Is This The Best REIT To Own With Rates Coming Down?

Great Starting Dividend Yield Combined With Nice Dividend Growth!

Note: Full disclosure before we start, I do hold a position in VICI Properties.

What Is A REIT?

VICI Properties is a REIT (Real Estate Investment Trust) and REITs are Companies that essentially own, operate or finance income producing real estate.

Investing in a REIT is a way to allow individuals to invest in large portfolios of real estate assets and from this the individuals will earn a share of the income that is produced without actually having to go out into the market and buy a property.

How Do They Make Money?

The business model is easy to understand, they lease space to tenants and collect rent on their real estate. The rent is effectively their income which they then pay out to shareholders in the form of dividends.

REITs are obliged to pay out at least 90% of their taxable income to shareholders, and from this the shareholders must then pay the income taxes on those dividends.

What Is VICI Properties?

VICI Properties are a REIT that own one of the largest portfolios of market-leading gaming hospitality and entertainment destinations.

These include Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas.

Who Are Their Tenants?

VICI Properties have 13 tenants spread across 93 properties as shown below.

These are big name tenants and some of the points we want to pull out of the below include:

75% of their annualized cash rent is made up of 2 big name - Caesars Palace and MGM Resorts which is spread over 31 properties. This is a potential red flag indicator if you believe that any of these 2 businesses will not be here for a long time (this is not something I believe).

The WALT (weighted average lease term) of these 13 tenants is 41.6 years meaning even with the increase we saw in interest rate hikes, these tenants are obligated to stay for a long time. (As we will see soon, VICI received 100% of their rent collection during Covid).

100% of these leases are Triple Net Leases - this is an agreement where the tenants are obligated to pay all expenses on the property including real estate taxes, building insurances and maintenance.

Key Facts?

VICI collected 100% of rent during the Covid pandemic in 2022 when the average collection of REITs in this period was between 70-99%.

Barriers-to-entry is high which makes it difficult for a competitor to come in and replicate what VICI do.

Remaining lease term (WALT) is 42 years compared to 8-11 with other REITs.

The average rent VICI receive per asset is around $32.5m compared to $460k for other REITs.

Dividend Growth?

As per below VICI typically declare a dividend increase in Q4 of every year. Since 2018 they have increased it by 7.6% on average every year.

This is above the 4% I always advocate on my YouTube channel just so you keep up in line with inflation.

Remember the US inflation rate on average over the last 40 years was 4% so if you are receiving less than that whether it’s your salary, dividends or other income producing assets then you are taking a pay cut and losing your purchasing power.

7.6% is the highest increase compared to other similar REITs as per below with Realty Income (O) being 3%.

Las Vegas?

Las Vegas continues to be a huge global entertainment hub as per below and we do not see this stopping.

As we can see below there are many reasons why people come to Vegas, whether it’s for conventions or entertainment and this doesn’t look like it’s stopping.

But What About The High Interest Rate?

Whilst we have seen the interest rate hike over the last few years based on the latest data it would be fair to assume that at some point in 2024 we will see the first interest rate cut.

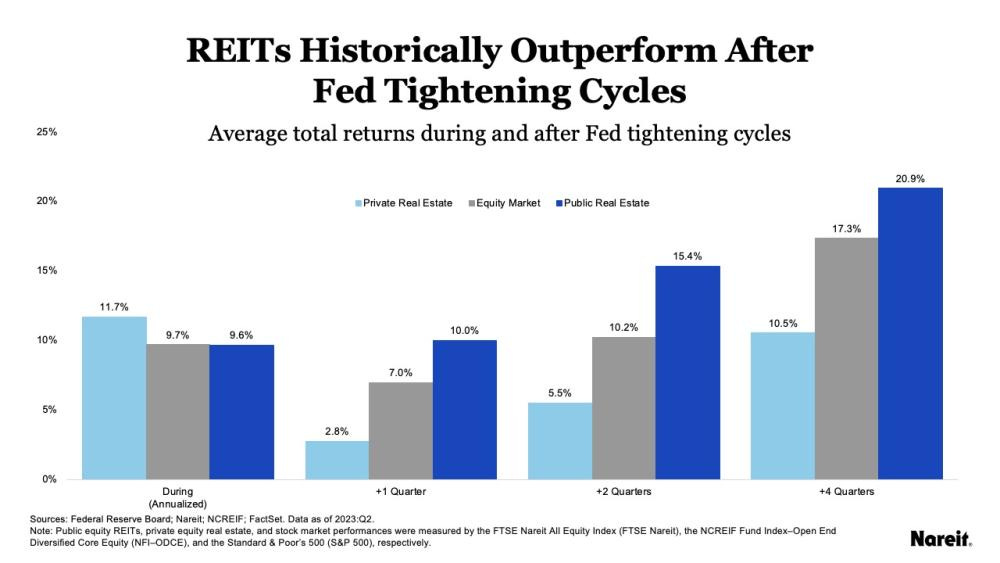

As per below, history tells us that after the Fed is done tightening over the subsequent 4 quarters REITs outperform the equity market quarter on quarter.

Now we have seen since these interest rates came in that the REIT sector as a whole has been hit with VICI down 11% over the last 12 months.

Potential Issues

As above we can see that the dividend safety score is sitting at 50 - borderline safe. The main reason why we see this score is due to their large debt position that we will show below.

The Net Debt to EBITDA (Earnings before tax, deprecation and amortization) correlates to both the dividend safety and the balance sheet strength.

What we want to see ideally for hotel REITs is below 3.5 (this is the number of years it would take the Company to pay off all of it’s debt net of cash on hand).

In 2022 it was sitting at 6.46, so it was nice to see the reduction to 5.86 in 2023.

It is expected to reduce in 2024 to 5.51 so it is moving in the right direction but it is something to keep an eye and will ultimately effect the dividend.

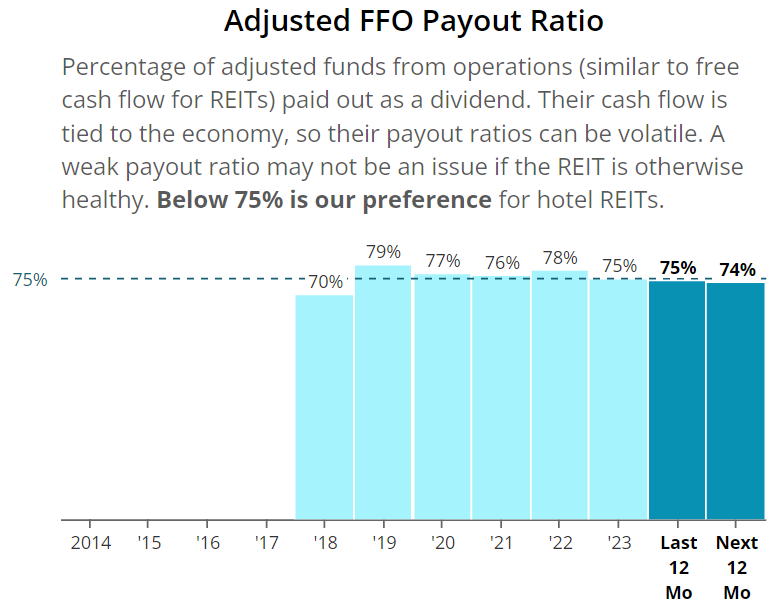

However this Company continues to pay nice mid to high single dividend increases over the last few years and their AFFO payout as per below is very healthy consistently around 75%.

Valuation Matters!

As always when you look into Companies to buy and you are happy to add them to your portfolio you need to consider what the right valuation is so that you are not buying a great Company at a poor price.

In Warren Buffett’s 1989 letter to shareholders of Berkshire Hathaway he stated that

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

On our latest review of VICI properties on our YouTube channel we came to the below:

Intrinsic value: $37.66

Margin of Safety: 20%

Wall Street Forecast: $36 (20% upside)

You can also grab a copy of this valuation model here:

https://www.buymeacoffee.com/dividendtalks/extras

To watch this full episode you can see it here:

On our YouTube channel we consistently review in detail the Companies that investors buy and sell. If you’re interested consider watching below and subscribe if you enjoy the content.

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.