Super Investors Portfolio Movement!

Some interesting moves noted.

How can we see what investors like Warren Buffett buy and sell?

Every quarter institutional investment managers who control over $100M in assets need to file a 13F form listing all of their equity assets under management, this is the regulatory requirement set by the United States Securities and Exchange Commission regulations, the US SEC.

The Top 10 Most Owned Stocks

1 - Alphabet (GOOGL) Held by 33 investors

2 - Microsoft (MSFT) Held by 31 investors

3 - Alphabet (GOOG) Held by 26 investors (The difference between the ticker symbol GOOGL and GOOG is that GOOG doesn’t hold any voting rights whilst GOOGL does)

4 - Meta Platforms (META) Held by 25 investors

5 - Amazon (AMZN) Held by 24 investors

6 - Visa (V) Held by 23 investors

7 - Berkshire Hathaway CL B (BRK.B) - Held by 19 investors

8 - MasterCard (MA) - Held by 17 investors

9 - Wells Fargo (WFC) - Held by 17 investors

10 - United Health Group (UNH) - Held by 16 investors

Individual Portfolio Investor Movements

Warren Buffett - Berkshire Hathaway

His new portfolio is shown here and we have gone to the detail of explaining his individual moves for Q4 2023 below.

Buys:

Sirius XM Holdings (SIRI) - added 30,559,834 shares increasing this position by 315.60%.

Chevron Corporation (CVX) - added 15,845,037 shares increasing his position by 14.37%

Occidental Petroleum (OXY)- added 19,586,612 shares increasing his position by 8.74%

Sells:

Apple (AAPL) - sold 10,000,382 shares decreasing his position by 1.09%

Paramount Global CL B (PARA) - sold 30,408,484 shares decreasing his position by 32.44%

HP Incorporated (HPQ) - sold 79,666,320 shares decreasing his position by 77.71%

Fully sold out of his positions in D.R. Horton (DHI), Markel Group (MKL), StoneCo (STNE) and Global Life (GL).

We can see from these moves that Warren is very bullish on oil having increased both his CVX and OXY positions.

We would however stray away from the narrative that he is becoming worried with AAPL or that there is any significant meaning behind his sales due to the fact that as we can see from above he still holds over 50% of Apple in his portfolio and he only reduced his position by 1%.

Bill & Melinda Gates Foundation Trust

Buys:

Veralto Corp (VLTO) - added 124,333 shares for this new position which makes up 0.02% of his portfolio.

Sells:

Microsoft (MSFT) - sold 1,075,301 shares decreasing his position by 2.74%

Deere & Co (DE) - sold 360,315 shares decreasing his position by 9.20%

Berkshire Hathaway CL B (BRK.B) - sold 2,613,252 shares decreasing his position by 11.60%

They also fully sold out of a large number of positions however in reality they were individually no larger than 0.02% of their total portfolio.

See below:

In conclusion these moves while they look like a lot of movement, numerically to the portfolio it is minimal.

The largest % movement to his portfolio from this activity was BRK.B which was a 2.20% change.

Bill Ackman - Pershing Square Capital Management

Buys:

Howard Hughes Holdings (HHH) - added 2,045,156 shares which increases his position by 12.17%.

Sells:

Hilton Worldwide Holdings (HLT) - sold 1,124,320 shares decreasing his position by 10.91%

Chipotle Mexican Grill (CMG) - sold 128,610 shares decreasing his position by 13.49%

Lowe’s (LOW) - sold 5,821,108 shares decreasing his position by 82.37%

The largest movement all of these stocks was Lowe’s which had a 12.48% total movement to his portfolio in comparison to the next largest change which was CMG of 2.83%

Lowe’s is up over 15% over the last 12 months and is near it’s 52 week high so you could argue Bill Ackman see’s this as entering overvalued territory/limited growth vs other potential options.

We recently reviewed both Home Depot (HD) and Lowe’s (LOW) on our YouTube channel, so feel free to watch below to hear our thoughts.

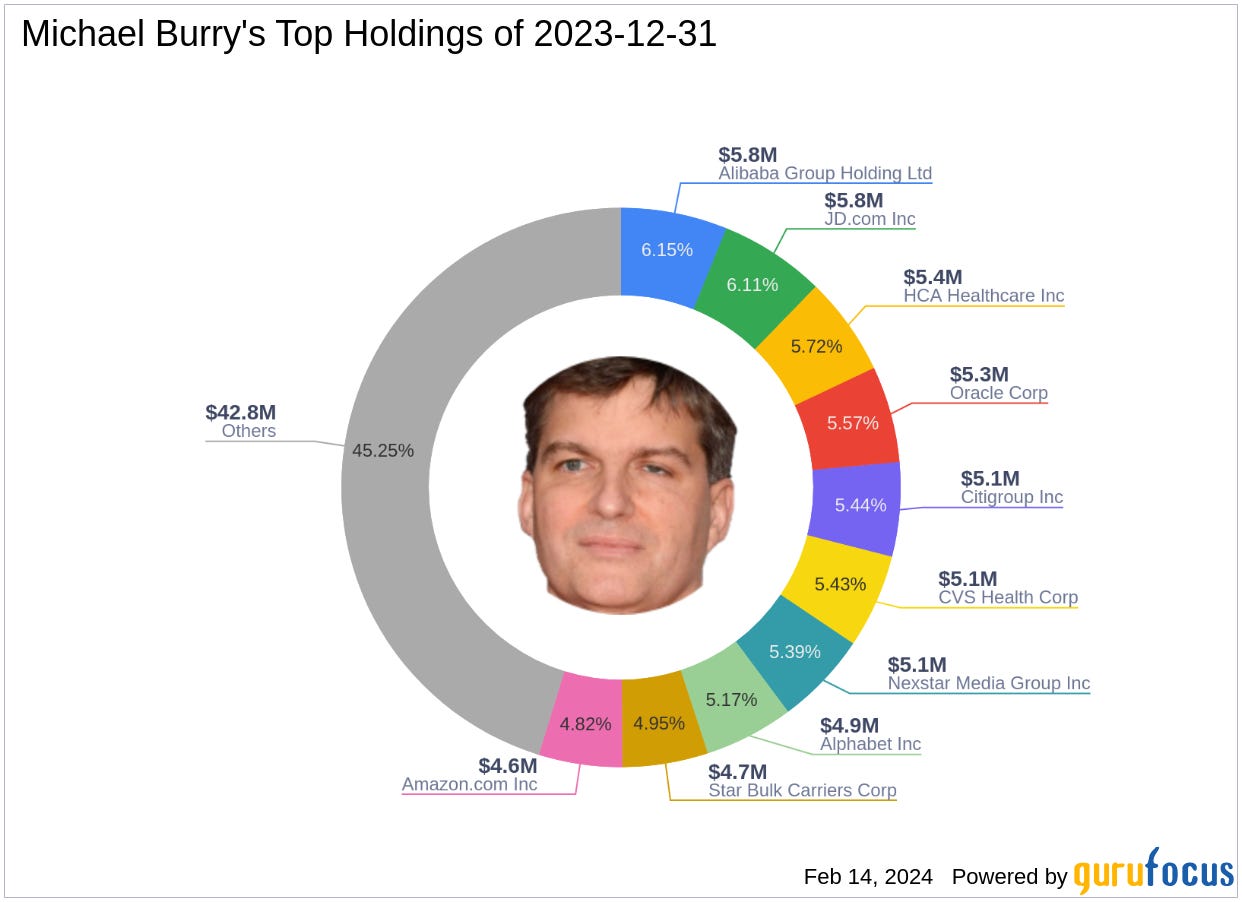

Michael Burry - Scion Asset Management

Buys:

JD.com (JD) - added 75,000 shares which increases his position by 60%

Alibaba (BABA) - added 25,000 shares which increases his position by 50%

Michael Burry also added a significant number of new positions as per below:

Sells:

Michael Burry also reduced positions and sold out of a few Companies:

On our YouTube channel we consistently review in detail the Companies that investors buy and sell. If you’re interested consider watching below and subscribe if you enjoy the content.

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.