The BEST Recession Proof Stocks!

Do You Own Any Of These?

Introduction

The last recession we endured was in 2007-2009 (The Great Recession). It was a sharp decline in economic activity and is considered the most significant downturn since the Great Depression in the 1930s.

What did this mean for the stock market?

As we can see below the S&P 500 went from the high in October 2007 of 1,565 (P/E of 15.2) to the lows of March 2009 (P/E of 10.3).

That is a 56% drop.

The S&P 500 as it has done throughout history recovered and in December 2011 it grew 85% from the drop to 1,257 (P/E of 11.8).

As the famous American writer said “ History doesn’t repeat itself but it often rhymes”.

So how can we prepare ourselves for the next inevitable recession?

“Recession Proof”

For something to be “recession proof” it is believed to be economically resistant to the effects of a recession.

Now we are unable to look inside a crystal ball to see what the future will bring for stocks but what we can do is look at the historical performance of those stocks that performed well and in fact significantly outperformed the S&P 500 during the Great Recession.

This is all in the hope that they will safeguard our investment portfolios against such times of economic decline.

6 Stocks To Consider

1 - WMT (Walmart)

Walmart is a Dividend King with a +7% Recession Return (during 07-09) when the S&P 500 averaged -55%.

Currently based on Dividend Yield Theory (DYT) below it does look to be overvalued, but a good one to keep on the watchlist to strengthen that recession proof part of your portfolio.

2 - MCD (McDonald’s)

3 years away from becoming a Dividend King and severely outperformed the S&P 500 in 07-09 with a -3% return vs the -55% of the S&P 500.

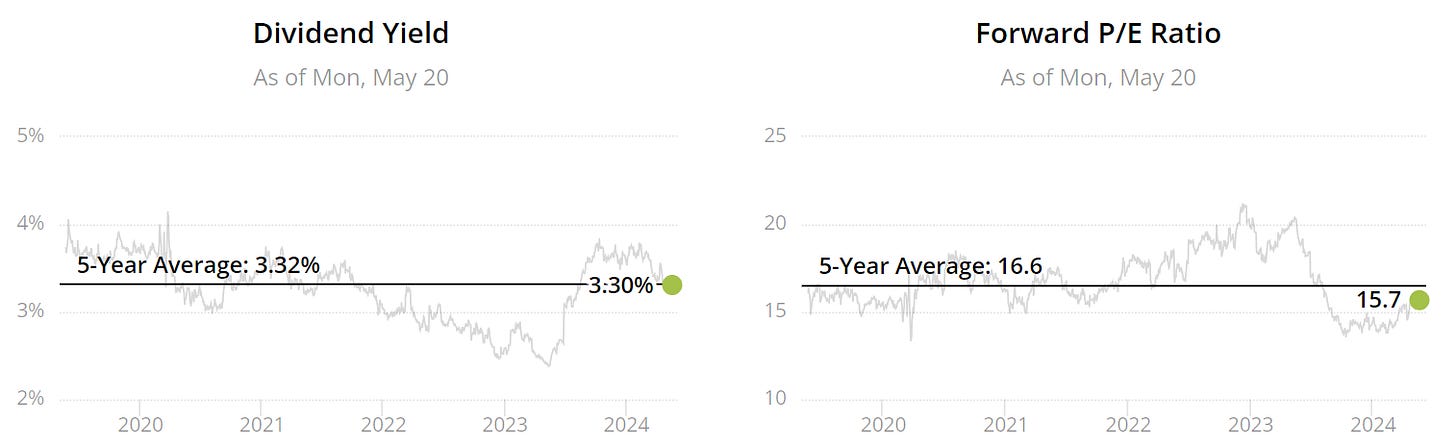

Looks undervalued per Dividend Yield Theory below.

If you want more information on Dividend Yield Theory you may want to check one of our previous articles below that goes into more detail:

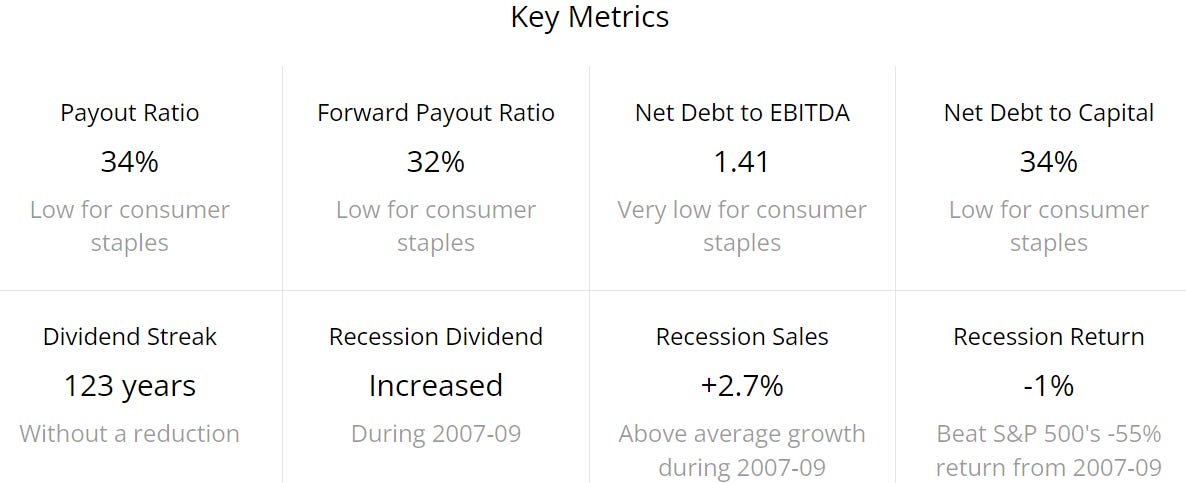

3 - CHD (Church & Dwight)

A Dividend Aristocrat and has being paying a dividend for the last 123 years without a reduction!

-1% return in the last recession too.

Does look slightly overvalued as per (DYT) below.

We have also recorded an episode on our YouTube channel around this topic below:

If you are interested in valuing stocks yourself, like we do in our videos, we have created a valuation model below which you can pick up:

4 - MA (MasterCard)

A recession return of -12% vs S&P 500 -55% for this incredibly strong company.

Also looks reasonably valued as per below:

5 - GIS (General Mills)

This company has been paying a dividend for the last 125 years without a reduction!

We also see a -12% recession return too.

Reasonable valuation as per below:

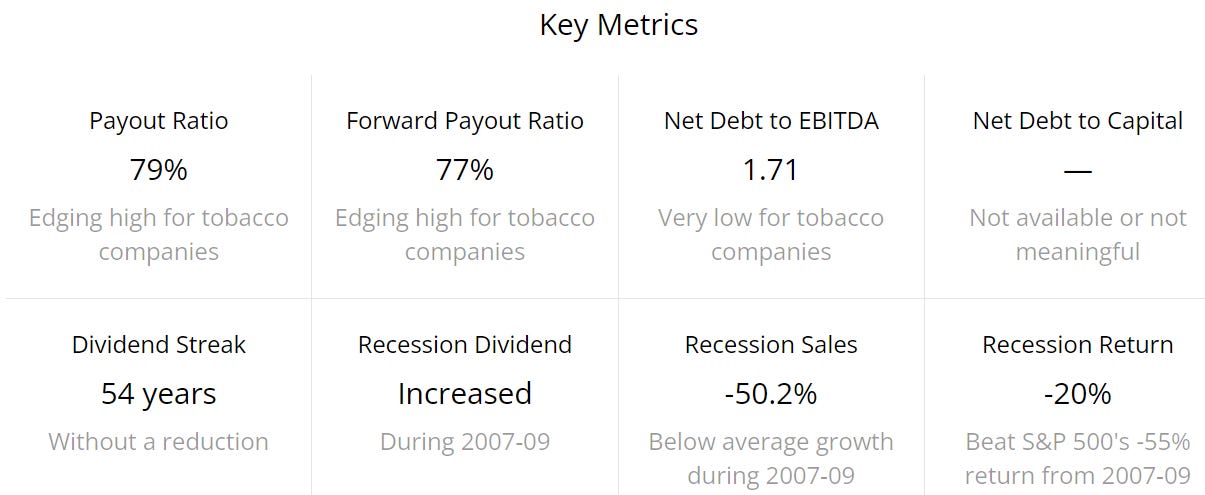

6 - MO (Altria Group)

A Dividend King with a nice high yield too returning -20% during the Great Recession.

Looks reasonably valued at the moment:

Conclusion

Whilst we don’t have a crystal ball, one thing is for certain, another recession will occur whether that is tomorrow, next year or in the next 10 years.

Historically speaking we have gone through 6 stocks above that performed significantly better than the S&P during the more recent recession.

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.