Super Investors: What They’re Buying and Selling

+ Market Update & Why Ackman’s Nike Exit Isn’t So Simple

Market Update

Last week we saw the S&P 500 experience a significant rally, rising 2.66%.

The surge was driven by easing US – China trade tensions, notably a 90-day pause in tariffs, and renewed investor optimism in the artificial intelligence sector.

The U.S. cut tariffs to 30%, and China to 10%, while also easing some rare-earth export restrictions.

Tech stocks also got an extra boost after the U.S. also eased AI chip export rules and NVIDIA struck a deal with Saudi Arabia.

On a more granular level, we had some very strong performers.

Biggest winners included:

Dell (DELL) up 19%

Tesla (TSLA) up 17%

Nvidia (NVDA) up 16%

Micron (MU) up 14%

Advanced Micro Devices (AMD) up 14%

Uber (UBER) up 11%

Palantir (PLTR) up 10%

Biggest losers included:

UnitedHealth (UNH) down 23%

Fiserv (FI) down 10%

Hershey (HSY) down 8%

Notable News

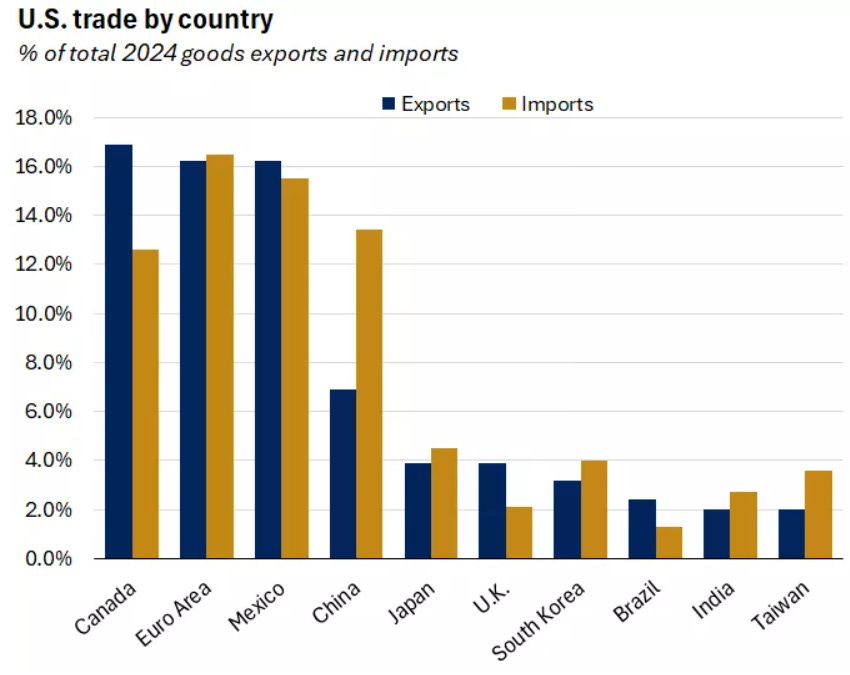

US Trade by Country:

The US – China tariff truce is especially significant given the scale of their trade relationship — 13% of US imports come from China, compared to just 2% from the UK.

Reaching a deal is more complex due to this large trade imbalance, making last week’s progress even more impactful.

Inflation US 2025:

Markets got a lift from April’s inflation and economic data, which showed price pressures easing.

Headline CPI rose just 0.2% month-over-month and 2.3% year-over-year — the lowest since early 2021.

Core CPI held steady at 2.8%. Meanwhile, producer prices (PPI) unexpectedly fell, suggesting further inflation cooling ahead.

Despite soft sentiment surveys, hard data suggests the economy remains resilient.

Soft data like consumer sentiment has been weak, with the University of Michigan’s index falling nearly 30% since January amid inflation and tariff concerns.

May’s early reading dipped again to 50.8 — the lowest since June 2022 — though most surveys were taken before the U.S.–China tariff pause was announced.

US Credit Rating Downgrade:

Last week, Moody’s downgraded the U.S. credit rating from Aaa to Aa1 due to rising deficits and growing national debt.

It’s the first time all three major agencies have rated U.S. debt below top-tier.

While the downgrade may not have immediate effects, it highlights long-term fiscal concerns and could push borrowing costs higher.

S&P 500:

US stocks have had a wild ride this year — falling nearly 19% from February highs to mid-April, just shy of bear-market territory, before rebounding back into positive territory for 2025.

The recovery shows how trying to time the market can backfire.

Globally diversified portfolios, meanwhile, have seen a smoother path thanks to stronger bond and international stock performance.

Earnings This week

Join 94,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

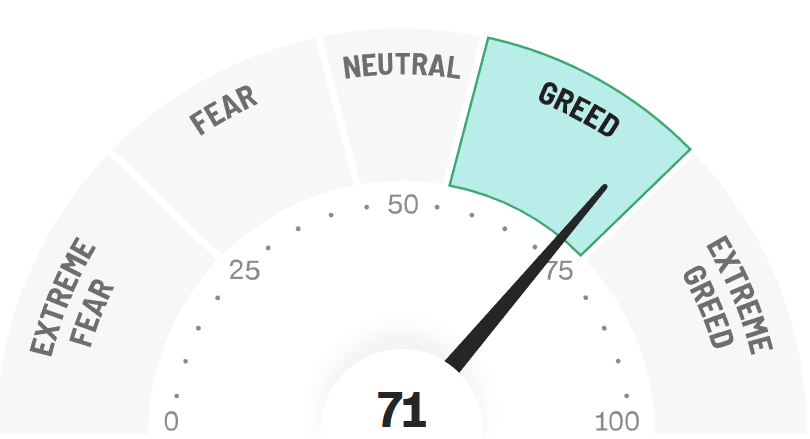

Fear & Greed Index

Super Investors Portfolio

Warren Buffett - Berkshire Hathaway

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q1 2025 below:

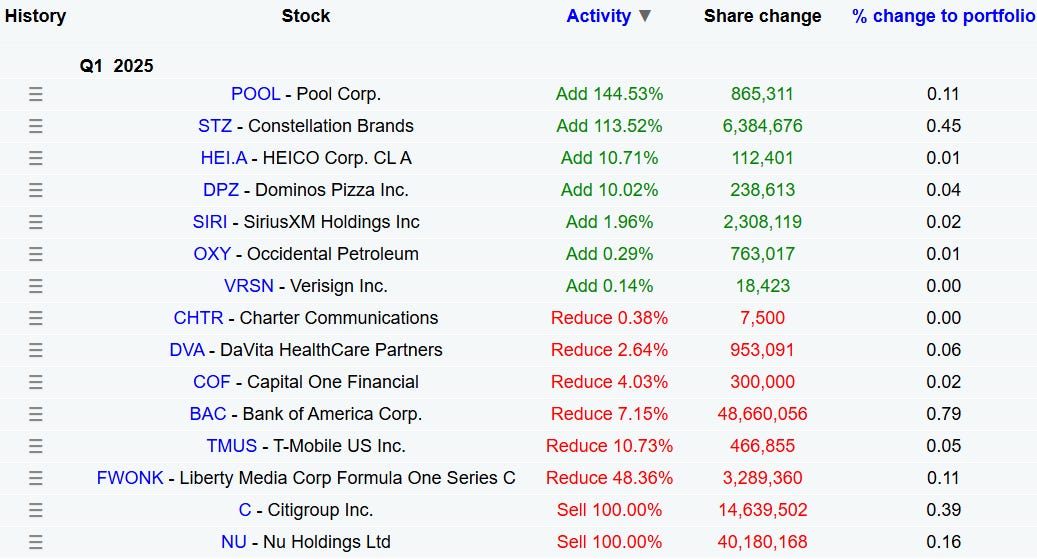

Below we can see the movements of Q1:

Highlights

We note that his largest buy was adding more of Constellation Brands (STZ) which is now approx. 1% of his total portfolio.

He continues to add OXY which is his 6th largest position totaling 5% of the portfolio.

He has fully sold out of both NU and C although these were small positions in total under 0.6% of the portfolio.

He also continues to reduce his BAC holdings, although it’s still the 4th largest holding.

Their cash position continues to hit all-time highs at $347.7bn:

Bill Ackman - Pershing Square Capital Management

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q1 2025 below:

Below we can see the movements of Q1:

Highlights

As we stated in an earlier article, Bill added a new position in UBER, which is also now his largest position in the portfolio sitting at 18.50%.

He also continues to top up BN which is his 2nd largest holding, only marginally smaller than UBER sitting at 18%.

We note that he has fully sold out of NKE, however this is not completely true.

So essentially, Ackman actually bought Nike using options, not regular shares.

And 13F filings don’t require funds to report options unless they hold the underlying stock too.

So while it seems like he “sold,” he may still hold the same position - just through options that don’t show up on the form.

Bill & Melinda Gates Foundation Trust

Their new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q1 2025 below:

Below we can see the movements of Q1:

Highlights

Very minimal movement overall but this has been the theme of this portfolio for quite some time.

Whilst BRK.B has been trimmed it is still the 2nd largest holding making up 22% of the portfolio.

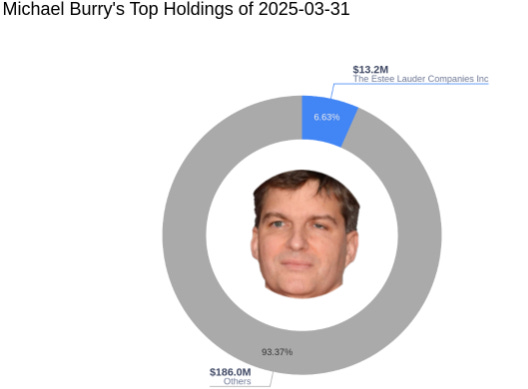

Michael Burry - Scion Asset Management

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q1 2025 below:

Below we can see the movements of Q1:

Highlights

He has fully sold out of nearly every single position in his portfolio.

The only position he holds of which he added to is EL.

Terry Smith - Fundsmith

His new portfolio is shown here and we have gone to the detail of explaining his key individual moves for Q1 2025 below:

Below we can see the movements of Q1:

Highlights

Fully sold out of PEP which was around 4% of the portfolio.

Trims META and MSFT which is a fairly sizeable 3.5% of the portfolio.

Adds a new position of INTU although a small position of around 0.5%.

Tops up ZTS which is 2% of his holdings.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 93,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.

Great update! I recently started writing about Super Investors and what we can learn from their portfolios. In my last update I also went a bit deeper on Burry’s moves

https://gurugems.substack.com/p/guru-portfolios-update-q1-2025

Great insights on the super investors' recent buys! It's always valuable to see their moves. Thanks for breaking it down.