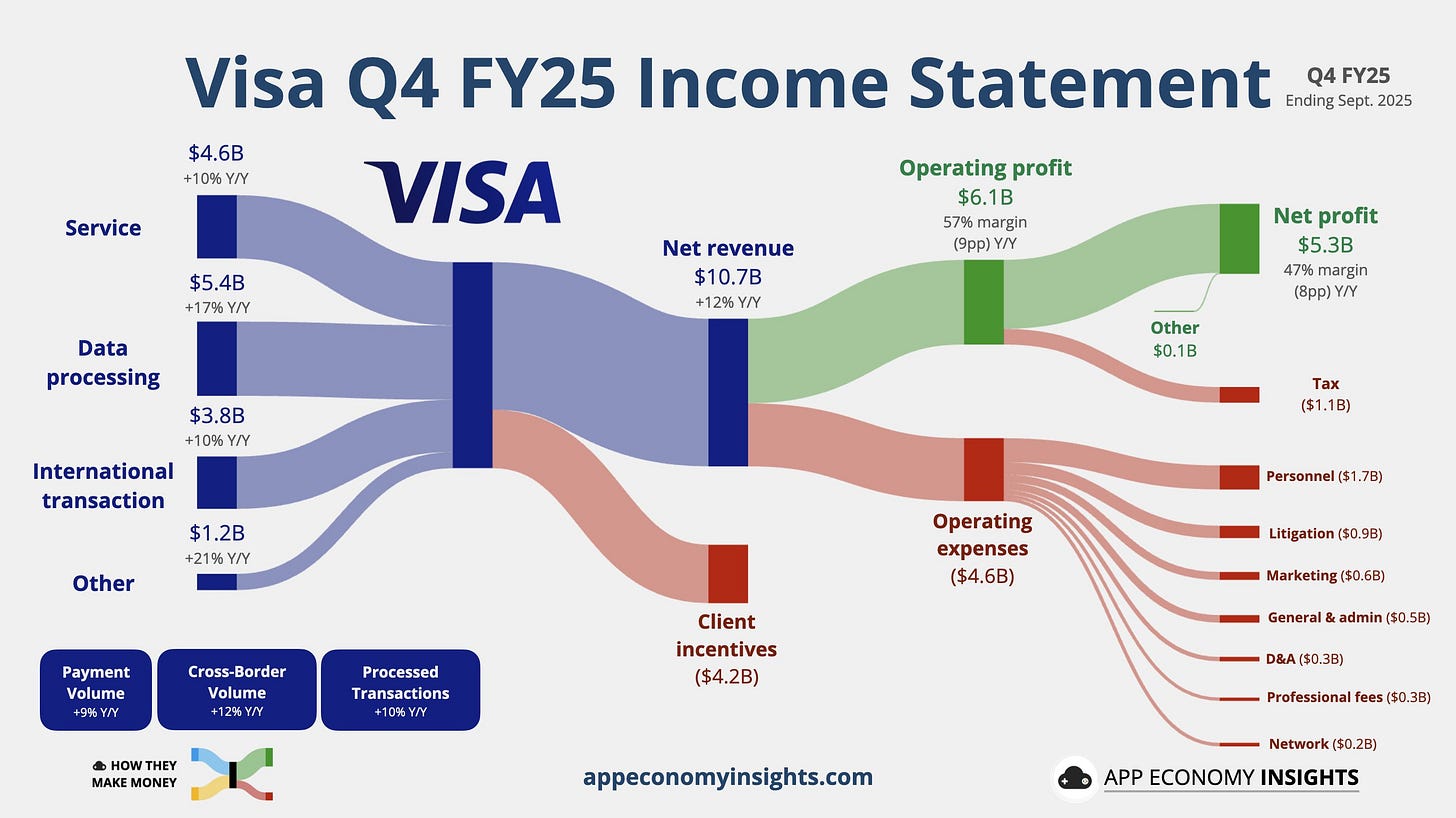

Why Visa Remains One of the Market’s Quiet Compounding Machines

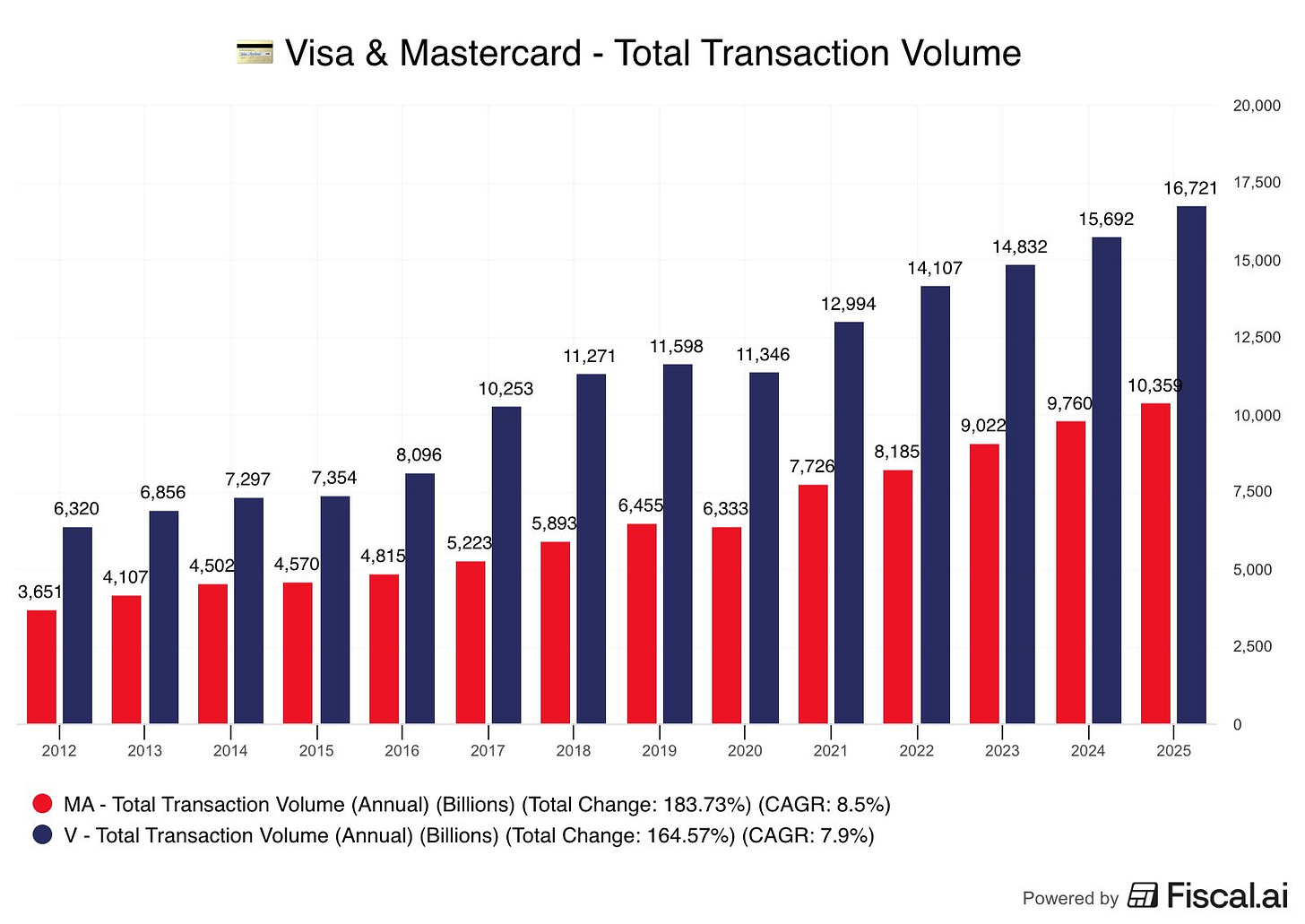

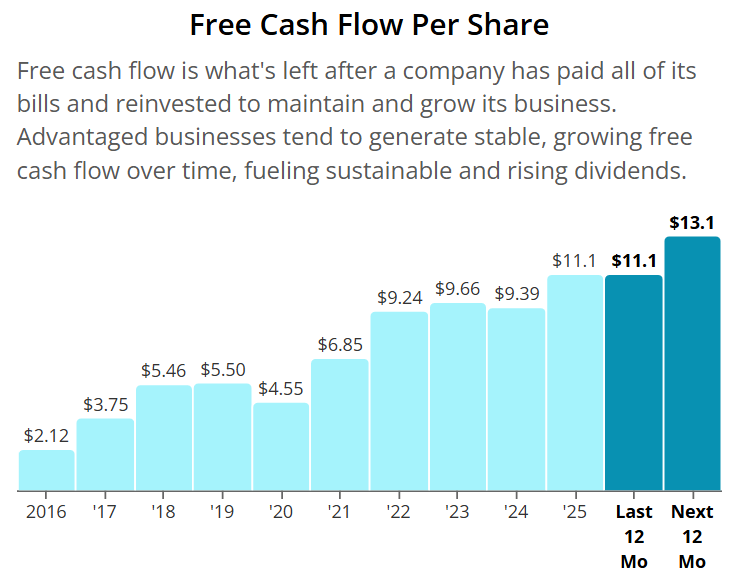

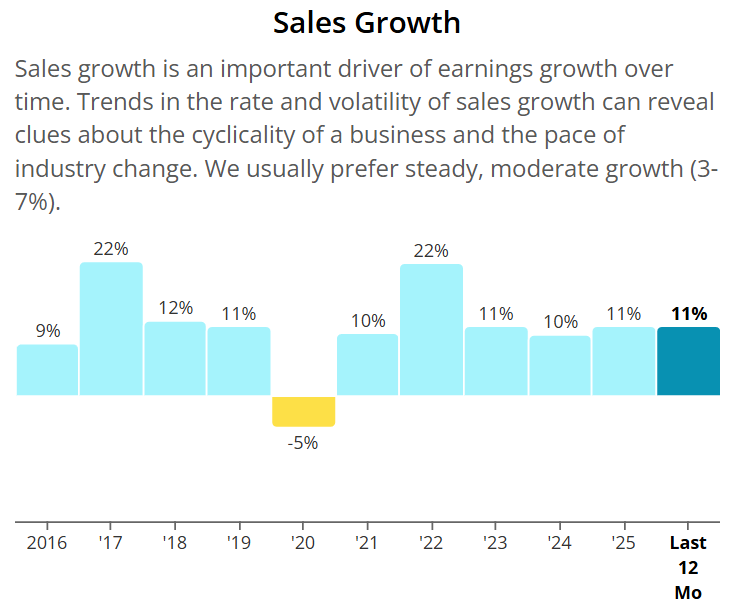

When you step back from the quarter-to-quarter noise, Visa’s long-term story becomes hard to argue with. This is the kind of business long-term investors gravitate toward: steady growth, enormous cash generation, and a track record of quietly rewarding shareholders year after year.

Visa doesn’t need splashy innovation cycles or risky bets to compound. It just needs the world to keep paying digitally - and that trend hasn’t slowed for a moment.

Over the past decade, Visa’s free cash flow has grown dramatically, rising from just over $2 per share in 2016 to more than $11 today. That’s software-like growth from a business that takes on minimal risk and requires very little capital to scale. Few companies manage to combine that kind of growth with this level of stability.

Revenue tells the same story. For nearly ten years, Visa has delivered high-single-digit to near-double-digit sales growth with remarkable consistency. The driver is simple: each year, more payments shift from cash to cards and from physical checkout lines to online subscriptions. Every tap, swipe, and click adds a small toll -and those tolls compound quietly over time.

Shareholders benefit in other ways too. Visa has steadily reduced its share count, shrinking outstanding shares by nearly 20% over the past decade. Buybacks may not grab headlines, but they increase your ownership of the business year after year - one of the cleanest drivers of long-term returns.

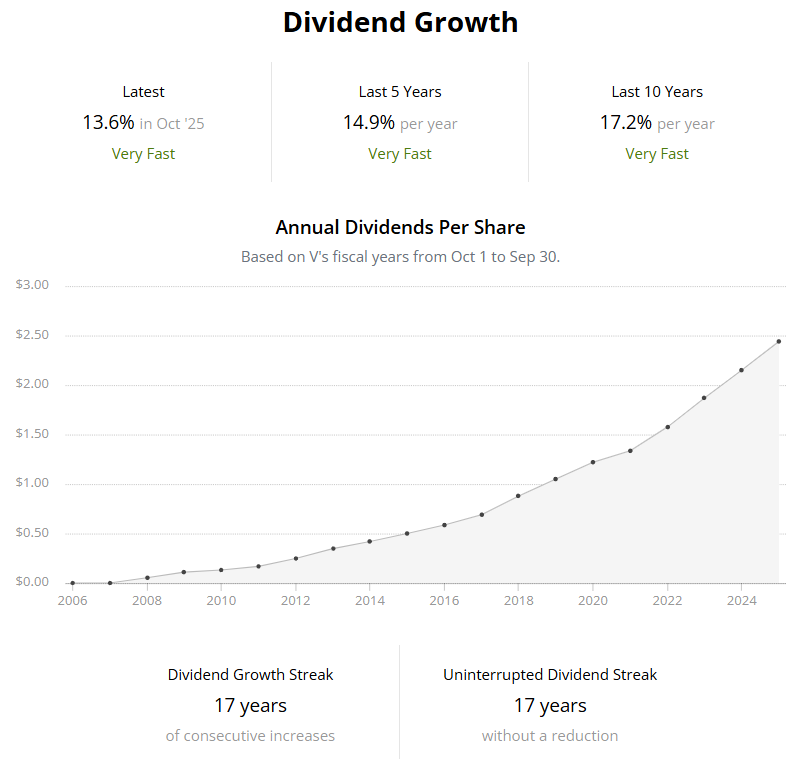

Then there’s the dividend. Visa’s yield isn’t flashy, but its growth rate is. With dividend growth running around 17% annually over the last decade, it adds another durable layer of shareholder return - especially when paired with aggressive buybacks.

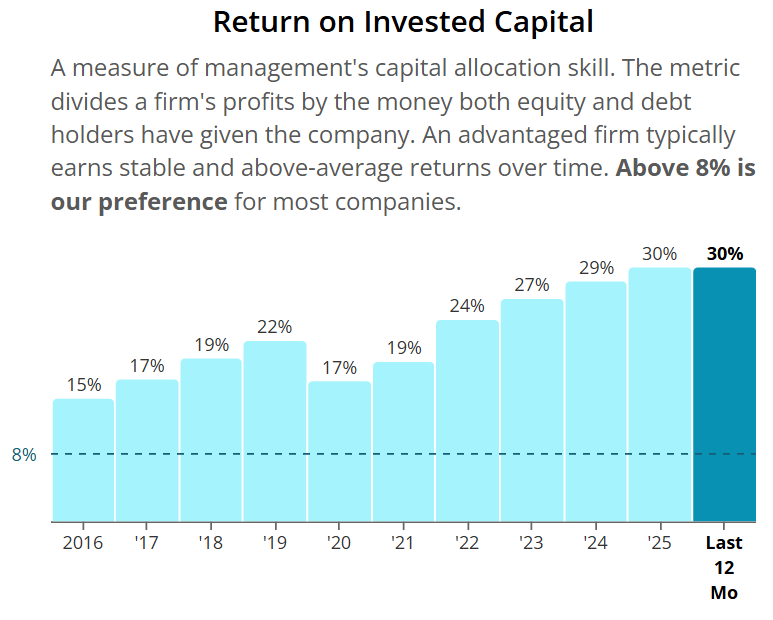

What truly sets Visa apart, though, is efficiency. Returns on invested capital hovering around 30% signal a business that consistently turns reinvested dollars into real value. Companies with that level of capital efficiency tend to dominate their industries - and reward patient investors.

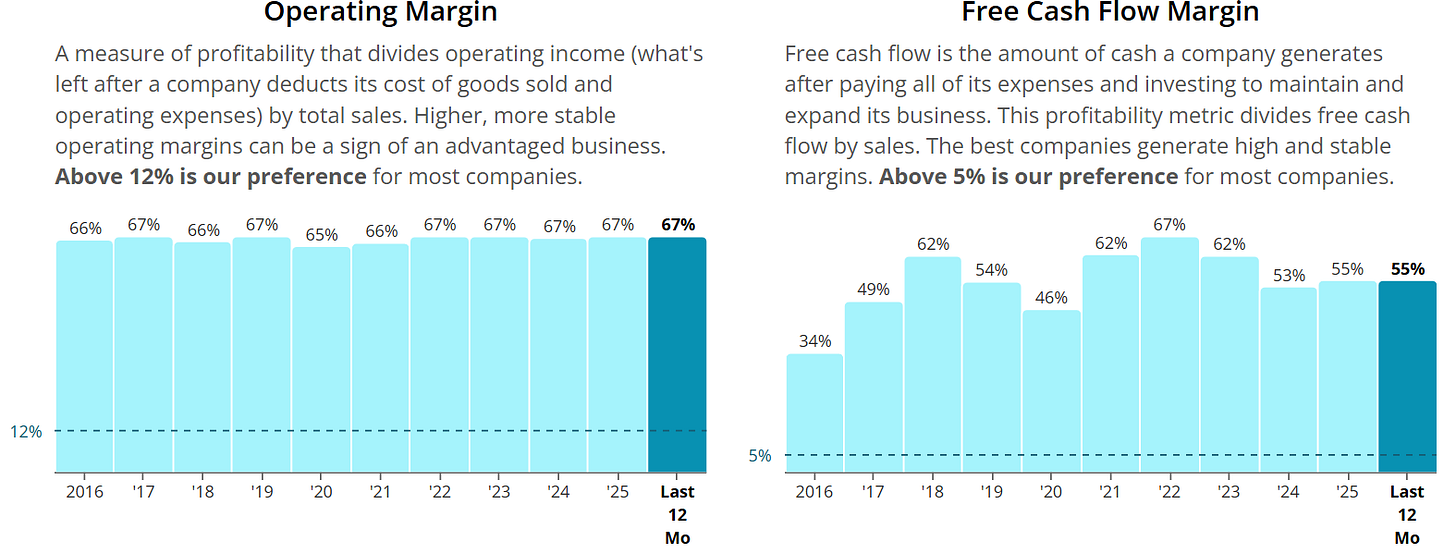

The margins reinforce the point. Operating margins at 67% and free cash flow margins above 50% are almost unheard of at Visa’s scale. Once the payment rails are built, the network does the heavy lifting.

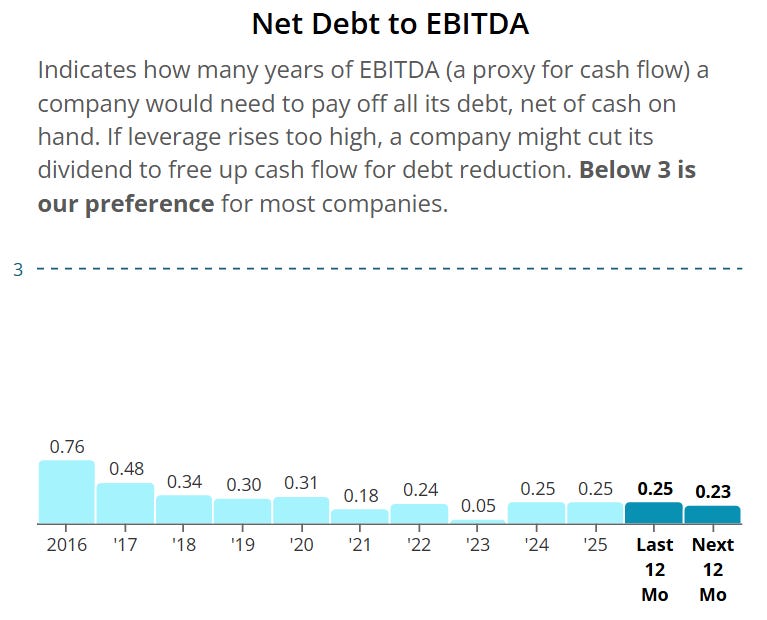

All of this sits on top of a rock-solid balance sheet. With minimal net debt relative to cash flow, Visa has the flexibility to invest, repurchase shares, and raise dividends without strain.

Short-term bumps will always come - legal headlines, competitive noise, margin worries. But beneath the surface is one of the most reliable compounding engines in the market.

Visa isn’t a flashy story.

It’s a durable one.

And over long periods of time, durability and consistency are often how real wealth gets built.

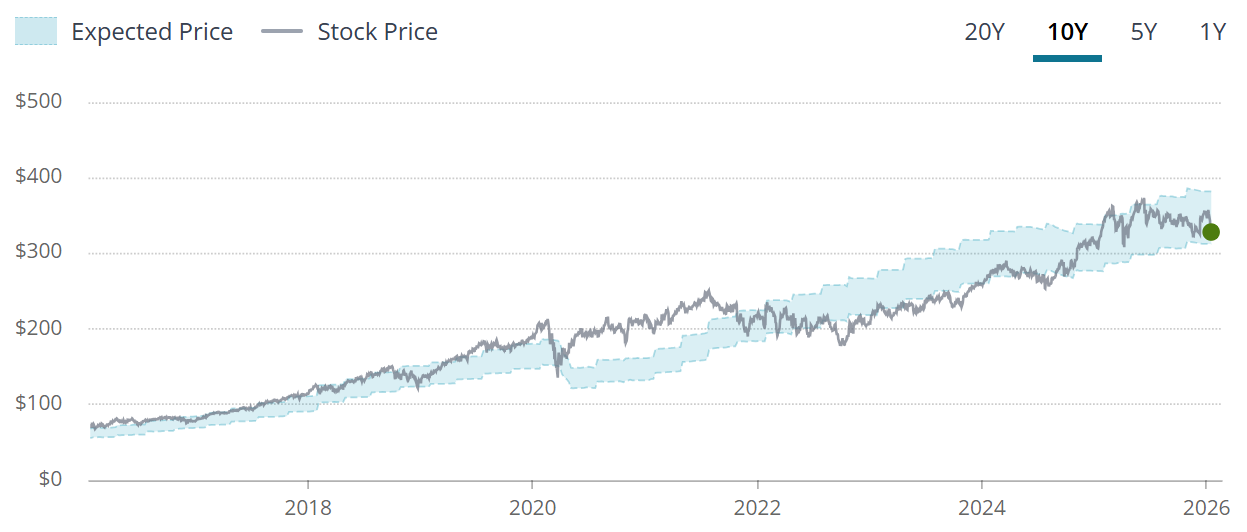

Valuation

The forward P/E sits below the 5Y average - 25.6x v 27.1x. This could indicate the company is potentially undervalued.

The blue tunnel highlights that the company is towards the lower end of the fair value boundary indicating a potential undervaluation signal.

When we zoom out to the last 10Y we can see that Visa has rarely traded at a massive discount.

DCF Model

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.