The Easiest Way To Be Financially Free!

This Applies To Everyone!

We all want to be financially free in life, we might just want it for different reasons.

This is to do what we want, when we want, with who we want and where we want.

Life Is All About Options

Every month when we get paid we have lots of different options to use our hard earned money, but we will simplify it down to these 3:

Spend it on goods/services whether that’s a new pair of trainers or going out on the weekend.

Put it in our savings account.

Invest it.

In today’s newsletter we are going to focus on option 3 and why if you want to be financially free in the easiest way that anyone can do and in the quickest timeframe, then you need to start by investing.

This means to invest a certain % of your money every month before even considering buying any goods/services that are a ‘want’ and not a ‘need’.

Saving My Money In The Bank Is Better, Is It Not?

First let’s just make it clear, option 2 (putting our money in a savings account) is not going to make you financially free, in fact you will be worse off.

As we can see above we have 2 individuals who save $500/month:

Kelsey - 2% a year on her savings account for 40 years gives her a total of $365,722

Kayla - 10% a year in index funds (we’ll come on to this later) gives her a total of $2,775,174

In fact if we factor in inflation of around 3-4% a year which has historically been the average in the US, then we can see that in the long term Kelsey is actually losing her purchasing power.

But How Much Should I Invest?

Well this really depends on several factors, with the main one being how much you can afford to put away from your paycheck every month.

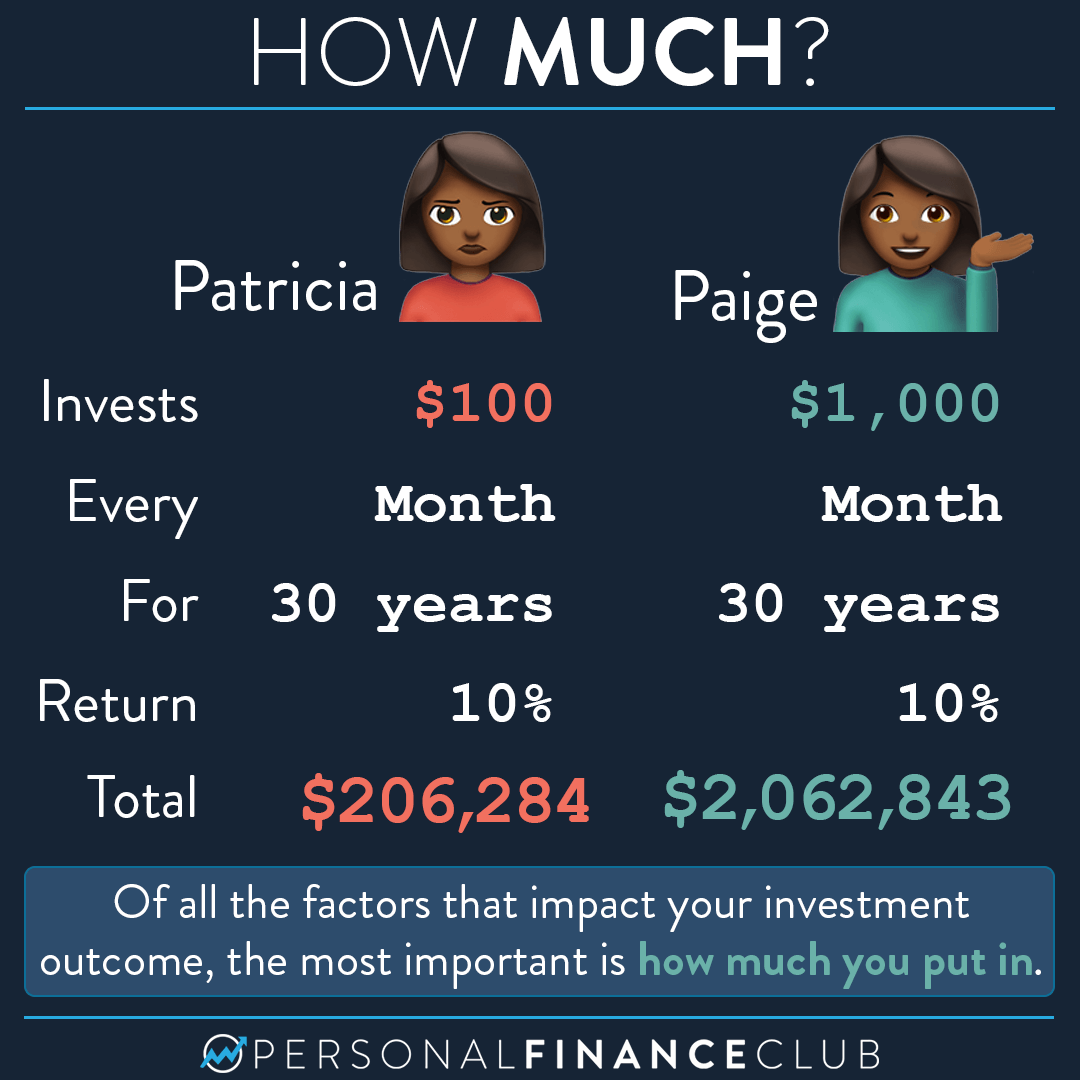

However as we can see, the more you invest, the more you will end up with.

From above we have 2 individuals with Patricia investing $100 a month and Paige investing $1,000 over a 30 year period, both receiving 10% returns year on year.

The end result:

Patricia = $206,284

Paige = $2,062,843

The more you can invest every month, the greater the return.

Ok, I Understand, But What Should I Be Investing In?

The answer to this question is simple, the S&P 500.

A very quick note for those that don’t know, the S&P 500 tracks the stock performance of 500 of the largest companies listed on the stock exchange.

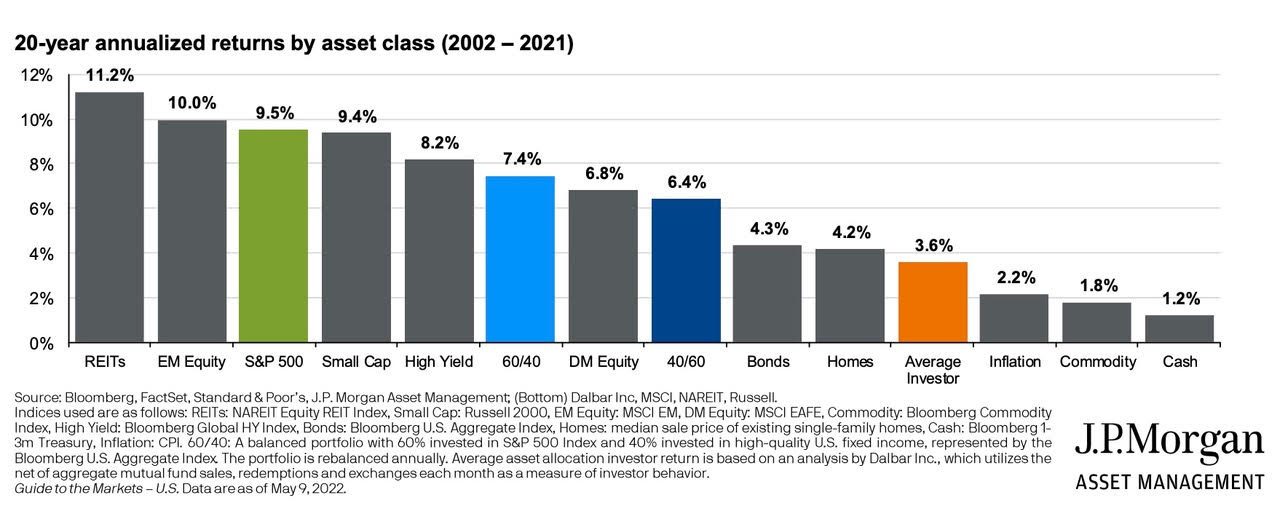

From 2002-2021 as per above it returned 9.5% a year to investors.

Now for the important part:

Too many investors try and beat the market and become worse off than if they had just invested in a S&P 500 fund and as we can see above over the same period the average investor returned only 3.6% a year, barely keeping up with inflation.

How about over a 30 year period?

S&P 500 Annual Return over 30 years = 10%

Average Investor Return over 30 years = 4%

S&P 500 Every Year

On average the S&P 500 returns 10% year on year and in fact it has returned positive results 73% of the time.

Conclusion

If you want to be financially free without having to pick individual stocks and try to outperform the average investor whose returns are significantly worse off than the S&P 500 then the easiest way without any mental effort is to just invest on a consistent basis in the S&P 500.

If you can automate this process even better, remembering the more you invest the larger the return.

Why try and beat the market when the average investor can’t?

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.