Put These 3 Stocks On Your Watchlist!

+ Market Update

Market Latest

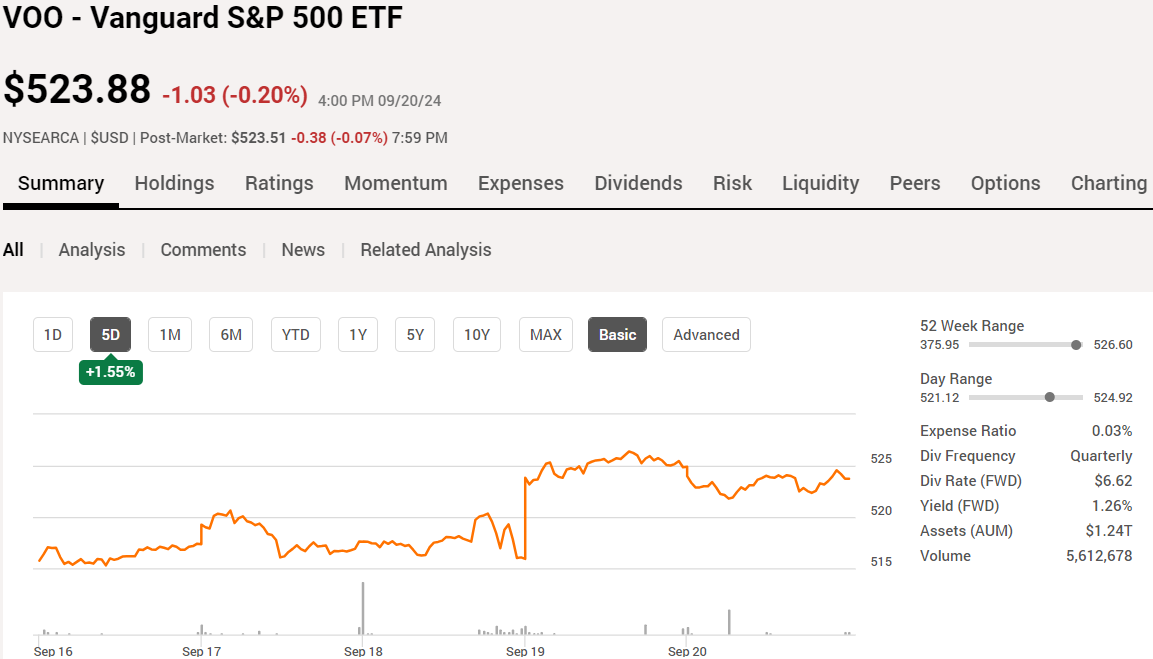

Last Thursday we saw the S&P 500 close at a record high after we heard from the Fed that interest rates would be cut by 50bps.

Investors are starting to believe that the Fed can deliver a soft landing for the US economy.

As a general rule, lower interest rates are considered to be a positive catalyst for stocks, in particular for the tech sector as they encourage economic growth.

Whilst the S&P 500 is at all-time highs, individually we can see some mixed results.

Big gainers include CrowdStrike (+16%), PayPal (+10%) and Meta (+7%).

Worst performers include FedEx (-11%), Altria (-5%) and Accenture (-4%).

Notable News

Last week we saw the Fed cut interest rates by 50bps which was the first cut since 2020.

Out of the last 14 rate cycles since 1929, 12 of them saw a positive S&P 500 return for the 12-month period following the first rate cut.

However, out of the more recent 3 years, 2 of them saw double digit decreases.

We can see a more detailed analysis below:

Expectations from the market are that we will see some more aggressive cuts by the Fed over the next few months and into 2025.

Earnings This Week

Earnings season is slowly starting to kick back up again with some big names reporting.

On Wednesday after market close, we have Micron reporting which may help us understand if the demand for semiconductors is still strong.

We then have Costco reporting after market close on Thursday where we expect a double beat and to see that the consumer is still going strong.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 52,000.

Fear and Greed Index

Just last week the market was sitting in neutral and now we are firmly within greed.

It will be interesting to see where we are next week with the market now expecting more rate cuts over the next few months.

3 High Quality Stocks For The Watchlist

Let us dive into the 3 High Quality Stocks we like.

To select those that we believe to be undervalued and worth a deep dive we have used the following criteria:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 10%

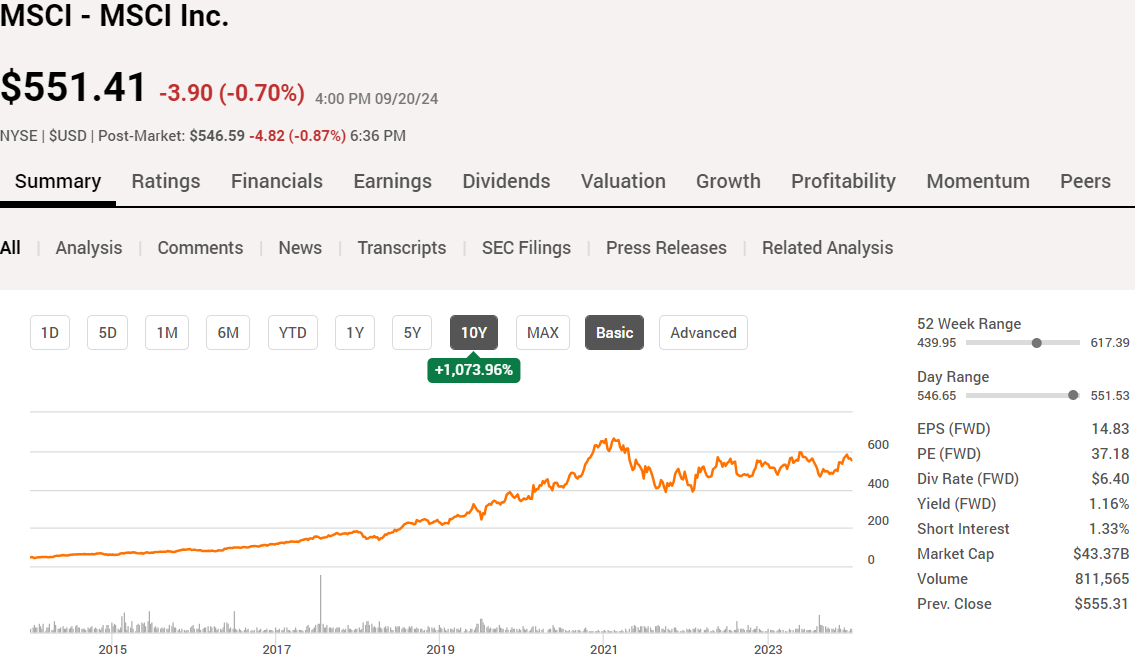

MSCI (MSCI)

MSCI provides financial services, including indices, research, and analytics tools, to help institutional investors make informed investment decisions across global markets.

Over the last 10Y MSCI has significantly outperformed the S&P 500 and is up 1,074%!

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (1.16% v 0.99%) and the Forward P/E is lower than the 5Y (35x v 41x).

Dividend Safety score of 61 indicates safety.

Look at that 5Y dividend growth of 24%!

ROIC is very strong and has been increasing over the last 10Y. Extremely impressive and gives us faith that management are able to effectively allocate their capital.

The Net Debt to EBITDA of 2.7 for 2023 is below the 3 maximum we want to see and expected to drop to 2.35 over the next 12 months.

As per below, Wall Street see 11.80% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $614.17

So, in conclusion for MSCI, we see around a 10% margin of safety around the $553 mark with Wall Street indicating 12% upside.

Whilst we believe this is a high-quality stock, we would wait for a larger margin of safety before adding.

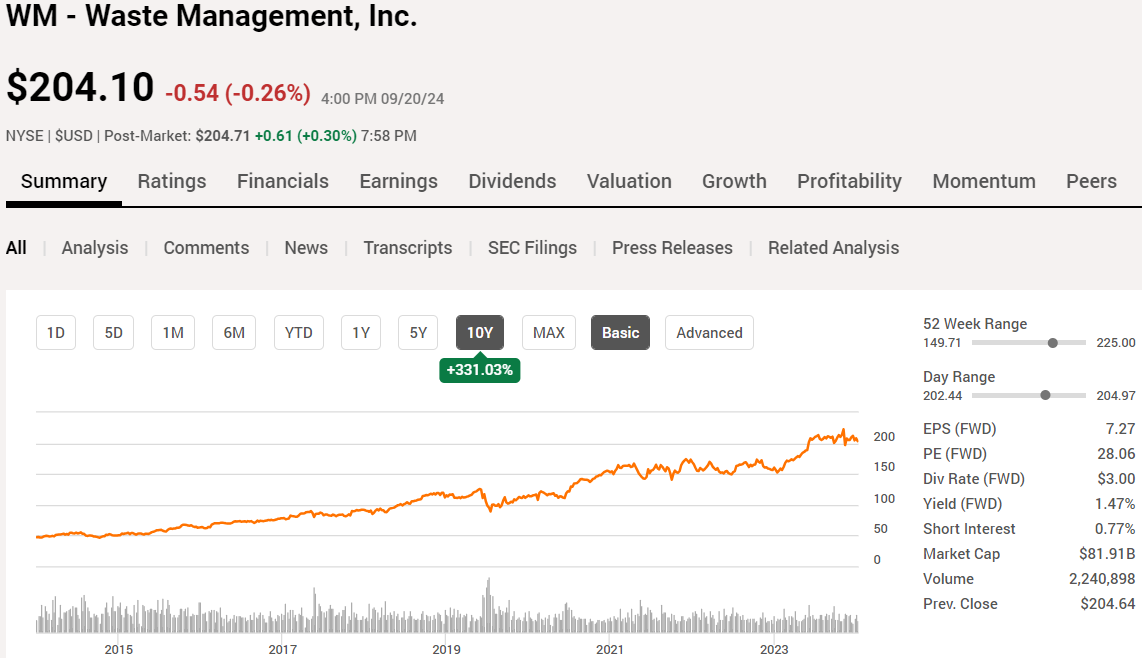

Waste Management (WM)

Waste Management provides waste collection, recycling, and disposal services for residential, commercial, and industrial clients in North America.

Over the last 10Y WM has outperformed the S&P 500 up 331%!

As per below, we get a double reasonable valuation signal as the current yield is slightly lower than the 5Y average (1.47% v 1.67%) and the Forward P/E is marginally lower than the 5Y (27x v 27.3x).

Dividend Safety score of 74 indicates safety.

Love to see this consistency in growth year on year, with the increase to the dividends being 33% per year, on average, over the last 20 years.

ROIC is fairly inconsistent, however it has been above the minimum 10% we want to see ranging between 11-16%.

The Net Debt to EBITDA of 2.68 for 2023 is good to note and is expected to drop to 2.25 over the next 12 months.

As per below, Wall Street see 9.98% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $212.95

So, in conclusion for Waste Management, we see around a 5% margin of safety around the $202/3 mark with Wall Street indicating 10% upside.

Whilst we believe this is a high-quality stock, we would wait for a larger margin of safety before adding, hence why it is on the watchlist.

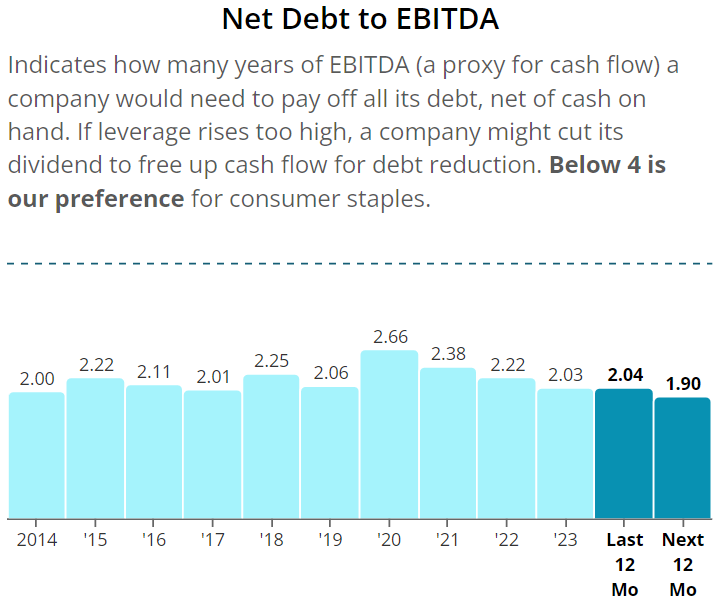

PepsiCo (PEP)

PepsiCo is a global food and beverage company that produces, markets, and distributes a wide range of products, including snacks, beverages, and packaged foods.

As we can see below, over the last 10Y PepsiCo is up 84%, and whilst this has underperformed the S&P 500, we believe over the longer term this is a high-quality stock that can outperform with a nice dividend too.

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (3.17% v 2.82%) and the Forward P/E is lower than the 5Y (20.3x v 24x).

Dividend Safety score of 93 indicates safety.

Love to see this consistency in growth year on year, with the increase to the dividends being 11% per year, on average, over the last 20 years.

PepsiCo is also a new Dividend King with 51Y of consecutively increasing their dividend.

ROIC has been consistently very strong around the 19-20% area.

The Net Debt to EBITDA of 2.03 for 2023 is good to note as well as the fact it is expected to drop to 1.90 over the next 12 months.

As per below, Wall Street see 9% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $195.95

So, in conclusion for PepsiCo, we see around a 10-15% margin of safety with Wall Street indicating 9% upside.

Similar to the 2 stocks above, we believe this is a high-quality stock and we would wait for a larger margin of safety before adding, hence why it is on the watchlist.

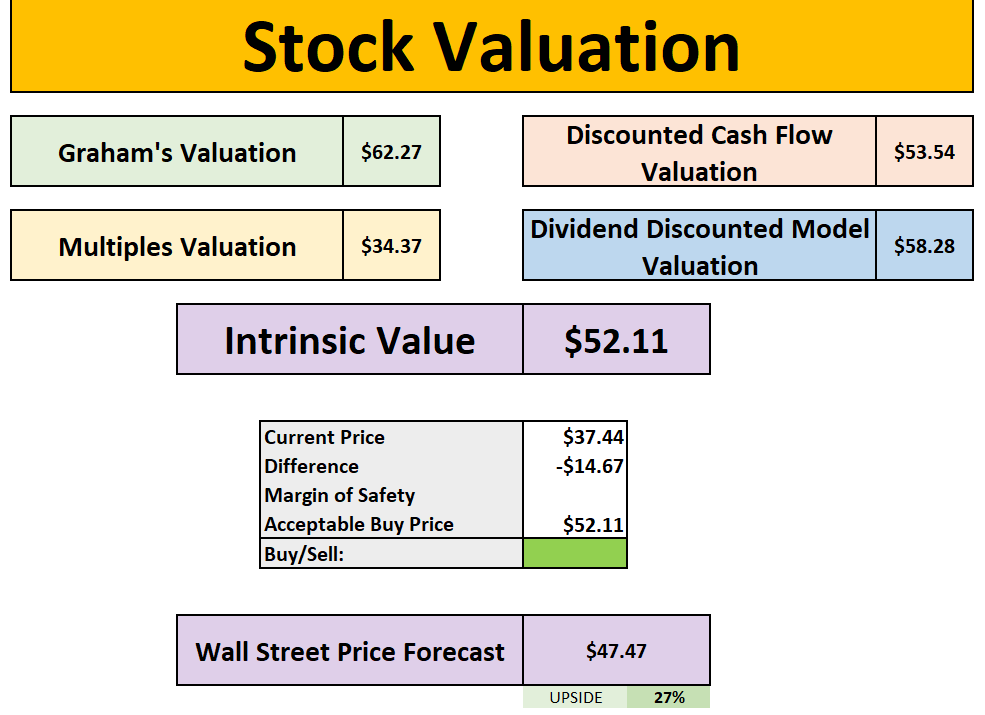

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

https://www.patreon.com/DividendTalks

Conclusion

We have gone through 3 High Quality Stocks to add on the watchlist.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.