📉 Tariffs, Tax Cuts & Trouble - 3 Undervalued AI Stocks to Watch

While markets sit near all-time highs, a storm is brewing. Here’s what the media isn’t telling you - and 3 overlooked AI plays that could shine as others fall.

Market Update

Stocks stayed close to their record highs this week, thanks to strong gains in energy and industrials - even as fresh tariff news made markets a bit jittery.

New tariffs were announced on over 20 countries, but the 90-day grace period has been pushed back to August 1, giving companies more time to adjust.

Meanwhile, the "One Big Beautiful Bill Act" was signed into law on July 4.

It extends key parts of the 2017 tax cuts and adds new tax breaks and spending cuts.

On a granular level, we had some strong performers but also some weak ones last week.

Biggest winners included:

Coinbase (COIN) up 9%

Palantir (PLTR) up 6%

Advanced Micro Devices (AMD) up 6%

Arista Networks (ANET) up 6%

Chevron (CVX) up 5%

Biggest losers included:

ServiceNow (NOW) down 10%

Molina Healthcare (MOH) down 8%

PayPal (PYPL) down 7%

Hershey (HSY) down 7%

Nike (NKE) down 5%

Notable News

The “One Big Beautiful Bill” Is Now Law

Passed on July 4, the One Big Beautiful Bill Act (OBBBA) extends several parts of the 2017 Tax Cuts and Jobs Act - and adds some new tax breaks, too.

Among the highlights: deductions for tips, overtime, and Social Security (with limits), and a big bump in the SALT cap — now up to $40,000, though it phases out for those earning $500K or more.

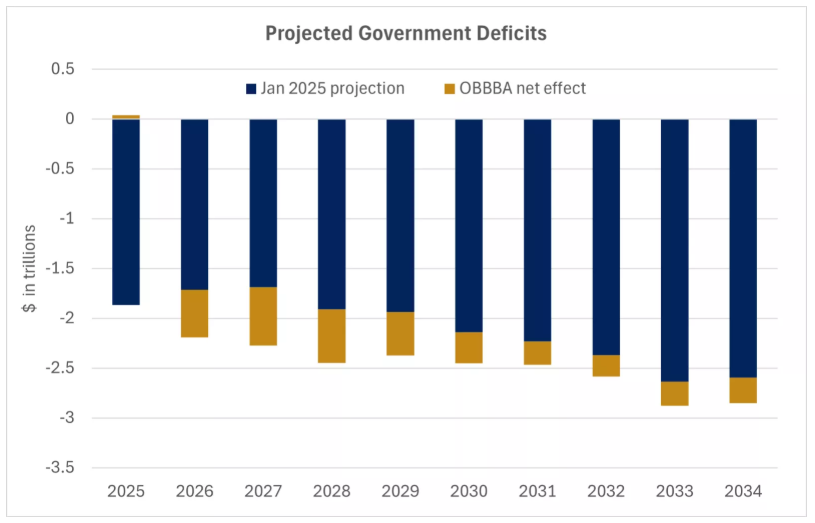

But there’s a cost. The tax cuts are expected to shrink federal revenue by $4.5 trillion over the next decade. To offset this, the bill includes about $1.2 trillion in spending cuts - targeting programs like Medicaid, food stamps, and clean energy credits. That still leaves a projected $3.3 trillion hole in the deficit over the next ten years - as shown in the chart below.

Tariffs Are Back in the Spotlight

With the 90-day pause ending on July 9, President Trump rolled out a fresh wave of tariffs this week targeting more than 20 countries. The new rates range from 20% to as high as 50%, set to kick in on August 1 - unless new trade deals are struck before then.

On average, these tariffs are similar to those announced in early April, but there’s a mix: some countries are seeing steeper hikes, others less so, which may hint at some room for negotiation.

Brazil is the big standout, with tariffs jumping from 10% to 50%, partly due to political tensions tied to former president Bolsonaro.

Canada’s rate climbs to 35%, up from 25%, though most goods covered under the USMCA trade deal are still exempt.

Most other countries are expected to face tariffs in the 15–20% range.

Vietnam struck a deal with the U.S. on July 2 that lowers its tariff rate to 20% - down sharply from the 46% originally floated back in April.

he U.K. had already locked in a 10% rate on its exports. While it's still early, it’s clear that countries can negotiate down from the initial numbers, which could be a sign of flexibility going forward.

Tariffs remain a major focus for the White House, and it looks like we’re heading for a significant jump from the average 2.3% rate seen at the end of 2024.

So far, the inflation impact has been muted - supply chains have absorbed much of the cost, or businesses have stocked up ahead of the changes. But as tariffs rise, the ability for companies to keep eating those costs is limited.

The bigger risk here is stagflation: slower growth and rising prices. That puts the Fed in a tricky spot. With the job market still holding up (though cooling), the central bank can afford to be patient.

With inflation at 2.3% and interest rates at 4.3%, policy is tight. But if inflation eases further into 2026, we could see the Fed bring rates down to the 3%–3.5% range over time.

Earnings This Week

Join 102,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

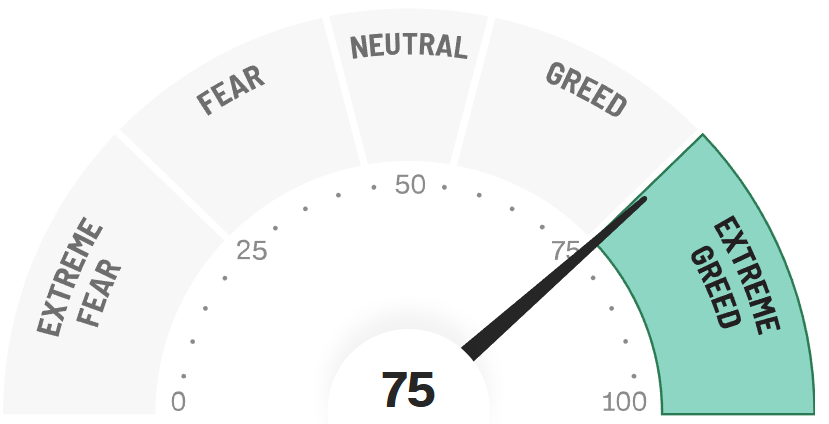

Fear & Greed Index

3 Undervalued AI Stocks

Let us dive into these 3 AI Stocks.

I have used the following criteria to help identify these stocks:

1. Outperformed S&P 500 last 10Y

2. Free Cash Flow Margin 20%+

3. Net Debt to EBITDA <1.5

4. Margin of Safety > 10%

Marvell Technology (MRVL)

Marvell Technology designs and develops high-performance chips that power the backbone of modern data infrastructure, including cloud computing, AI, and 5G networks.

They specialize in custom silicon, networking, storage, and connectivity solutions.

Key clients include Amazon, Google, and Microsoft, who rely on Marvell for custom AI and data center chips.

Marvell’s moat lies in its deep expertise in custom chip design and its strong position in high-speed networking and cloud infrastructure.

Outperformed S&P 500 last 10Y

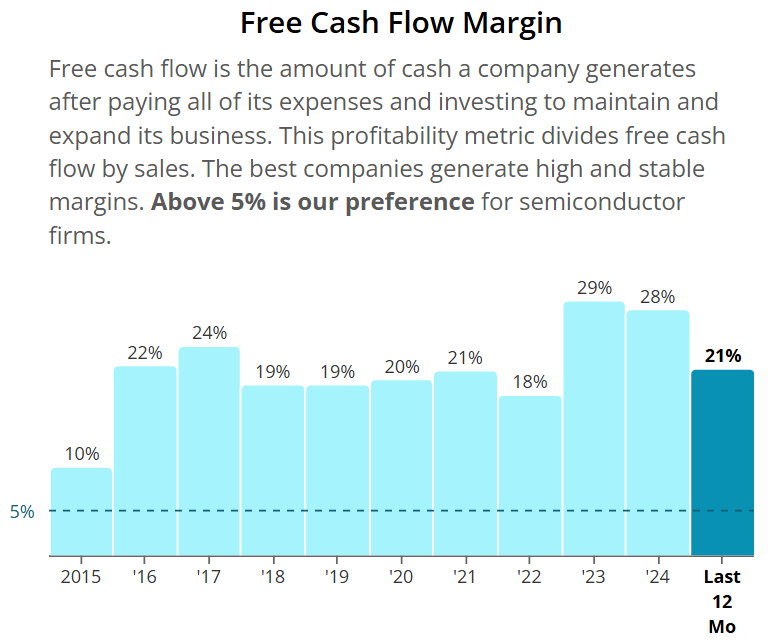

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

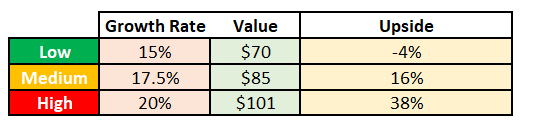

Valuation

It trades at a forward P/E of 24.5x which is lower than it’s 5Y at 35.1x.

MRVL is offering a 15% Margin of Safety at $72.

This is based on a growth rate to the free cash flow moving forwards at 17.5%.

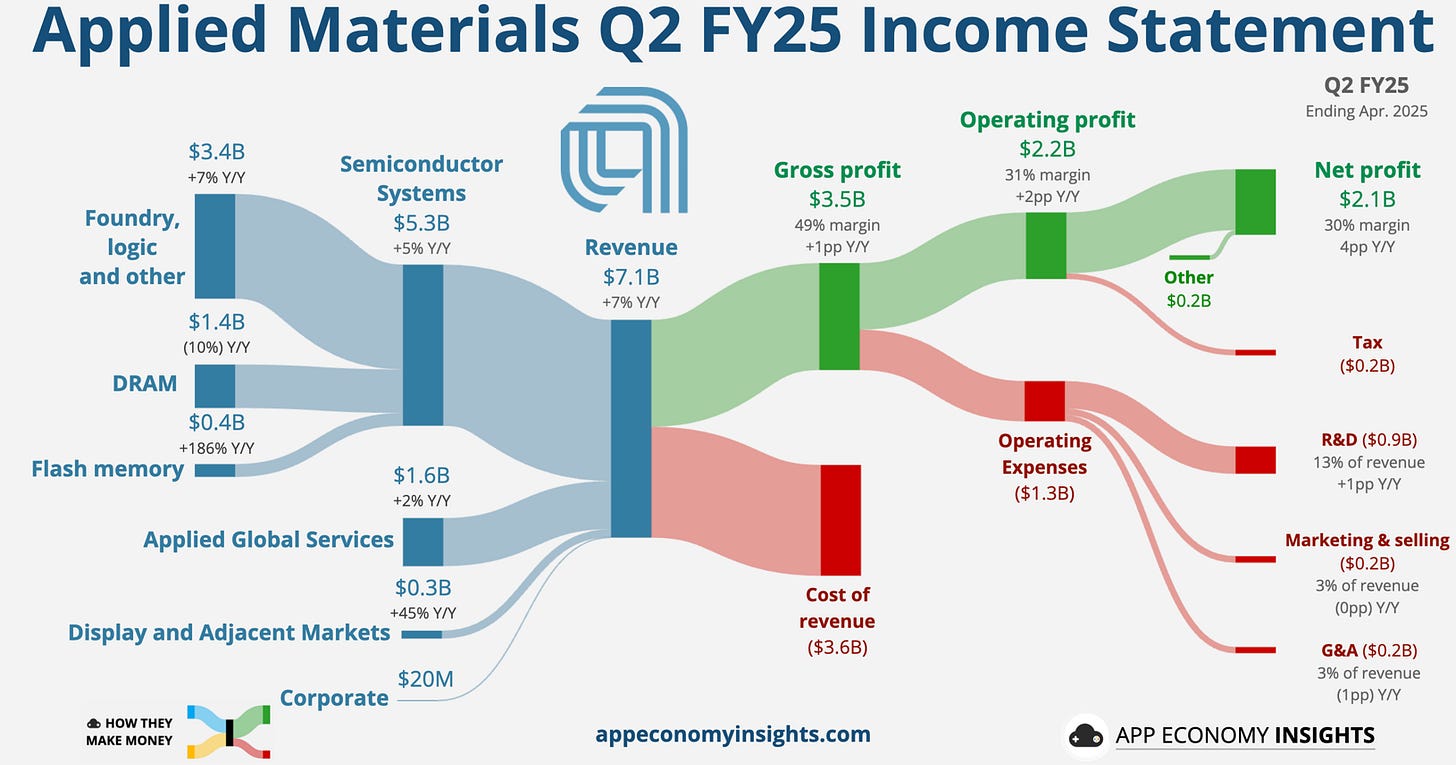

Applied Materials (AMAT)

Applied Materials is a global leader in semiconductor equipment, providing the machines and software used to manufacture chips.

Their tools are essential for building advanced chips used in AI, smartphones, data centers, and more.

Key customers include TSMC, Samsung, and Intel.

AMAT’s moat comes from its unmatched scale, decades of process innovation, and critical role in every stage of chip production.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

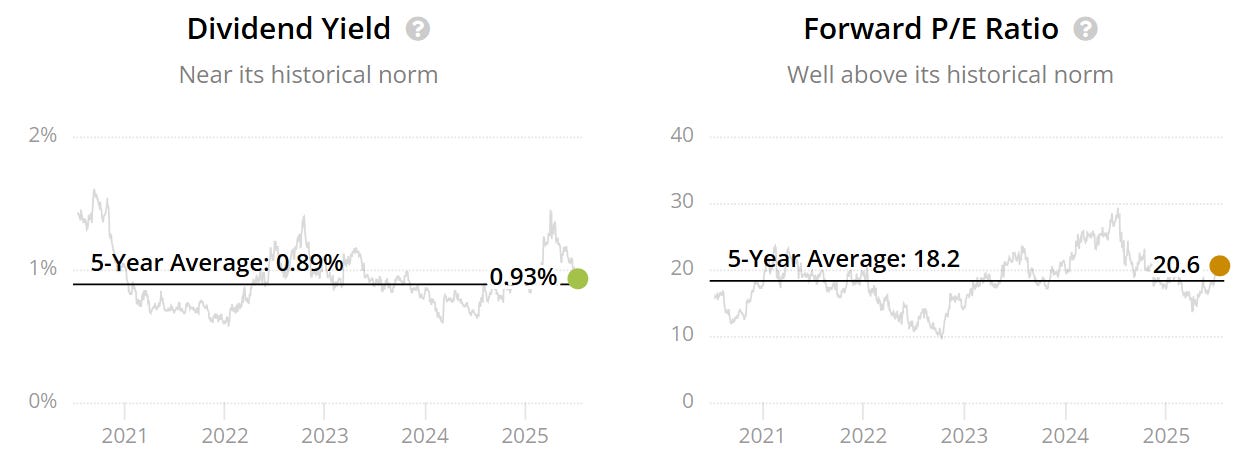

Valuation

It trades at a forward P/E of 20.6x which is higher than it’s 5Y at 18.2x.

AMAT is offering a 10% Margin of Safety at $203.

AMAT is offering a 15% Margin of Safety at $192.

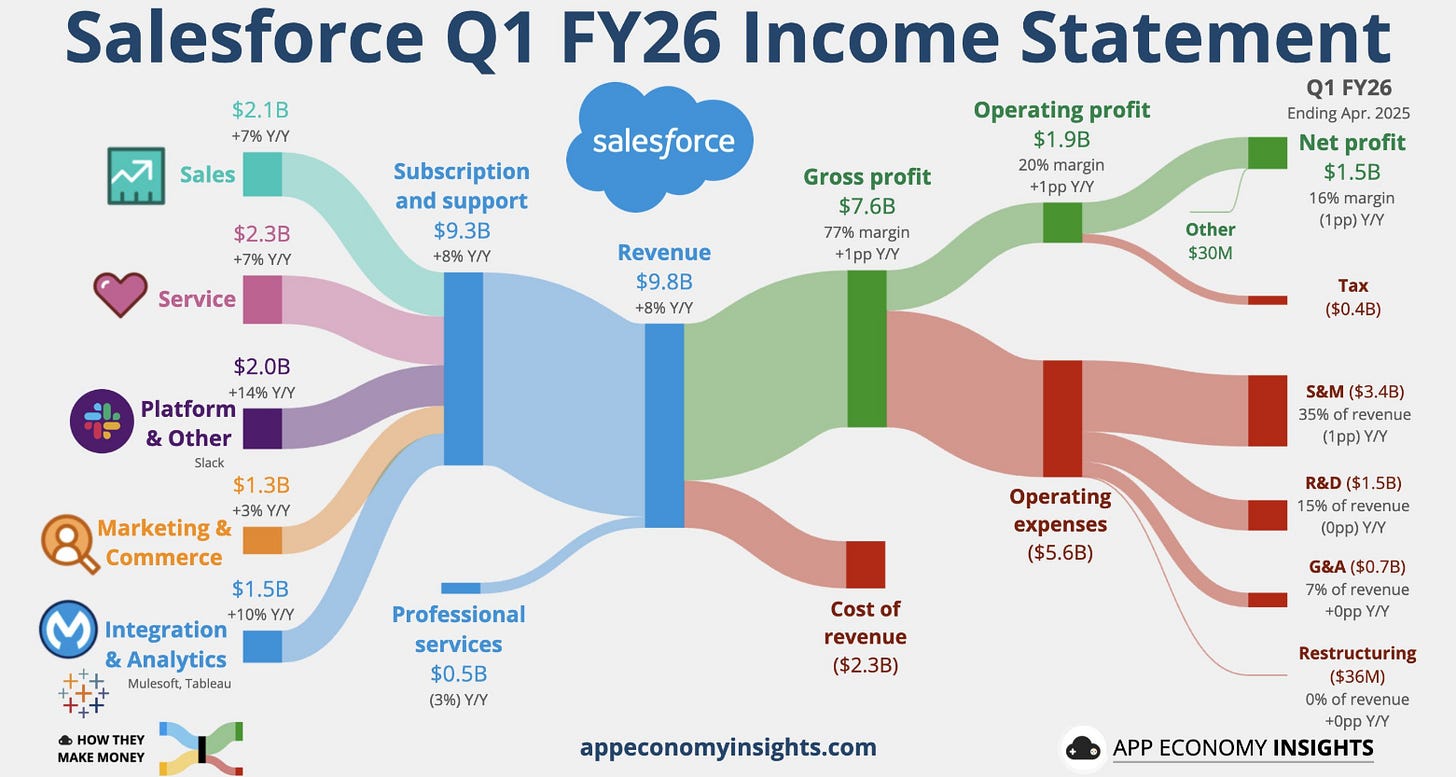

Salesforce (CRM)

Salesforce is a leading cloud software company best known for its customer relationship management (CRM) platform, which helps businesses manage sales, marketing, and customer support.

It also offers tools for data analytics, automation, and AI through its Einstein platform.

Major clients include Coca-Cola, Amazon Web Services, and Toyota. Salesforce’s moat comes from its deep integration across business functions, strong brand loyalty, and massive ecosystem of third-party apps and developers.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

Valuation

It trades at a forward P/E of 22.1x which is higher than it’s 5Y at 31x.

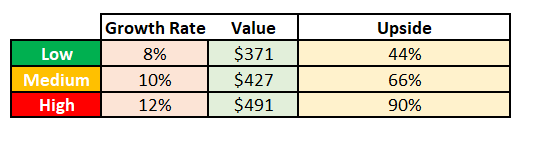

CRM is offering a 30% Margin of Safety at $260.

This is based on a growth rate to the free cash flow moving forwards at 8%.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 102,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

To mitigate, there could be some reasons why the market prices some companies to the level they appear underevaluated. Take CRM, ADOBE (big SAAS comp.), it is very unclear how they will/will not surfer from AI agents suite from Google, Microsoft, Oracle... MOAT is eroding. Market prices this uncertainty.