Super Investors Buys And Sells!

+ Market Update

Market Latest

Dragged down by mega-cap tech, the S&P 500 momentarily wiped out its year-to-date gains but still sits 15% higher than a year ago.

Problems continue to pile up:

Trade uncertainty

Weakening consumer confidence

Growth worries

The S&P 500 briefly dipped below last year’s closing level falling 4.5% from its February 19 all-time high.

Over the past two years, the Magnificent 7 accounted for more than half of the index’s gains.

However, this year, the group has transitioned from a leader to a laggard, slipping into correction territory.

On a granular level we can see a lot of red right across the board.

Biggest losers included:

Palantir (PLTR) down 16%

Tesla (TSLA) down 13%

Dell (DELL) down 13%

Lam Research (LRCX) down 11%

Advanced Micro Devices (AMD) down 10%

Nvidia (NVDA) down 7%

Earnings This Week

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 83,000:

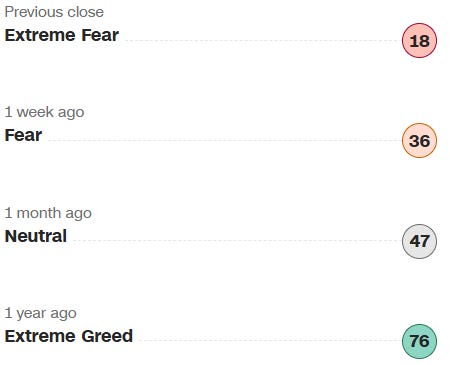

Fear and Greed Index

We have now entered into Extreme Fear territory, with investor sentiment looking incredibly anxious and bearish.

When we see fear in the markets, it reminds us of this Warren Buffett quote:

Let me know in the comments if you have added any stocks this week?

Super Investors Portfolio

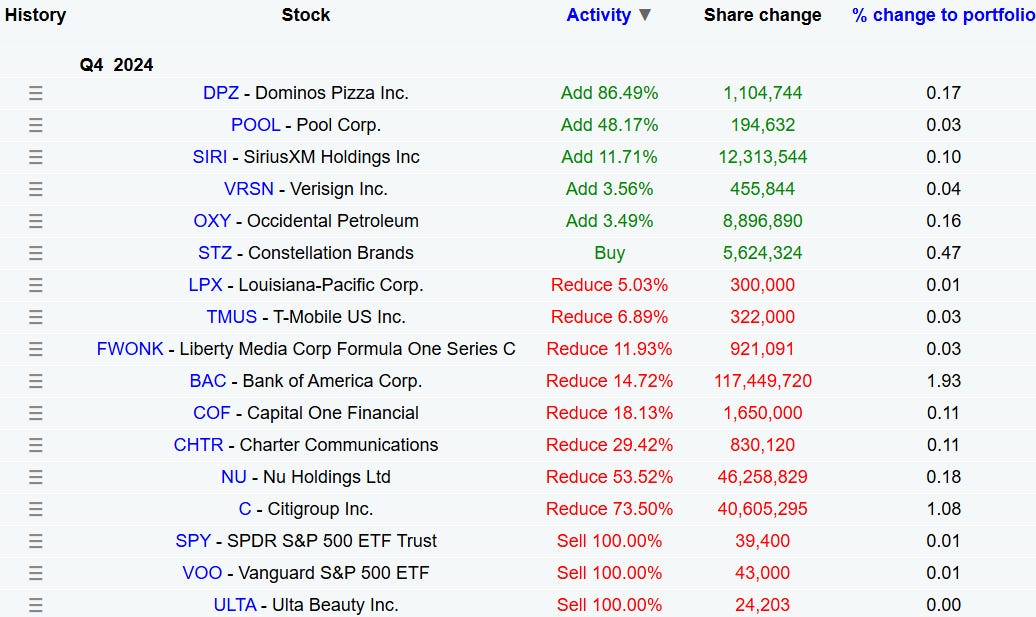

Warren Buffett - Berkshire Hathaway

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q4 2024 below:

Below we can see the movements of Q4:

Highlights

We note 1 new buy of Constellation Brands (STZ) which is at a 52 week low, check our in depth thoughts on this buy below.

He fully sold out of 3 stocks, although they were very small as a % of his total portfolio - SPY, VOO and ULTA (which was only a recent new buy from him).

He has sold shares of a lot of banks in his portfolio, including Bank of America which he has been selling for quite some time now - it is however his 3rd largest position sitting at 11%.

His largest top up buy, outside of his new STZ position was Dominos Pizza (DPZ) which was actually a new position in the previous quarter.

Their cash position continues to hit all-time highs at $334bn:

Bill Ackman - Pershing Square Capital Management

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q4 2024 below:

Below we can see the movements of Q4:

Highlights

Bill Ackman continues to add Nike, Brookfield and Seaport, something we also saw him do in the previous quarter.

He continues to sell Hilton, like the last quarter, although we can see it still makes up 11% of his overall portfolio.

He has started to sell off CMG, although only 14% at this stage, still making it his 3rd largest position overall.

Remember, these portfolio updates are from the previous months, however with Bill Ackman he has come out to say he has added a new position to his overall portfolio in January, so we expect to pick this up in the next quarter release.

The company?

This would take it to his largest position overall!

We actually covered the stock when it was near it’s 52 week low where it looked like a bargain, go check it out:

Bill & Melinda Gates Foundation Trust

Their new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q4 2024 below:

Below we can see the movements of Q4:

Highlights

Bill Gates continues to sell Microsoft (although a small percentage), this is something he has done for several quarters now.

He has added a new position, although very small - McDonalds (MCD) 0.23% of total portfolio.

He also continues to sell Berkshire, something we saw last quarter, although it is still his 2nd largest position at 21%.

Michael Burry - Scion Asset Management

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q4 2024 below:

Below we can see the movements of Q4:

Highlights

He has added a lot of new positions, although the 2 largest adds in relation to his overall portfolio is Estee Lauder (EL) 9.7% - making it his 4th largest position and Pinduoduo (PDD) 9.4% - making it his 6th largest position.

He has fully sold out of Shift4 Payments (FOUR) which was previously 16% of his portfolio, and was his 3rd largest holding.

He has also sold a significant amount of his 2 previously largest positions, Alibaba and JD. Selling 25% and 40% respectively.

10 Largest Buys Last Quarter

More Detail

If you want more information on other Super Investors and our thoughts on their buys and sells, then check out an in depth video we did below:

Stock Resources

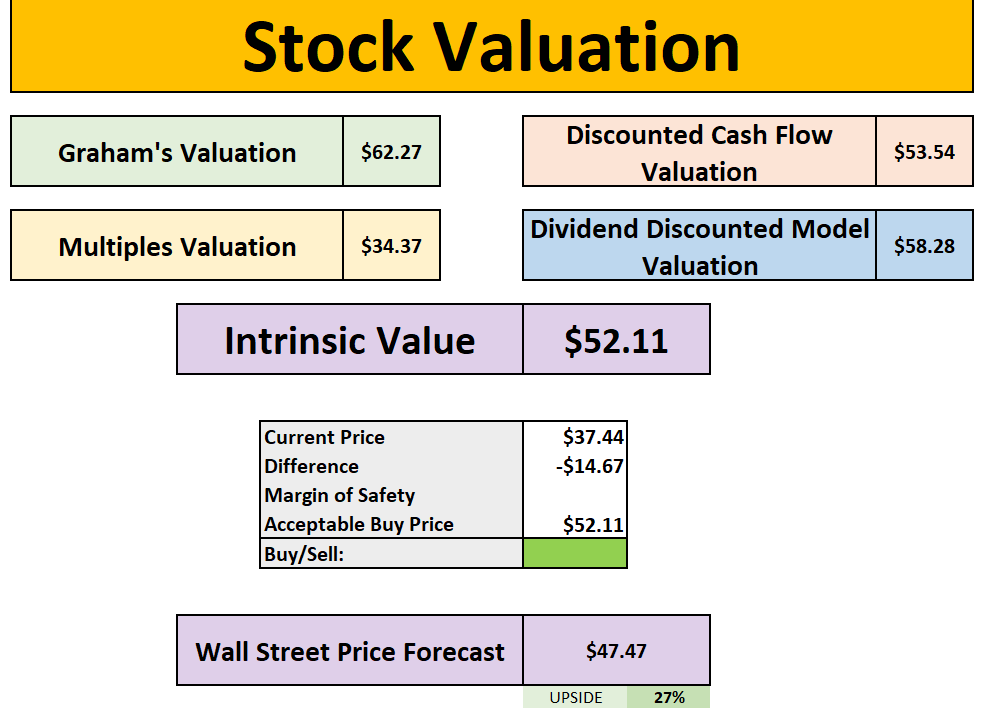

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

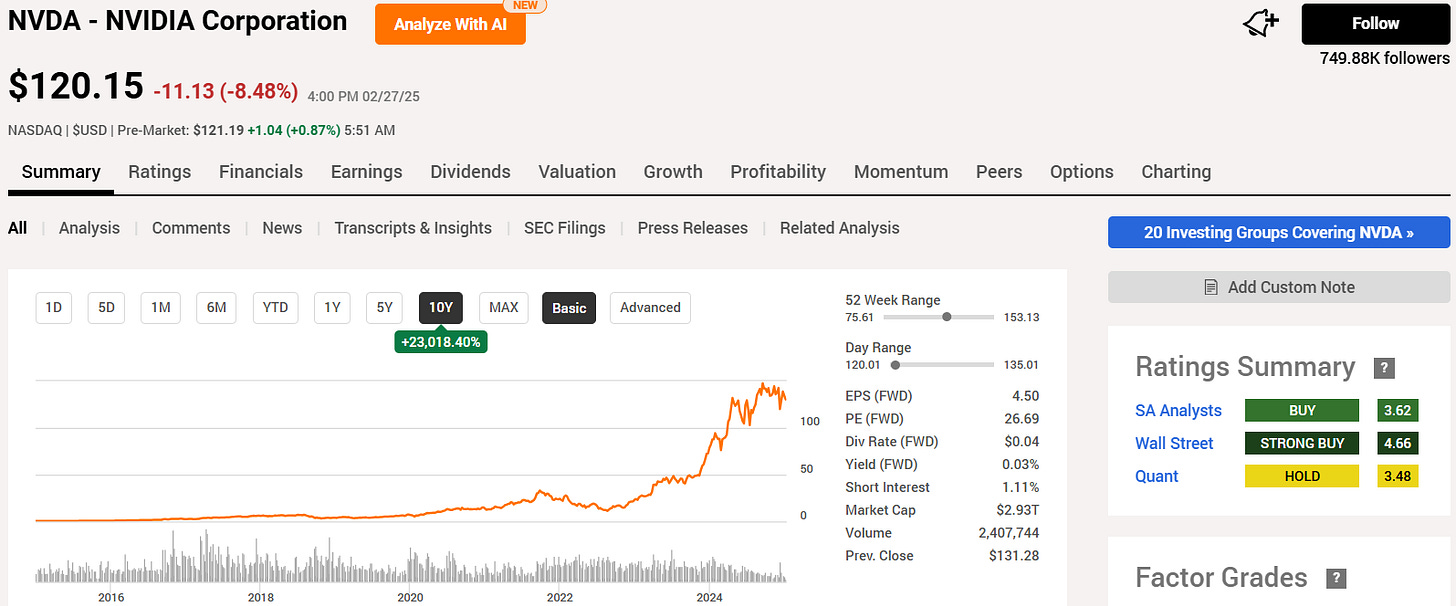

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

TipRanks

To find the predicted upside of stocks, I typically use TipRanks, for example, using their system for Micron (MU) we get the below:

They currently have a 50% offer below.

50% OFF TipRanks:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through Super Investors Buys and Sells.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.