Stock Market Crash!

Best Stocks To Buy Now

Market Latest

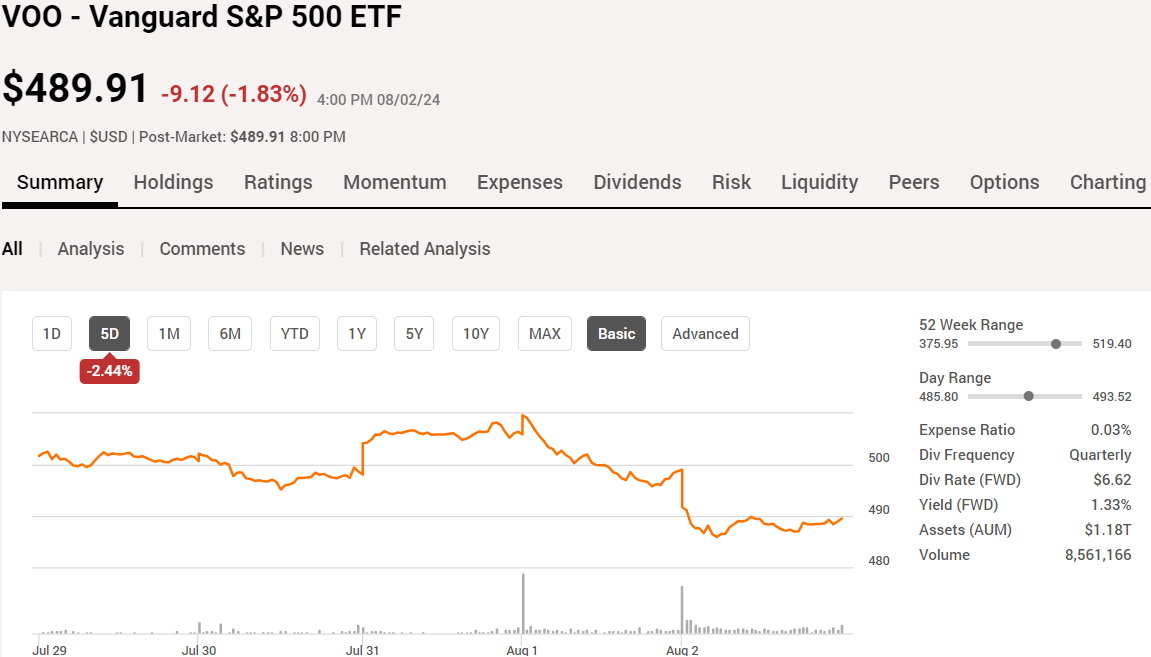

Last Friday we had the worst day in the stock market since the 2020 Covid crash wiping out approximately $3 Trillion due to fears of a global recession.

The S&P 500 was down 2.44%, and this follows the downward trend from last week where it was down 1.76%.

Since the S&P hit all time-highs in mid-July, it is down 5.7%.

As we have mentioned in previous articles, August has historically been one of the worst performing months in the stock market.

Since 1988, the monthly performance of the S&P 500 in August has been -1%.

Unfortunately, the bad news does not stop there, as September is also a bad month historically.

Since 1950, the S&P 500 Index has averaged a 0.54% decline in September, the worst of all 12 months.

Earnings This Week

Looking ahead this week, earnings season continues with some very big names:

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is nearing 50k.

Notable News

Berkshire Hathaway

Warren Buffett’s Berkshire Hathaway sold nearly 50% of its Apple stock, surprising, or expected given they had sold a portion in previous quarters?

Apple currently has a forward P/E of 31x v 5Y average of 27x and has grown this quarter’s revenue by 5% vs same quarter in 2023.

For the 9 months ended June 2024, growth comes in at 0.8%.

Does Warren Buffett believe the valuation is over stretched or is he anticipating a recession incoming.

Berkshire’s cash pile has also hit a record $277bn:

Interest rates

We have seen interest rate cuts over the last few weeks from both Canada, UK as well as other Countries:

The US however decided to keep rates flat, with many investors and analysts worried it is now too little, too late.

Undervalued Stocks

Now let us dive into some undervalued stocks to buy and take advantage of the market decline last week:

Amazon (AMZN)

Amazon is a multinational technology company that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence.

As you can see above, over the last 10Y this company’s share price has increased by 930%, significantly outperforming the S&P 500.

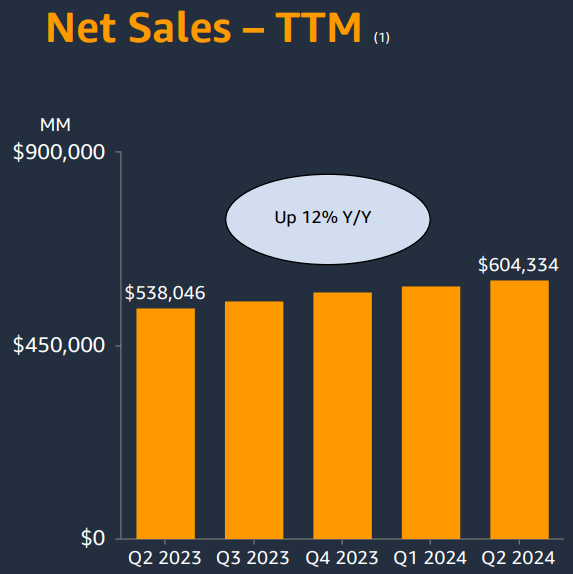

Amazon’s growth story continues with a 12% increase YoY on a trailing 12-month basis.

Last 10Y Sales growth is below:

And this story follows on other metrics too:

Operating income is up 207% YoY.

Net income is up 240% YoY.

Free Cash Flow growth is also up significantly (572% YoY).

We can also see below that the Company has a strong balance sheet with a low Net Debt to EBITDA metric:

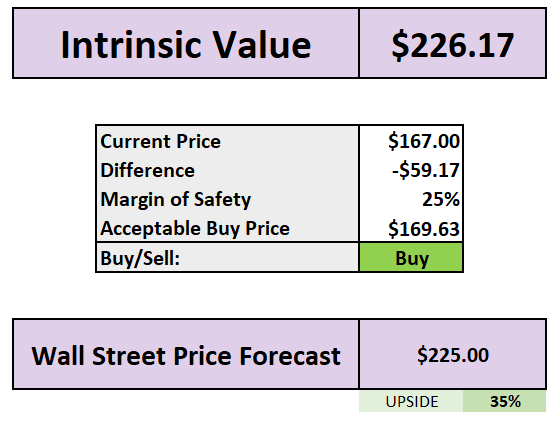

Running it through a Discounted Cash Flow Model:

We can see that if they can increase their free cash flow at a rate of 20% then our intrinsic value arrives at $226.

This gives us a margin of safety of 25% and we can see Wall Street’s forecasted price is not dissimilar at $225 and this gives upside over the next year of 35%.

Alphabet (GOOGL)

Google is a multinational technology company specialising in Internet-related services and products, including search engines, online advertising, cloud computing, software, and hardware.

As you can see above, over the last 10Y this company’s share price has increased by 477%, significantly outperforming the S&P 500.

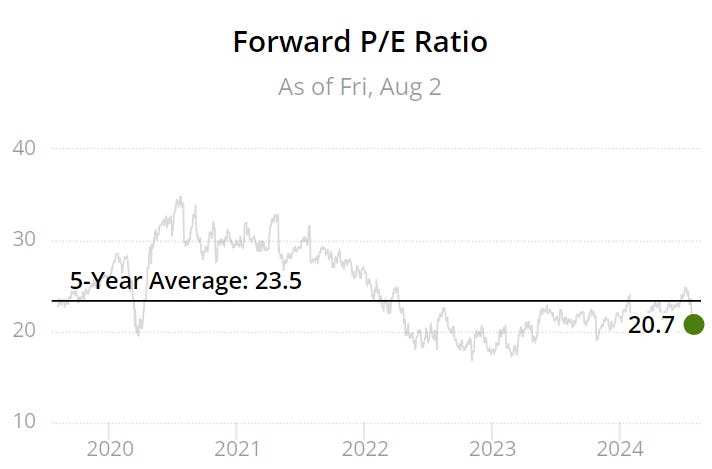

Not only does Google trade at a forward P/E of 20.7x making it the lowest valued magnificent 7 stock, but it also trades lower than the S&P 500 which sits around 22.5x AND it trades lower than its 5Y average of 23.5x.

It has also increased its free cash flow consistently over the last 10Y and is expected to continue over the next 12 months.

From 2018 they have also started to buy back shares which is a nice addition to the recent dividend they have started to pay out.

Both ROIC and margins also look very favourable and one of our favourite metrics is their Net Debt to EBITDA which has historically sat at 0 and expected to continue over the next 12 months.

This means that it won’t even take them 1 day to pay off all of their debt net of cash on hand.

Putting it through a very conservative DCF model, on a 10% growth rate to the free cash flow moving forward the intrinsic value sits at $188.

Their average 10Y growth sits at 24%.

Those who believe 15% is more appropriate, the intrinsic value comes to $264.

Therefore with a very conservative 10% growth rate, you are getting at least a 10% margin of safety with 26% upside per Wall Street’s forecast.

ASML (ASML)

ASML is a Dutch company that designs and manufactures photolithography equipment used in the production of semiconductor devices.

As you can see above, over the last 10Y this company’s share price has increased by 785%, significantly outperforming the S&P 500.

Disappointing dividend growth last month at 4.8%, but historically this Company grows the dividend at a rapid rate - last 10Y have been 26% YoY.

Double undervaluation signal as above. Both yield is above the 5Y average and the forward P/E is lower than the 5Y.

ROIC is very high and shows us that management are able to effectively allocate the capital.

Margins also look very good and consistently above the averages.

Similar to Google, ASML has a fantastic balance sheet as we can see 0 for the Net Debt to EBITDA metric.

Valuation wise, based on a 30% growth rate which is lower than the 10Y average, it puts the intrinsic value at around $1,152.

If you believe that is too optimistic, 25% gives $831 (not far off the current price).

35% = $1,584.

On a 30% growth rate, the intrinsic value offers 30% margin of safety and we can see our value is similar to Wall Street’s target of $1,173 giving a 45% upside target over the next 12 months.

This essentially tells us that Wall Street believe 30% growth rate to be reasonable.

Booking Holdings (BKNG)

Booking Holdings is a company that provides online travel and related services, including hotel reservations, car rentals, airline tickets, and vacation packages.

Over the last 10Y Booking Holdings has had a near S&P 500 return.

I love to see the consistent growth over the last 10Y on the free cash flow with the expectation this is to increase over the next 12months.

It is also noted that it dropped during Covid which is justified given the industry.

The decrease in shares outstanding is very nice to note and an added bonus to the dividend that they offer which currently sits at 1.1%.

ROIC is also well above our minimum 10% level and after the Covid year it has bounced back sharply and sits at 48% on a trailing twelve-month basis.

Impressive margins are noted, although we would like to see the operating margin go back to the pre Covid highs of mid 30’s.

Another very strong balance sheet with the Net Debt to EBITDA sitting at 0.13 on a trailing twelve-month basis.

On a very conservative basis of 4% free cash flow growth the intrinsic value sits at $4,294.

This equates to a margin of safety of at least 20% with Wall Street seeing 27% upside over the next twelve months.

Latest YouTube Videos!

Some videos we have covered this week on the YouTube channel:

Nancy Pelosi Just Bought More Nvidia And Sold Another Stock:

5 Dividend Stocks On Sale That I’m Buying In August:

Why Is Nvidia Crashing?

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Conclusion

We have just gone through 4Stocks to buy and take advantage of the market decline.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.