Super Investors Buys And Sells!

+ Market Update

Market Latest

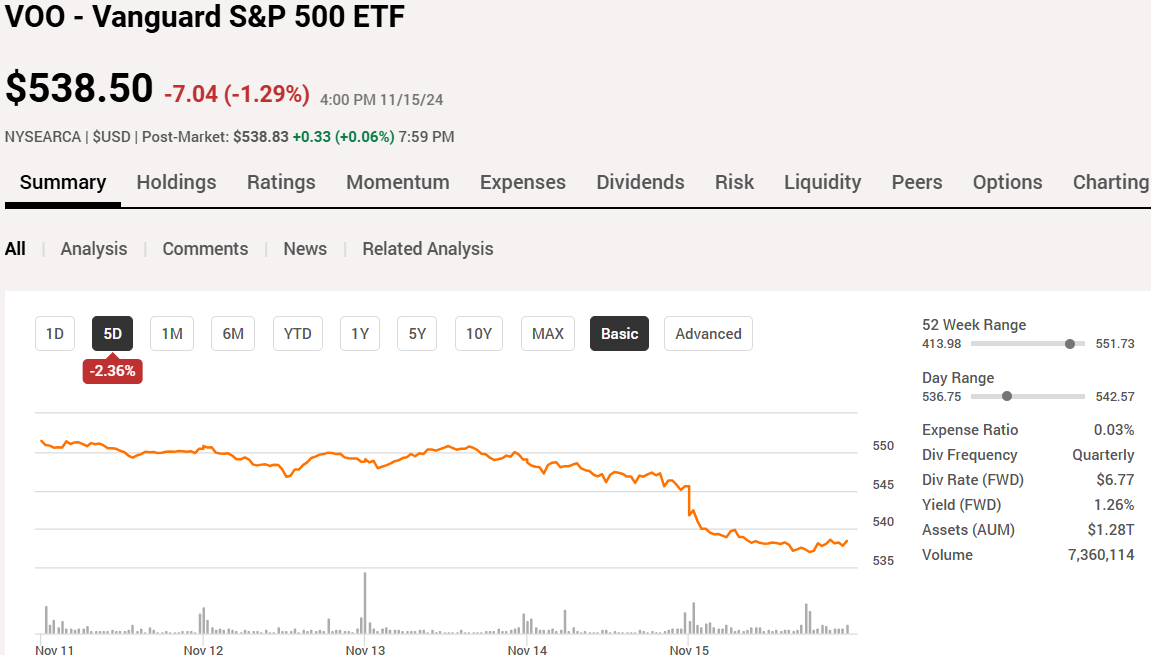

Not the greatest week for the stock market by any means, however it is still up 23.78% in 2024 with 6 weeks left before we close out the year.

The S&P 500 was down 2.36% on the week as the post-election rally fades.

The Majority of stocks had a terrible week, with only a few that ended the week in the green.

Biggest losers last week included:

AbbVie (ABBV) down 18%

Micron Technology (MU) down 14%

Broadcom (AVGO) down 10%

Eli Lilly (LLY) down 10%

Merck & Co (MRK) down 7%

Lockheed Martin (LMT) down 6%

Elevance Health (ELV) down 5%

and others.

2 Big Winners in the week were Disney (who reported their earnings) up 17% and Palantir (PLTR) up 13% after announcing it’s move to Nasdaq..

Notable News

One of the biggest reasons we saw a lot of healthcare stocks falls last week was because of this appointment.

Kennedy is the founder of the nonprofit Children’s Health Defense, the most well-funded anti-vaccine organization in the country.

Is the drop in this sector an overreaction or within reason, only time will tell.

CNBC analyst Jim Cramer has said that he thinks it won’t affect junk food and the drug industries.

However, be aware investors have made money in the past by doing the complete opposite of what Jim says.

We have all-time highs for Bitcoin last week at $93,000 and it will be interesting to see where this goes under Trump’s term as he has talked about a lot of positive policies for Bitcoin.

Palantir continues to steam roll ahead, up in fact, more than 12% this week where we saw news come out that it is moving to the Nasdaq.

From one very well performing stock, to one incredibly poor performing, SMCI. They have a deadline in which they must provide a viable compliance plan given they have not reported on their earnings or they face possible delisting from Nasdaq.

Earnings This Week

Earnings season may be winding down, however we have possibly the most watched Company reporting their earnings, that is Nvidia (NVDA) on Wednesday after market close.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 58,000:

Fear and Greed Index

The market switched up very quickly, and now we are in neutral territory with regards to sentiment.

Last week we sat in Greed (score of 62).

As we said last week:

“Do remember as quickly as things can go positive, they can go as quickly negative.”

Super Investors Portfolio

Warren Buffett - Berkshire Hathaway

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q3 2024 below:

Below we can see the movements of Q3:

Highlights

Warren Buffett has sold an additional 25% of his Apple stock. Having said that, Apple is still his largest holding at 26%.

He has sold out a majority (97%) of Ulta Beauty which was a new position only added last quarter.

2 New buys took place, Dominos Pizza (DPZ) and Pool Corporation (POOL) (check the video below for a look into whether or not we believe them to be undervalued good buys today).

He also continues to sell out of Bank of America, 23% this quarter, bringing his total allocation now to 12%.

Their cash position continues to hit all-time highs:

Bill Ackman - Pershing Square Capital Management

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q3 2024 below:

Below we can see the movements of Q3:

Highlights

Bill Ackman continues to add more Nike to the portfolio, and this now takes his total allocation to 11% of the portfolio.

He also continues to add a significant amount of Brookfield shares (BN), which is his major holding at 13.5%.

Biggest sell was Hilton, reducing the position by 18%, although it is still the 2nd largest holding at 13.2%, just behind BN.

Bill & Melinda Gates Foundation Trust

Their new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q3 2024 below:

Below we can see the movements of Q3:

Highlights

Bill Gates continues to sell Microsoft (MSFT), yet it is still the largest position at 28%.

Whilst he has added PACCAR (PCAR) it is only a small position of the portfolio (below 1%).

Adds more of FedEx (FDX), taking his total position to 1.54%.

Sells some Berkshire Hathaway (BRK.B), although it is his 2nd largest position at 23%.

Michael Burry - Scion Asset Management

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q3 2024 below:

Below we can see the movements of Q3:

Highlights

Michael Burry continues to buy Chinese stocks, and has added a massive 250,000 shares of JD.com (JD), which is now his 2nd largest position at 15%.

He continues to be very bullish on Alibaba (BABA), adding 45,000 shares to his number 1 position which totals 16% of his overall portfolio.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $30 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out:

Conclusion

We have just gone through 2 Cheap Dividend Stocks.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.