Is AI's Fear Campaign Creating a Once-in-a-Decade Buying Opportunity in Software?

With stocks rallying on softer economic data, dovish Fed signals, and easing inflation, the stage may be set for AI-driven software gains unlike anything we’ve seen in a decade.

Market Update

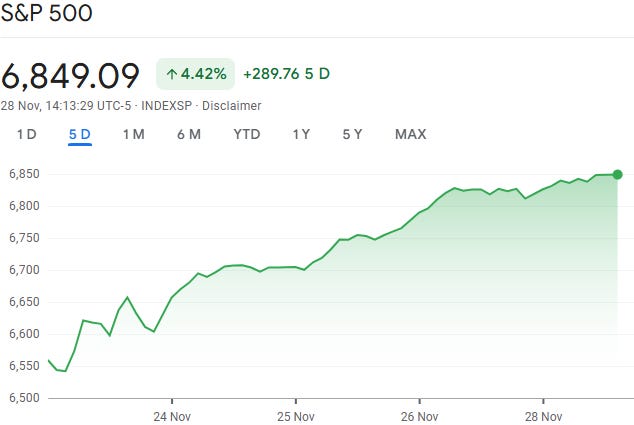

The market ended the holiday-shortened week in a grateful mood. A mix of softer economic data and unexpectedly dovish whispers from Fed officials sent investors into the weekend believing a December rate cut is still very much alive.

That hope was enough to push all the major indexes higher with the S&P 500 up 4.4% on the week. Even tech shook off last week’s valuation jitters as the Nasdaq snapped back on renewed AI optimism.

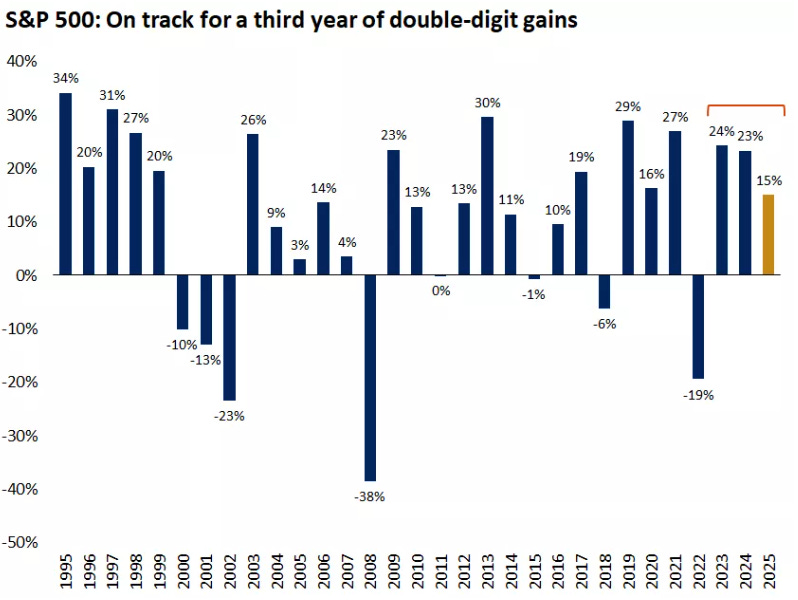

The S&P 500 is quietly lining up its third straight year of double-digit gains - up roughly 15% so far.

Not bad for an index that flirted with a bear-market correction back in April. Those who held their nerve through the turbulence are being rewarded yet again.

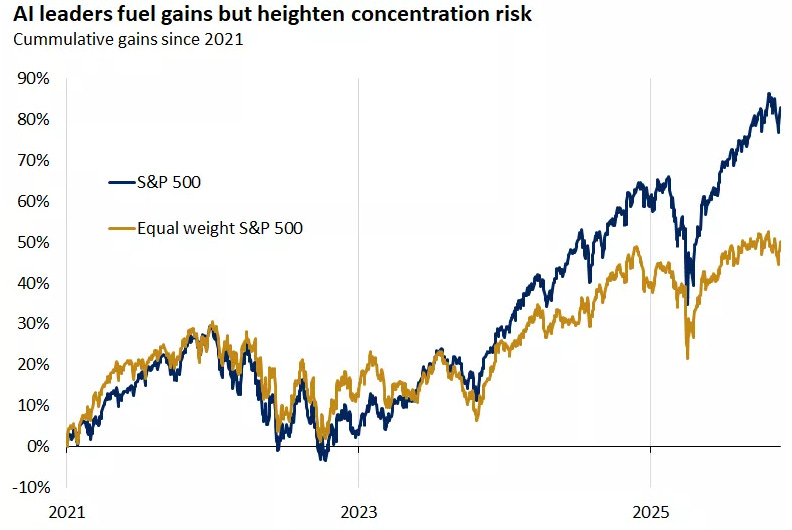

Ever since ChatGPT exploded onto the scene in late 2022, the AI boom has poured billions into the sector and powered a relentless rally in the Nasdaq.

It’s become the heartbeat of this market cycle - an innovation wave with the potential to reshape entire industries and turbocharge productivity.

But every boom carries its shadows. The risks are real: crowded trades, lofty valuations, and the possibility that early expectations outrun real-world adoption.

Last Weeks Winners & Losers

Top performers:

Intel (+21%)

Micron (17%)

Broadcom (+16%)

Google (+11%)

Meta (+10%)

Biggest drops:

Copart (-5%)

Oracle (-4%)

Nvidia (-2%)

Lockheed (-2%)

Deere & Co (-2%)

Notable News

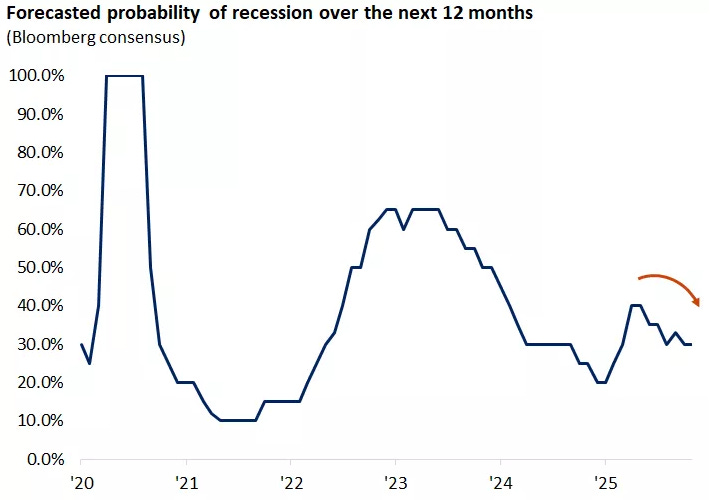

Fading recession fears

If 2025 has taught us anything, it’s that the recession everyone kept waiting for simply never showed up.

After a tariff-driven dip in the first quarter - when companies rushed to stockpile imports - the economy snapped back with strength in Q2 and Q3, powered by steady consumer spending and ongoing investment in AI.

Confidence, however, tells a very different story. Survey data remains weak, weighed down by the recent government shutdown and persistent anxiety over prices. Yet spending keeps humming along. The divide comes down to who’s doing the spending: wealthier households, lifted by strong market gains, have kept cash flowing, while lower-income families feel the pinch of slower wage growth and rising essentials.

Even so, the near-term outlook looks solid. The National Retail Federation expects holiday sales to climb around 4% from last year - topping $1 trillion for the first time.

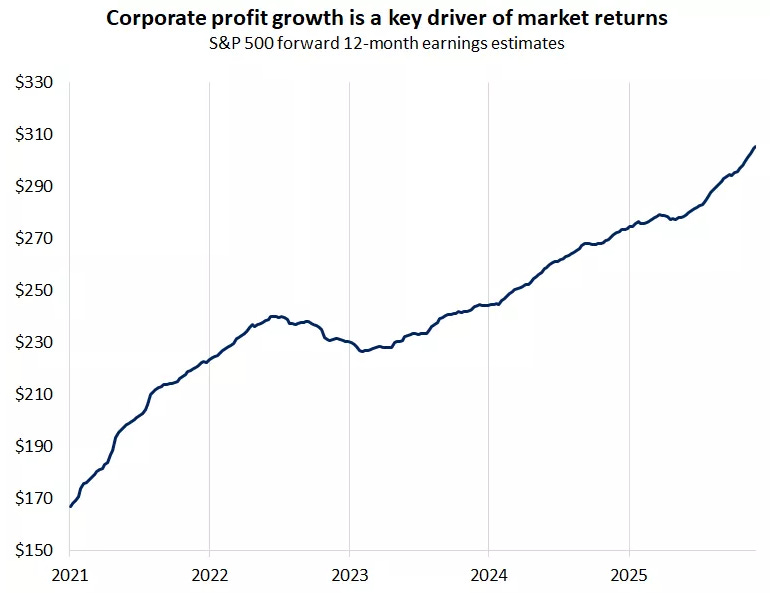

Rising corporate profits

Strong economic momentum gave corporate America exactly what it needed this year: room for earnings to grow - and repeatedly beat expectations. Large-cap companies far outpaced the broader economy, with S&P 500 profits on track to climb roughly 11% and margins holding near record highs.

Tariffs did create headwinds, forcing businesses to absorb the bulk of the added costs. But companies adapted quickly, leaning on cost cuts, productivity gains, reworked supply chains, and targeted price hikes to protect profitability.

With valuations already stretched, earnings - not multiple expansion - are likely to steer stock performance from here. And the outlook remains optimistic: Wall Street is penciling in about 14% profit growth for 2026.

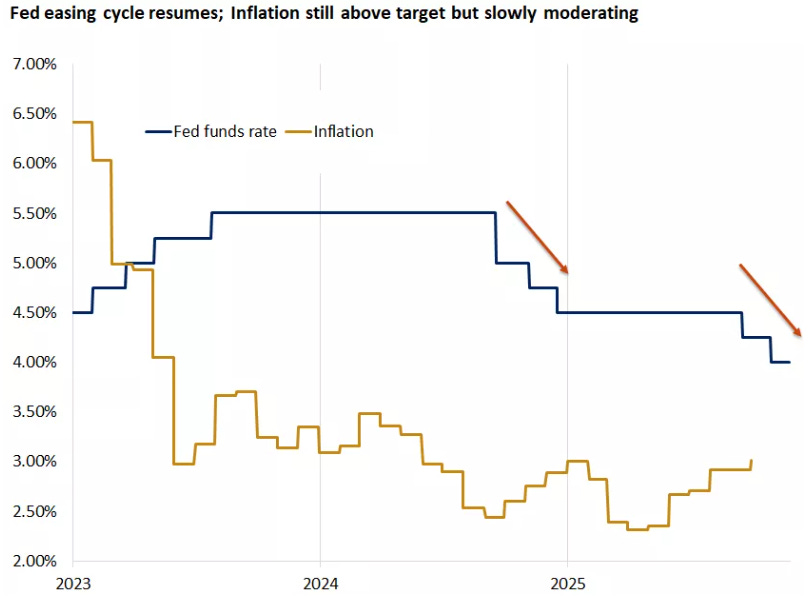

Modest Fed policy and inflation relief

After months of debate and shifting expectations, the Fed finally restarted its rate-cutting cycle this year. That pivot toward a gentler stance has loosened financial conditions and pulled the average 30-year mortgage rate down from 7.1% to 6.4%.

Inflation has also been cooperating. Oil prices have averaged about $65 a barrel this year, down from $76 in 2024, helping cool overall price pressures.

Tariffs have added some friction to goods prices, but not as much as feared, and services inflation continues its gradual slowdown.

The result: headline CPI has eased from 3% last year to roughly 2.7% so far in 2025.

The end to 2025

After a quick stumble in early November, stocks regained their footing, and the S&P 500 managed to close the month in positive territory.

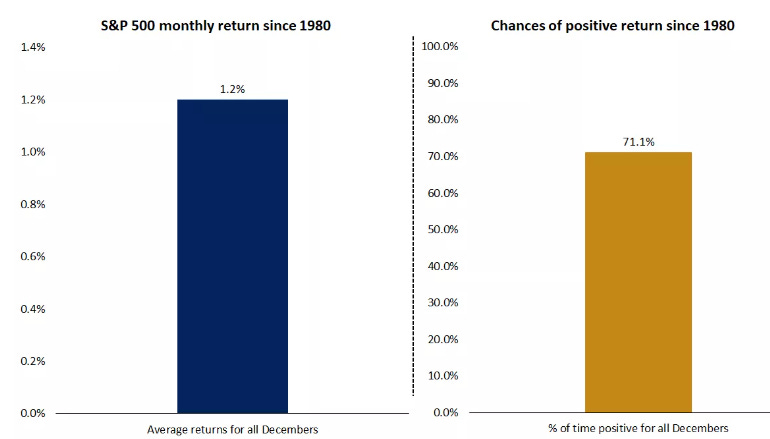

Seasonality suggests the momentum may continue: the post-Thanksgiving stretch has historically been kind to investors.

Over the past three decades, December has delivered an average gain of about 1%, with markets finishing higher roughly 70% of the time.

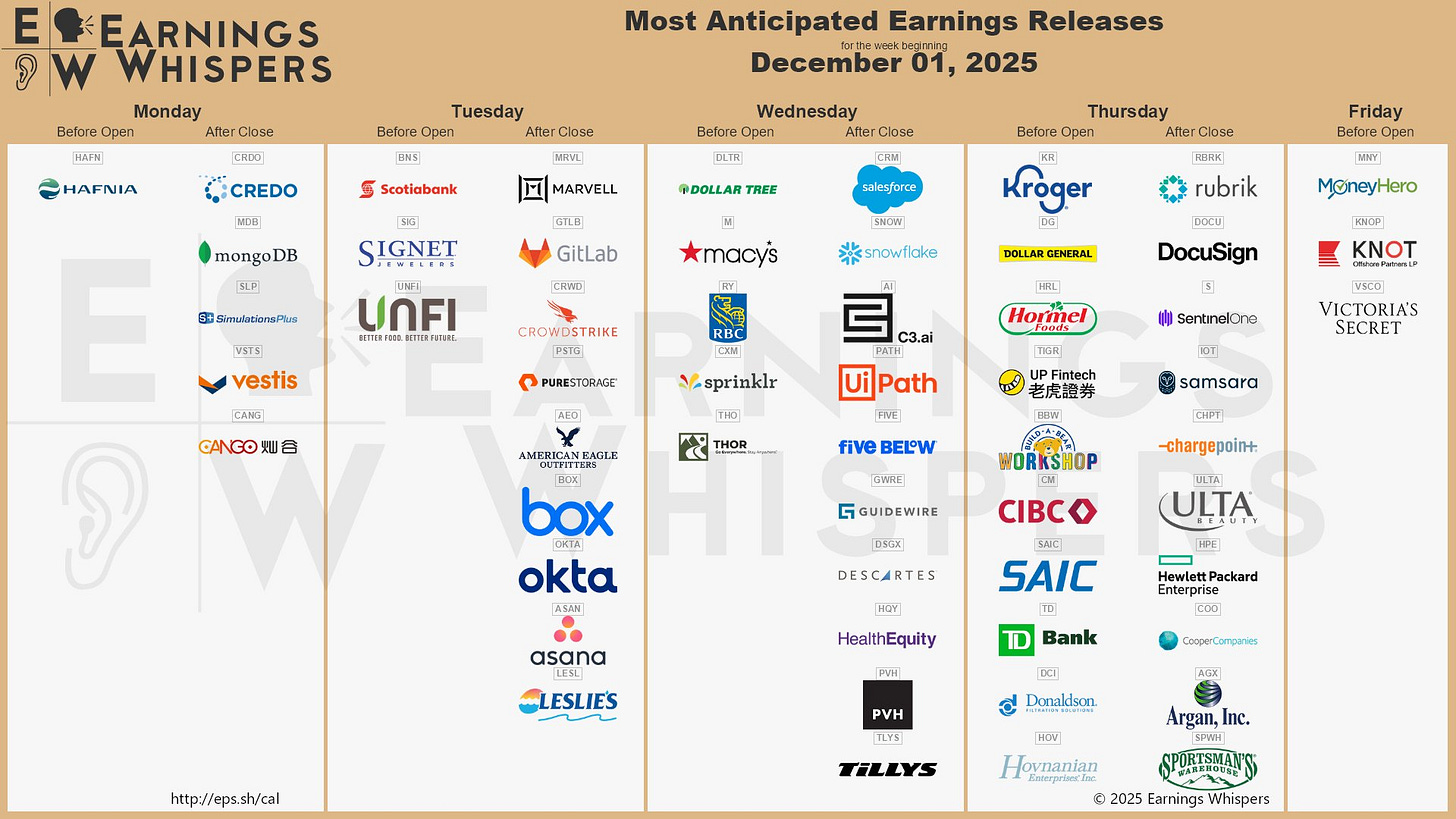

Earnings Season

Join 118,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

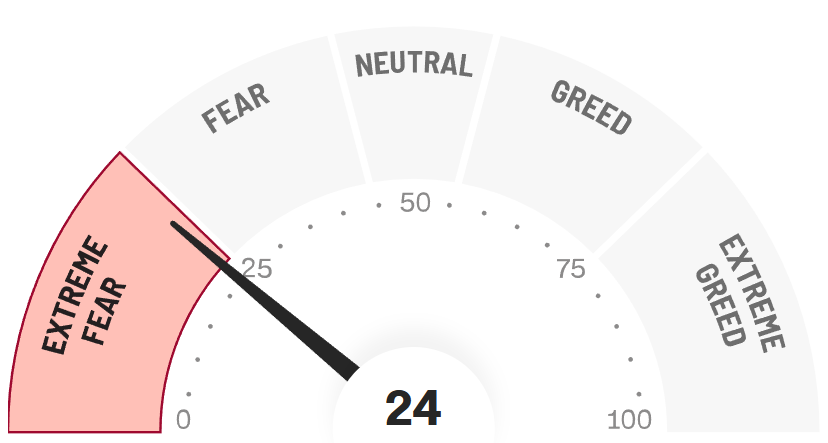

Fear & Greed Index

Introduction: The Great AI Panic

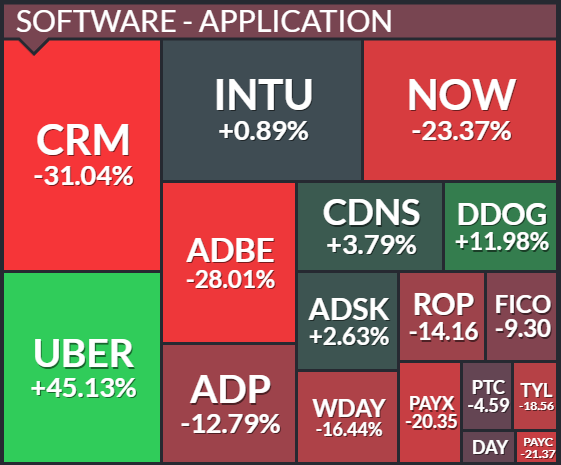

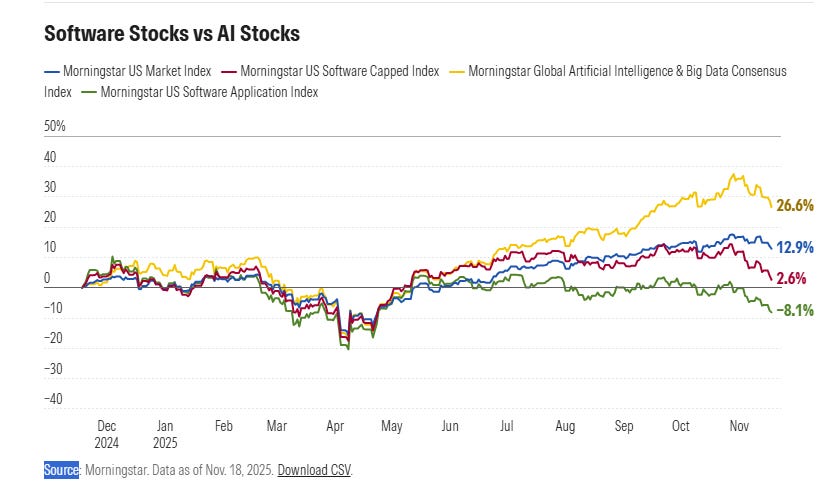

A storm is sweeping through the software sector, and the market is in full-blown panic mode.

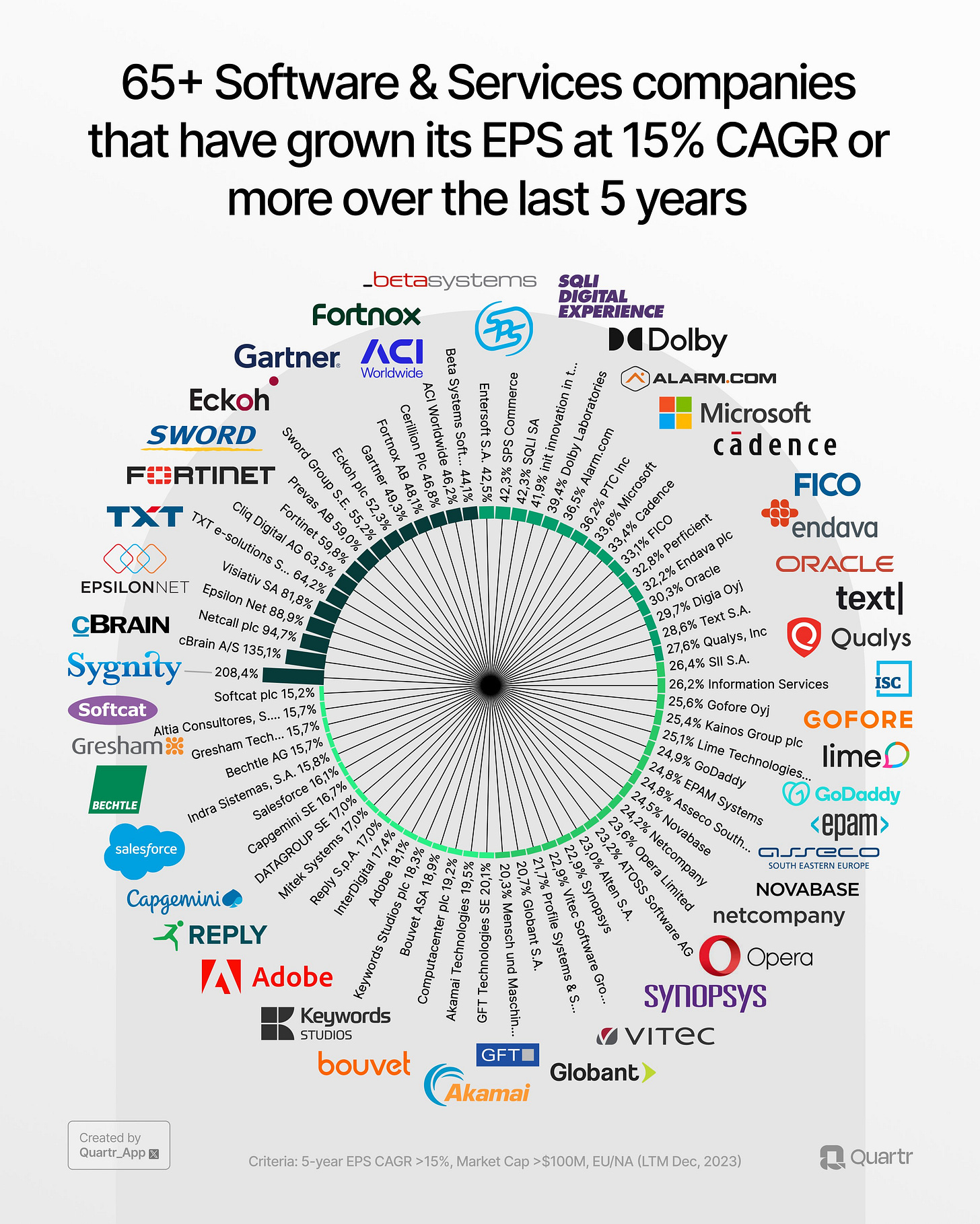

At the heart of the sell-off: fear that Artificial Intelligence will disrupt and devalue traditional software companies, an industry that has historically produced fast EPS growth.

Billions have been wiped off the market this year, with some names down more than 50% from their highs - and major players like Salesforce losing nearly a third of their value in 2025 alone.

Even as other sectors post double-digit gains, software continues to lag. Companies tied too closely to older tech, or slow to pivot to AI, are feeling the brunt of the pressure.

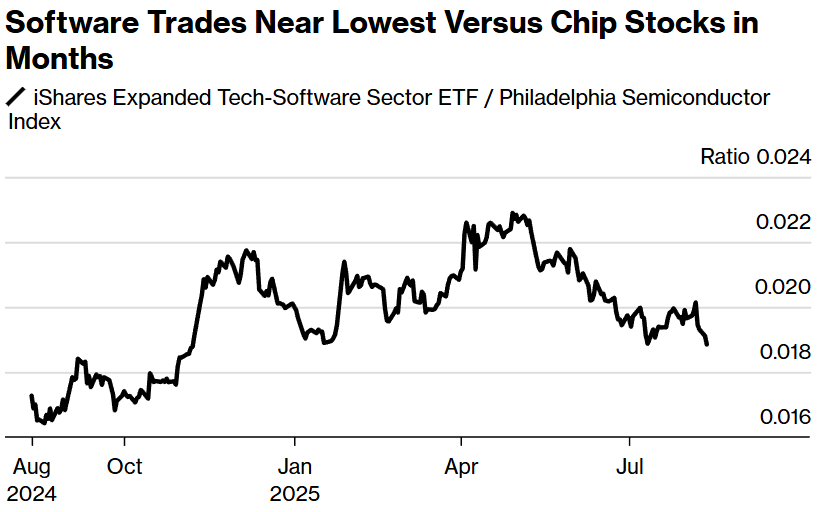

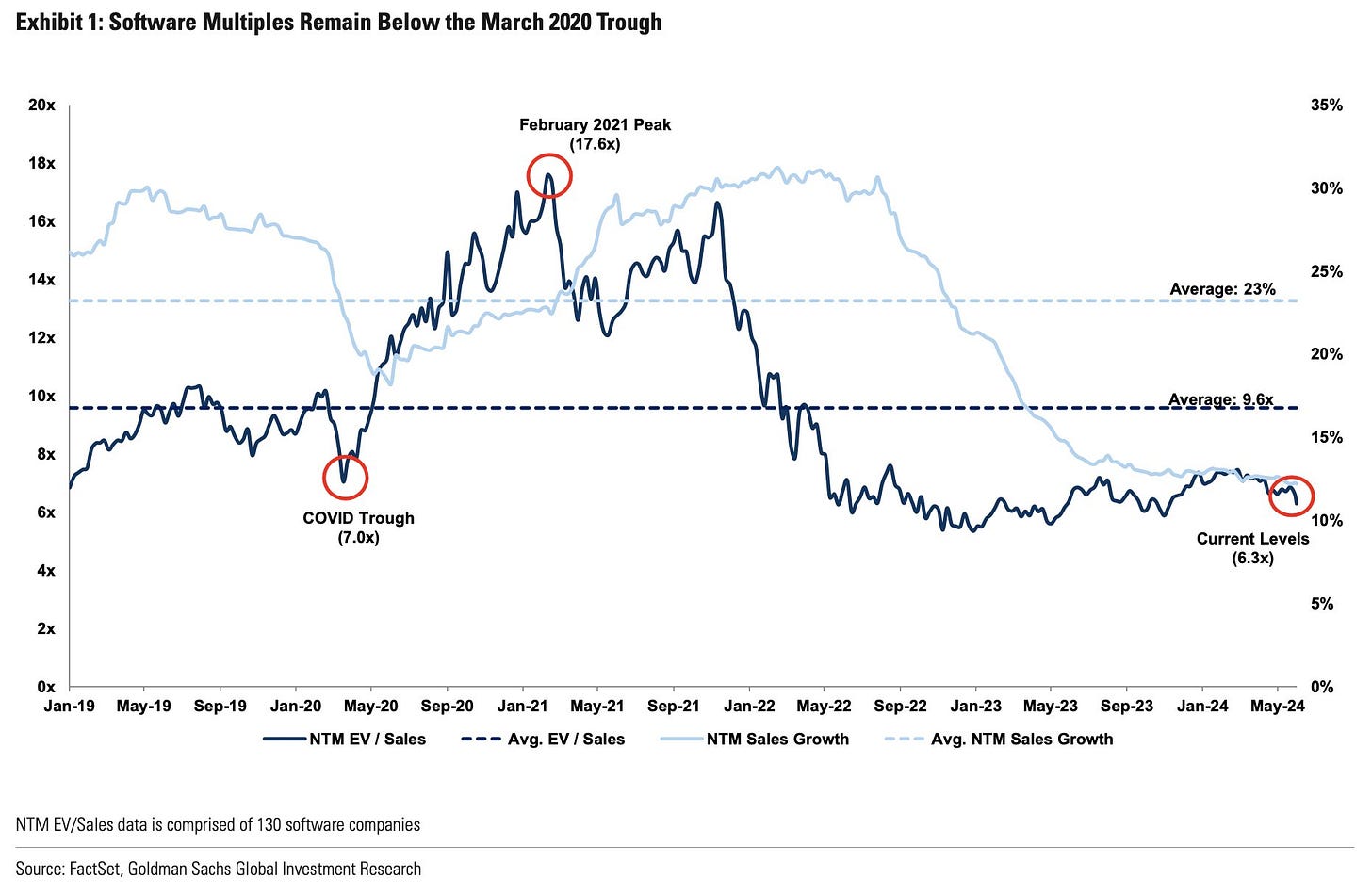

The disconnect between fear and fundamentals is stark: mid-year, software stocks were already trading at their lowest levels relative to chipmakers:

and today that gap has widened to all-time lows…

Analysts still see software as critical to the AI revolution, but not every company will thrive in this new landscape.

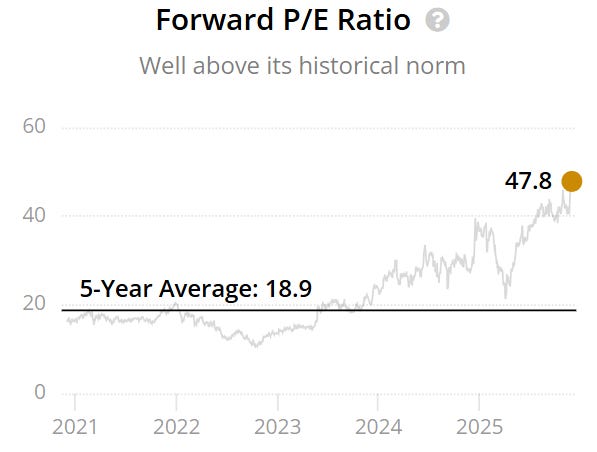

Meanwhile, the market’s focus has shifted to AI-heavy semiconductor names. Companies like Broadcom are trading well above their 5-year averages:

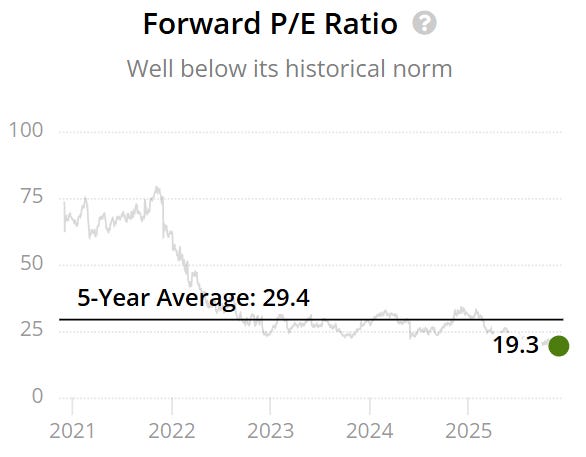

….while software multiples for many firms have fallen below levels last seen during the 2020 COVID crash.

The result: a market that seems irrationally obsessed with hardware while largely ignoring the software that will ultimately power AI - a potential once-in-a-decade opportunity for disciplined investors.

The Disconnect: Software Valuations vs. Chipmakers

The fear frenzy has created a striking valuation gap between the AI infrastructure builders - like chipmakers - and the traditional software companies whose products run on that infrastructure.

Today, that gap has widened to fresh all-time lows, highlighting the market’s obsession with hardware while largely ignoring the software that will ultimately power AI. For long-term investors, this dramatic mismatch could signal an extraordinary opportunity.

The Market is Pricing in Catastrophe: Near-Zero Growth for Industry Giants

To grasp just how pessimistic investors have become, we can use a simple tool: a reverse discounted cash flow (DCF) model.

In plain English, it calculates the growth rate the market is implicitly expecting from a company’s stock price.

The results for some of the biggest software names are startling - essentially, the market is pricing in near-zero growth, as if AI disruption will completely derail their businesses.

We will select a few examples to walk through later on.

A Rare Discount: Valuations Cheaper Than the 2020 Crash

For many beaten-down software stocks, valuations haven’t just fallen - they’ve plummeted to over five-year lows.

Put another way, the market is treating AI disruption as a bigger threat than the global economic shutdown of 2020. That’s a profoundly questionable assumption, and it highlights just how fear-driven this sell-off has been.

Example 1 - Salesforce (CRM)

The current forward P/E sits at 19.3x, the lowest in at least the last 5Y with the average sitting at 29.4x.

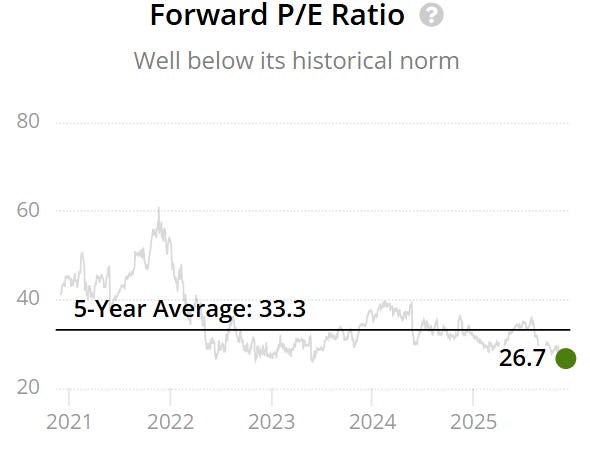

Example 2 - Intuit (INTU)

The current forward P/E sits at 26.7x, the lowest in at least the last 5Y with the average sitting at 33.3x.

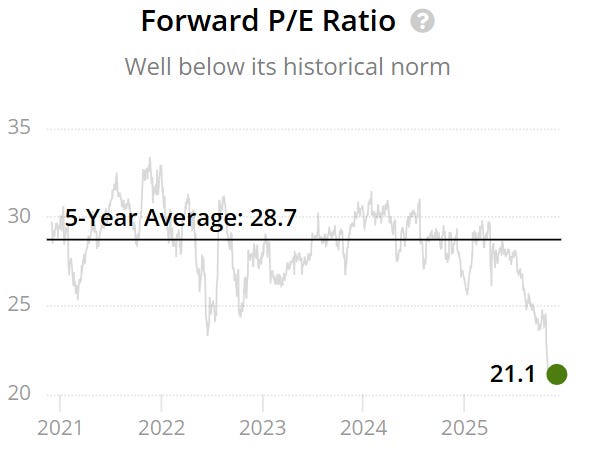

Example 3 - Roper Technologies (ROP)

The current forward P/E sits at 21.1x, the lowest in at least the last 5Y with the average sitting at 28.7x.

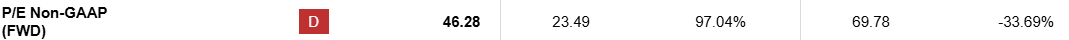

Example 4 - ServiceNow (NOW)

The current forward P/E sits at 46.3x, the lowest in at least the last 5Y with the average sitting at 69.8x.

Example 5 - Adobe (ADBE)

The current forward P/E sits at 15.3x, the lowest in at least the last 5Y with the average sitting at 30.9x.

The “Margin of Safety” Is Back - and It’s Huge

Value investors live for this moment. The margin of safety (MOS) - the gap between a stock’s market price and its estimated intrinsic value - is the buffer that protects investors from mistakes or unforeseen shocks. For a quality company, a 10% MOS is a solid baseline.

Remarkably, even with highly conservative assumptions, many software leaders now offer enormous MOS. Wall Street price targets hint at upside, but our independent analysis confirms deep value potential using grounded, historically-informed estimates.

Next, we’ll dive into five software stocks to show:

the margin of safety on offer

the free cash flow already baked into today’s prices (via reverse DCF)

our intrinsic value estimates

actionable buy targets

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.