UnitedHealth and Novo Nordisk: Why These Market Giants Are Slipping - And What Their Valuations Tell Us

Breaking down the latest market shifts - from rising tariffs and a softer labor market to earnings surprises.

Market Update

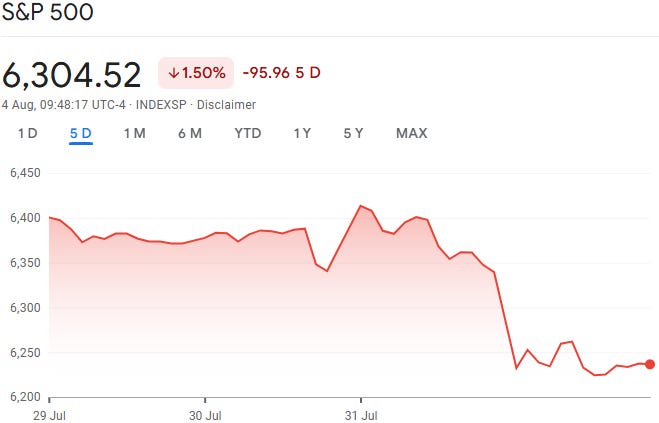

Markets Face New Hurdles: Tariffs, Jobs, and Fed Uncertainty

This past week, investors got a triple dose of news that could shape the path into 2026.

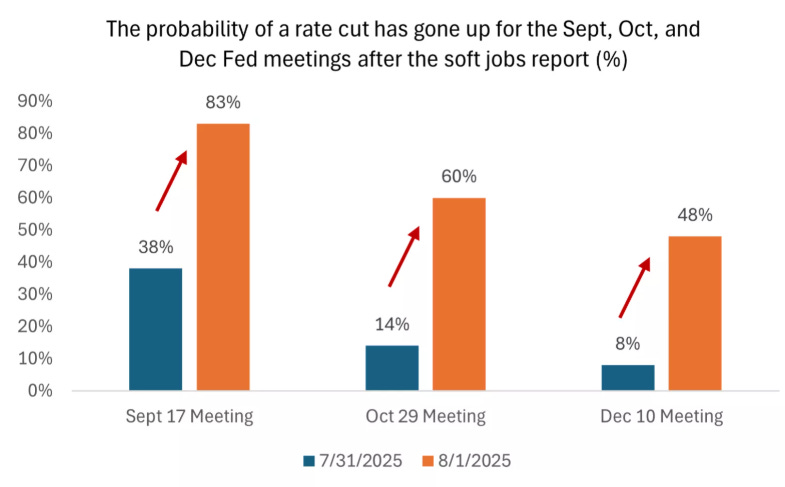

First, the Federal Reserve kept rates steady at 4.25%–4.5% during its July meeting. Fed Chair Jerome Powell didn’t offer much clarity on what's next - especially around a potential September rate cut. But markets are starting to bet one might be on the table.

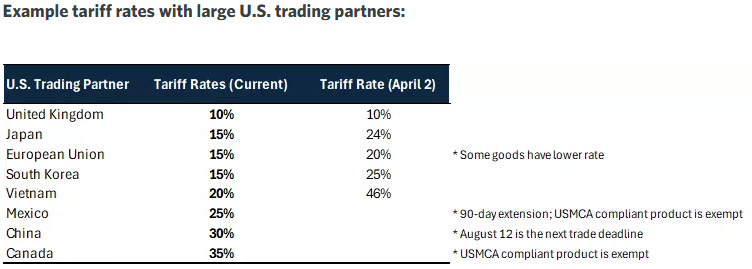

Meanwhile, the U.S. moved ahead with new trade measures. Ahead of its August 1 deadline, the administration struck deals with a few allies like the UK, Japan, and the EU - but also slapped new tariffs (many 15% or higher) on others.

According to the Yale Budget Lab, average U.S. tariff rates have jumped from 2% to around 18%. That’s a meaningful shift - and one that could push prices higher and weigh on consumer spending.

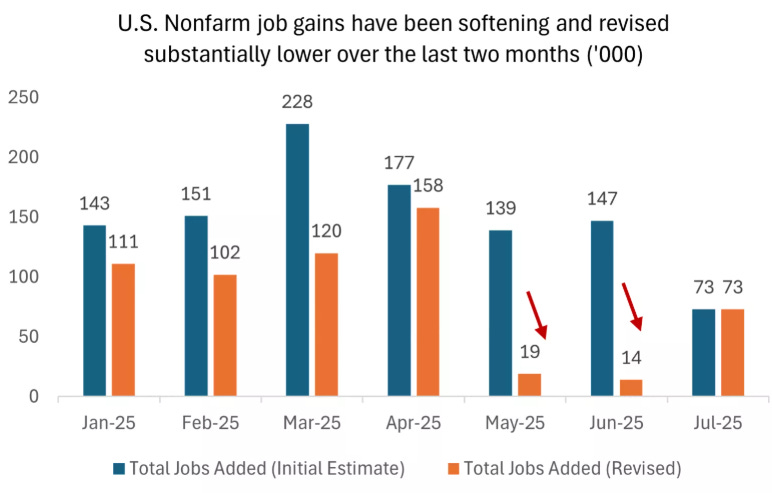

Lastly, the labour market showed fresh signs of cooling. July’s jobs report came in below expectations, and previous months were quietly revised down. The unemployment rate also edged up to 4.2%.

The market has enjoyed a strong rally in recent months - but cracks are forming. Tariffs are rising, job growth is slowing, and the Fed remains cautious. Still, the growing chance of rate cuts, along with some fiscal support from the new tax bill, could help steady the ship as we move toward 2026.

Winners and Losers This Week

Top performers:

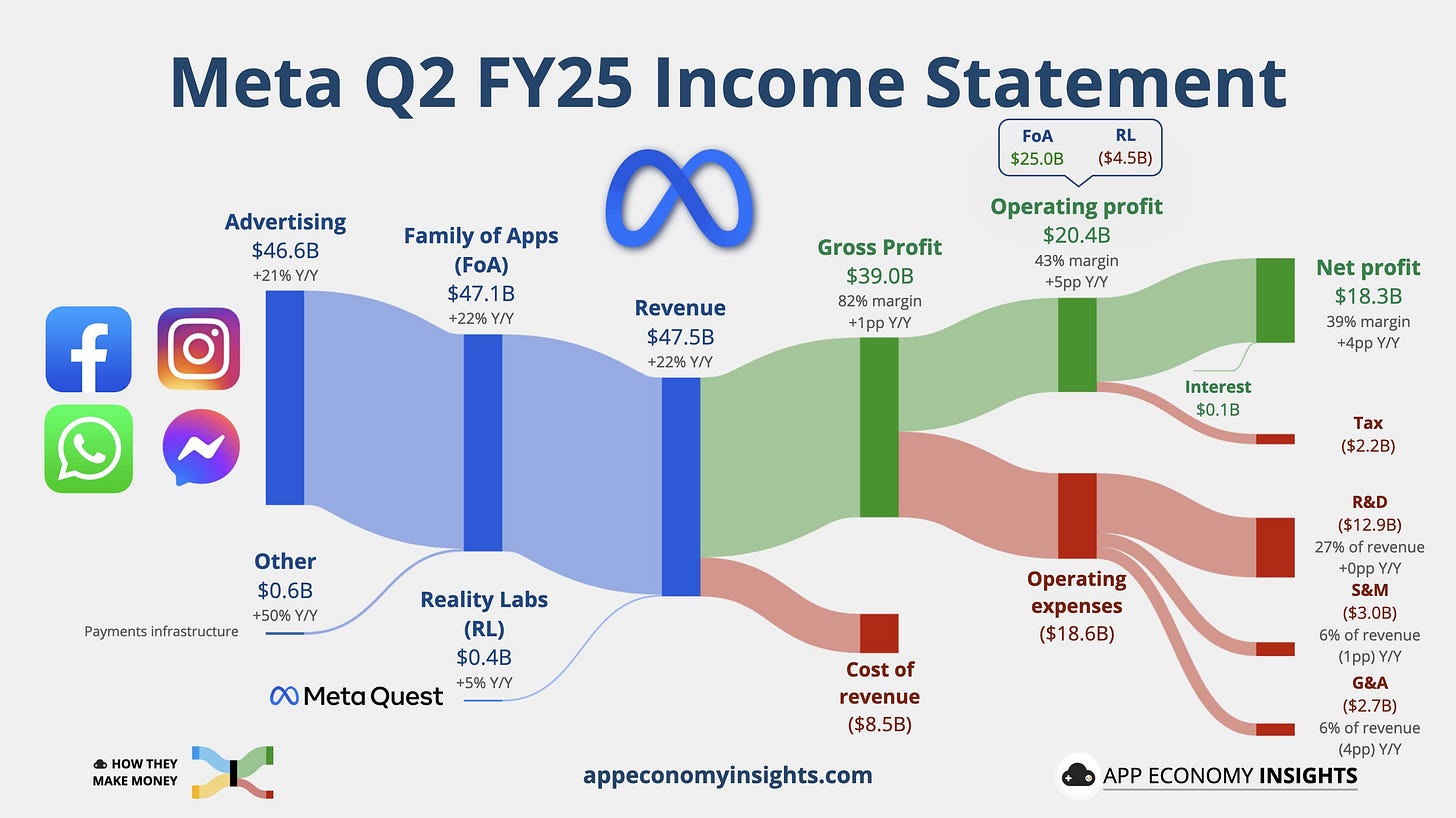

Meta Platforms (+7%)

Altria (+6%)

Kimberly Clark (+5%)

S&P Global (+4%)

AbbVie (+4%)

Biggest drops:

UnitedHealth (-16%)

PayPal (-14%)

Airbnb (-9%)

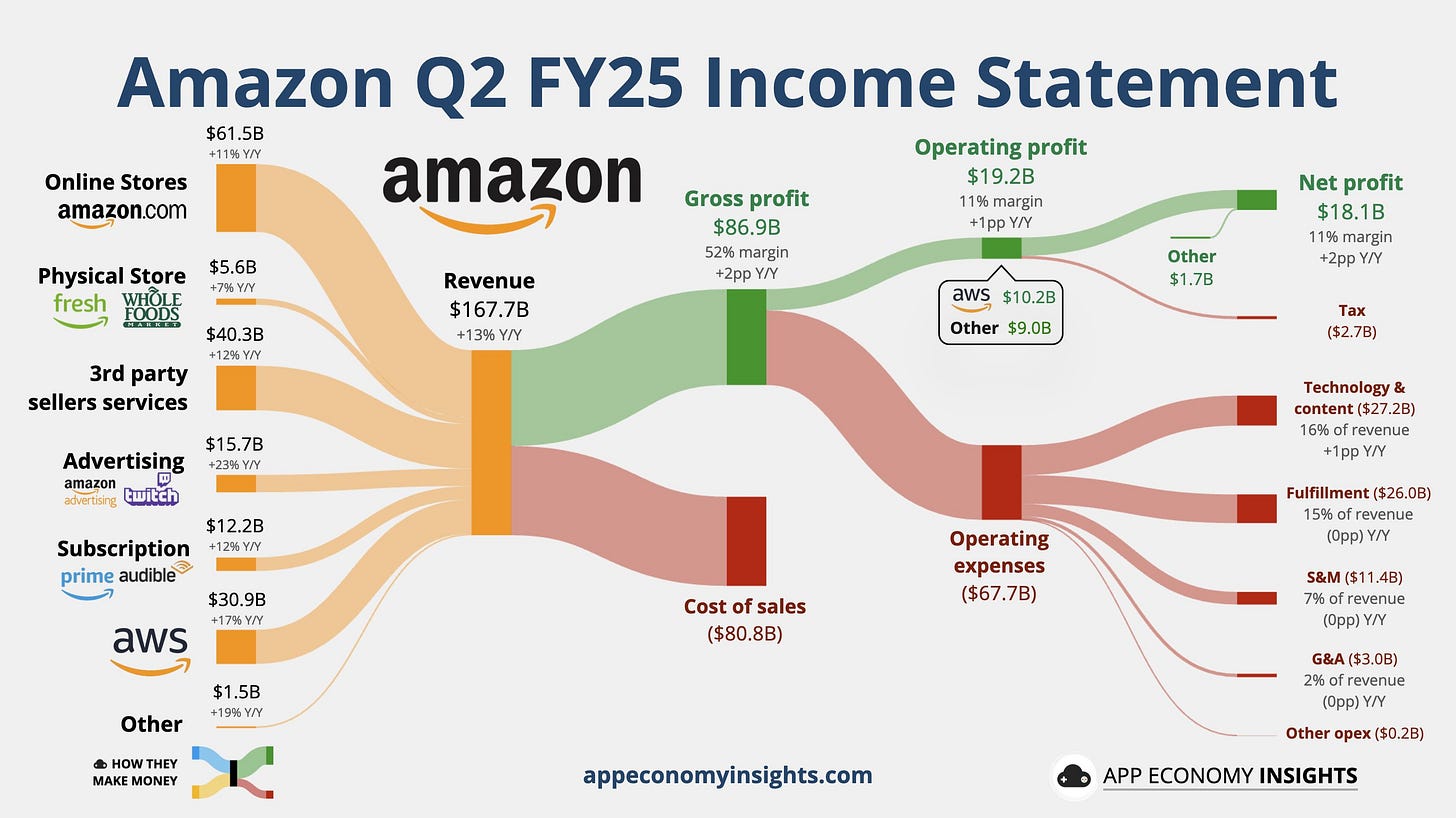

Amazon (–8%)

Fair Isaac (-8%)

Notable News

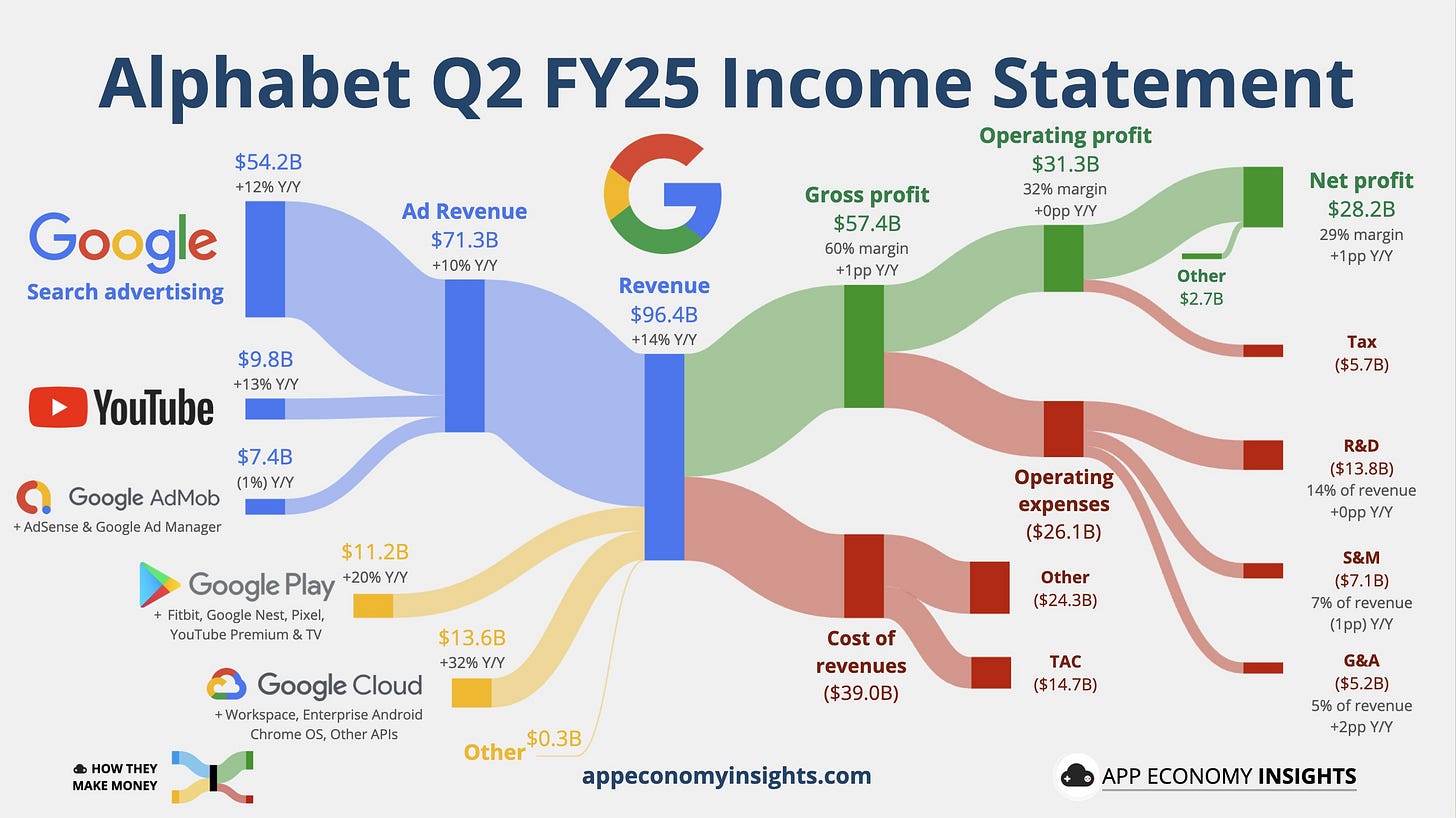

All but one of the Mag7 have now reported

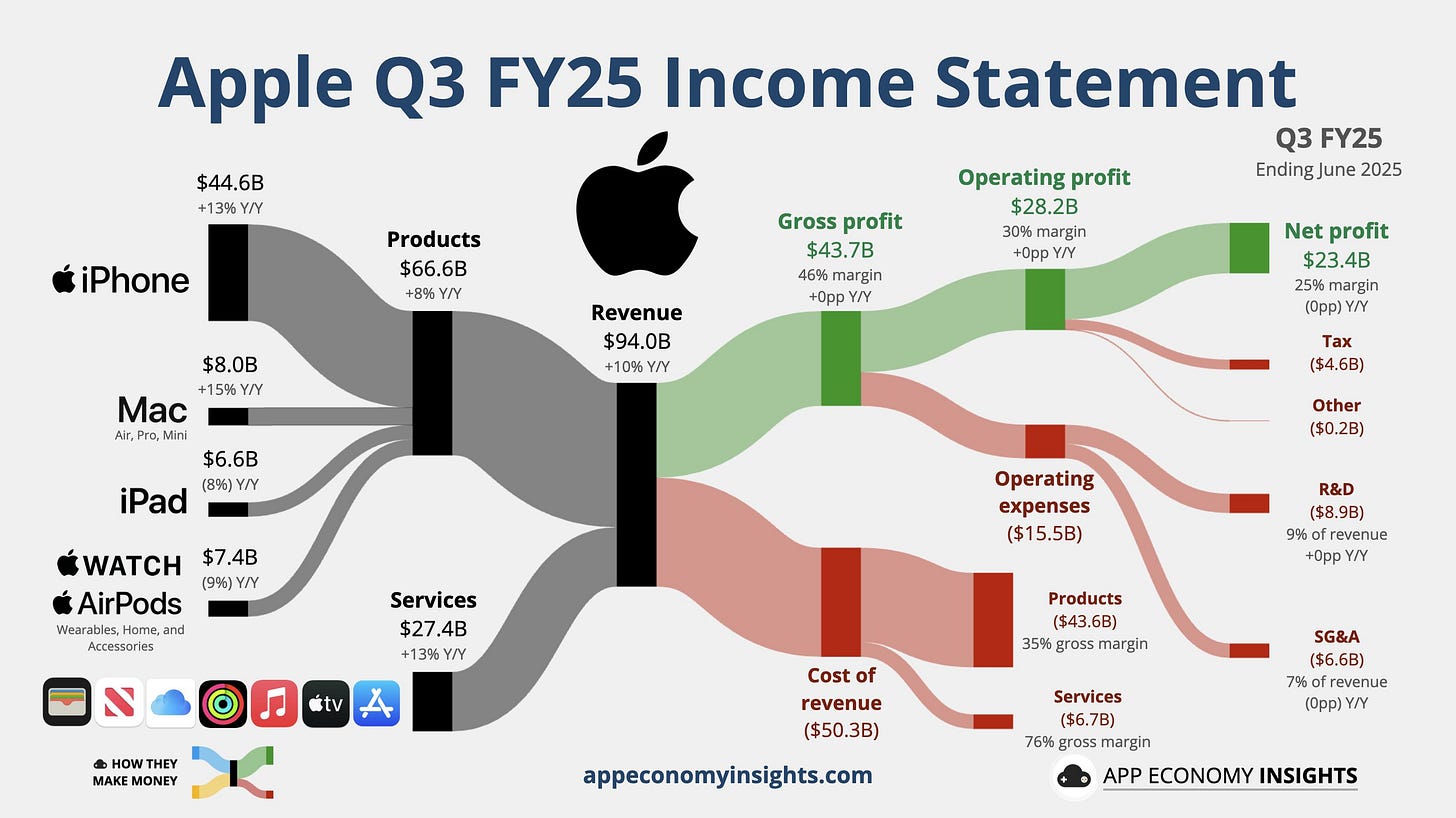

Apple

Amazon

Meta

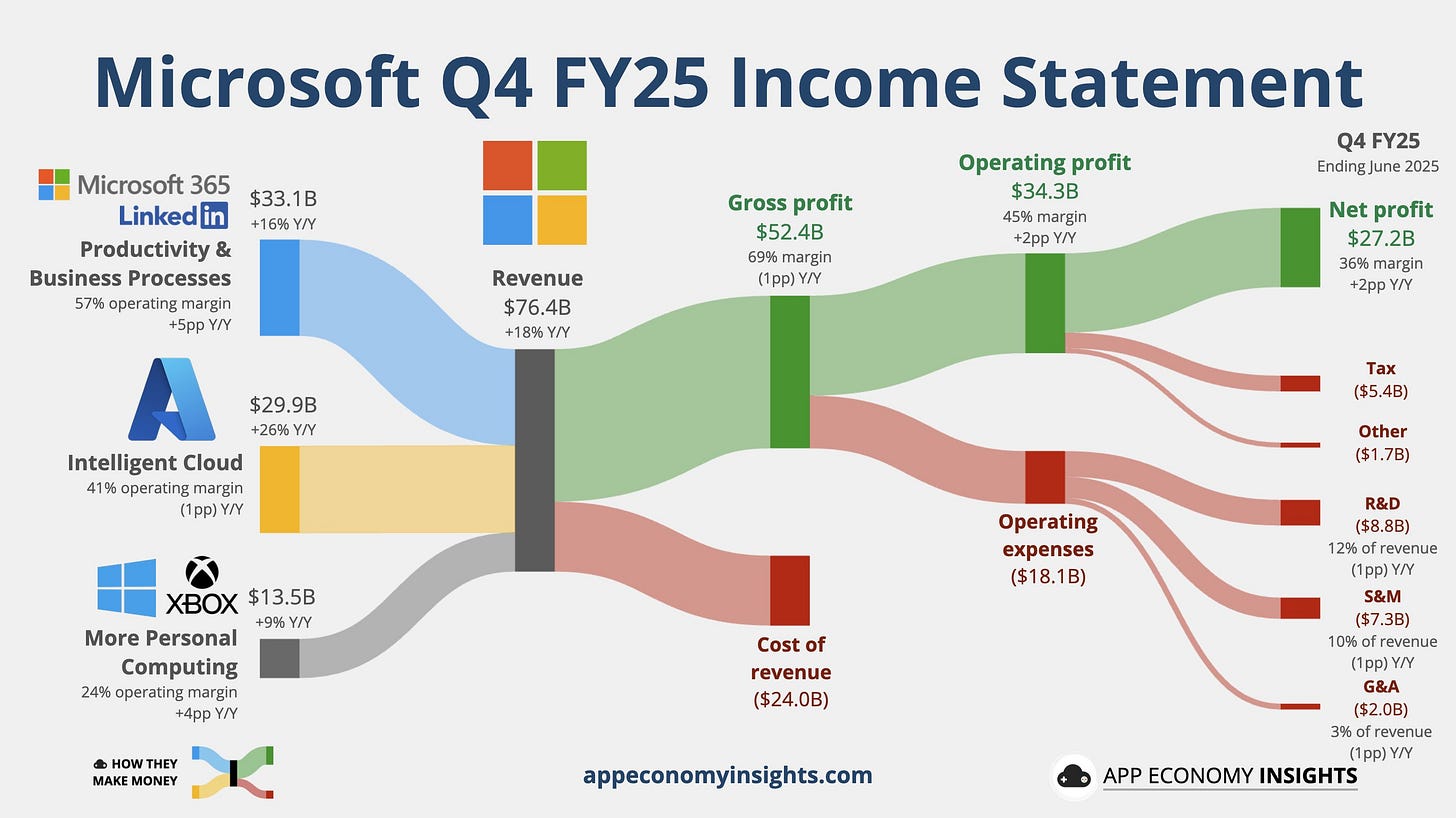

Microsoft

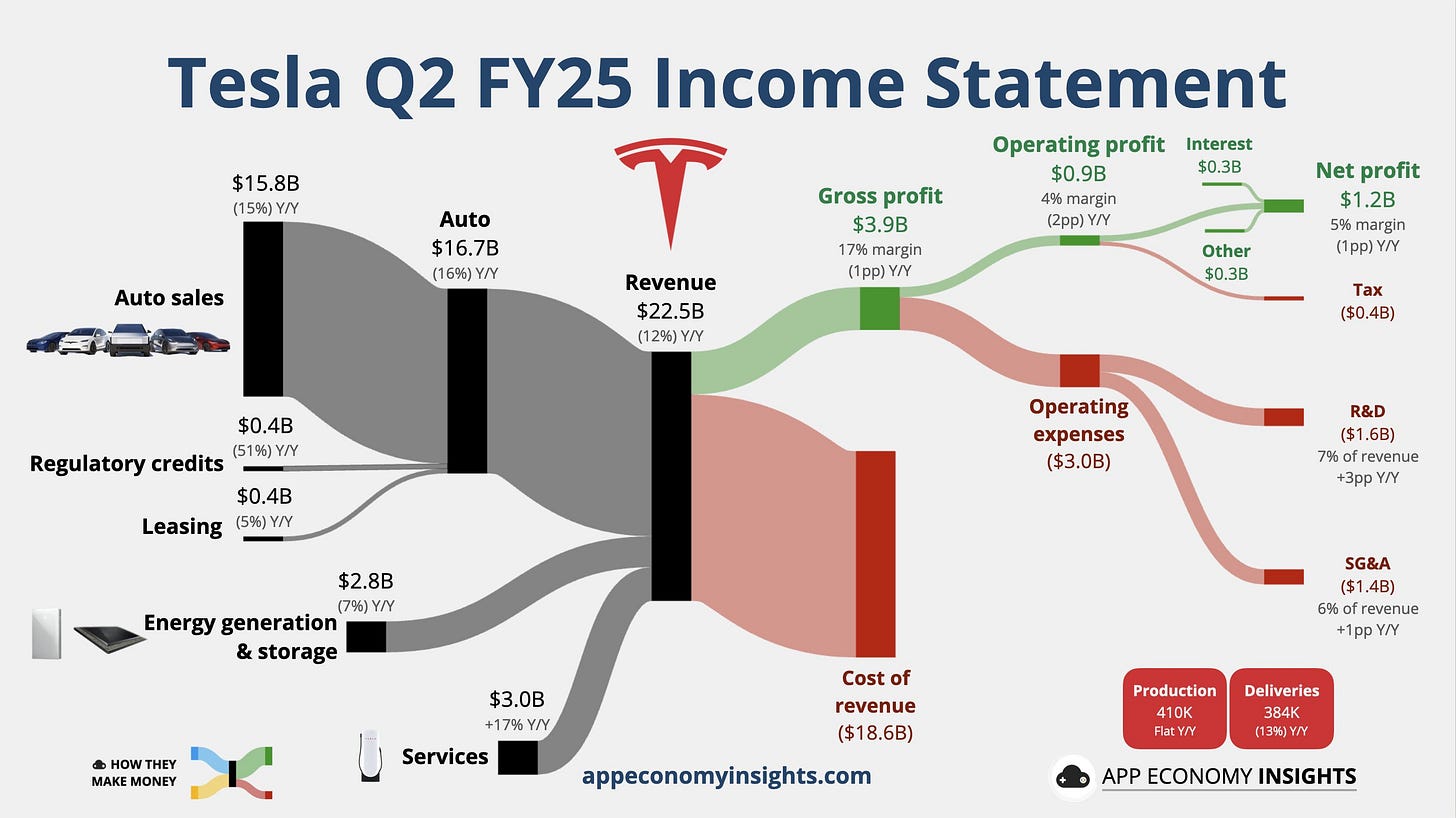

Tesla

Earnings day performance

Earnings season is living up to its reputation - plenty of companies are closing lower on the day, even after decent reports.

Earnings This Week

Join 106,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

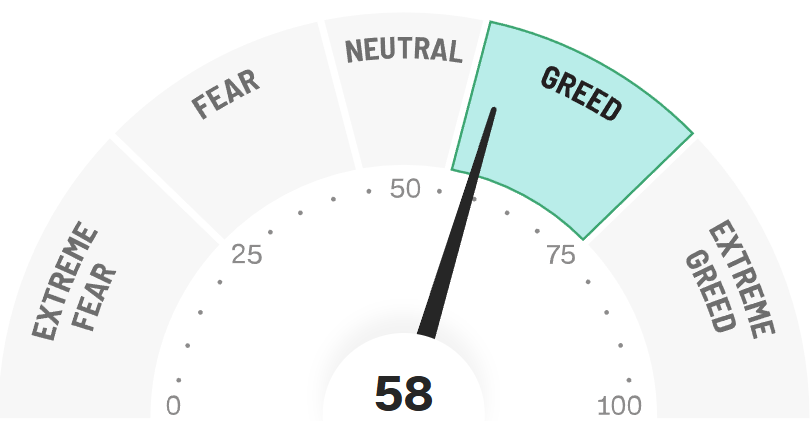

Fear & Greed Index

Are Novo Nordisk (NVO) and UnitedHealth (UNH) A Buy Now?

Novo Nordisk (NVO)

Why Novo Nordisk Is Taking a Hit

Novo Nordisk has been one of the hottest stocks for years, leading the way with its blockbuster weight-loss and diabetes drugs like Wegovy and Ozempic. But recently, the shine has started to fade.

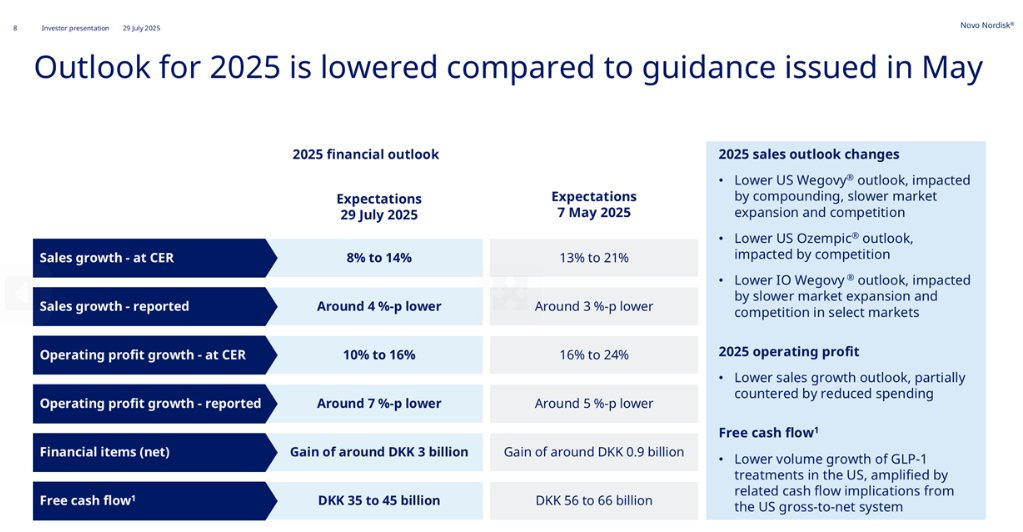

It began when the company lowered its sales and profit growth forecasts for 2025, surprising many investors. Growth still looks solid, but it’s not as strong as previously hoped. The main culprit? Slower-than-expected demand for its key drugs.

Part of the challenge comes from new rivals stepping into the obesity drug market. Eli Lilly, in particular, is making waves with treatments that some patients prefer, putting pressure on Novo’s dominance. Meanwhile, cheaper, unofficial versions of Wegovy are floating around, cutting into Novo’s pricing power and profits.

On top of that, a leadership change stirred unease. Novo appointed a new CEO from within the company who doesn’t have much experience in the U.S. market - the company’s biggest and most important region. Investors were hoping for a fresh face to steer the ship through this rough patch, so this move added to the uncertainty.

Then there’s the political angle. Public calls from Washington for lower drug prices have weighed on Novo’s shares. The pressure to rein in costs in the U.S. raises questions about how much pricing power Novo will have going forward.

All these factors combined have led to a sharp drop in Novo’s stock price - around 64% down from its peak last year, wiping out a huge chunk of its market value.

In short, what was once a clear winner now faces serious headwinds: tougher competition, pricing challenges, and leadership questions. It’s a reminder that even the strongest companies can stumble when the landscape shifts quickly.

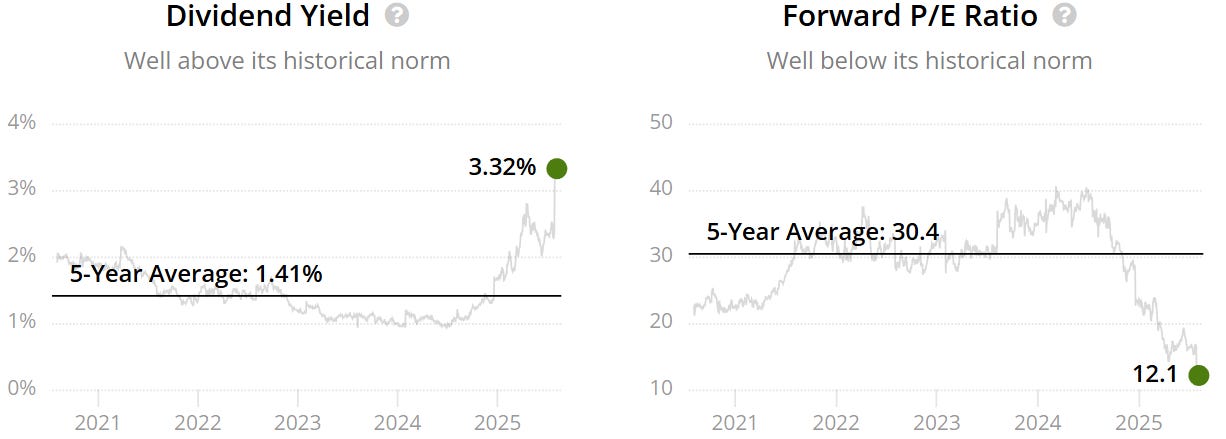

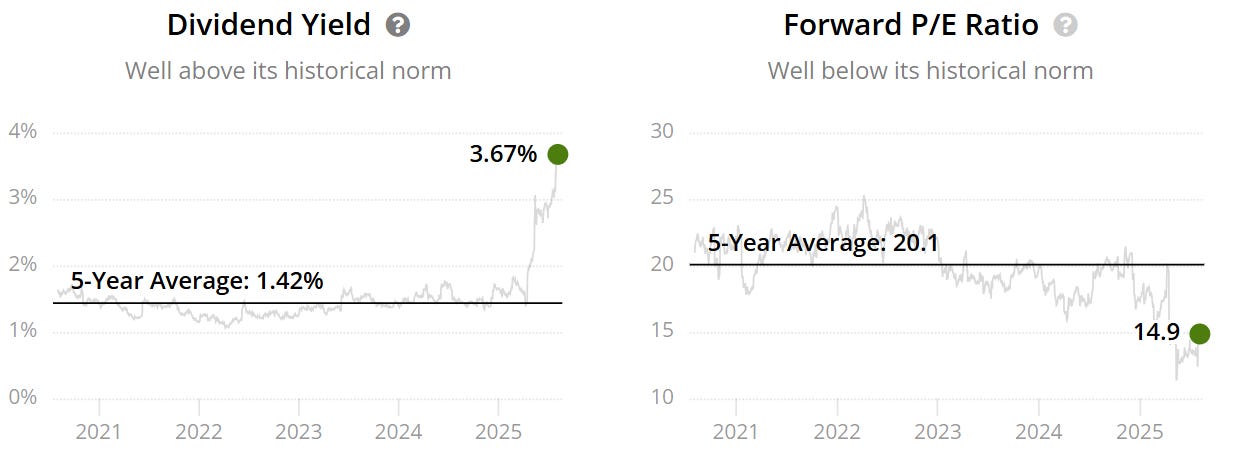

It currently trades at a Forward P/E of 12.1x vs it’s historical 30.4x.

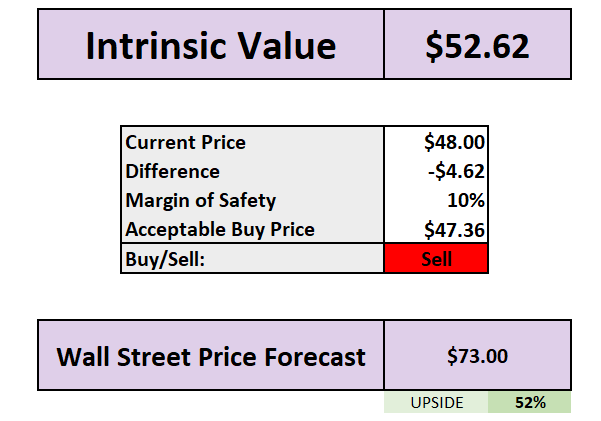

Valuation

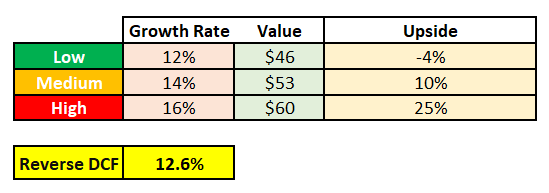

Depending on how much you see NVO growing it’s future free cash flow, you can see that there is potentially upside.

Based on the reverse DCF, it has about 12.6% of growth currently baked into the numbers.

These numbers took a large hit in our DCF model due to the recent cut in gudiance which also affected the expected FCF in 2025.

Based on 14% growth, we see around a 10% margin of safety up to $48.

Wall Street after the huge drop are bullish with a price target in 12 months of $73 (52% upside).

UnitedHealth (UNH)

Why UnitedHealth Group Is Under Pressure

UnitedHealth Group, once a Wall Street darling, is facing a significant downturn. The company recently slashed its 2025 earnings forecast to at least $16 per share, a sharp decline from earlier projections of up to $30. This revision has raised concerns among investors and analysts alike.

Several factors contribute to this situation:

Rising Medical Costs: The company reported a 20% year-over-year increase in medical expenses, particularly within its Medicare Advantage business. This surge in costs has outpaced pricing expectations and is impacting profitability.

Leadership Changes: CEO Andrew Witty's unexpected departure in May 2025 led to the reinstatement of former CEO Stephen Hemsley. This leadership transition has added to the uncertainty surrounding the company's future direction.

Regulatory Scrutiny: UnitedHealth is under investigation by the U.S. Department of Justice for potential Medicare Advantage billing issues. This scrutiny has further complicated the company's operational landscape.

Operational Challenges: The company is grappling with increased healthcare utilization and shrinking markets in Medicaid and Obamacare, which are affecting its overall performance.

As a result of these challenges, UnitedHealth's stock has declined by over 53% this year, reflecting the market's concerns about its ability to navigate these issues effectively.

It currently trades at a Forward P/E of 14.9x vs it’s historical 20.1x.

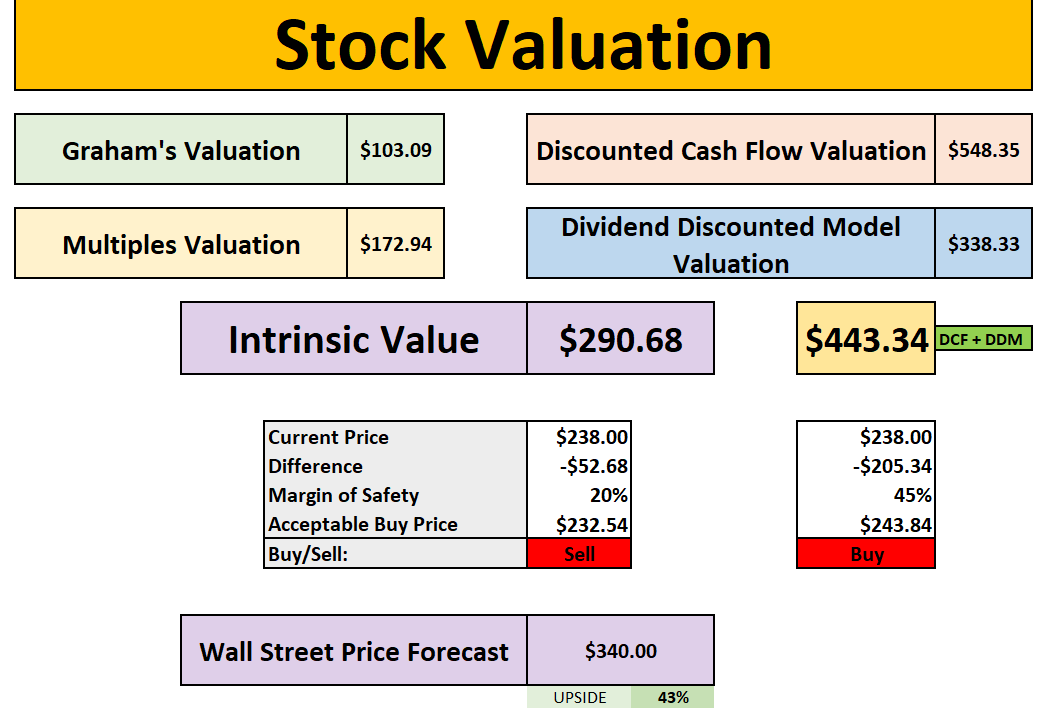

Valuation

The current valuation suggests that if you think these challenges are long-term, then across all four models, the fair value comes to around $291. That means there’s about a 20% margin of safety today.

But if you believe these issues are temporary - more of a one-off that will clear up within a year - then focusing on the DCF and DDM models might make more sense. Those put fair value closer to $340, implying a 45% margin of safety.

Wall Street seems to lean toward that more optimistic view, pricing the stock around $340 going into 2026, which translates to roughly 43% upside from here.

And for consistency, currently baked into the DCF is -5% growth.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 106,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰