Super Investors Portfolio Movement!

Key Highlights To Be Aware Of!

How can we see what investors like Warren Buffett buy and sell?

Every quarter institutional investment managers who control over $100M in assets need to file a 13F form listing all of their equity assets under management, this is the regulatory requirement set by the United States Securities and Exchange Commission regulations, the US SEC.

The Top 10 Most Owned Stocks

1 - Microsoft (MSFT) Held by 32 investors

2 - Alphabet (GOOGL) Held by 31 investors

3 - Alphabet (GOOG) Held by 25 investors (The difference between the ticker symbol GOOGL and GOOG is that GOOG doesn’t hold any voting rights whilst GOOGL does)

4 - Visa (V) Held by 24 investors

5 - Meta Platforms (META) Held by 23 investors

6 - Amazon (AMZN) Held by 23 investors

7 - Berkshire Hathaway CL B (BRK.B) - Held by 19 investors

8 - Wells Fargo (WFC) - Held by 18 investors

9 - MasterCard (MA) - Held by 18 investors

10 - Apple (AAPL) - Held by 16 investors

Individual Portfolio Investor Movements

Warren Buffett - Berkshire Hathaway

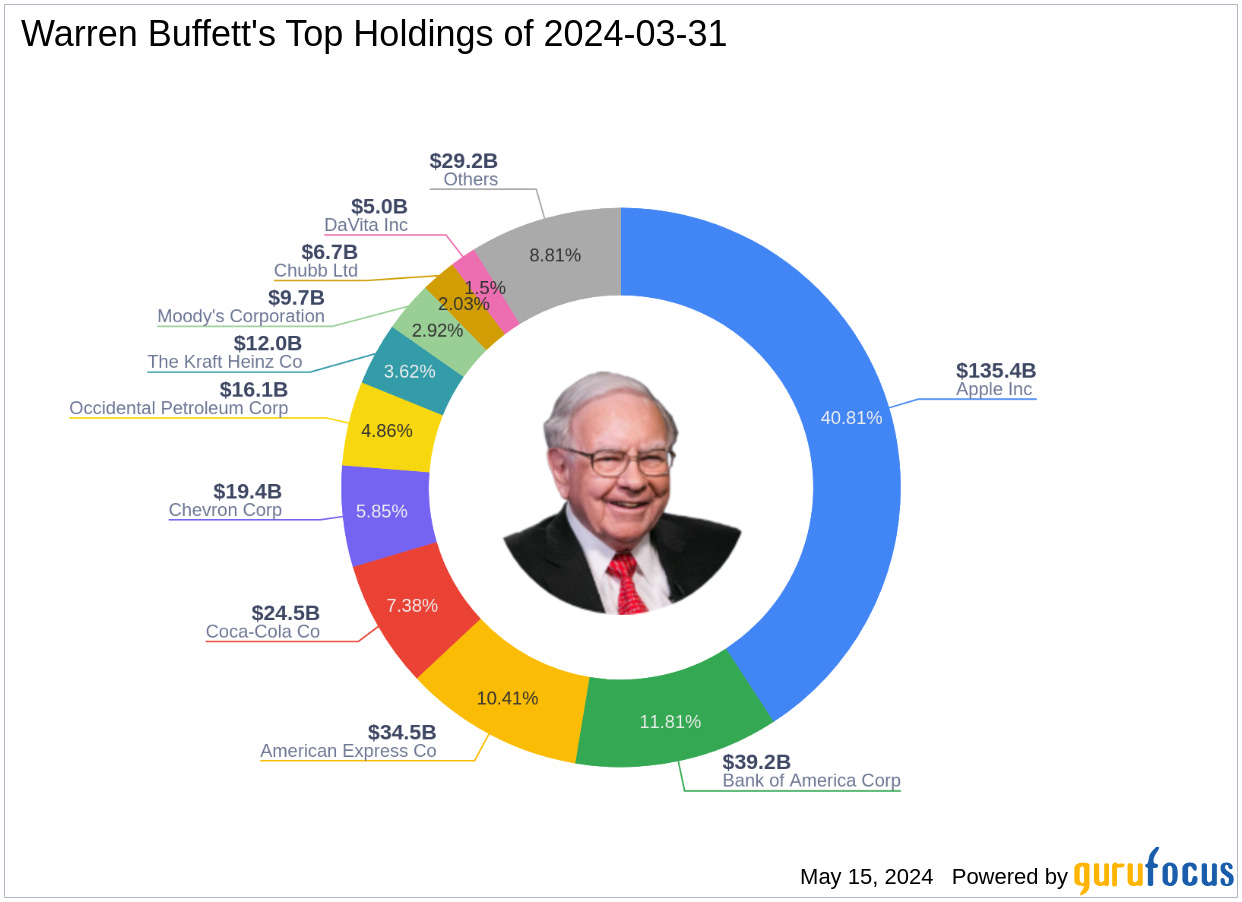

His new portfolio is shown here and we have gone to the detail of explaining his individual moves for Q1 2024 below:

Buys:

Liberty Sirius XM Series A (LSXMA) - added 12,547,944 shares increasing this position by 62.09%.

Liberty Sirius XM Series C (LSXMK) - added 22,277,997 shares increasing this position by 51.56%.

Chubb Limited (CB) - added 5,823,840 shares increasing his position by 28.97%

Occidental Petroleum (OXY)- added 4,302,324 shares increasing his position by 1.77%

Sells:

Apple (AAPL) - sold 116,191,550 shares decreasing his position by 12.83%

Paramount Global CL B (PARA) - sold 55,790,726 shares decreasing his position by 88.11%

Sirius XM Holdings (SIRI) - sold 3,561,146 shares decreasing his position by 8.85%

Louisiana - Pacific Corp (LPX) - sold 446,962 shares decreasing his position by 6.34%

Chevron (CVX) - sold 3,113,119 shares decreasing his position by 2.47%

Fully sold out of his position in HP Inc (HPQ)

The main takeaway from this quarter review of the Berkshire portfolio, is that we now know what the new stock was that Warren Buffett had asked the SEC to allow him not to disclose, so he could build up a larger position.

For those interested in an in-depth review of Warren Buffett’s new stock CB, we have reviewed this in detail on our YouTube channel below.

Bill & Melinda Gates Foundation Trust

Buys:

No buys were noted in this quarter.

Sells:

Microsoft (MSFT) - sold 1,711,272 shares decreasing his position by 4.48%

Berkshire Hathaway CL B (BRK.B) - sold 2,613,252 shares decreasing his position by 13.12%

Bill Gates continues to sell both MSFT and BRK.B as he had done in the previous quarter too, although we do note that both of these sells make up a small % of his total portfolio (1.57% and 2.40% respectively).

It is also worth noting that he has not bought anything substantial in this portfolio since Q2 2023 where he added 5,453,008 shares of BRK.B.

Maybe he does not see anything of value currently?

Before we move on, just to let you know we have reviewed the top 10 stocks bought by all Super Investors in our latest YouTube video below:

If you are interested in valuing stocks yourself, like we do in our videos, we have created a valuation model below which you can pick up:

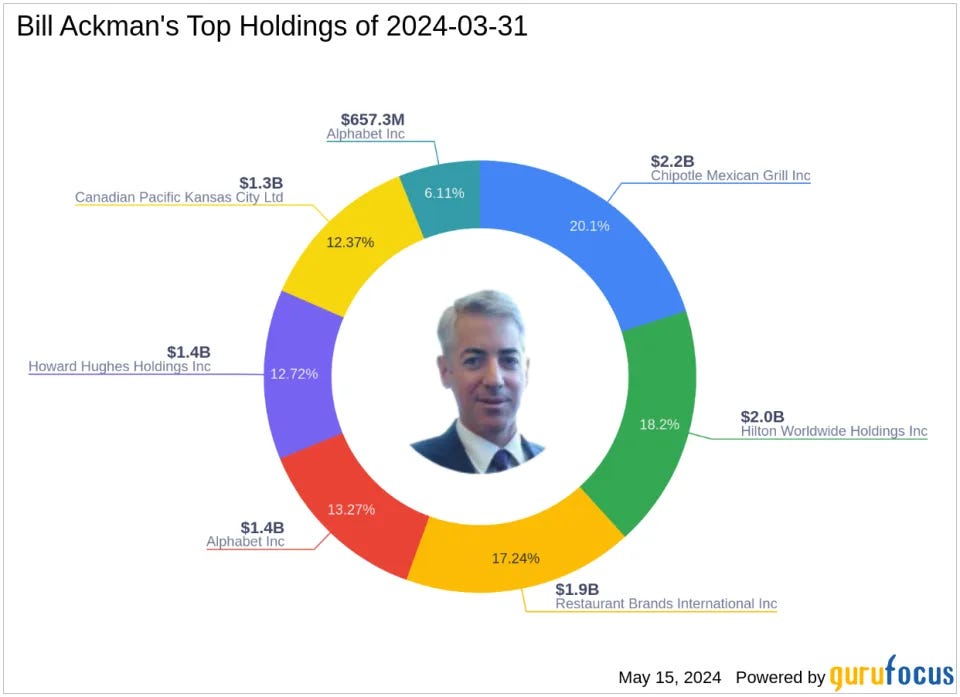

Bill Ackman - Pershing Square Capital Management

Buys:

No buys were noted in this quarter.

Sells:

Chipotle Mexican Grill (CMG) - sold 81,014 shares decreasing his position by 9.82%

Fully sold out of his position in Lowe’s (LOW) - this had previously made up 2.67% of his portfolio.

Similar to the last quarter Bill Ackman trims his position in CMG whilst fully selling out of LOW.

Last quarter he reduced his LOW position by 82.37% so this was something that should have been of no surprise. It is likely that he sees the growth opportunities moving forwards of Lowe’s to be limited and would rather hold cash to wait, similar to what we saw above with Bill Gates.

CMG is up 38% year to date so this could just be Bill taking some of the profits given it is only a small decrease to his current position.

Michael Burry - Scion Asset Management

As always, a lot of movement in Michael Burry’s portfolio!

Buys:

Key takeaway here is that he continues to invest more into China, as we can see below with adds to JD now making it nearly 10% of his total portfolio as well as adds to BABA making it 9% of this portfolio.

2 new large adds here as well of CI (7% of portfolio) and PHYS (7.4% of portfolio).

Sells:

Michael in this quarter has sold out of a lot of stocks as we can see below.

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.