The AI Trade Isn’t Over - It’s Just Changing

Markets are hitting new highs, confidence is fading, and three stocks are quietly turning AI investment into real earnings growth.

Market Update

Markets drift higher as the year winds down

The holiday-shortened week was quiet, but the tape kept inching higher. Both the S&P 500 and the Dow notched fresh all-time highs, helped by light trading, a few encouraging economic data points, and the market’s ongoing belief in anything AI-related. Small caps lagged again, barely positive on the week, while gold and silver continued their strong run - reminding investors that inflation hedges are very much back in fashion.

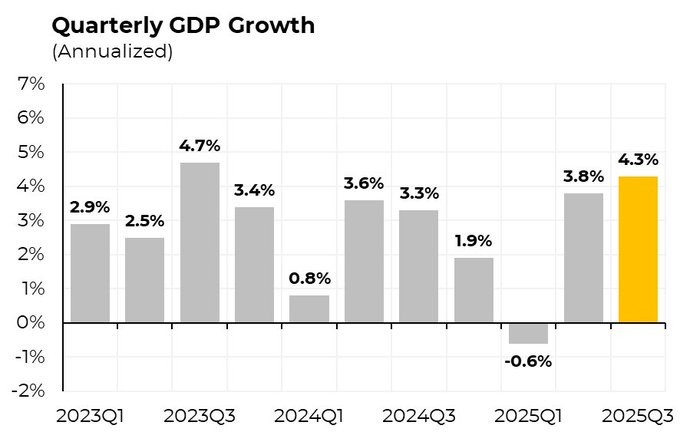

The economy shows surprising momentum

One of the more notable updates came from GDP. The U.S. economy grew at a 4.3% annualized pace in Q3 - the fastest growth in two years and well ahead of expectations. Consumers were the clear engine, continuing to spend despite higher rates and lingering uncertainty.

Not all the data was as clean. Durable goods orders fell sharply in October, dragged down by transportation equipment. Strip out aircraft and defense, though, and business investment actually rose again - its seventh straight monthly increase. Under the surface, corporate spending still looks resilient.

Consumers are getting cautious

Confidence is another story. Consumer sentiment slipped for the fifth month in a row, with worries creeping in around jobs, income, and business conditions.

For the first time in months, views on current business conditions turned negative - a subtle but important shift in mood.

That said, the labor market hasn’t cracked. New unemployment claims fell again and remain historically low, even as continuing claims ticked higher. In short: people are more anxious, but most are still employed.

Looking back: what defined the market this year

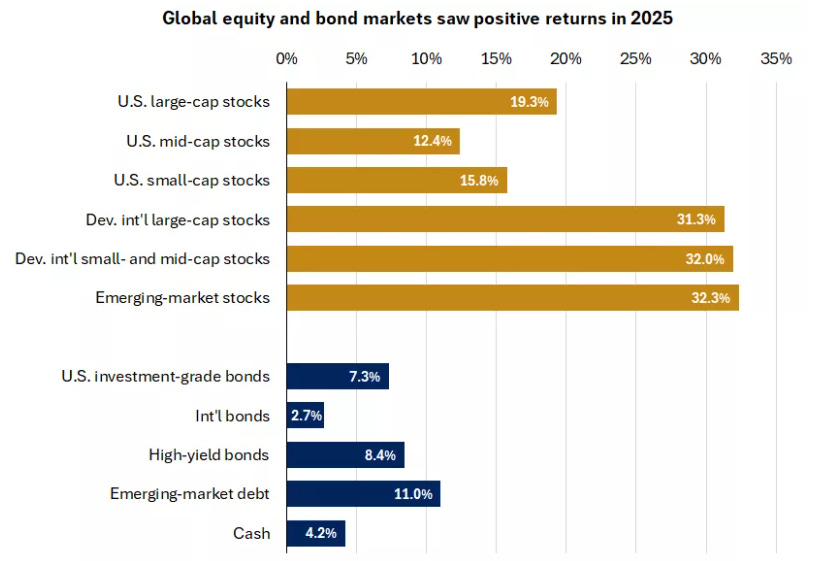

As we zoom out, 2025 delivered far more than most expected.

Markets across the globe posted solid gains, pushing through trade noise and political disruptions.

AI wasn’t just hype - it drove real earnings growth and helped power U.S. economic momentum.

International stocks quietly stole the show, outperforming U.S. equities by a wide margin and rewarding diversification.

Cash lost its appeal as short-term yields fell, making bonds and equities the better place to be.

The S&P 500 logged dozens of new highs, while markets in Europe and Japan joined the party. Bonds had their best year in several cycles, and higher-risk credit paid investors well.

The takeaway: 2025 reminded investors that staying invested - diversified and forward-looking - still matters more than timing every headline.

Last Weeks Winners & Losers

Top performers:

Micron (+15%)

Oracle (+10%)

Nvidia (+10%)

Citigroup (+7%)

Merck & Co (+6%)

Biggest drops:

Lamb Weston (-29%)

Brown-Forman (-9%)

Nike (-7%)

PepsiCo (-4%)

General Mills (-3%)

Notable News

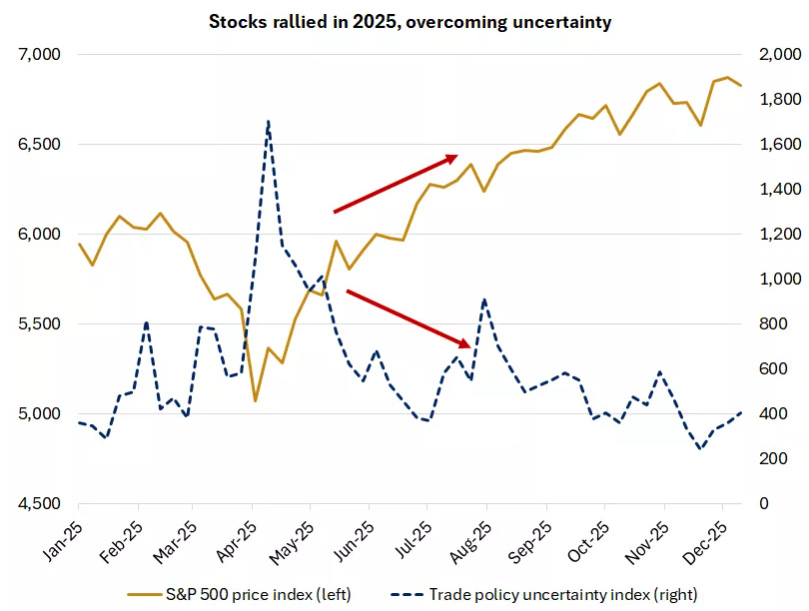

Overcoming uncertainty

After a couple of unusually calm years, volatility made a comeback in 2025. Investors were forced to navigate trade-policy shocks and a government shutdown that dragged on longer than any in history. Markets didn’t ease into the turbulence either - the S&P 500 saw more big daily swings this year than in the previous two years combined.

Most of the chaos hit early. In April, sweeping tariff announcements reignited recession fears and sent stocks sharply lower. At its worst point, the S&P 500 was down nearly 20% from its highs, as investors questioned whether tighter trade conditions would choke off growth.

But as the year progressed, the tone shifted. Trade tensions cooled as negotiations rolled back the most extreme measures, and while tariffs remained elevated, they were far less disruptive than initially feared. The economy kept moving, corporate earnings held up, and AI investment continued to provide a powerful tailwind.

By year-end, what looked like a potential breakdown had turned into another reminder of market resilience. The S&P 500 finished with its third straight year of returns above 15% - a result few would have predicted during the spring sell-off.

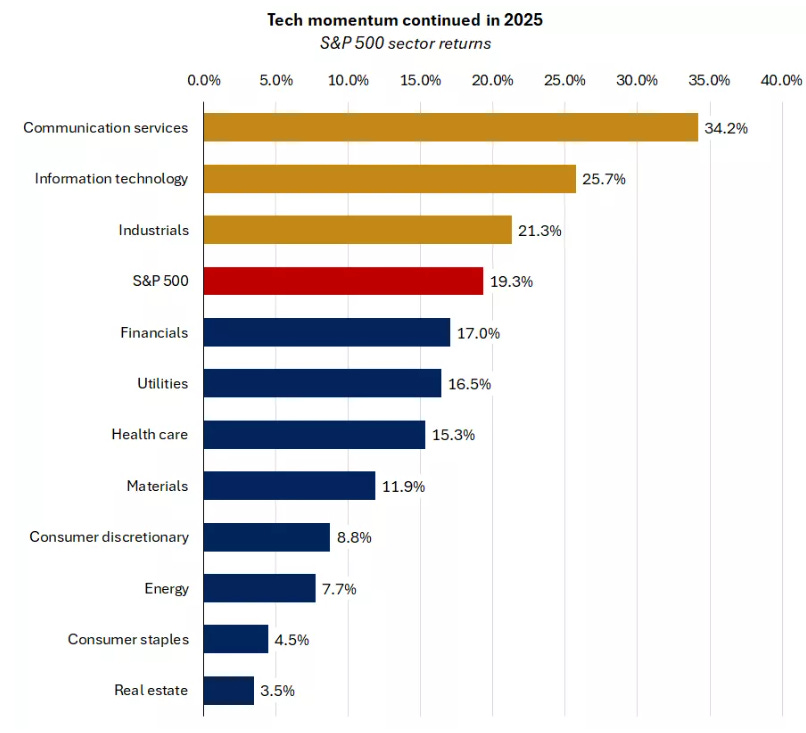

Tech keeps leading - and it’s not just a market story

Once again, technology sat at the center of the U.S. market’s gains. Along with communication services, tech finished as one of the top-performing sectors for the third year in a row, each rising more than 25%. More importantly, these weren’t hollow gains - earnings growth followed, with profits climbing at a double-digit pace as AI spending continued to accelerate.

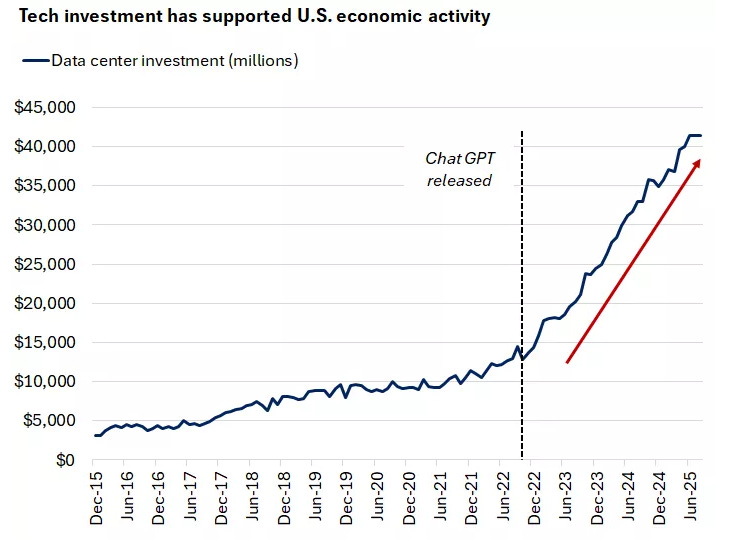

What made this cycle different is that tech wasn’t just lifting stock prices - it was showing up in the real economy. Since the launch of ChatGPT in late 2022, investment in data centers has exploded, roughly tripling as companies raced to build the infrastructure behind AI.

Data centers are still a relatively small slice of total U.S. investment, but the ripple effects are growing. Spending on information-processing equipment surged at a strong pace in the third quarter, and broader business investment remained healthy throughout the year.

In other words, AI didn’t just fuel market optimism in 2025 - it helped support economic growth as well.

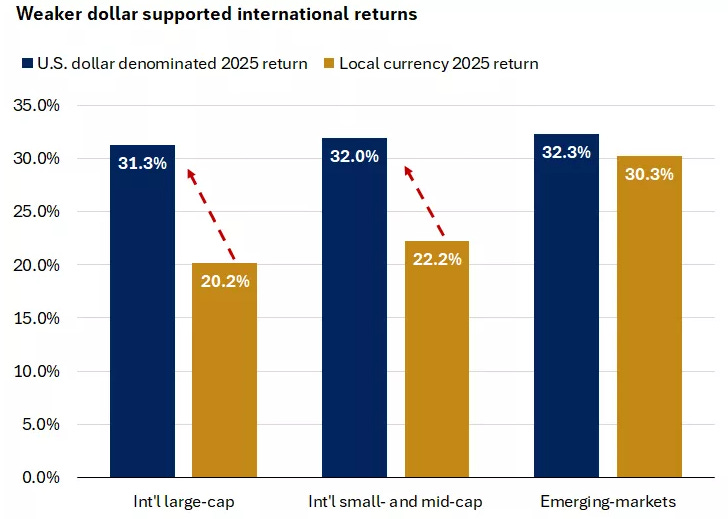

International markets finally take the lead

One of the quieter but more important stories of 2025 was the resurgence of international stocks. After years of trailing the U.S., overseas markets outperformed by a wide margin - beating U.S. equities by 13%, the largest gap in well over a decade. For investors who stayed globally diversified, it paid off.

Europe benefited from a rare combination of fiscal support and easier monetary policy. Germany stepped up spending, the European Central Bank eased financial conditions, and economic activity across the eurozone began to stabilize. Japan delivered another standout year as well, with stocks climbing even as higher U.S. tariffs lingered in the background. Corporate profit margins there quietly pushed to record highs.

A weaker U.S. dollar added fuel to the rally. Political and fiscal uncertainty at home, along with a shrinking interest-rate advantage, pushed the dollar sharply lower - its steepest annual drop since 2017. That currency move amplified returns for U.S.-based investors holding international assets.

Emerging markets joined the rally too. While currencies were less of a tailwind, strength in tech-heavy markets like China and Korea drove powerful gains, lifting emerging-market equities more than 30% on the year.

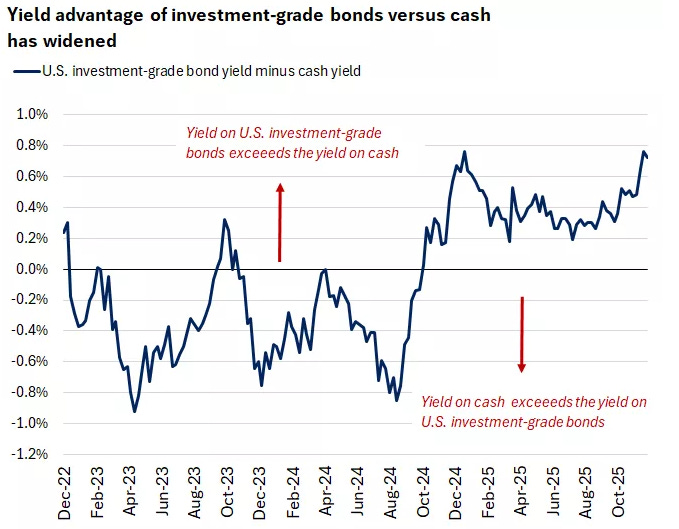

Bonds make a quiet comeback

After years of playing second fiddle to cash, bonds finally had their moment in 2025. U.S. investment-grade bonds returned more than 7% for the year, beating cash by about three percentage points - the biggest gap since 2020.

The backdrop shifted in bonds’ favor. The Fed began cutting rates, the labor market cooled, and Treasury yields drifted lower across most maturities. That combination created exactly what bond investors had been waiting for: falling yields and solid income at the same time.

Yield did a lot of the heavy lifting. Throughout the year, investment-grade bonds consistently offered more income than cash, and by year-end that gap sat near the high end of its recent range. For investors who had parked too much on the sidelines, 2025 was a reminder that holding excess cash comes with its own opportunity cost.

Earnings Season (Back again in the New Year)

Join 119,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

3 AI Stocks for 2026

The AI story isn’t done yet - but the easy gains are behind us. Markets are shrugging off headlines, economic growth is holding up, and investors are now looking for companies that are quietly turning AI investment into real profits.

This week, we’re highlighting three leaders with significant runway left in the AI-driven economy.

Even in a year where markets are hitting new highs, these companies are proving that AI isn’t just hype - it’s becoming a measurable, sustainable driver of earnings.

No.1 - Microsoft (MSFT)

The Toll Booth for AI Adoption

If you’ve been watching the market this year, you’ve probably noticed a curious pattern: AI is everywhere in headlines, but only a handful of companies are actually turning that hype into predictable revenue growth. Microsoft is one of the few doing it at scale.

The story isn’t just about flashy demos or generative AI buzz. It’s about embedding AI into the products that millions of businesses and professionals already rely on every day - from Office 365 and Teams to Azure and GitHub. With the rollout of Copilot across these platforms, Microsoft is quietly transforming productivity tools into AI-powered subscription engines. Imagine it as a “toll booth”: every time a business leverages AI in their workflow, Microsoft is collecting a predictable, recurring fee. This isn’t a speculative bet - it’s monetization happening in real time.

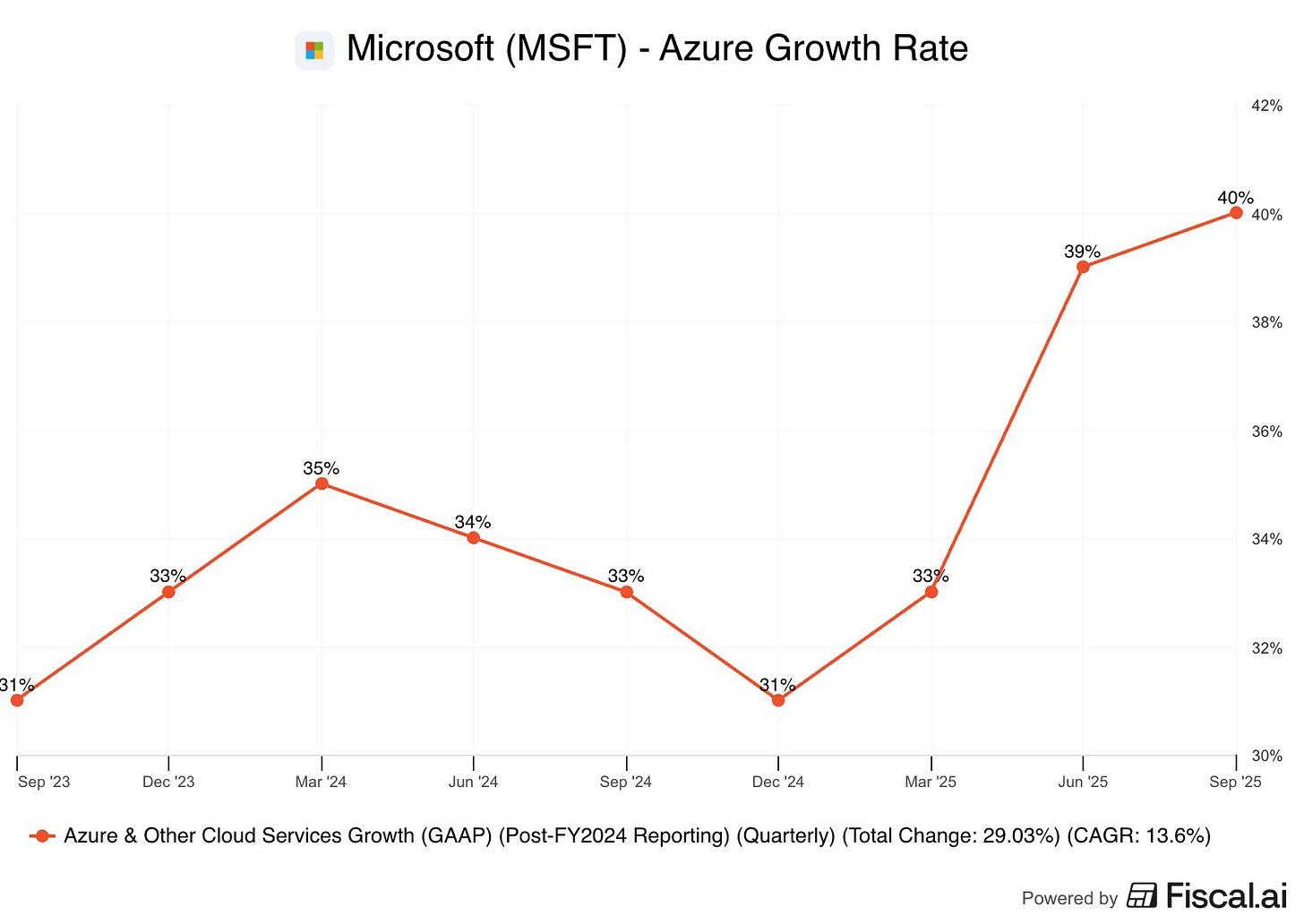

Azure is another critical piece of the puzzle. AI workloads are driving massive cloud demand, and Microsoft sits at the center of this surge. Data center investment has roughly tripled since late 2022, yet Microsoft’s cloud infrastructure isn’t just a passive beneficiary. It’s the platform that powers many AI applications across industries, creating a structural revenue tailwind that is likely to persist for years.

What makes Microsoft particularly compelling right now is timing and scale. Unlike smaller AI plays that need to prove adoption, Microsoft’s AI integration is gradual, widespread, and tied to products businesses can’t stop using. The adoption curve is still early - there’s plenty of room for growth before the market fully prices in the impact on margins and profits. Even after years of strong performance, the AI opportunity here is far from fully reflected in the stock.

From a market perspective, this fits neatly into the broader narrative we’ve been tracking: GDP is accelerating, consumer confidence is softening, but corporate spending and AI investment are real engines of growth. Microsoft sits at the intersection of these trends, capturing the upside of both enterprise IT spend and the broader AI-driven productivity boom.

What the Latest Earnings Reveal - Not Just the Headlines

Microsoft’s most recent quarterly report didn’t just beat expectations - it validated the core narrative we’re tracking: AI is moving from promise to measurable profit.

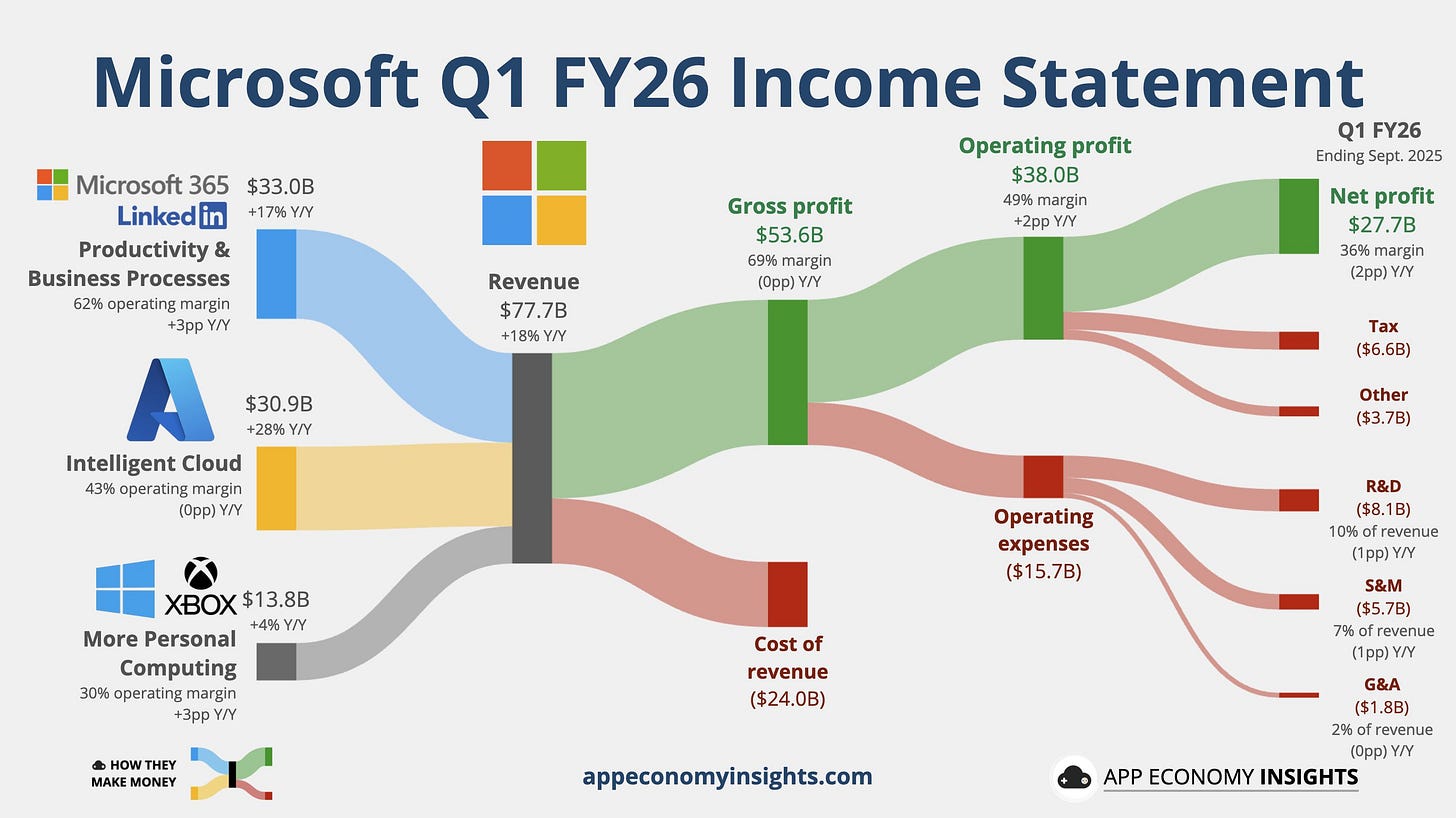

In the first quarter of fiscal 2026, Microsoft posted $77.7 billion in revenue, up about 18% year‑over‑year - a solid acceleration fueled by strength across nearly every business segment.

Cloud and AI Still Driving the Train

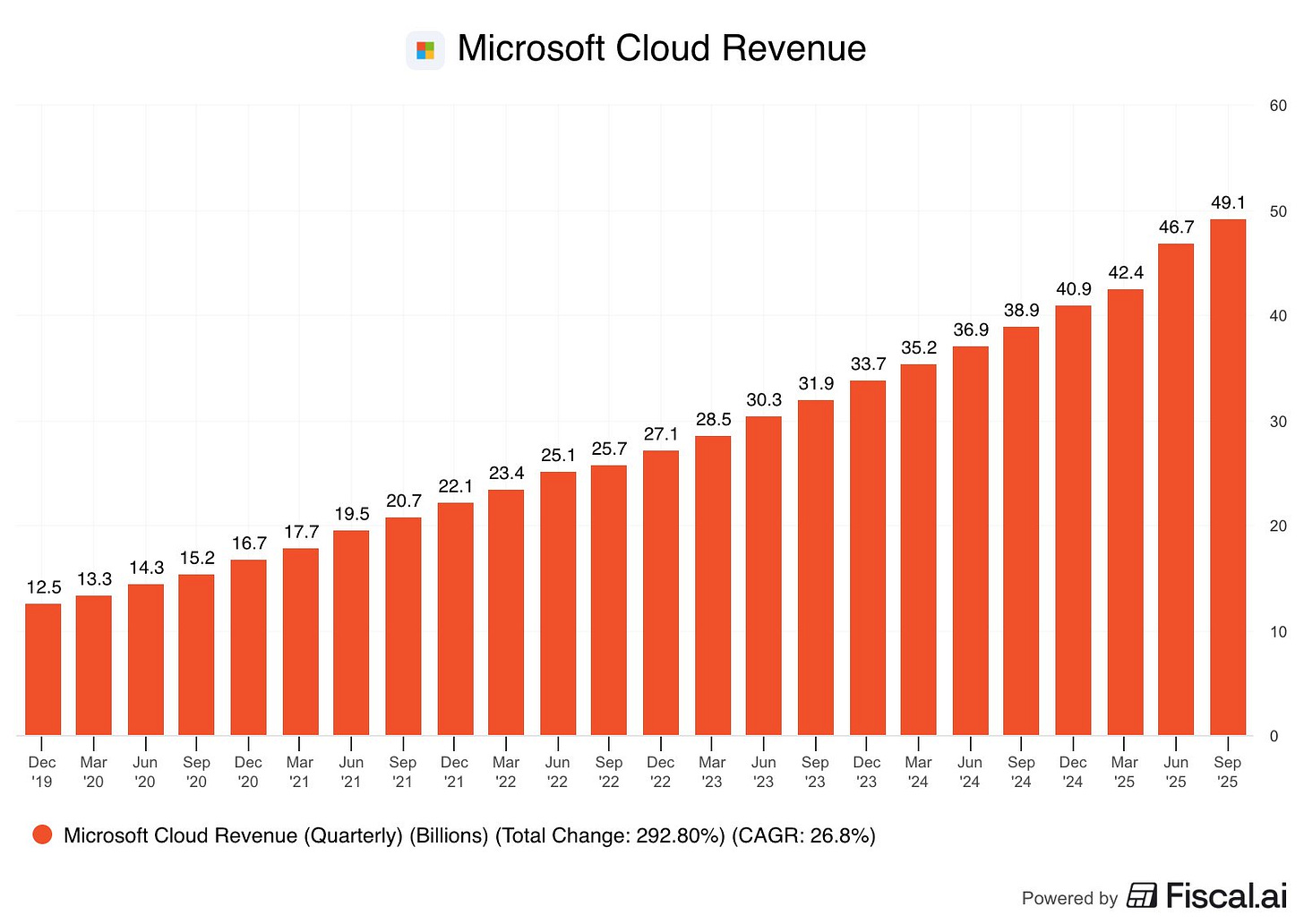

The Microsoft Cloud - the heart of the company’s future - brought in $49.1 billion, up 26% from the year prior. That’s not just cloud growth - that’s AI-enabled cloud growth, with Azure and related services up around 40% on a constant-currency basis.

This is where AI workloads - training, inferencing, data services - are concentrated. Enterprises aren’t just experimenting anymore; they’re signing multi-year contracts that show up in real revenue today.

Productivity Tools: AI Isn’t Just Optional - It’s Getting Paid For

The Productivity and Business Processes segment - including Office, Microsoft 365, LinkedIn, and Dynamics 365 - grew 17%.

Copilot adoption is expanding within this revenue stream. Companies are paying for premium productivity tools now enhanced with AI, giving Microsoft both pricing power and stickiness. AI isn’t an add-on - it’s becoming part of the core value proposition.

Profitability Holds Up Even With Heavy AI Investment

Operating income jumped roughly 24% to $38 billion, and earnings per share came in at about $4.13, beating expectations.

Even with investments in AI infrastructure and talent, margins remained healthy. This distinguishes Microsoft from speculative AI plays: it’s scaling AI without sacrificing profitability.

What the Balance Sheet and Cash Flow Tell Us

Net income was about $27.7 billion, up double digits year-over-year, showing that even after investing heavily in AI, Microsoft continues to generate substantial profits. Free cash flow remains robust - a clear signal that growth is backed by real business momentum, not financial engineering.

AI Isn’t a Side Project - It’s a Business Driver

What ties all of this together is demand for AI capabilities:

Azure’s growth remains strong even amid infrastructure constraints, showing enterprise AI demand is outpacing supply.

Copilot adoption across enterprise and developer tools continues to accelerate.

Long-term commitments with AI partners support future revenue streams.

The key takeaway: AI isn’t just hype anymore - it’s a quantifiable growth driver. For investors, that means Microsoft’s growth story has real runway left, making it a compelling pick even after years of strong performance.

Valuation

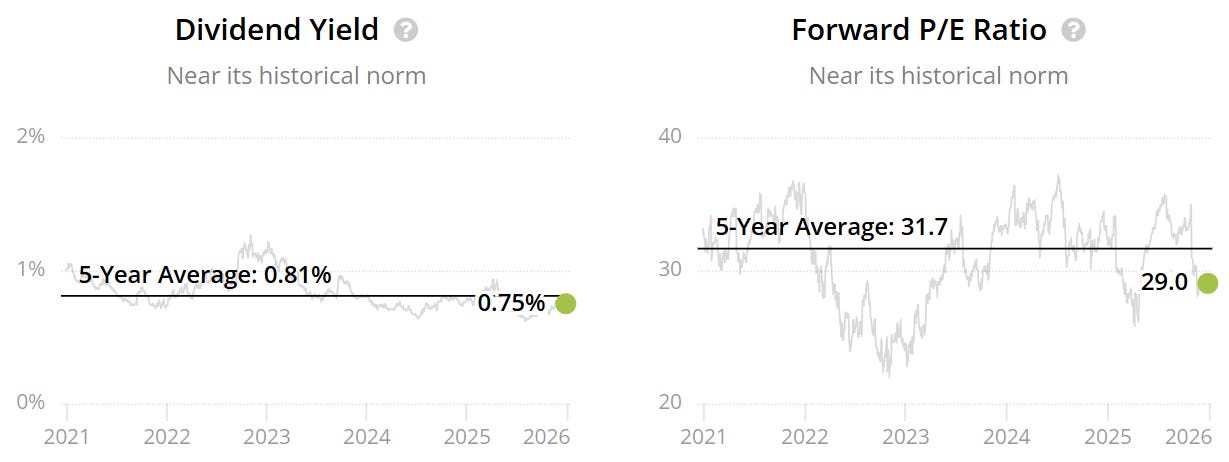

The forward P/E sits below the historical - 29x v 31.7x. This could indicate the company is potentially undervalued.

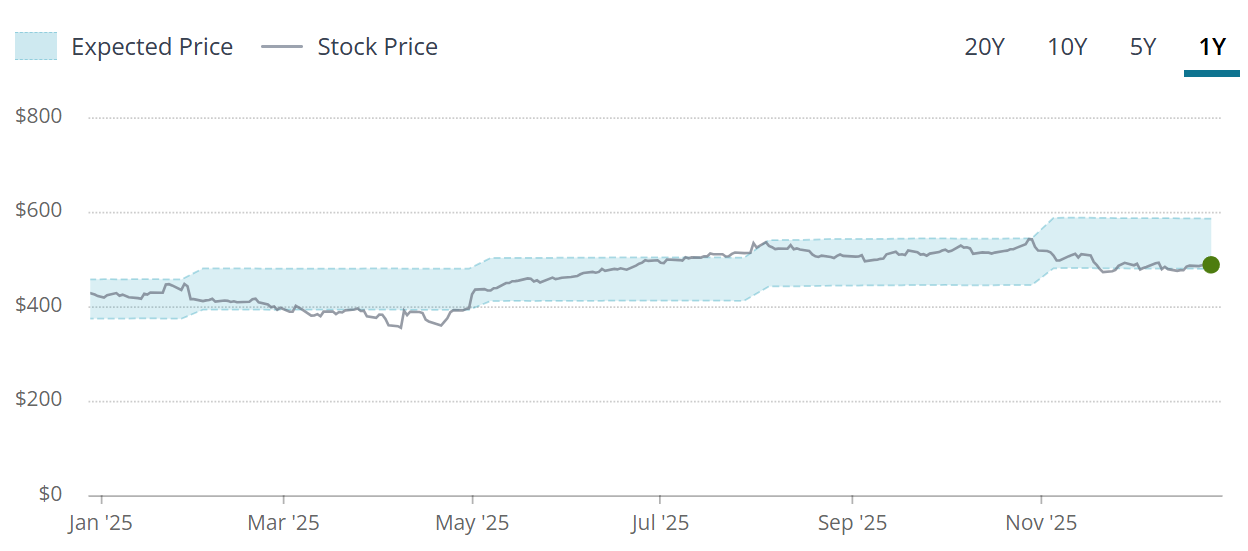

The blue tunnel methodology highlights that the company is towards the lower end of the intrinsic/fair value boundaries indicating potential undervaluation.

When we zoom out to the last 10Y we can see this Company has rarely trades at a massive discount.

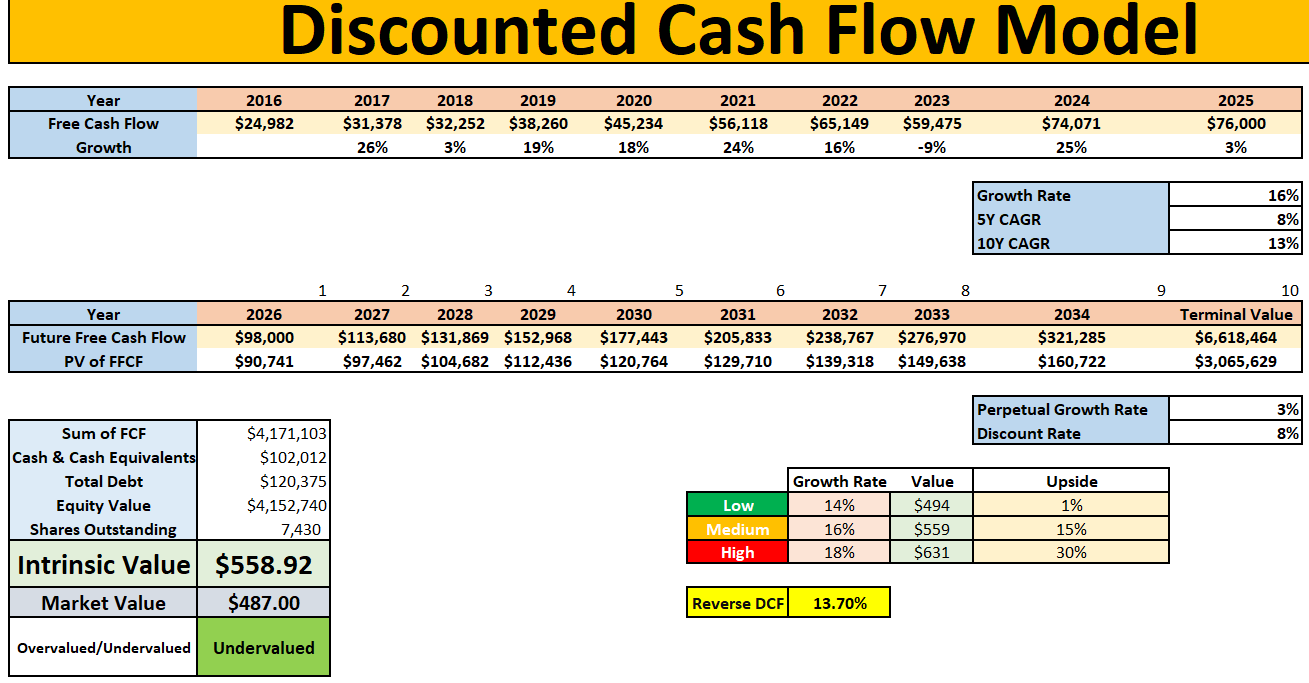

DCF Model

Using our DCF model a few things to note:

13.7% is baked into the FCF growth moving forwards.

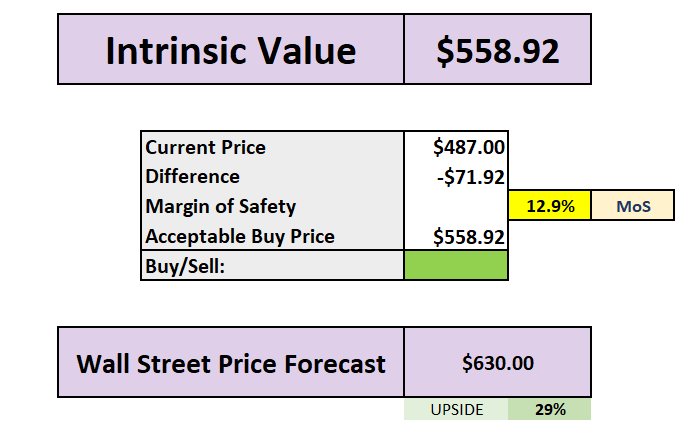

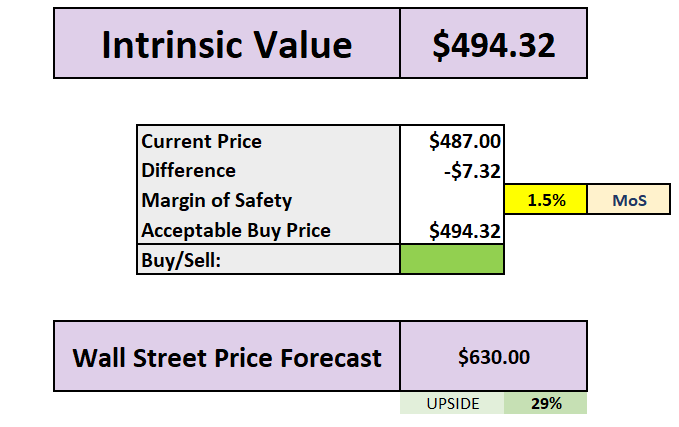

Using 14% (the lower rate) gives an intrinsic value of $494.

Using 16% (the middle rate) gives an intrinsic value of $559.

Using 18% (the higher rate) gives an intrinsic value of $631.

Using the middle growth rate of 16%, we get an intrinsic value of $559 which leads to a 13% margin of safety.

On average wall street see 29% upside into 2026.

Using the lower growth rate of 14%, we get an intrinsic value of $494 which leads to a 2% margin of safety.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.