The Last 3 Undervalued Stocks in Today’s Market

With the Fed cutting rates, Nvidia teaming up with Intel, and TikTok reshaping U.S.–China ties, markets are running hot—but I’ve found the rare gems still trading below their true value.

Market Update

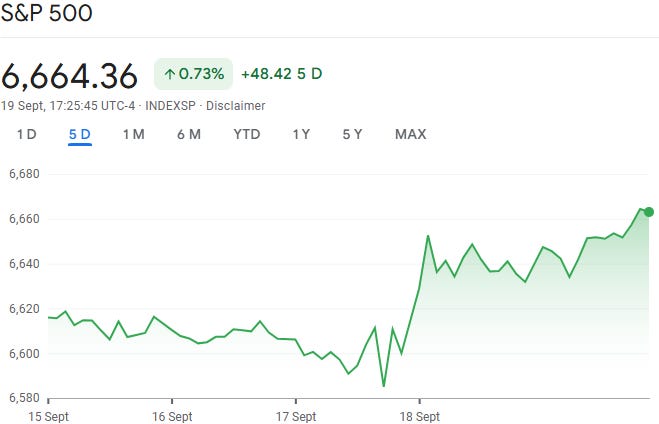

It was another strong week on Wall Street with the S&P 500 continuing to climb to new all time highs once again.

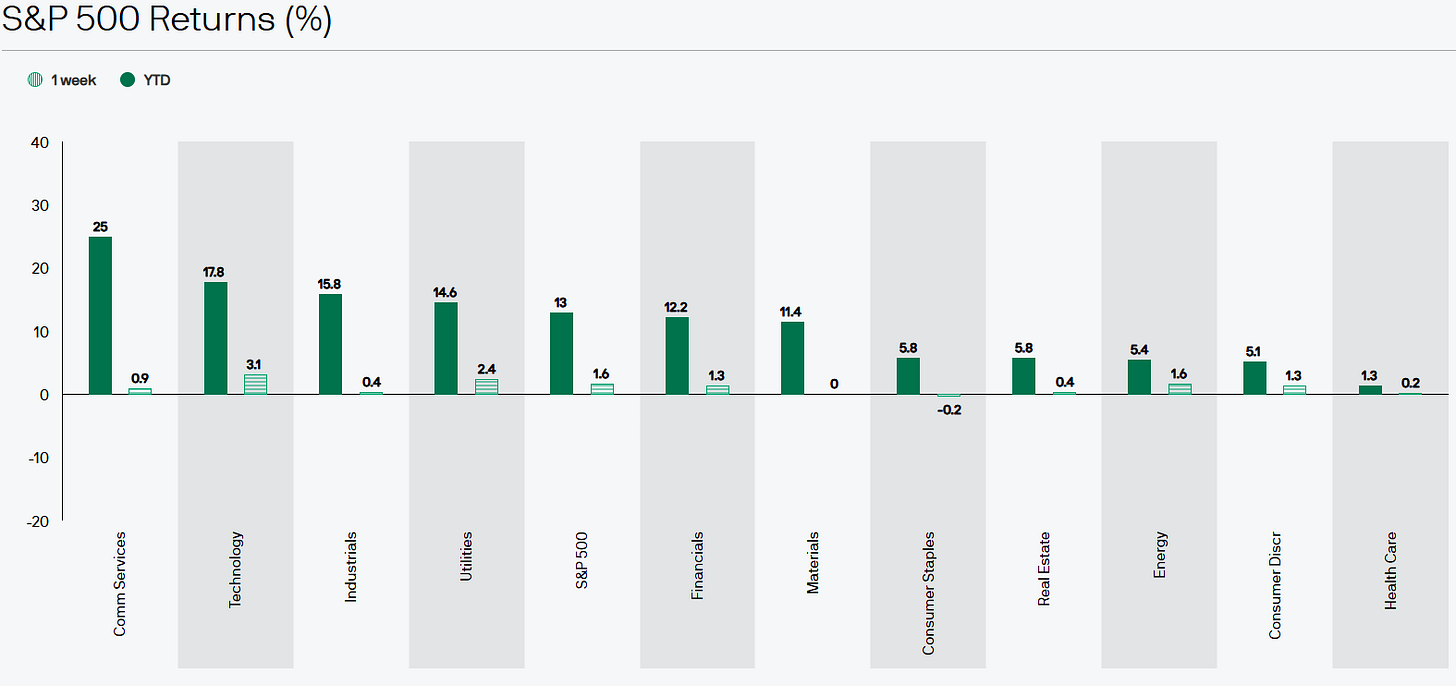

Most of this growth is coming from consumer services and technology year to date.

We also saw all the major U.S. indexes pushing to fresh record highs after the Federal Reserve finally trimmed short-term interest rates - the first cut we’ve seen in nine months.

Winners and Losers This Week

Top performers:

Intel (+23%)

Synopsys (+16%)

Crowdstrike (+15%)

Tesla (+8%)

Caterpillar (+8%)

Biggest drops:

Darden Restaurants (-13%)

S&P Global (-7%)

Extra Space Storage (-5%)

Broadcom (-4%)

UnitedHealth (-4%)

Notable News

Rate Cuts Moving Forwards

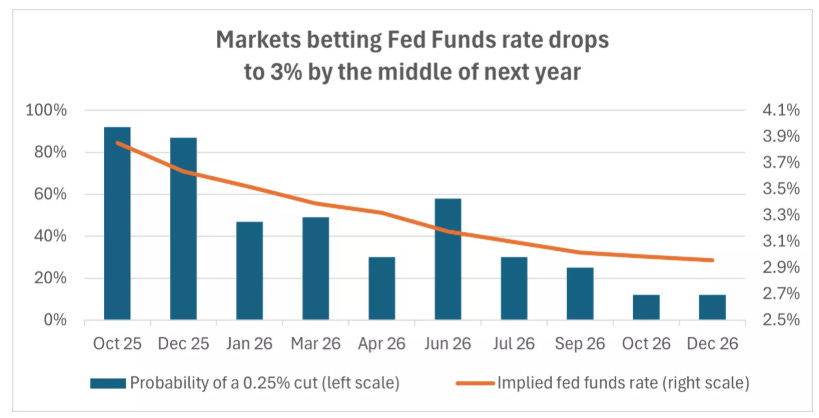

Looking ahead, the market seems convinced this isn’t the last cut we’ll see.

Traders are betting heavily - about a 90% chance - that the Fed will lower rates again in October and then once more in December.

Even with the Fed sending out its usual mixed signals, investors haven’t lost their optimism.

Nvidia & Intel: A Game-Changing Partnership

Big news in the chip world this week: Nvidia is taking a $5 billion stake in Intel. The two will team up on custom chips for AI data centers and PCs, combining Intel’s CPU expertise with Nvidia’s GPU dominance.

The market reaction was massive. Intel shares soared nearly 23% in a single day -their biggest jump since 1987 - on hopes this partnership could mark a turning point.

For Nvidia, this isn’t just about money. It’s about securing a tighter grip on the AI hardware ecosystem by working directly with Intel’s x86 CPU platform, while also pushing into new system-on-chip designs for PCs.

Of course, challenges remain. Intel’s foundry business still has hurdles, and regulators will be watching closely. But for now, this move reshapes the balance of power in semiconductors and signals a new era of cooperation between two historic rivals.

Trump also posted the above picture after the release of the news, highlighting the US Government’s gain after their 10% stake was purchased around $20.

TikTok: A Bargaining Chip in U.S.–China Relations

On Friday, Donald Trump and Xi Jinping held their first call in three months, with TikTok right at the top of the agenda. Both leaders are trying to hammer out a deal that would keep the app running in the U.S. while easing tensions between Washington and Beijing.

Trump is under pressure. Congress had ordered TikTok shut down unless ByteDance sold its U.S. assets, but he’s been reluctant to enforce it - partly because he knows banning an app with such a massive American user base could backfire politically. As he bluntly put it, “I like TikTok; it helped get me elected.”

The framework on the table would see TikTok’s U.S. assets transferred to American owners, while still relying on ByteDance’s algorithm under license. That detail worries lawmakers, who fear Beijing could still wield influence or access data. China, for its part, insists there’s no evidence TikTok poses a security threat.

Friday’s call was about more than just TikTok. Trade, tariffs, and tech competition all loomed in the background. Trump has sharply raised tariffs this year, while Beijing has responded in kind, pushing U.S.–China relations to their tensest point in years. TikTok, then, has become more than a social media app - it’s a bargaining chip in a much larger geopolitical game.

Earnings This Week

Join 111,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

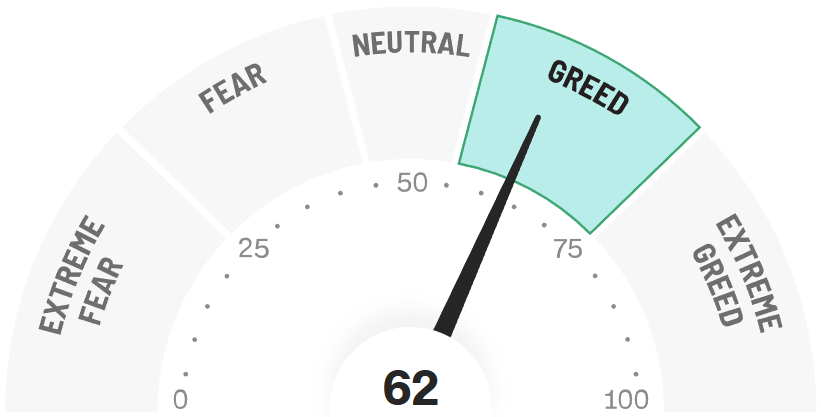

Fear & Greed Index

3 Undervalued Stocks In This Overinflated Market

Let us dive into these 3 undervalued Stocks.

I have used the following criteria to help identify these stocks:

1. Trading below 5Y P/E

2. Free Cash Flow Margin 20%+

3. Net Debt to EBITDA <1.5

4. ROIC > 10%

5. Undervalued per Blue Tunnel Methodology

Novo Nordisk (NVO)

Novo Nordisk – A Rare Gem in Healthcare

Novo Nordisk isn’t just any pharmaceutical company - it’s a global leader in diabetes care and obesity treatments, two markets that aren’t going away anytime soon. The company has consistently grown revenue and profits, driven by high-demand treatments like GLP-1 medications, which continue to reshape how obesity and diabetes are managed.

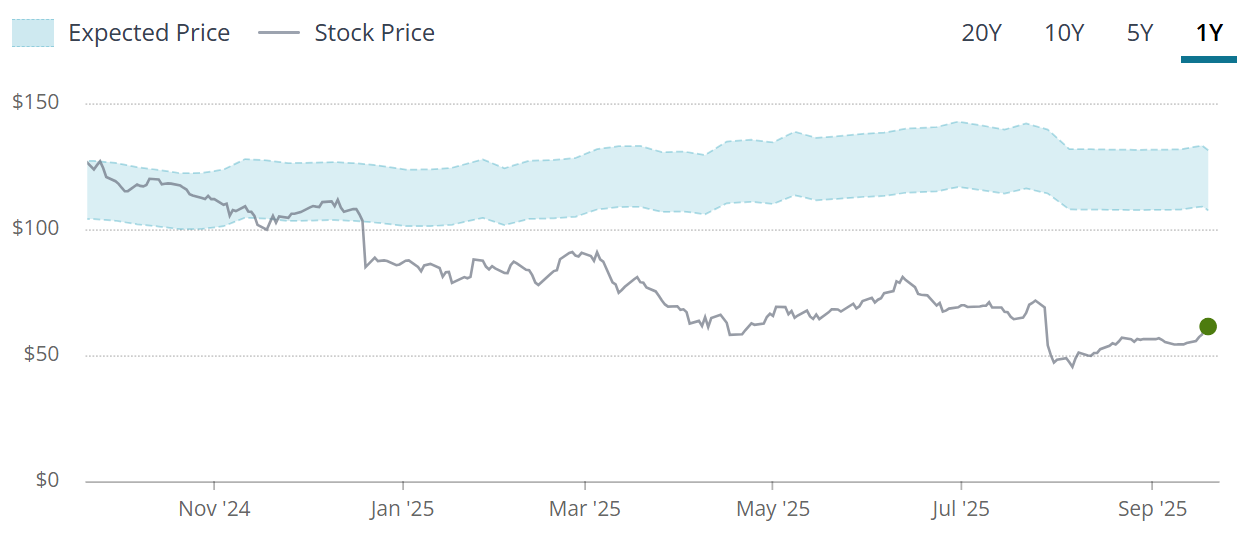

What makes Novo Nordisk especially appealing right now is its valuation (see below). Despite strong earnings growth and a dominant market position, the stock still trades at levels that make it undervalued compared with its peers in healthcare. For investors looking for a company with both stability and growth, NVO stands out in a market that’s otherwise overinflated.

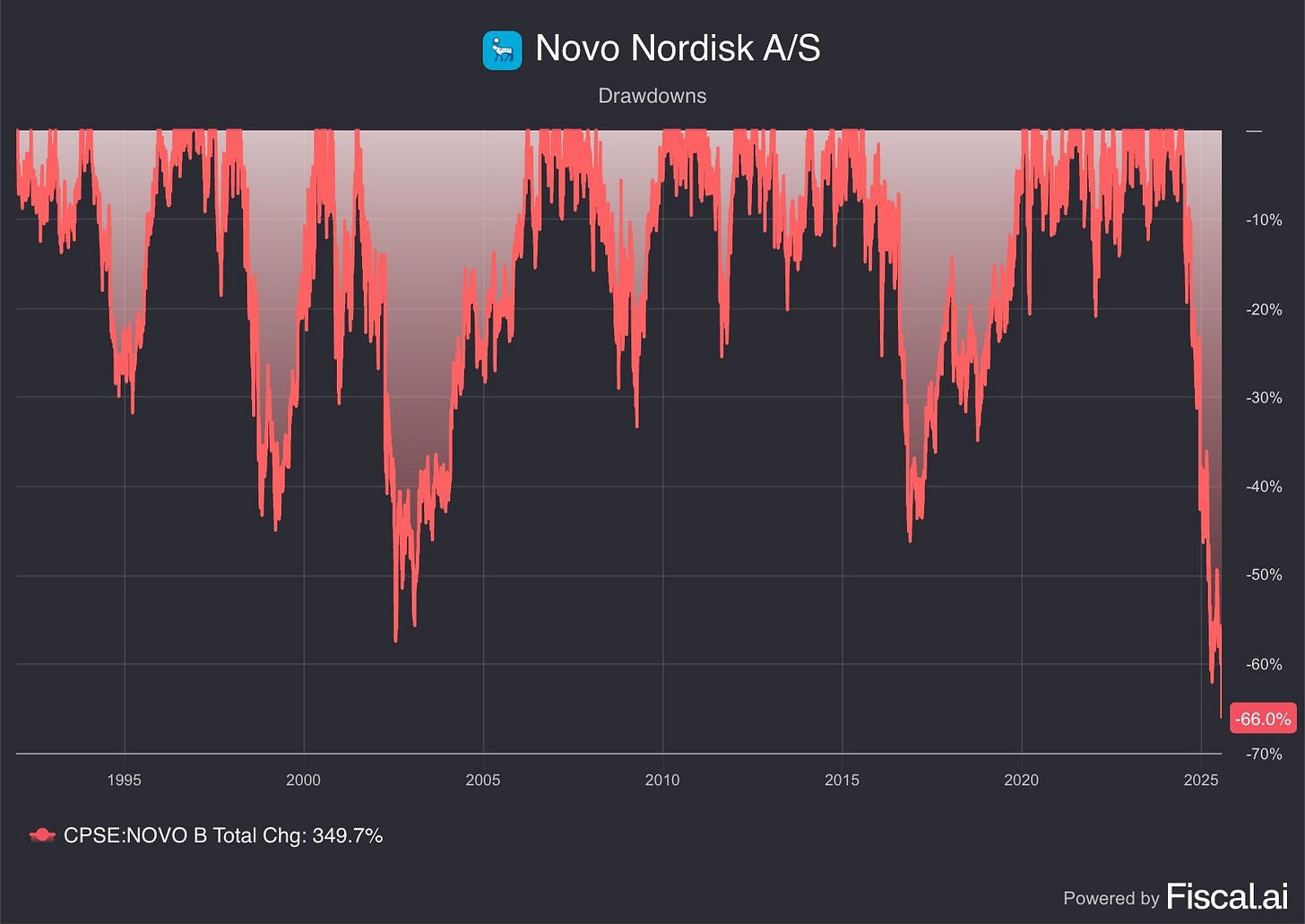

Why has it performed poorly lately?

Novo Nordisk's stock has experienced a significant decline recently. This downturn is primarily attributed to several key factors:

Slower-than-Expected Growth in Obesity Drugs: The company revised its 2025 sales and operating profit growth forecasts downward, citing slower-than-expected uptake of its weight-loss drugs, Ozempic and Wegovy, in the U.S. market. Additionally, competition from compounded GLP-1 alternatives has impacted market share.

Disappointing Clinical Trial Results: Novo Nordisk faced setbacks with its experimental obesity treatment, CagriSema. The Phase 3 trial showed only a 22.7% average weight loss, below the anticipated 25%, leading to concerns about the company's future pipeline.

Leadership Changes and Restructuring: The appointment of a new CEO, Maziar Mike Doustdar, and the announcement of a global workforce reduction of 9,000 employees have raised questions about the company's strategic direction and operational efficiency.

These factors combined have led to investor apprehension, contributing to the recent stock price decline.

Why Novo Nordisk Could Be Poised for a Strong Comeback

Despite recent challenges, Novo Nordisk’s long-term prospects remain compelling:

Strong Financial Performance: In Q2 FY25, Novo Nordisk reported earnings per share (EPS) of $6.53, far above expectations, with revenues of $78.09 billion.

Advancements in Obesity and Diabetes Treatments: The company’s oral Wegovy pill showed an average weight loss of 16.6% over 64 weeks, with nearly one-third of participants losing 20% or more of their body weight. This positions Novo Nordisk to capture a substantial share of the growing obesity treatment market.

Regulatory Approvals Enhancing Product Portfolio: Novo Nordisk has also received label updates for Rybelsus, its oral diabetes medication, to include cardiovascular benefits. Additionally, potential FDA approval for its non-alcoholic fatty liver disease (NAFLD) treatment could open a major new revenue stream.

Strategic Restructuring for Efficiency: The company plans to reduce its global workforce by 9,000 employees, aiming to save $1.27 billion annually by 2026. These savings are expected to be reinvested into research and development, manufacturing, and commercial execution, enhancing long-term profitability.

Analyst Confidence and Market Potential: Analysts remain optimistic about Novo Nordisk’s future performance, with estimates pointing to significant potential upside from current levels.

Collectively, these factors suggest that Novo Nordisk is well-positioned to overcome recent setbacks and deliver strong returns for investors in the coming years.

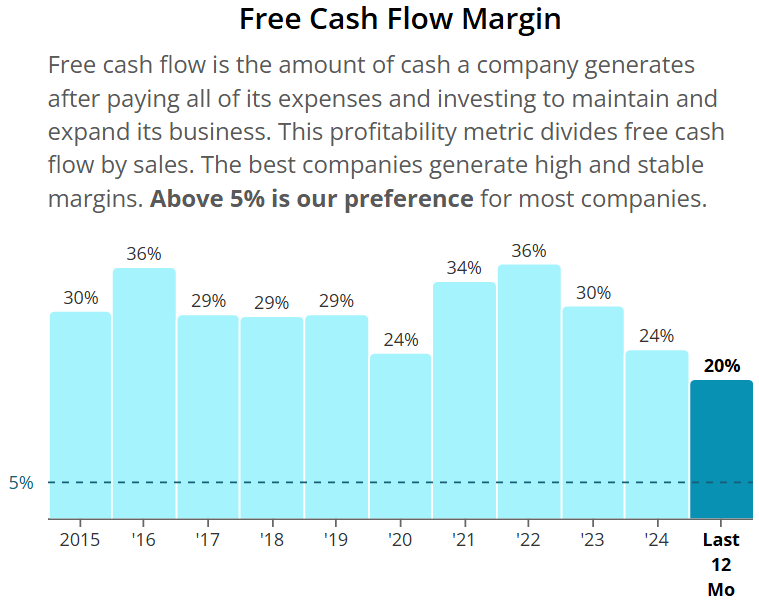

Free Cash Flow Margin 20%+

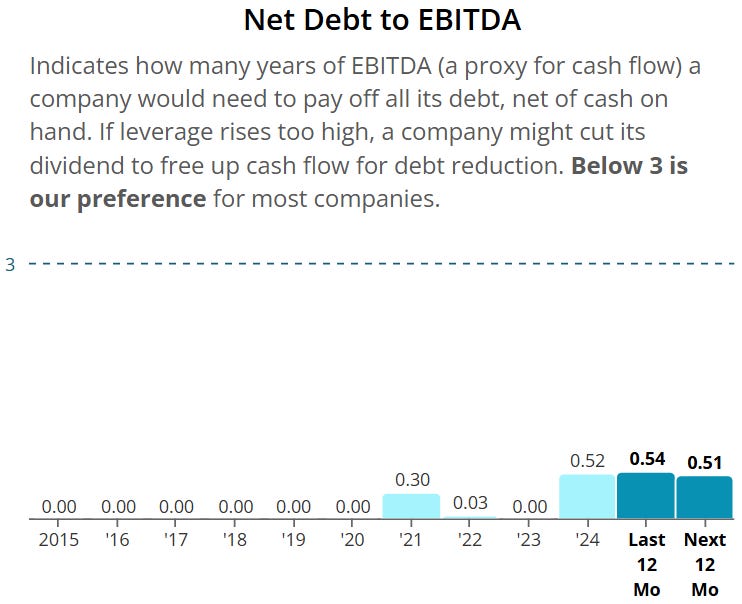

Net Debt to EBITDA <1.5

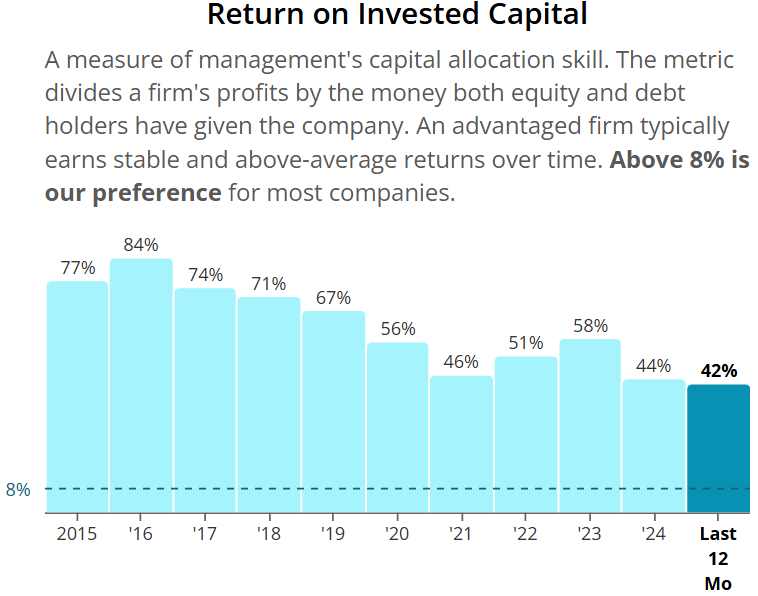

ROIC > 10%

Blue Tunnel (Huge disparity between stock price and lower end of expected value)

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.