Share Buybacks Are Important.

Don't overlook this!

What are share buybacks?

A share buyback is when the Company purchases its own shares which ultimately reduces the shares outstanding - this means shareholders get a larger stake in the Company.

Benefits

The share price tends to increase due to the stock in the company retaining its original value but comprises fewer shares. (This does also depend on the market behaviour).

EPS (earnings per share) should increase as there are fewer shares in circulation. Shareholders end up having a larger stake of the company’s profits. By having less shares in circulation, the earnings and now divided by a lower number of outstanding shares.

Buybacks are a tax-free transaction which returns excess cash to the shareholder whereas dividends are taxable for the individual investor.

Can offset the dilution of shares through stock-based compensation.

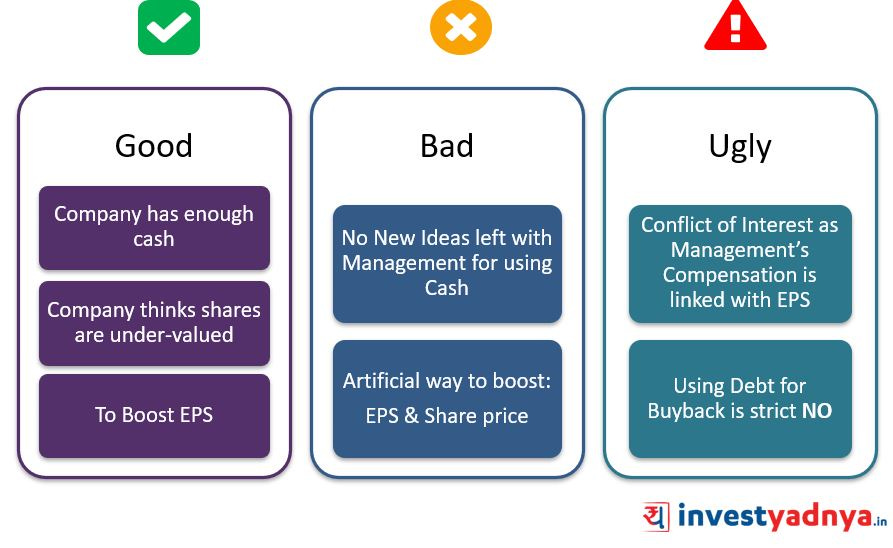

Negatives

They are typically financed with debt which can hurt the Company’s cash flow.

Artificial way to boost earnings per share and management may be buying at a time when the share price is overvalued (therefore not a great way to use cash).

Reduces Company’s cash balance.

May not be the best way to use the capital.

Examples of Companies with Aggressive Share Buybacks

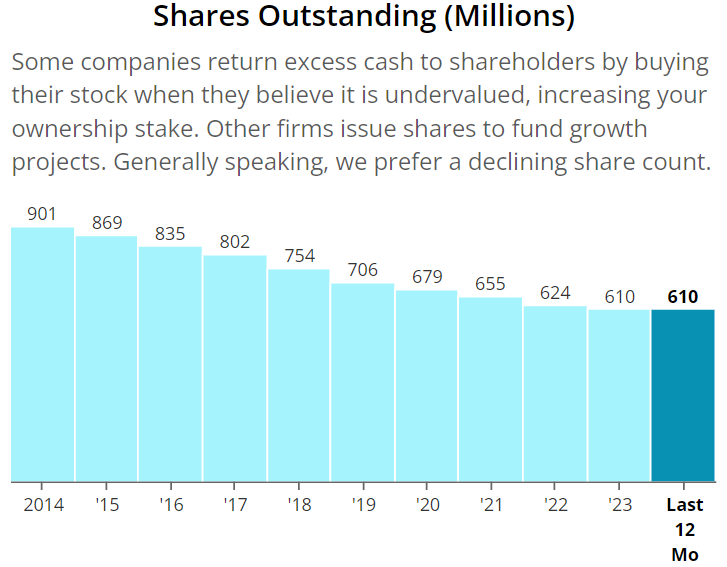

Number 1 - eBay (EBAY)

This company has bought back 58.9% of shares outstanding over the last 10 years.

Number 2 - Lowe’s (LOW)

This company has bought back 44.2% of shares outstanding over the last 10 years.

Number 3 - Apple (AAPL)

This company has bought back 35.9% of shares outstanding over the last 10 years.

Number 4 - Union Pacific (UNP)

This company has bought back 32.3% of shares outstanding over the last 10 years.

Number 5 - Home Depot (HD)

This company has bought back 29.4% of shares outstanding over the last 10 years.

Conclusion

Returning excess cash to shareholders either through dividends or share buybacks both have their benefits and negatives, and you could argue if management believe that the stock is trading below its intrinsic value then it may be a good option.

However, it is also important to note that the best option will differ from Company to Company and therefore whilst share buybacks are not a reason to invest in a Company it should definitely be a metric to include.

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.