Undervalued with Strong Upside?

Let's take a look!

This week’s deep dive is LVMH and it will be under the investing spotlight.

Background

LVMH is a French multinational holding and conglomerate specializing in luxury goods, headquartered in Paris.

The company controls around 60 subsidiaries that manage 75 luxury brands that you can see below. Some notable names include Christian Dior, Fendi and Givenchy.

CEO Bernard Arnault has been the CEO and Chairman since January 1989 (35 years!). He also owns 48.4% making him the largest shareholder (and one of the most wealthy in the world). He holds 63.9% of all votes and has full control of LVMH.

Mergers and Acquisitions

As the below image shows this Luxury Empire of Arnault continues to grow year on year through acquisitions of some big names in the industry.

It is also worth noting that their revenue has grown 24x since 1989 and doesn’t look to be stopping.

7 Golden Dividend Metrics

Before we get into the detail we can use last week’s newsletter to see if this Company meets our 7 Golden Dividend Metrics.

Criteria 1 - PE Ratio < S&P 500

LVMH - 20.68

S&P P/E - 26.82

Criteria 1 MET

Criteria 2 - Dividend CAGR 10Y > 4%

10Y Dividend CAGR = 19%

Criteria 2 MET

Criteria 3 - Cash Flow Payout Ratio < 60%

Cash Flow Payout = 53.46%

Criteria 3 MET

Criteria 4 - Fair Value (Discounted Cash Flow Model) 10%+

Fair Value per DCF = $995.90 (37% Upside)

If you want to see the full deep dive on YouTube with regards to valuation, check out the video here:

Criteria 4 MET

Criteria 5 - Upside Valuation 10%+

Analyst Expectation = $910 (25% Upside)

Criteria 5 MET

Criteria 6 - EBIT Margin > 10%

EBIT Margin = 26.41%

Criteria 6 MET

Criteria 7 - ROIC > 10%

ROIC = 21%

Criteria 7 MET

All 7 Metrics have been met so we are off to a good start.

Insider Buying

One thing that is very important to note is that insider buying is a very bullish signal and we believe this as management will only buy shares of their own Company if they believe that the share price will go up.

Insider selling on the other hand is not necessarily a bearish signal as management may sell for many reasons including both personal and financial.

Over the last 3 months the CEO and Chairman Bernard Arnault in 3 separate tranches has bought shares of LVMH:

27/10/23: 3million euros worth of shares

16/11/23: 12.9million euros worth of shares

04/12/23: 15million euros worth of shares

Growth over the last 10Y

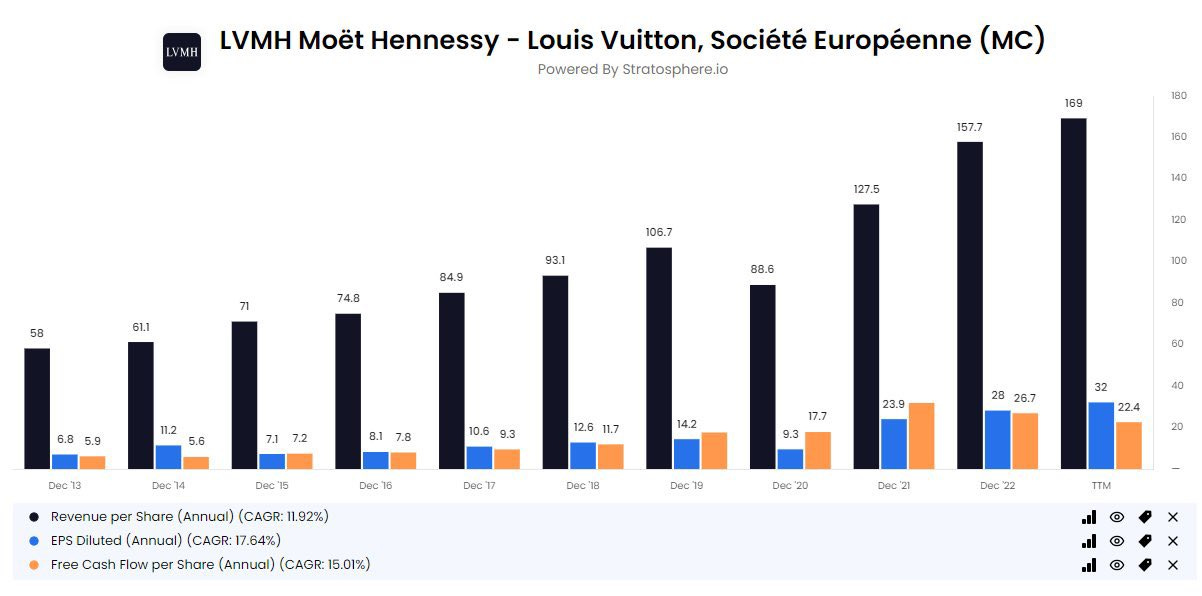

Over the last 10 Years:

Revenue per share (CAGR) = 11.92%

EPS (CAGR) = 17.64%

Free Cash Flow per share (CAGR) = 15.01%

Q4 Earnings

LVMH just reported their earnings and it was good.

Revenue 23.95bn EUR vs 23.72bn expected.

Organic revenue was up 10% with Wall Street expecting 8.17%.

The dividend also increased by 8%.

Key Financial Metrics

Total Sales 2014 - $30.6bn

Total Sales 2023 - $86.2bn

LVMH have nearly tripled their total sales over the last 10 years.

Free Cash Flow per share 2014 - $5.66

Free Cash Flow per share 2023 - $21.80

Free cash flow per share has increased by approximately 4x.

Operating Margin 2014 - 19%

Operating Margin 2023 - 26%

They have managed to increase their margins over the long term which is a strong sign of efficiency.

Net Debt to EBITDA 2014 - 2.90

Net Debt to EBITDA 2023 - 1.04

This is a very strong sign of both balance sheet strength and dividend safety. In summary it shows us that in 2023 it would take management 1.04 years to pay off their debt net of cash on hand.

Conclusion

In summary LVMH is trading at good value and also has some very strong metrics across the board.

The question you have to ask yourself is if you believe that a recession is looming in 2024 will that affect the clientele of LVMH.

Will those who buy products of this Company hesitate to continue and instead focus on cash retention or are they people who are unaffected by recessions and continue to splurge their cash regardless of the economic condition.

Let me know your thoughts!

If you are interested in purchasing a copy of the stock valuation model I use on YouTube and to calculate intrinsic value and acceptable buy prices of Companies see below:

https://www.buymeacoffee.com/dividendtalks/extras

Feel free to also buy me a coffee below:

https://www.buymeacoffee.com/dividendtalks

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.

You do great work. I have to pass on any of these high priced stocks because my level of conviction on any purchase is around $100.