The Best 2 Undervalued Stocks?

+ Market Update

Market Latest

The S&P 500 closed above 5,800 for the first time ever:

For those who just index and chill, a very impressive 33.43% return just over the last 12 months, however as we enter in earnings season, volatility is expected as well as all eyes on the Fed in November for potentially more aggressive rate cuts.

On a more granular level below we can see that the week was not great for all:

Biggest losers included:

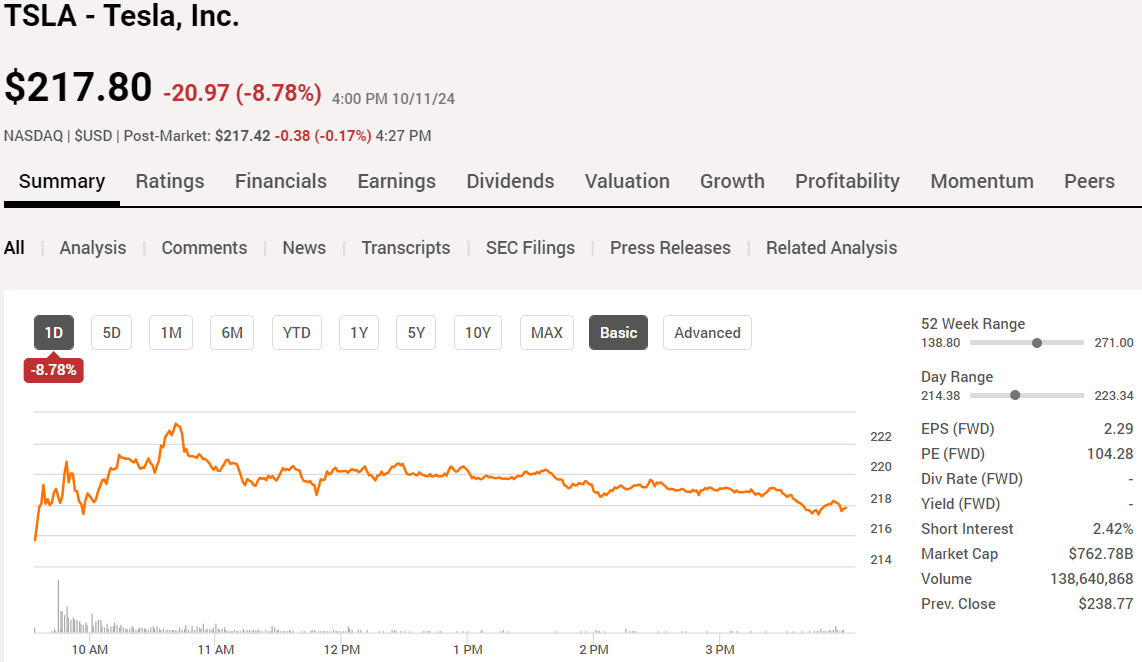

Tesla (TSLA) down 13%

Darden Restaurants (DRI) down 5%

Bristol-Myers Squibb (BMY) down 3%

Alphabet (GOOGL) down 2%

Notable News

Inflation

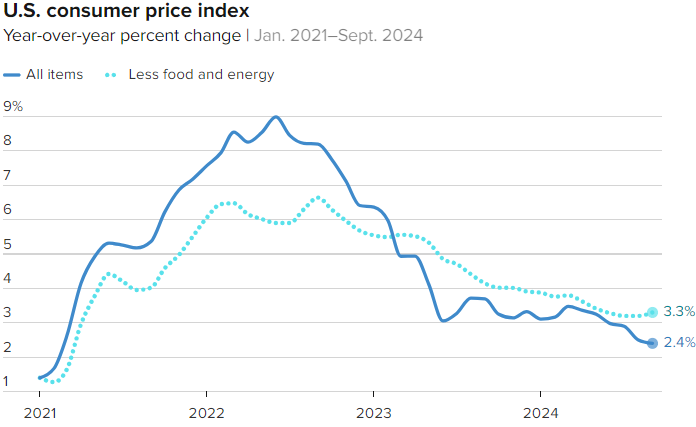

The annual inflation rate in September came in at 2.4% which was only marginally higher than the 2.3% the market had anticipated.

Excluding food and energy, core prices increased 0.3% on the month, taking the annual rate to 3.3%.

Fed Interest Rate Decision - November

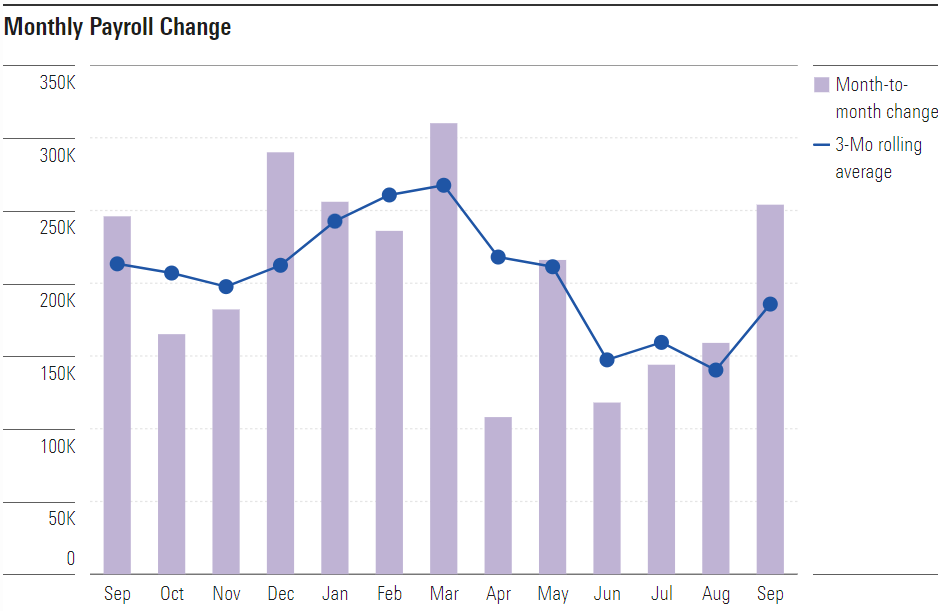

The US Jobs Report came in stronger than economists had anticipated, which means it is less likely the Fed will cut by 50bps again. A likelier scenario would be 25bps.

The US economy added 254,000 jobs in September, with forecasts estimating 140,000 jobs.

As inflation is starting to cool, although possibly slower than hoped, and with a strong US job market, it is likely we see more rate cuts this year however one policy maker did indicate a skip may be necessary in November.

Tesla 10/10 Event

We had an extremely anticipated event last Thursday with what Elon Musk called the “We, Robot” event.

This was the first product unveiling since 2019’s Cybertruck.

Here’s what was covered:

CyberCab:

Cost around $30,000

Will cost about $0.20 a mile

Robotic cleaning and wireless charging

In production before 2027

Optimus Robot:

Cost between $20,000-$30,000

Will be used for many tasks and chores

Estimated to be ready in 2025

Robovan

Autonomous bus

Transport up to 20 people

Transport goods

No estimated timeline

How did the market react?

Tesla ended the day down 9%.

We released an in-depth dive on our YouTube channel too:

Earnings This Week

Earnings season has now started in full force, with the upcoming week having some big names reporting.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 54,000.

Fear and Greed Index

Market sentiment remains unchanged from last week sitting on the border of Greed and Extreme Greed.

Last month we were sitting in neutral and last year this time we were in Extreme Fear.

Markets can change very quickly, and with big names reporting we could see sentiment move into any other category within just a few days.

Best 2 Undervalued Stocks?

The market is currently looking expensive overall, just take a look at the S&P 500 based on P/E:

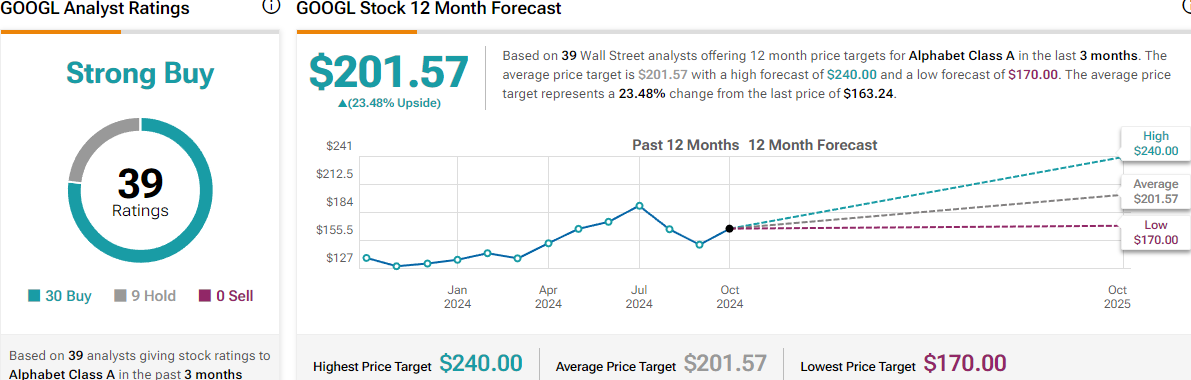

However, we believe that two of the best opportunities right now exist in the Mag7, that is Alphabet (GOOGL) and Amazon (AMZN).

Let’s explore each one further below:

Alphabet (GOOGL)

Google’s income streams primarily come from the following sources:

Advertising (Google Ads): The largest portion of Google's revenue comes from advertising through its platforms, such as Google Search, YouTube, and Google Display Network. Advertisers pay to display ads based on user searches, demographics, and behaviors.

YouTube Ads and Premium Services: Google earns from ads shown on YouTube videos as well as subscriptions to YouTube Premium and YouTube TV, which provide ad-free content and additional services.

Cloud Computing (Google Cloud): Google Cloud, which includes Google Cloud Platform (GCP) and Google Workspace, generates revenue by offering businesses infrastructure, data analytics, AI tools, and collaboration software like Gmail and Google Drive.

Google Play Store: Google earns commissions from app purchases, in-app purchases, and subscription services offered through the Google Play Store for Android devices.

Hardware: Google generates income from hardware sales, such as Pixel smartphones, Google Nest smart home products, Chromecast devices, and other accessories.

Other Bets: Through Alphabet’s "Other Bets," Google invests in various ventures like Waymo (self-driving cars), Verily (healthcare technology), and others, though these currently generate smaller revenues compared to its core businesses.

Alphabet is up 525% over the last 10Y and has massively outperformed the S&P 500 in this period.

As per the Forward P/E, Google trades lower than it’s 5Y average:

Forward P/E = 20.3x

5Y Average = 23.1x

ROIC has historically been very strong for this Google, however over the last 3Y it has stepped up another level around the high 20’s, with the trailing twelve-month metric showing 31%.

Excellent Balance Sheet, it wouldn’t even take them 1 day to pay off all of their debt, net of cash on hand.

Net Debt to EBITDA has consistently been 0.

As per below, Wall Street see 23.48% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $188.11

So, in conclusion for Alphabet, we see around a 15% margin of safety around the $160 mark with Wall Street indicating 24% upside.

One thing to remember with Alphabet is that they own Waymo, which is a self-driving technology company.

It was initially formed as part of Google's self-driving car project, which began in 2009, before becoming its own entity in 2016. Waymo develops autonomous driving technology designed to operate vehicles without human input.

In August it was announced that they are doing more than 100,000 paid robotaxi rides every week across LA, San Francisco and Phoenix. That was double what they had disclosed a few months prior.

Something to think about when considering adding this Company to the portfolio.

Amazon (AMZN)

Amazon’s income streams primarily come from the following sources:

1. E-Commerce Retail

Online Stores: Amazon’s primary revenue source comes from selling a wide variety of products directly to consumers through its online marketplace. This includes electronics, clothing, groceries, books, and more.

Third-Party Seller Services: Amazon charges fees to third-party sellers who use its platform to sell their products. These fees include referral fees, shipping fees, and fulfillment charges for using Amazon’s logistics (FBA - Fulfillment by Amazon).

2. Amazon Web Services (AWS)

AWS is a cloud computing platform that offers services such as computing power, storage, databases, machine learning, and AI to businesses, governments, and individuals. AWS is Amazon's most profitable business segment and generates substantial revenue from services like hosting websites, providing data analytics, and more.

3. Subscription Services

Amazon Prime: Customers pay a subscription fee for Amazon Prime, which offers free shipping, access to Amazon Prime Video, Prime Music, and other perks.

Kindle Unlimited: A subscription service offering unlimited access to e-books and audiobooks.

Amazon Music Unlimited and Audible: Subscription-based music streaming and audiobook services.

Twitch: Amazon owns the popular game-streaming platform Twitch, which generates revenue through subscriptions, advertisements, and other user-paid services.

4. Advertising

Amazon’s advertising platform allows businesses to promote their products on Amazon’s website and its affiliate sites. The company earns significant revenue from display ads, sponsored products, and other forms of digital advertising.

5. Physical Stores

Whole Foods Market: Amazon owns the Whole Foods grocery chain, generating revenue from physical retail stores.

Amazon Go: Amazon operates cashier-less convenience stores, offering products in a grab-and-go format.

Amazon Fresh: This is another grocery initiative, offering physical stores in addition to online grocery delivery services.

6. Devices and Consumer Electronics

Amazon sells its own consumer electronics, such as Amazon Echo (smart speakers powered by Alexa), Fire TV, Kindle e-readers, Fire tablets, and more.

7. Logistics and Fulfillment Services

Amazon offers fulfillment and shipping services to third-party sellers via its Fulfillment by Amazon (FBA) service. It also generates revenue through delivery services that offer faster shipping options, like Amazon Prime Air and Amazon Logistics.

8. Media Content and Streaming

Amazon Prime Video: This service competes with Netflix and other streaming platforms by offering original content, movies, and TV shows.

Amazon Studios: Produces original films, series, and content for Amazon Prime Video, generating revenue from both subscriptions and direct purchases/rentals of content.

9. Other Investments and Acquisitions

Amazon invests in various ventures and businesses, which contribute indirectly to its revenue. This includes startups, healthcare initiatives (like Amazon Pharmacy), and logistics expansions.

10. Amazon Business

This is a B2B marketplace where businesses can purchase products in bulk. It offers various enterprise-level services, and Amazon earns revenue through both sales and services.

By diversifying its income sources, Amazon reduces its reliance on any single revenue stream, allowing the company to grow into many sectors, including technology, entertainment, and logistics. AWS and advertising have become increasingly important to the company’s profitability, while e-commerce remains a substantial part of its overall business.

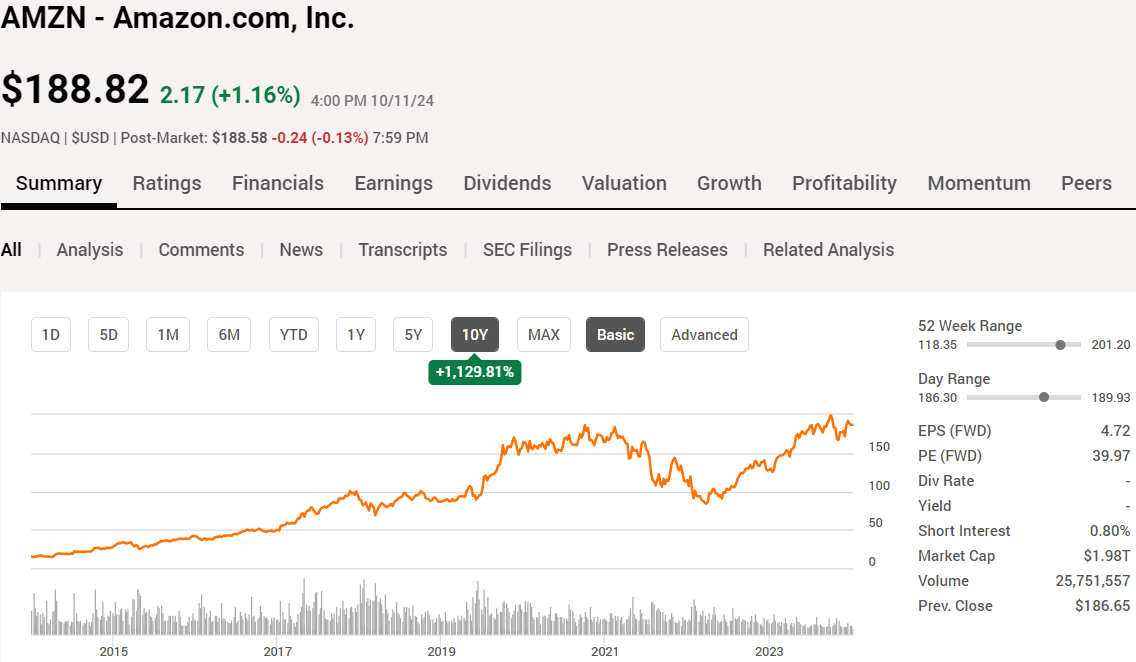

Amazon is up 1,130% over the last 10Y and has massively outperformed the S&P 500 in this period.

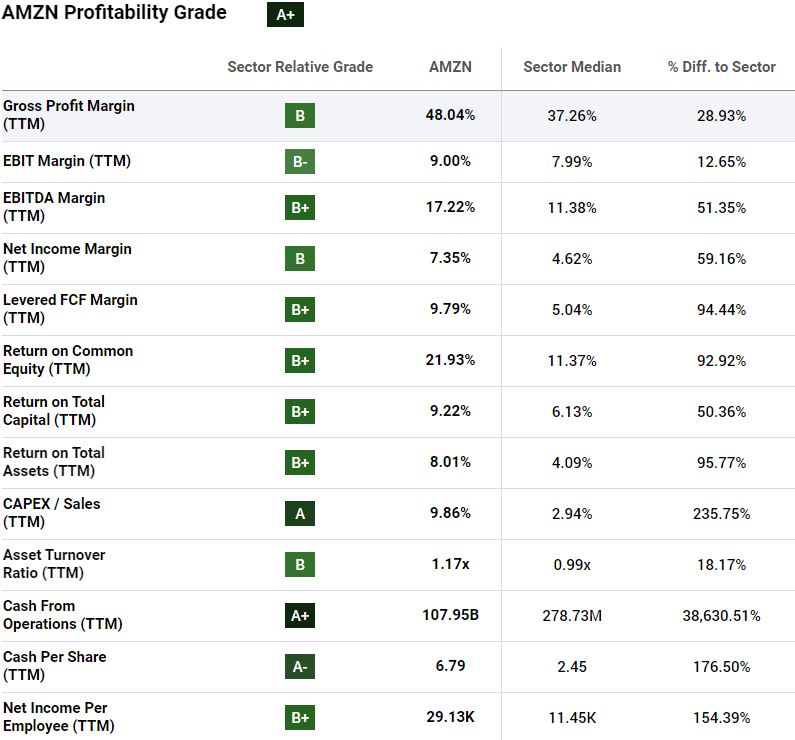

Whilst Amazon trades at a Forward P/E of 40, it is important to understand it has strong metrics that make it worth a premium in relation to the sector, question is, how much of a premium does it deserve?

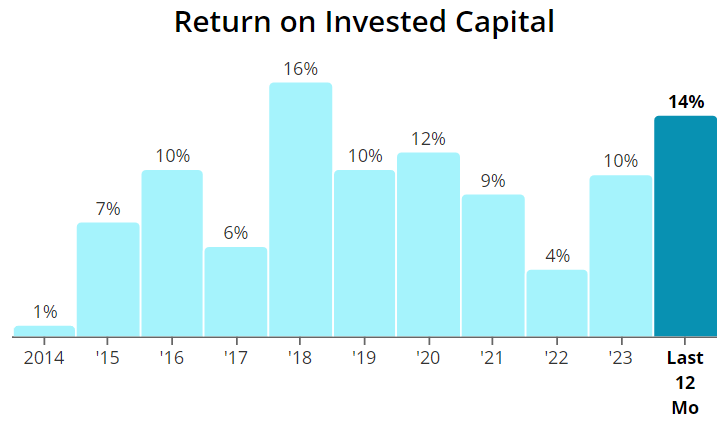

As we can see, ROIC has been very inconsistent, how we hope moving forwards we can see a trend above 10% continue, and it is good to see 14% on the TTM.

Net Debt to EBITDA of 0.61 is very good for 2023, and even better to see it expected to come down to 0.43 over the next 12 months. Strong balance sheet and hopefully it stays that way.

As per below, Wall Street see 18.83% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $226.38

So, in conclusion for Amazon, we see around a 15% margin of safety around the $192 mark with Wall Street indicating 19% upside.

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Conclusion

We have just gone through 2 stocks we believe could be considered as the best undervalued stocks in the market right now.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.