Super Investors Buys And Sells!

Key Highlights To Be Aware Of!

Market Latest

With the belief that the US will see a soft landing, the majority of US stocks performed incredibly well last week.

We can see the S&P 500 up 3.92%.

We also saw a quick return in the VIX (volatility index) also known as Wall Street’s “fear gauge”, which has retreated from last week’s four year high.

Earnings This Week

Looking ahead this week, earnings season continues with some very big names:

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is nearing 50k.

Notable News

US Inflation Report:

Good news for the US, as we saw inflation come down to 2.9%, the lowest seen since March 2021.

Excluding food and energy, core CPI came in at a 0.2% monthly rise and a 3.2% annual rate, meeting expectations.

A 0.4% increase in shelter costs was responsible for 90% of the all-items inflation increase. Food prices climbed 0.2% while energy was flat.

UK Inflation Report:

Overall prices rose by 2.2% in the year to July, slightly above the Bank of England’s target of 2% where the rate had been since May.

A rise was widely predicted and is due to prices of gas and electricity falling by less than they did a year before.

How can we see what investors like Warren Buffett buy and sell?

Every quarter institutional investment managers who control over $100M in assets need to file a 13F form listing all of their equity assets under management, this is the regulatory requirement set by the United States Securities and Exchange Commission regulations, the US SEC.

Top 10 Buys

Before we look at individual Super Investors, let us look at the Top 10 Most Bought Stocks by all Super Investors:

Adobe (ADBE) - bought by 5 Super Investors

Humana (HUM) - bought by 5 Super Investors

Solventum (SOLV) - bought by 5 Super Investors

CVS Health (CVS) - bought by 6 Super Investors

MSCI (MSCI) - bought by 6 Super Investors

Apple (AAPL) - bought by 6 Super Investors

Uber Technologies (UBER) - bought by 7 Super Investors

Microsoft (MSFT) - bought by 7 Super Investors

United Health Group (UNH) - bought by 8 Super Investors

Berkshire Hathaway (BRK.B) - bought by 9 Super Investors

Individual Portfolio Investor Movements

Warren Buffett - Berkshire Hathaway

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q2 2024 below:

Below we can see the movements of Q2.

Warren Buffett has sold 49% of his Apple stock which was major news a few weeks ago when the story broke. Having said that, Apple is still his largest holding at 30% - if you want to understand this more and our own valuation of Apple, see the video below.

A new position was started in Ulta Beauty, now whilst this is only a very small position, it could be one that he starts to add and make a bigger position. Why? Well as we’ve covered before on the YouTube channel it has some very high quality metrics, looks undervalued and there is an argument that it is recession resistant.

Other than Apple, Warren sold out of a few other stocks as indicated above, however these were all less than 1% of his total portfolio combined.

Other than Ulta and HEICO as new buys, we see continued buys this quarter of OXY, SIRI, CB (which was a new buy last quarter, and LSXMA).

Bill Ackman - Pershing Square Capital Management

We have a little bit more movement in Bill Ackman’s portfolio than usual:

Some big sells noted here, with the CMG position reduced by 23%, although it is still his 2nd largest position at 17% of his total portfolio. Maybe you could argue it makes sense given it currently trades at 50x Forward P/E.

Another big sell, with Google reduced by 25%, making his total position 20%. Probably the one investor movement I do not personally agree with as I do believe it is undervalued currently as per the video below:

A notable buy here of Nike which is a new position for Bill at 2.2% of the portfolio. Interesting to see both Warren and Bill purchasing retail stocks as this goes against their historical strategy. No major shock as we have covered Nike on the YouTube channel and it did look undervalued with some very good historical metrics.

Another new position, Brookfield, which makes up 3% of his total portfolio. BN currently trades towards it’s 52 week high with a yield of 0.70%.

Bill & Melinda Gates Foundation Trust

Not a lot of movement in the portfolio, similar to Q1 2024:

As we mentioned above, Berkshire Hathaway was the number 1 most bought stock and we can see above that 7,317,105 shares were added taking their total position to 21% of the portfolio. Interestingly, in Q1 2024 they sold 2,613,252 shares of BRK.B.

1,610,000 shares of MSFT were sold, however it is still the largest position at 33%, and this is one that was also sold in Q1 2024, where 1,711,272 shares were disposed.

Carvana has been fully disposed of, although this was only 0.1% of the total portfolio.

If interested, we have an old episode where we ran through Bill Gates top dividend stocks:

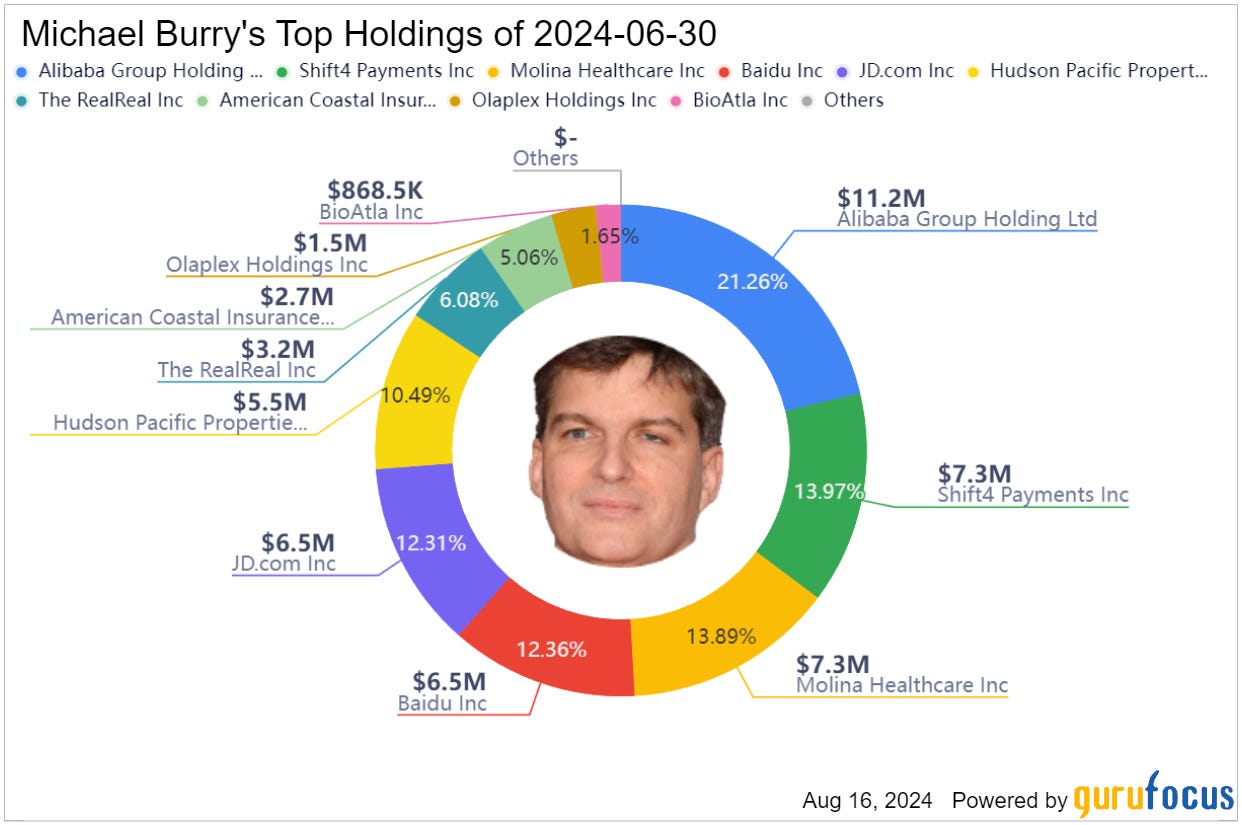

Michael Burry - Scion Asset Management

Like every quarter from Michael Burry, we see A LOT of movement:

Big buys and in fact new positions this quarter include, FOUR, which is now 14% of his total portfolio alongside Molina Healthcare, also at 14% of his portfolio.

Burry continues to add Alibaba, another 30,000 shares making it his largest position at 21%.

Burry continues to favour the Chinese market, as we can see from 3 of his top 5 holdings.

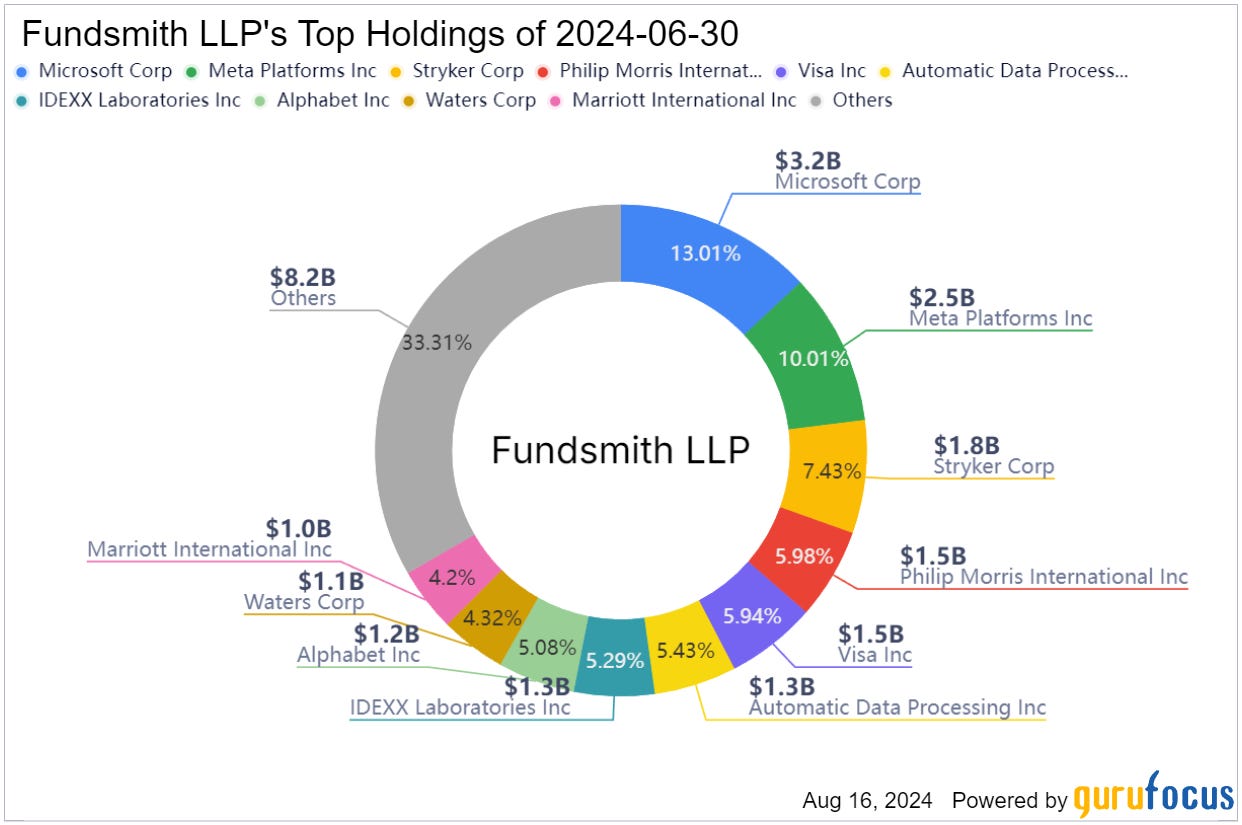

Terry Smith - Fundsmith

Although very small changes, Terry Smith has had a lot of movement as we can see below:

The main takeaway from Terry Smith is that he has only added to 3 positions, which makes up around 1% of his portfolio, however he has sold around 3-4% of his total portfolio, perhaps saving cash for any new opportunities which we may come to see in the next quarter report.

Other Notable Investors

Chuck Akre - Akre Capital Management

Pat Dorsey - Dorsey Asset Management

Mohnish Pabrai - Pabrai Investments

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the patreon where we discuss weekly buy and sells.

https://www.patreon.com/DividendTalks

Conclusion

Hope you enjoyed today’s newsletter and found some value in analysing key movements in these Super Investors portfolios.

Hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.