January Undervalued Stocks

+ Spreadsheet Inside

Every month for paid subscribers I release a spreadsheet detailing those stocks that look undervalued based on several metrics.

For this month we have 46 undervalued stocks that meet our 4 criteria below.

Undervalued Stocks In January

Within this we have also included useful information which can be used as a good starting point for analysis.

We have selected these stocks based on the 4 criteria below:

Dividend Yield Theory

This is when the current yield is higher than the 5Y average.

For example, we can see below that this Company would be undervalued as the current yield of 3.43% is higher than the 5Y average of 2.73%.

Dividend Safety (minimum Safe level of 60+)

We want to own Companies that can continue to pay dividends into the future, and one way to have this confidence is to invest in those that have safe dividends.

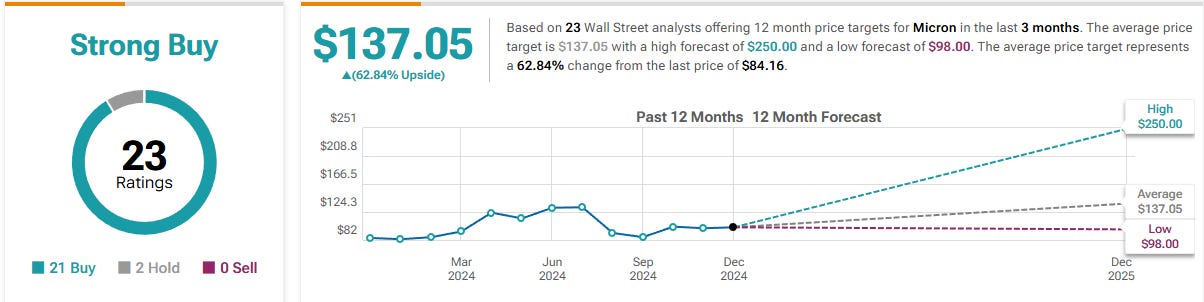

Upside 15%+

We want to invest in Companies that have upside of at least 15%, because whilst we love receiving dividends, we also want upside to the share price.

Strong Balance Sheets

We want to own Companies that have strong balance sheets and this means having a reasonable Net Debt to EBITDA metric.

For the majority, this will be below 3, for REITs this will be below 5.5.

Spreadsheet Below

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.