Markets Are Rallying — But Healthcare Just Crashed

We break down why pharma and insurers are tumbling, why it isn’t just noise, and 4 healthcare stocks now trading at their cheapest in years.

Market Update

Markets Hit New Highs, But Tariff Clouds Loom

The S&P 500 rose about 1% last week, hitting a fresh all-time high - now up over 26% since its April 8 low.

What's driving the gains? Solid economic data. June inflation came in as expected, retail sales beat forecasts, and Q2 earnings are mostly topping estimates so far.

But there’s still some caution. Tariffs are back in focus ahead of the August 1 deadline, and markets are bracing for potential new sector-specific tariffs. So far, inflation and growth have held up surprisingly well despite higher tariff levels this year.

Expect some choppiness as we move through August and into the seasonally volatile September.

Still, the bigger picture looks constructive: rate cuts are on the table, tax changes are in place, and we should get more clarity on trade soon - all of which could set up a stronger finish to the year.

On a granular level, we had strong performers but also weak ones.

Biggest winners included:

Palantir (PLTR) up 8%

Citigroup (C) up 8%

Advanced Micro Devices (AMD) up 7%

PepsiCo (PEP) up 6%

Tesla (TSLA) up 5%

Johnson & Johnson (JNJ) up 4%

Biggest losers included:

Elevance Health (ELV) down 19%

Centene (CNC) down 11%

Micron (MU) down 8%

UnitedHealth Group (UNH) down 7%

Exxon Mobil (XOM) down 7%

Uber (UBER) down 5%

Notable News

Markets Keep Climbing - Thanks to Strong Data

Stocks continued to edge higher last week, with both the S&P 500 and Nasdaq hitting new all-time highs. Year-to-date, they’re up around 7–8%.

What’s driving this? Solid economic signals. Here’s a quick breakdown:

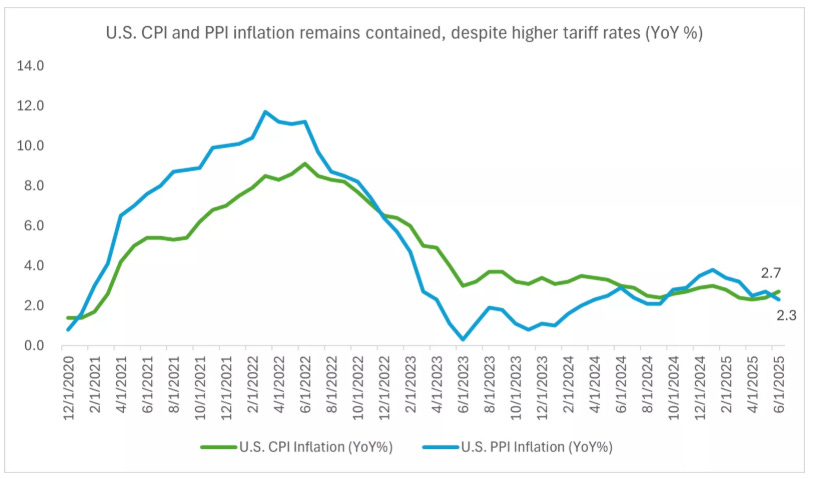

Inflation holding steady (despite tariffs):

June CPI came in at 2.7% year-over-year - a bit higher than expected - but still within a manageable range. Some categories like clothing and appliances saw price jumps, but others (like used cars) fell.Producer prices (PPI) were softer than expected:

PPI rose 2.3%, below the 2.5% forecast - a sign that higher tariffs aren’t fully bleeding into upstream costs just yet.Retail sales bounced back:

June retail sales jumped 0.6%, beating expectations and reversing May’s dip. Consumers are still spending, especially on cars, clothes, and dining out. With consumption making up ~70% of U.S. GDP, this is an encouraging sign.

Bottom line: The U.S. economy is still proving resilient. Inflation’s under control (for now), consumers are spending, and earnings are mostly beating expectations - all of which is helping markets climb, despite ongoing trade worries.

Earnings Season Off to a Strong Start

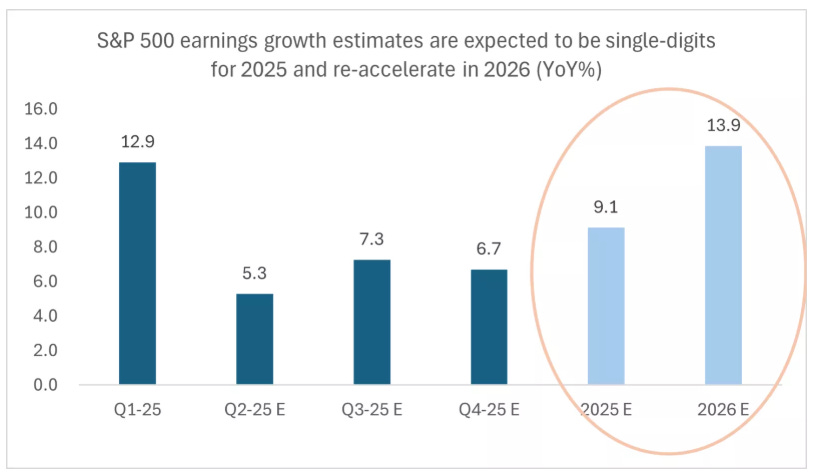

Q2 earnings season is underway, and results so far have been better than expected.

Roughly 12% of S&P 500 companies have reported, and 86% have beaten estimates - well above the 10-year average of 75%. Financials are leading the charge, with strong reports from names like J.P. Morgan and Goldman Sachs, driven by better trading revenues and capital markets activity.

It’s still early, but expectations had been lowered heading into the quarter - from ~11% growth at the start of the year to just 5% by the end of June. That reset has made it easier to beat, and it now looks like Q2 will come in comfortably ahead of that lowered bar.

Looking further out, if rates come down and trade uncertainty clears, we could see corporate earnings re-accelerate in 2026 - potentially back into double-digit growth territory.

Tariffs Still a Risk - But Markets Aren’t Panicking

Tariffs remain a key overhang for markets, but investors may not be ignoring the risk - just waiting for more clarity.

The U.S. has pushed back its next major trade deadline to August 1, keeping uncertainty in the air. There have been a few small deals recently (like with the U.K. and Vietnam), and talks are ongoing with China, the EU, India, and others.

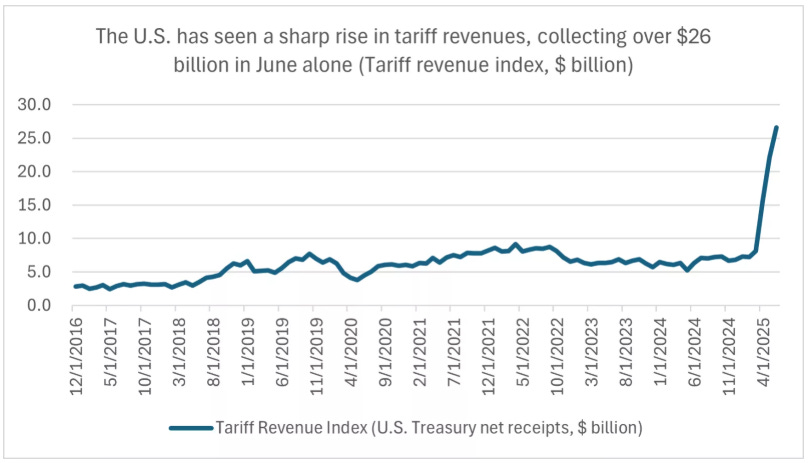

Still, tariff rates have already jumped significantly - from an average of 2.4% to over 20%, the highest in over a century. Much of this comes from broad 10% tariffs, along with steeper ones on key sectors like autos, steel, and aluminum.

Despite these increases, markets have held steady - likely because inflation hasn’t surged and growth hasn’t yet cracked. But with $27 billion in tariff revenues collected just in June, this is a pressure point that’s still very much in play.

Earnings This Week

Join 104,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

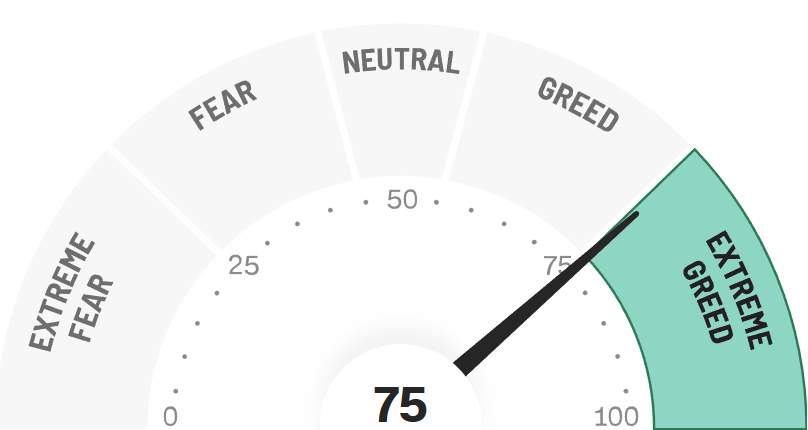

Fear & Greed Index

💊 So… Why Are Healthcare and Pharma Stocks Crashing?

While the broader market keeps pushing to new highs, healthcare stocks - especially insurers and pharma - have been getting hammered.

Reasons for Healthcare Weakness

🧾 1. Medical Cost Ratios Are Rising

The medical loss ratio (MLR) — the % of premium revenue spent on medical care - is increasing.

More patients are getting procedures done, especially post-COVID, including expensive outpatient and elective surgeries.

This squeezes margins because insurers can't raise premiums fast enough to match the rising claims.

🏥 2. Higher Utilization

UNH recently said they're seeing increased utilization in Medicare Advantage.

That means more people are going to the doctor, having surgeries, or using expensive services - all of which cost insurers more money.

💰 3. Medicare Advantage Payment Uncertainty

The government recently proposed tighter reimbursements for Medicare Advantage plans (which these insurers rely heavily on).

There’s concern that lower payment rates or stricter risk adjustment rules will hurt profits.

⚖️ 4. Political & Regulatory Risk

Health insurance is always politically sensitive.

Any noise around regulation, drug pricing, or Medicare-for-All-style reforms can weigh on the sector.

📉 5. Valuation Rotation & Sentiment

As other sectors (tech, industrials) rally, investors may be rotating out of defensive names like health insurers.

Negative headlines and earnings misses have kept sentiment weak.

Bottom Line:

Health insurers are being hit by higher-than-expected medical costs, Medicare uncertainty, and a shift in investor sentiment. While valuations (like ELV at <9x forward P/E) look cheap, many are waiting to see if earnings stabilise before jumping back in.

🧬 Reasons for Big Pharma Weakness

🧓 1. U.S. Drug Price Negotiations (Medicare)

The Inflation Reduction Act (IRA) gives Medicare the power to negotiate prices on select drugs starting this year.

This will directly cut into revenues of blockbuster drugs (like Eliquis, Jardiance, etc.) over time.

Companies like Bristol Myers, Merck, and Pfizer are especially exposed.

💊 2. Patent Cliffs / LOEs (Loss of Exclusivity)

Several top-selling drugs are approaching patent expiry, meaning cheaper generics or biosimilars will soon enter the market.

Examples:

Keytruda (Merck) starts losing protection later this decade.

Opdivo, Eliquis, Stelara, and others are also nearing LOE.

Investors fear revenue erosion with limited high-margin replacement drugs ready.

🏗️ 3. Pipeline & R&D Doubts

While there’s excitement around GLP-1 drugs (Novo Nordisk, Lilly), many other pharma giants lack high-growth assets in their pipelines.

Failures or delays in clinical trials (especially oncology) drag share prices.

📉 4. Generic Pricing Pressure / Volume

Even outside IRA, pricing pressure globally is an issue - especially in Europe and emerging markets.

Generic competition is dragging down pricing power for older drug portfolios.

💼 5. Poor Execution / Guidance Cuts

Some names (e.g. Pfizer) have slashed earnings guidance due to collapsing COVID vaccine revenues and weaker-than-expected core growth.

Bristol Myers also recently cut its full-year forecast and delayed some key drug launches.

🤝 6. Acquisition Risk

With patent cliffs looming, many Big Pharma firms are doing aggressive M&A, raising fears of:

Overpaying for biotech targets

Taking on too much debt

Diluting returns with integration risk

💉 4 Healthcare & Pharma Stocks at Their Cheapest in Years

The healthcare and pharmaceutical sectors have been under pressure lately, pushing some strong companies down to multi-year lows.

For investors looking for value and potential long-term gains, this presents a rare buying opportunity.

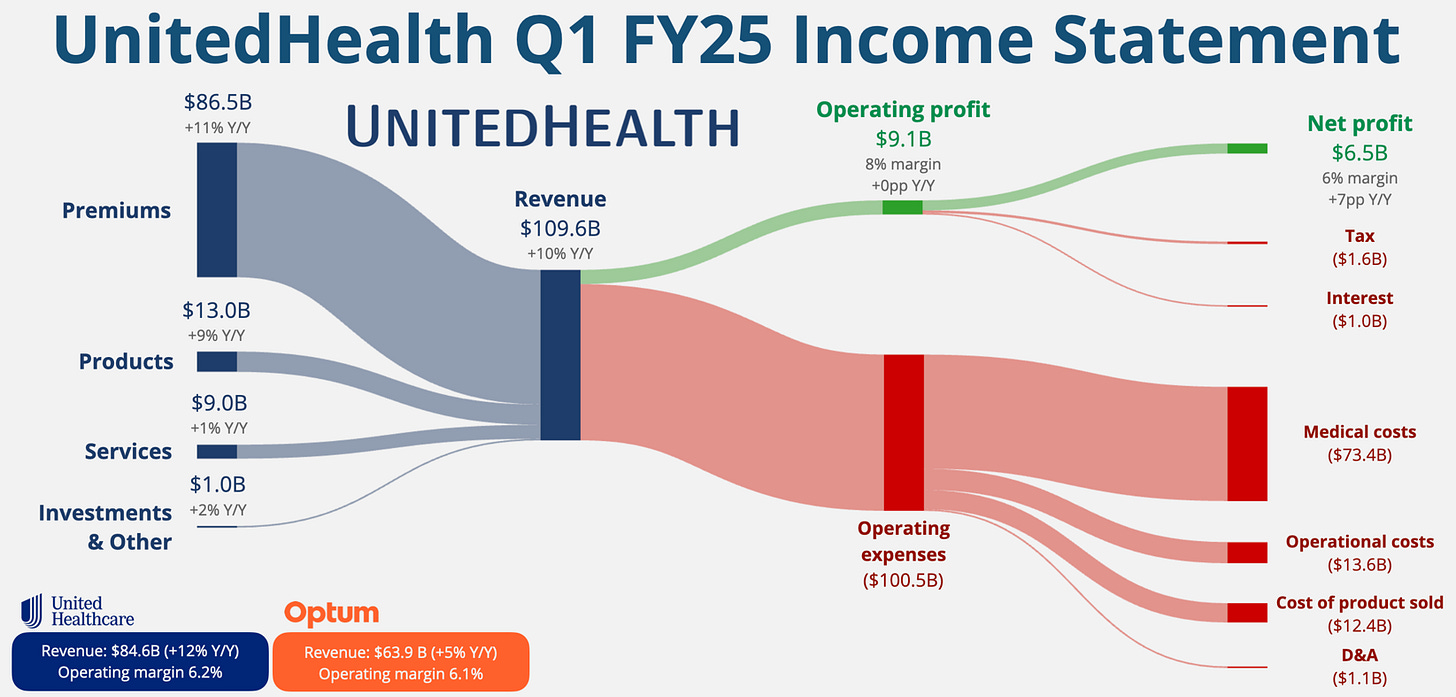

UnitedHealth (UNH)

UnitedHealth Group is a leading healthcare company offering health insurance and healthcare services.

It operates through two main businesses: UnitedHealthcare, which provides health benefits, and Optum, which offers data, analytics, and care services.

UNH serves millions of members across the U.S.

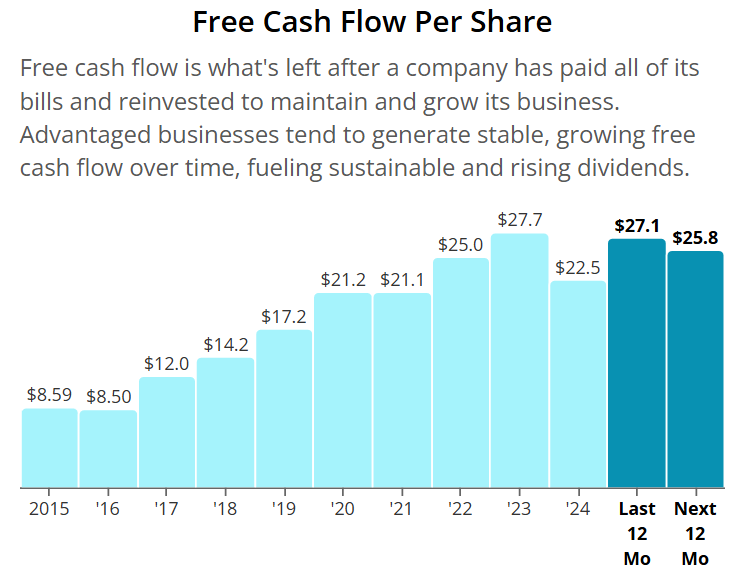

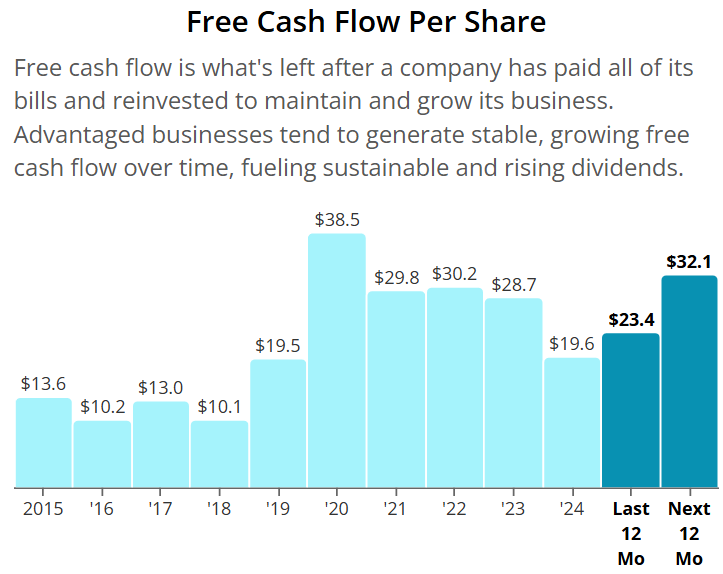

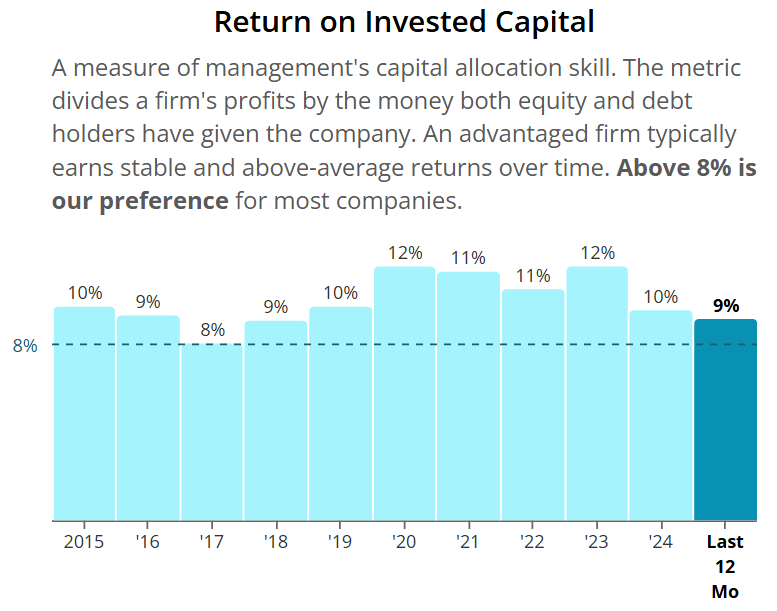

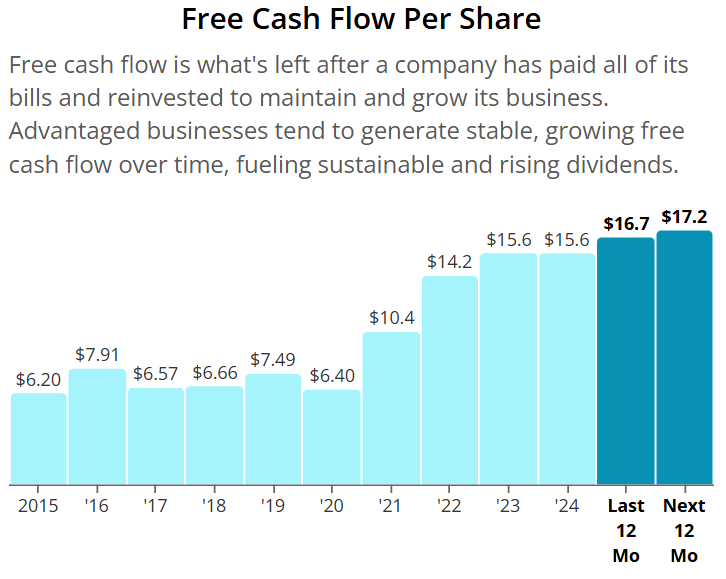

Free cash flow growth

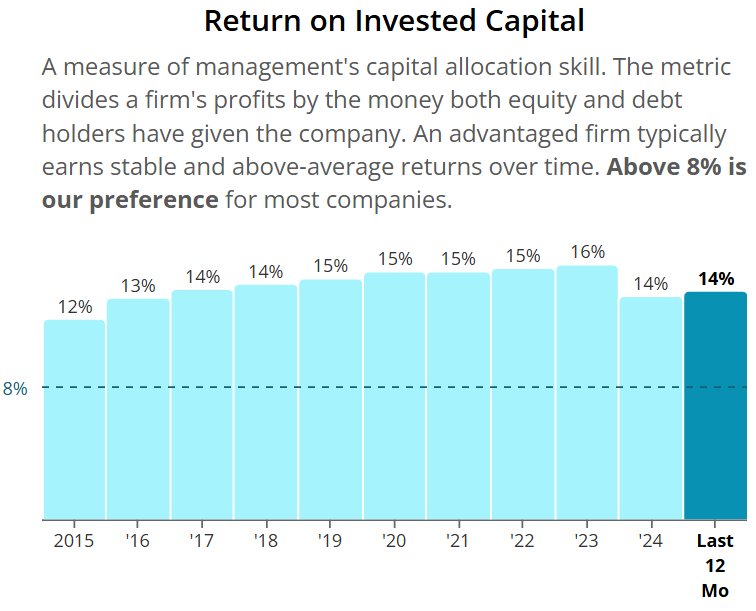

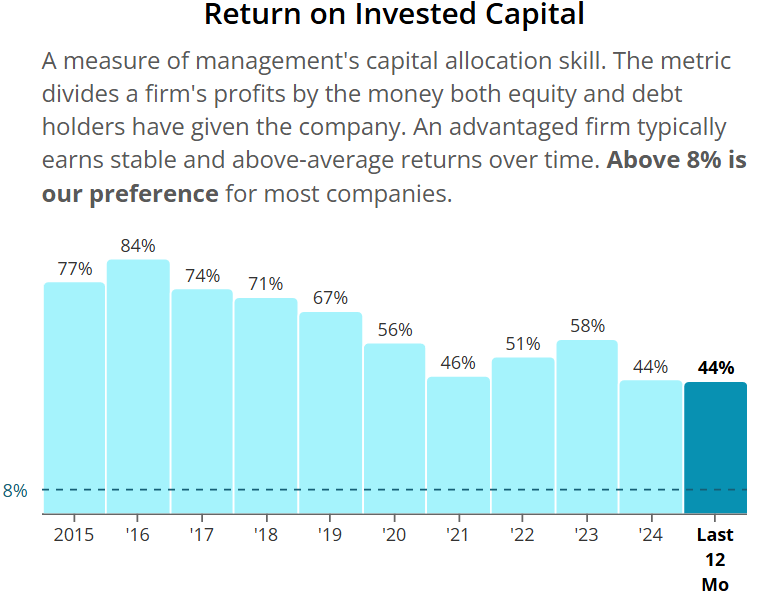

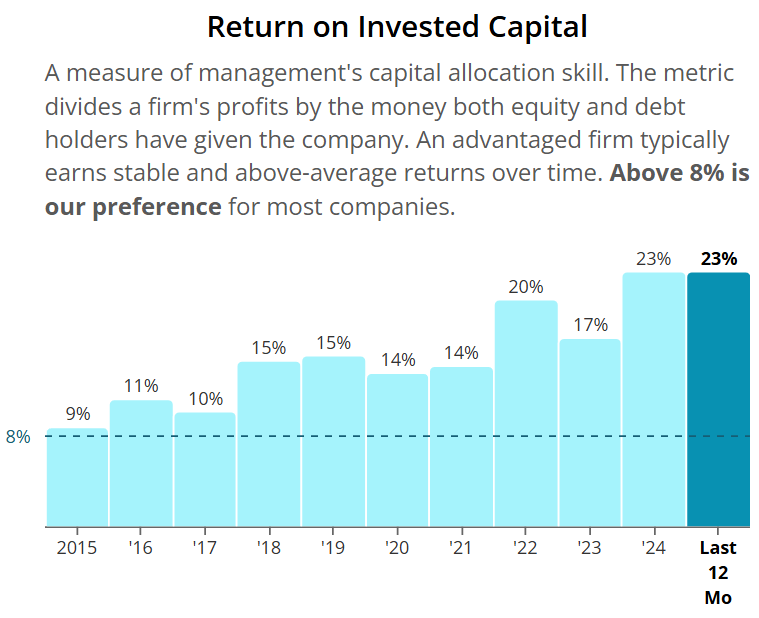

ROIC

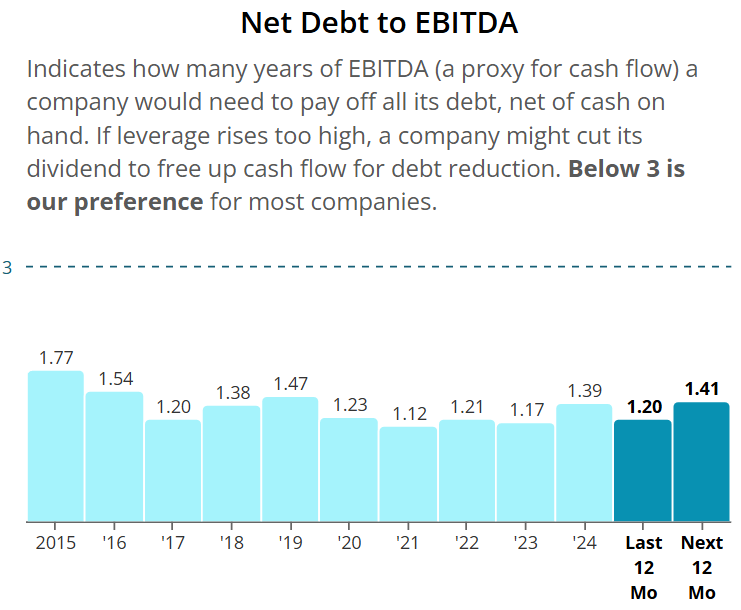

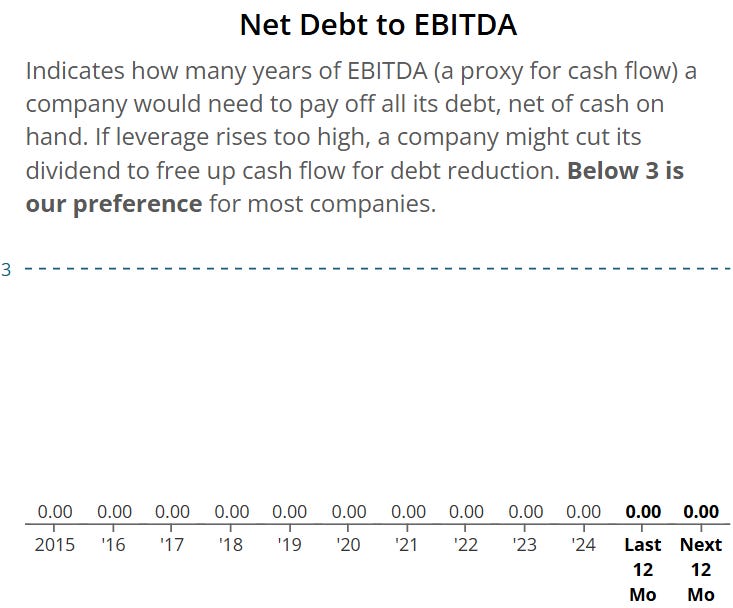

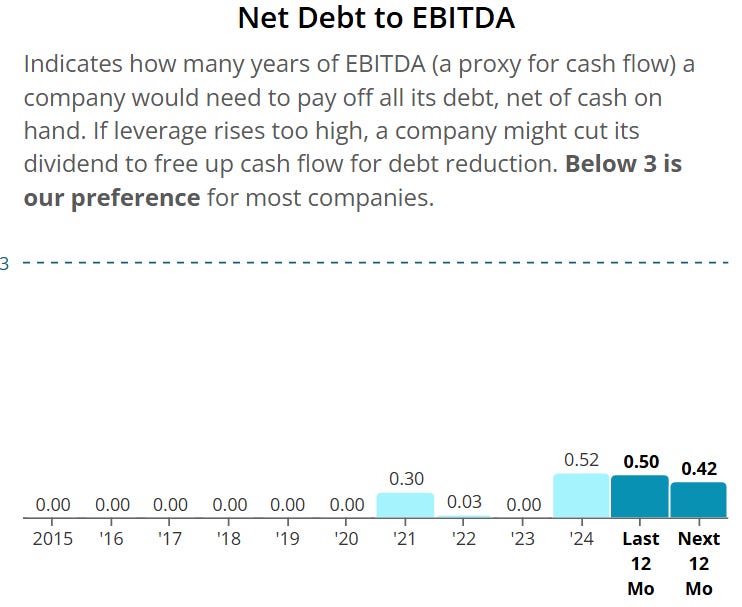

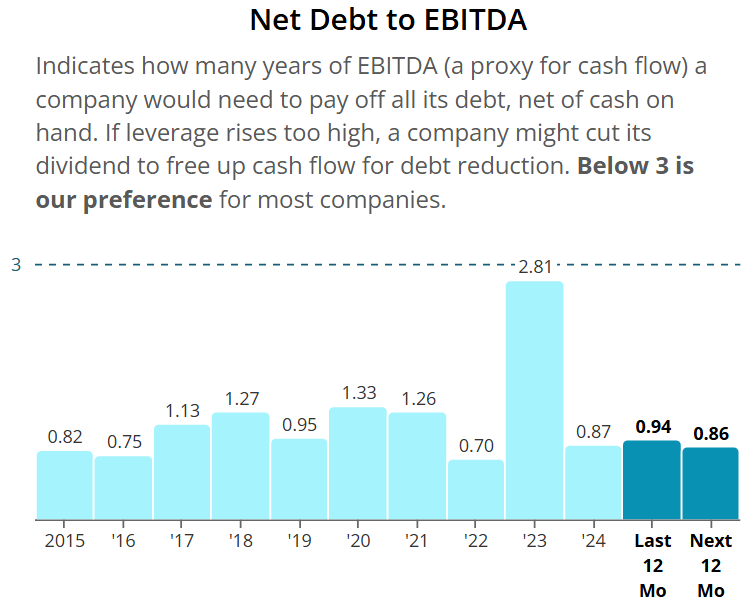

Net Debt to EBITDA

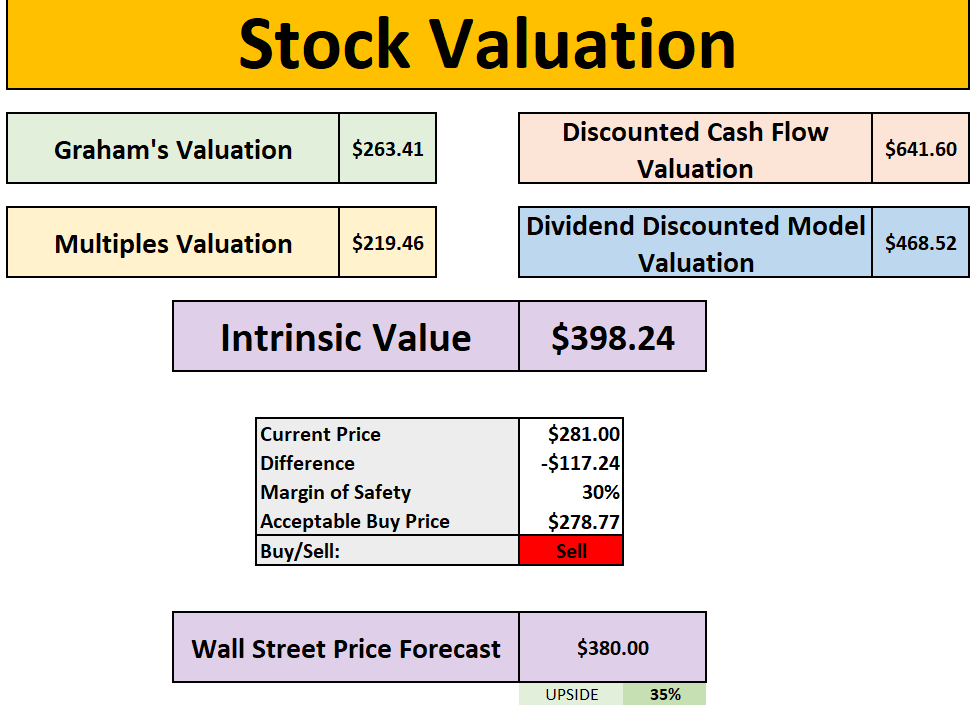

Valuation

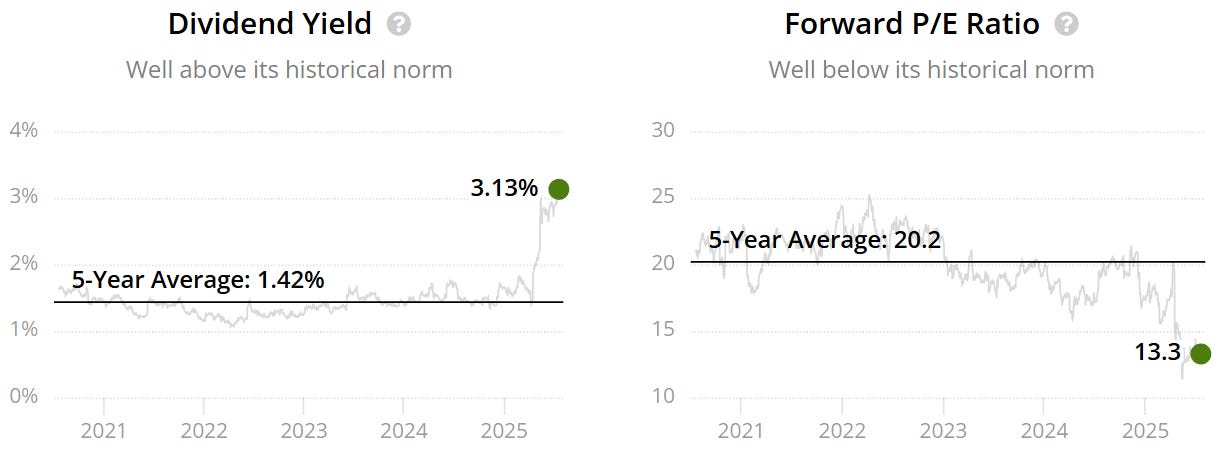

It trades at a forward P/E of 13.3x which is lower than it’s 5Y at 20.2x.

UnitedHealth is offering a 30% Margin of Safety at $279 with Wall Street estimating 35% upside.

Elevance Health (ELV)

Elevance Health (formerly Anthem) is a major health insurance provider in the U.S., offering a range of medical, pharmacy, and specialty benefits.

The company serves millions of members through government and commercial plans.

Elevance focuses on improving health outcomes while managing costs through technology and personalized care.

Free cash flow growth

ROIC

Net Debt to EBITDA

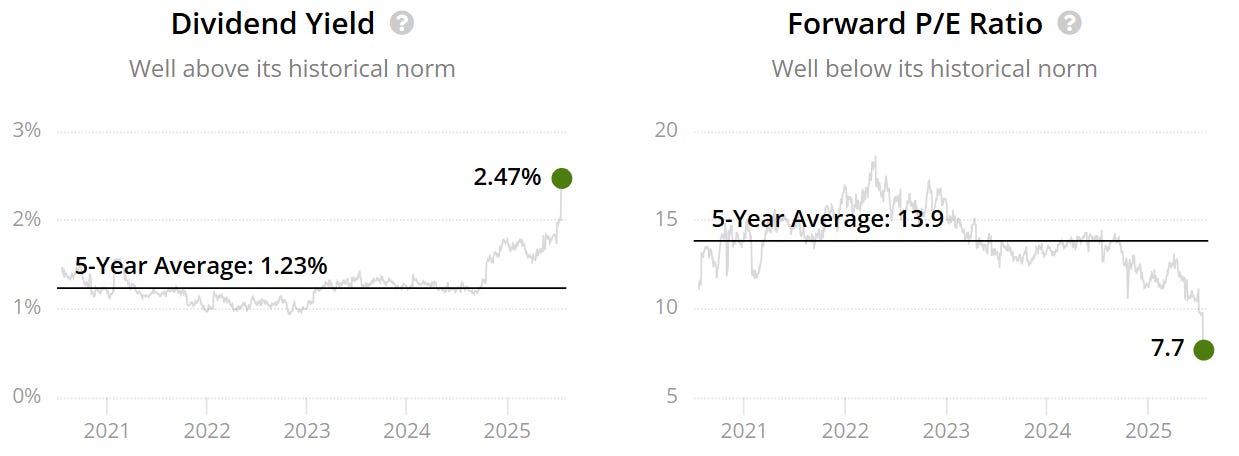

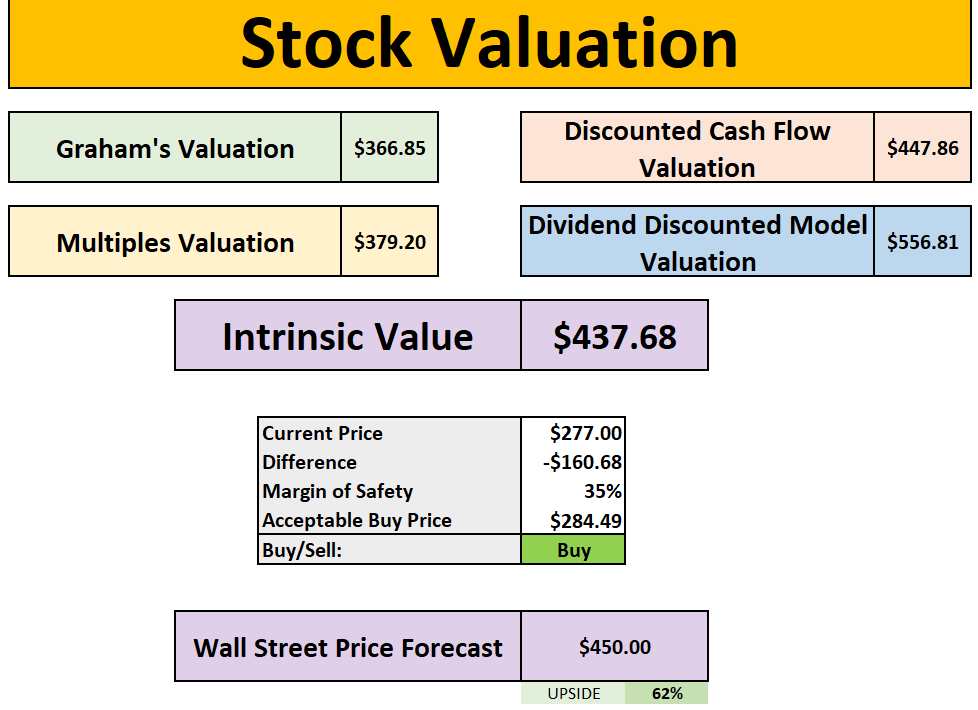

Valuation

It trades at a forward P/E of 7.7x which is lower than it’s 5Y at 13.9x.

Elevance Health is offering a 35% Margin of Safety at $285 with Wall Street estimating 62% upside.

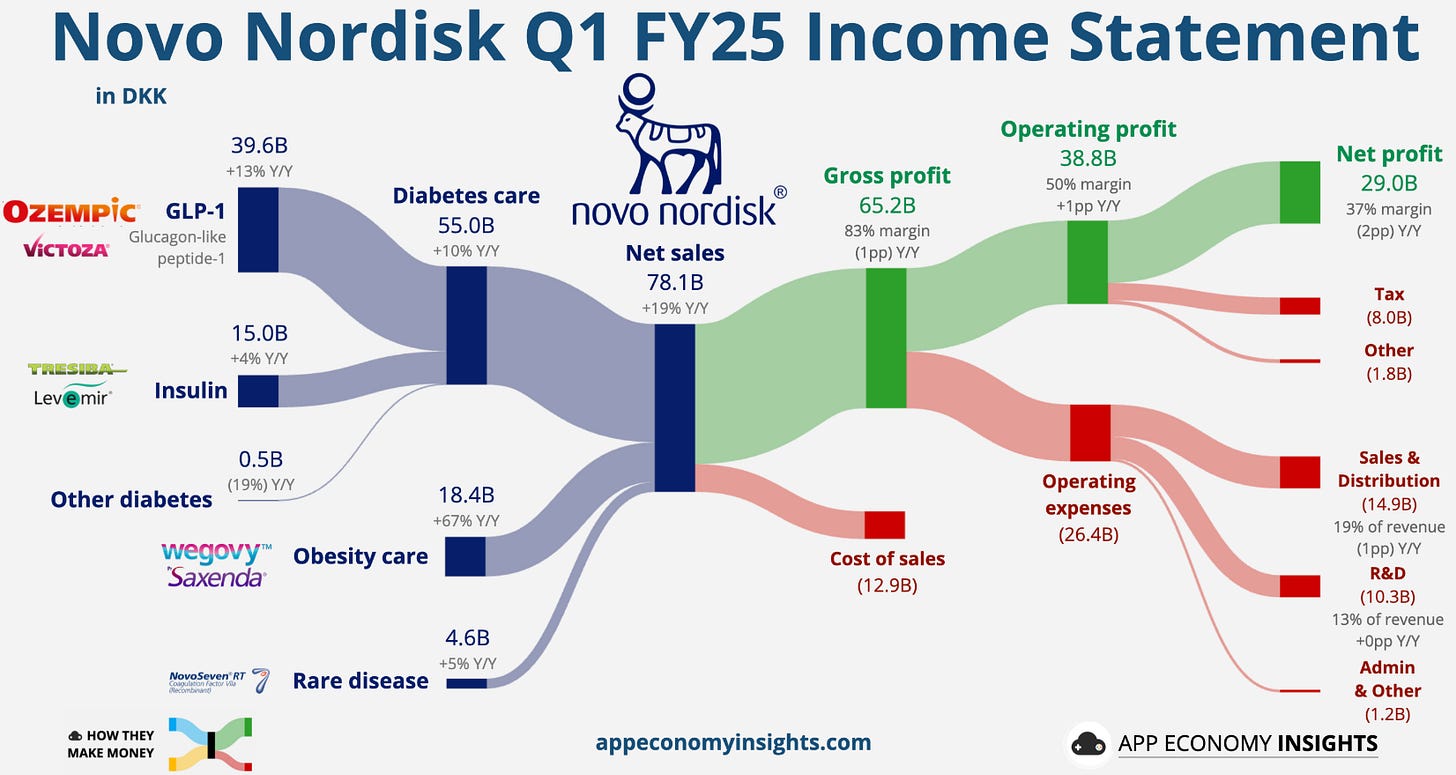

Novo Nordisk (NVO)

Novo Nordisk is a global pharmaceutical company specializing in diabetes care and other chronic diseases like obesity and hemophilia.

It develops and manufactures insulin, GLP-1 therapies, and other innovative treatments.

Novo Nordisk is known for its strong R&D focus and leadership in metabolic health.

Free cash flow growth

ROIC

Net Debt to EBITDA

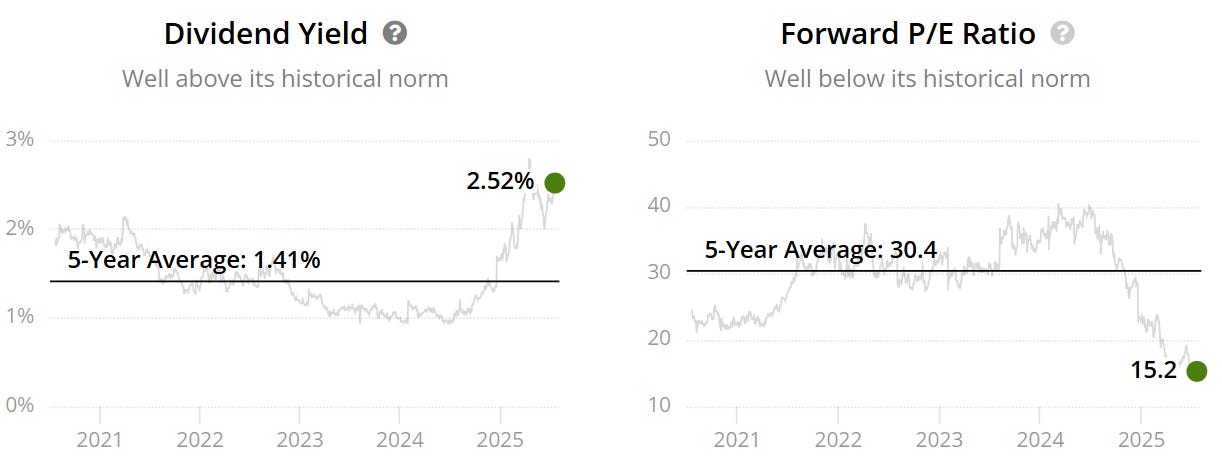

Valuation

It trades at a forward P/E of 15.2x which is lower than it’s 5Y at 30.4x.

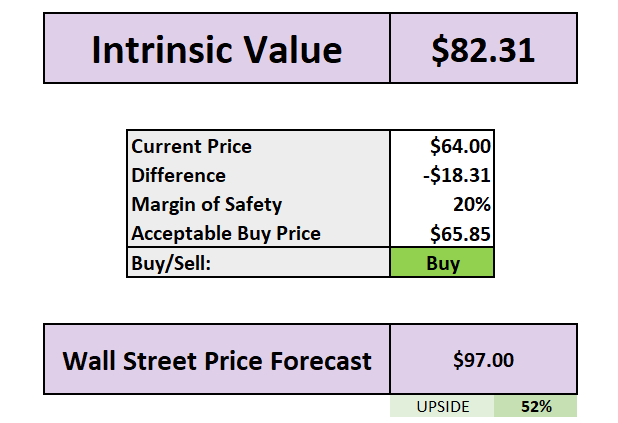

Novo Nordisk is offering a 20% Margin of Safety at $66 with Wall Street estimating 52% upside.

This is based on future free cash flow growth of 14%.

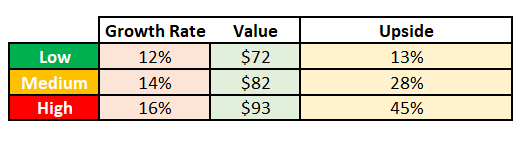

Merck & Co (MRK)

Merck is a global pharmaceutical company focused on discovering, developing, and manufacturing prescription medicines and vaccines.

It is known for its strong portfolio in oncology, infectious diseases, and vaccines, including its blockbuster cancer drug Keytruda.

Merck invests heavily in research to bring innovative treatments to patients worldwide.

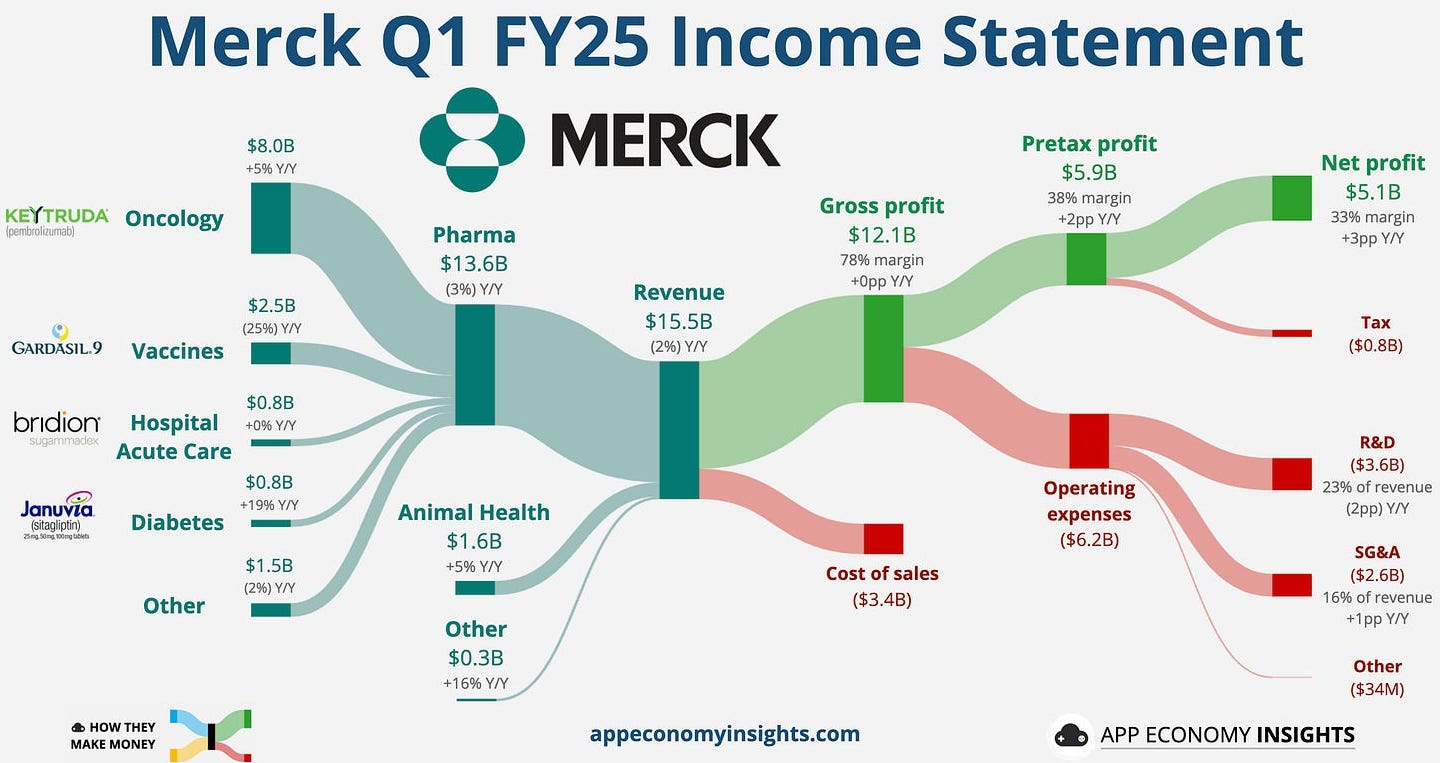

Free cash flow growth

ROIC

Net Debt to EBITDA

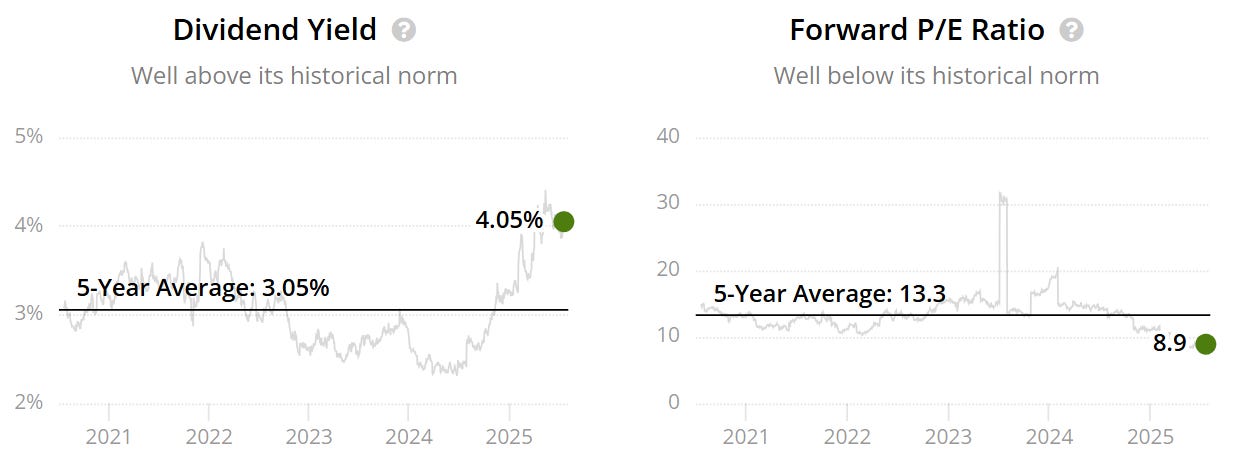

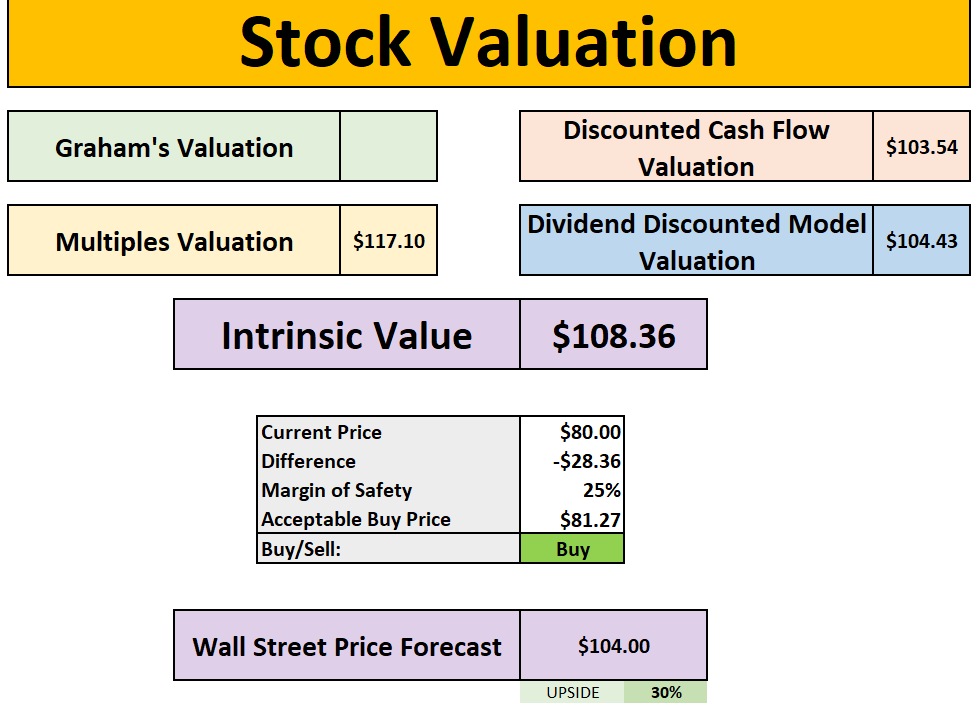

Valuation

It trades at a forward P/E of 8.9x which is lower than it’s 5Y at 13.3x.

Merck & Co is offering a 25% Margin of Safety at $81 with Wall Street estimating 30% upside.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 104,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

What is the price of the sunscription in USD?