The 1 Stock I'm Buying In December

+ Market Update

Market Latest

The S&P 500 continues to climb higher and higher, up 1% on the week.

Having said that, it has been an incredibly mixed week on an individual basis. Half the market performing exceptionally well with the other half falling off a cliff.

Biggest losers last week included:

Intel (INTC) down 13%

UnitedHealth Group (UNH) down 10%

United Parcel Services (UPS) down 8%

Uber (UBER) down 8%

CSX Corp (CSX) down 6%

Verizon (VZ) down 5%

and many, many others.

Notable News

Intel CEO Leaves

Intel announced that CEO Pat Gelsinger had retired from the Company in which the stock has fallen 52% YTD. As we saw above the stock was down 13% in just the last week alone.

We took a look at Intel just last week following the news:

UNH CEO shot dead

We had horrific news with the UNH CEO shot dead in broad daylight

Goldman Sachs Targets

Goldman Sach’s believe that the S&P 500 will gain about 11% from now until the end of next year.

However, when they extend their forecast to over the next 10 years, they only see a 3% annual return (that is below average inflation).

Dividend Increases

We’ve had quite a few Companies that have announced dividend increases, with some into the double digits as we have run through in the below episode.

Earnings This Week

A few interesting Companies reporting next week, this includes Adobe, Costco and Broadcom.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is heading over 63,000:

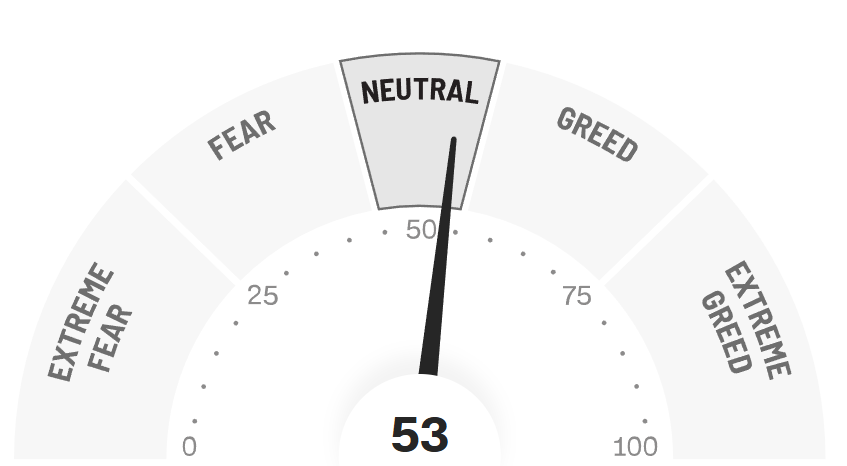

Fear and Greed Index

Quite a pull back for the overall market sentiment as we see it drop from a Greed score last week of 66 to this week’s Neutral 53.

Typically, December is a fairly bullish month, but as always past performance has no bearing on the future.

December Buys

Let us dive into the High Quality Stock I’m buying in December.

I have used the following criteria to help identify these stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 1 (Strong Balance Sheet)

Upside > 20%

1. Alphabet (GOOGL)

2023 Google Revenue Split

Here's a breakdown of its major revenue streams:

1. Google Services (Advertising)

Google Ads: The largest revenue generator, including search ads, display ads, and YouTube ads.

Search Advertising: Ads displayed on Google Search results pages.

YouTube Ads: Video and display ads on YouTube.

Google Network Members' Properties: Ads displayed through Google's AdSense and AdMob programs on third-party websites and apps.

Other Google Services: Revenue from apps, in-app purchases, Google Play Store, and hardware sales.

2. Google Cloud

Google Cloud Platform (GCP): Revenue from cloud infrastructure services, including data storage, computing, and machine learning tools.

Google Workspace: Revenue from productivity and collaboration tools such as Gmail, Google Drive, Docs, Sheets, and Meet.

3. YouTube Non-Advertising Revenue

YouTube Premium: Subscription-based ad-free experience and access to YouTube Music.

YouTube TV: Subscription revenue from the live TV streaming service.

Channel Memberships & Super Chats: Paid features for content creators and their audiences.

4. Google Other Revenues

Hardware: Sales of devices like Pixel phones, Google Nest products (smart home devices), and Chromecast.

Play Store: Revenue from app purchases, subscriptions, and in-app purchases on Android devices.

5. Other Bets

Alphabet invests in high-risk, high-reward ventures known as "Other Bets," which are primarily early-stage projects. These include:

Waymo: Autonomous vehicle technology.

Verily: Life sciences and health technology.

Calico: Aging and longevity research.

Wing: Drone delivery services.

X Development (formerly Google X): Experimental "moonshot" projects.

6. Licensing and Other Revenues

Revenue from licensing intellectual property and patents.

Partnerships with manufacturers or service providers leveraging Google technology.

7. Investment Income

Returns from investments in startups and technology ventures through Google Ventures (GV) and Google Capital (CapitalG).

These streams enable Alphabet to maintain dominance in the tech space while funding its innovation-driven projects and moonshots for future growth.

We recently saw very impressive earnings with a double digit increase to their top line as well as an improvement in their margin from 28% to 32%.

Not only did they have a double beat on Revenue and EPS, but they also performed very strongly in relation to what the market was expecting for the individual streams Wall Street likes to monitor (YouTube ad, Cloud, TAC).

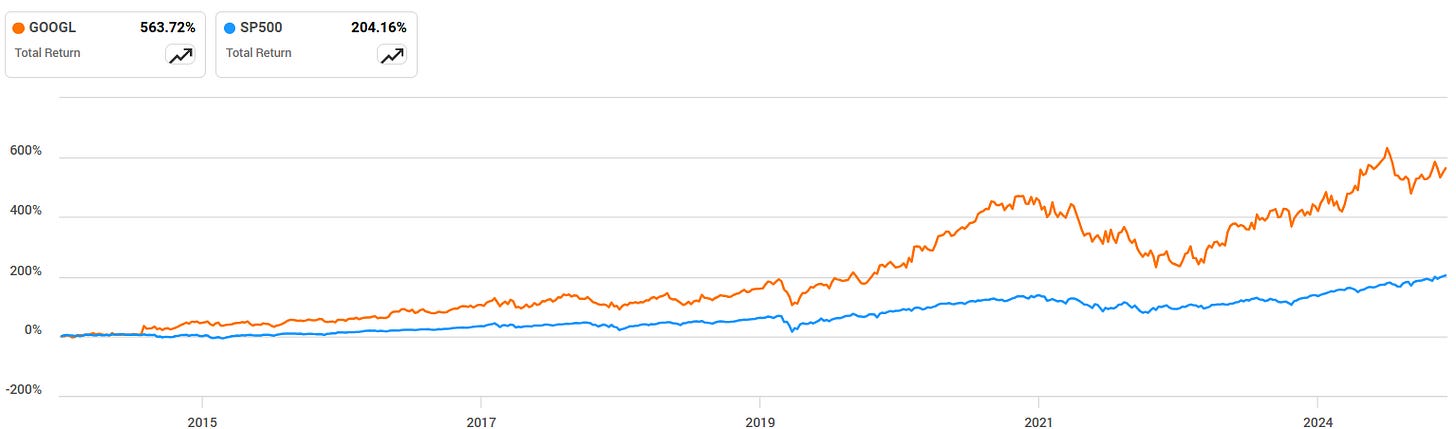

Over the last 10Y GOOGL has outperformed the S&P 500.

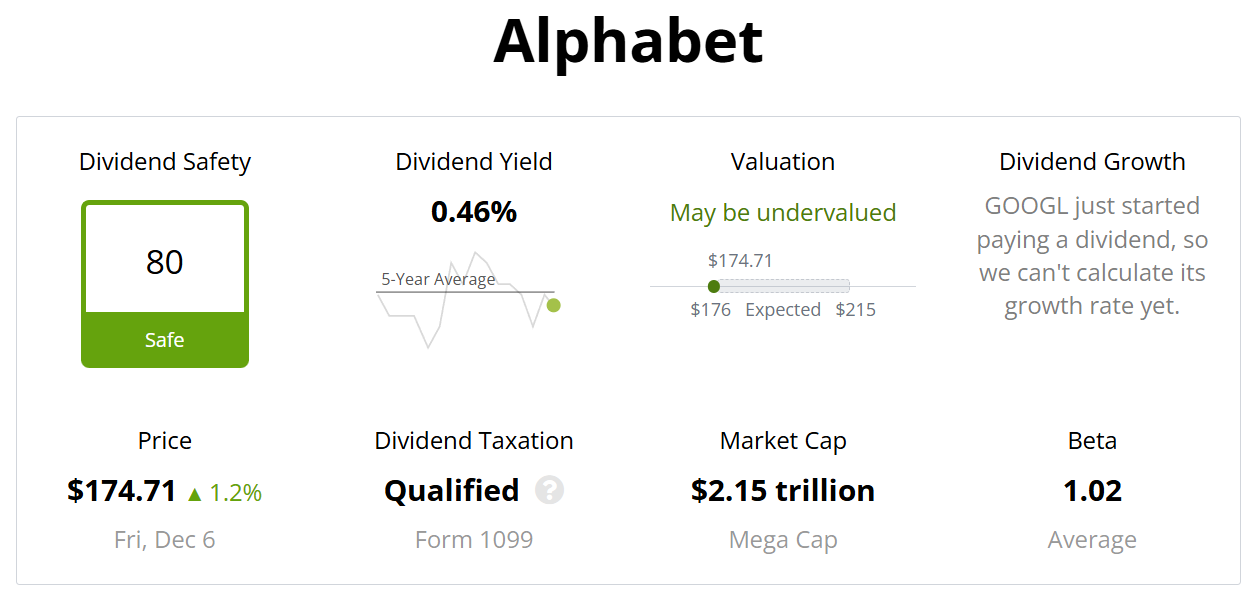

Google currently trades lower than its 5Y average.

We also note a safe dividend score at 80.

We want to see consistent increases with the free cash flow, and we get that near enough. It has grown by more than 5x over the last 10 years! It is also expected to have a large jump over the next 12 months too.

9 of the last 10 years, they have grown their top line by double digits, with 2023 being the first single digit increase, and that came in at 9%.

Nice to see the trailing twelve-month coming in at 14% showing us 2024 should be another strong year.

ROIC has historically been very strong for this Google, however over the last 3Y it has stepped up another level around the high 20’s, with the trailing twelve-month metric showing 32%.

Excellent Balance Sheet, it wouldn’t even take them 1 day to pay off all of their debt, net of cash on hand.

Net Debt to EBITDA has consistently been 0.

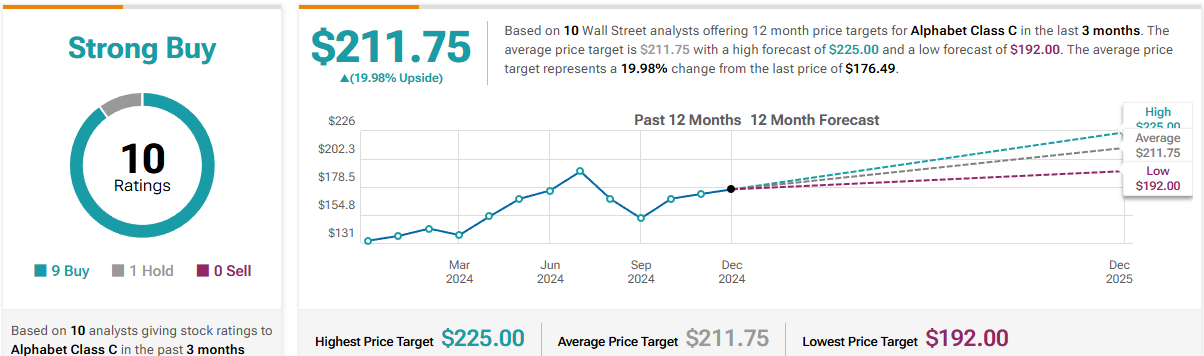

As per below, Wall Street see 20% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $216:

So, in conclusion for GOOGL, we see around a 20% margin of safety around the $172 mark with Wall Street indicating 20% upside.

One thing to remember with Alphabet is that they own Waymo, which is a self-driving technology company.

It was initially formed as part of Google's self-driving car project, which began in 2009, before becoming its own entity in 2016. Waymo develops autonomous driving technology designed to operate vehicles without human input.

When we covered this company last month it was at a reported 100,000 robotaxi rides a week, it's now at 150,000.

On top of that we had news last week that they are expanding into Miami with plans for paid rides by local users in 2016.

Something to think about when considering adding this Company to the portfolio.

If you want more of our thoughts on Google, as well as some points we haven’t covered today like the DoJ wanting them to divest their Chrome position as well as some other key points, check out our latest video:

2 Stocks I’m BUYING In This Crazy Market:

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

MASSIVE BLACK FRIDAY SALE:

Seeking Alpha (the stock analysis website I use in my videos) have just released a huge price drop:

Seeking Alpha Premium: WAS $299, NOW $209/Year (7-day free trial for new paid subscribers, $90 discount).

Alpha Picks: WAS $499, NOW $359/Year ($140 discount, +170.39% return since July 2022 vs. S&P 500’s +55.20%).

Alpha Picks + Premium Bundle: WAS $798, NOW $509/Year ($289 discount, no free trial included). Take advantage by signing up below:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out:

Conclusion

We have just gone through the stock I’m Buying in December.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.