Visa & Mastercard Just Dropped 10% — Here’s What You Should Know

A fresh look at market moves, the Fed’s cautious pause, tariff risks, and whether these payment giants are a buy today.

Market Update

Last week, the S&P 500 edged down about 0.34% - marking its second consecutive weekly loss.

This was due to a few factors which included mixed economic data and persistent geopolitical uncertainty, underscoring ongoing investor caution.

Key takeaways included:

🔹 Rates on hold: The Fed maintained current rates, opting for a cautious wait‑and‑see approach amid tariff and broader economic uncertainties.

🔹 Growth remains moderate: The economy shows resilience, though the pace of expansion is slowing.

🔹 Temporary inflation risks: Tariff‑driven inflation may surface in H2, but is expected to be short‑lived.

🔹 Gradual easing path: Fed signals a slow, steady approach to any rate cuts-more akin to the 1995 cycle than deep recession-era easing.

🔹 Geopolitical concerns: Elevated, but so far have had limited impacts on markets.

On a granular level, we had some very poor performers just last week.

Biggest losers included:

Mastercard (MA) down 10%

Accenture (ACN) down 10%

Visa (V) down 9%

Adobe (ADBE) down 9%

Eli Lily (LLY) down 6%

PayPal (PYPL) down 6%

Google (GOOGL) down 5%

Notable News

How will tariffs impact inflation?

So far, tariffs haven’t pushed inflation much-core PCE hit a four-year low in April and May is expected at 2.6%. Many firms used pre-tariff stock or absorbed costs to keep prices stable.

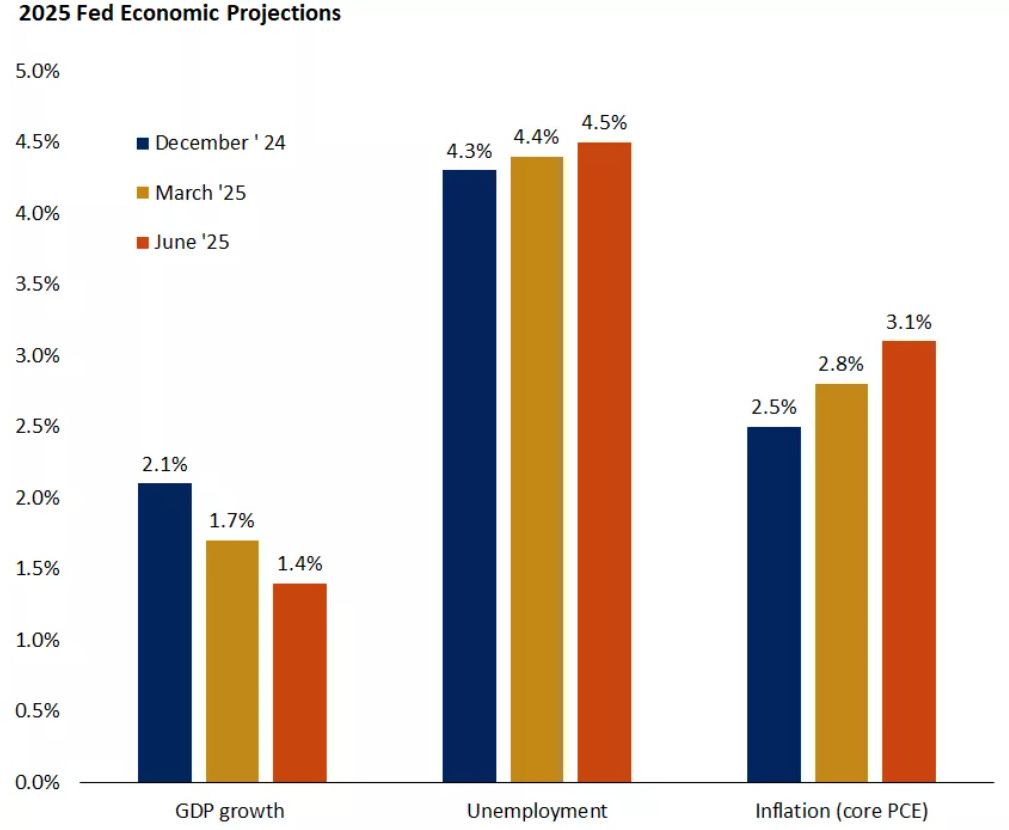

But that’s changing. As inventories run out, companies are starting to raise prices - one reason the Fed bumped its 2025 inflation forecast from 2.8% to 3.1%.

With effective tariffs now near 15% (the highest since 1936), some goods prices may rise, though services inflation should stay steady.

The Fed expects any inflation spike to be temporary and ease by 2026.

Is the Fed still in a rate-cutting cycle?

The Fed is likely on pause this summer, watching data before acting - but easing isn't off the table.

The latest projections still show two cuts in 2025, with a slower pace ahead (just one cut in 2026 and another in 2027).

Markets expect a slightly lower rate path than the Fed, but the gap is narrowing.

With inflation sticky and unemployment ticking up, the Fed remains cautious.

This looks more like a slow, 1990s-style cycle, not the sharp recession cuts of 2008 or 2020.

What role do geopolitics play?

Rising tensions, especially around the Israel–Iran conflict, add uncertainty -mainly through potential oil price spikes.

So far, markets have been resilient. Past conflicts rarely caused lasting inflation or market damage.

The U.S. is now a net oil exporter, and energy makes up a smaller slice of GDP, which helps cushion the impact.

How to position portfolios for an uncertain summer

Markets have rallied over 20% since early April, but with the Fed on hold and geopolitical risks rising, the summer could bring more volatility.

Diversified portfolios have held up well so far.

Bonds continue to offer solid income.

Equities may benefit from clarity on tariffs or a softer U.S. dollar.

In the U.S., leadership is broadening beyond tech, with financials and health care showing opportunity.

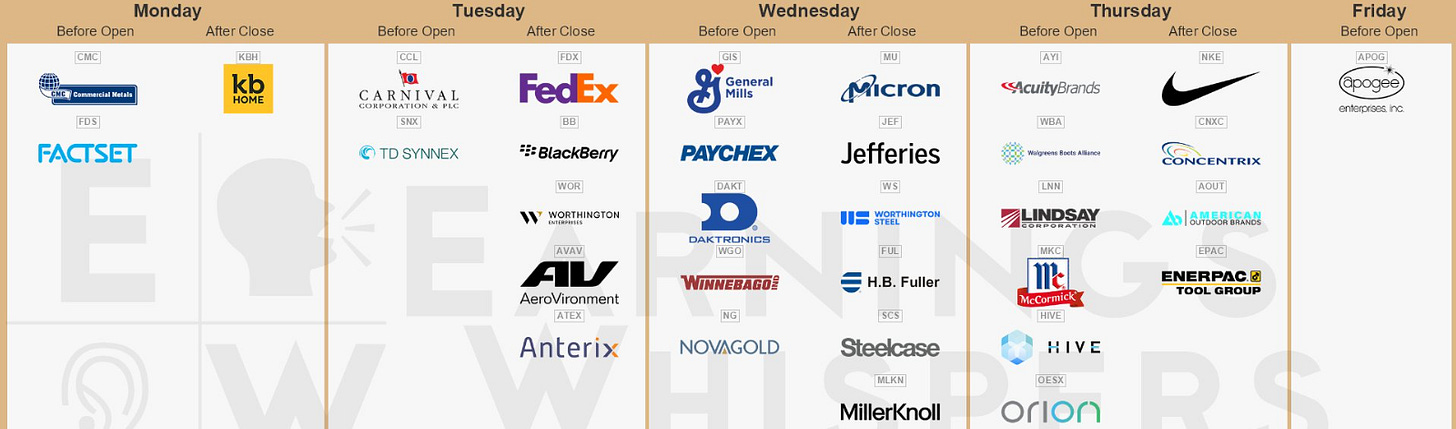

Earnings This week

Join 97,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

Visa & Mastercard Hit 10%

Why are they both down?

Visa and Mastercard dropped about 10% as big retailers like Walmart and Amazon look into creating their own stablecoins - digital dollars that could let them avoid the usual card payment systems.

This could mean huge transaction volumes moving away from Visa and Mastercard, saving merchants billions in fees and speeding up payments, especially for international suppliers.

With new laws like the Genius Act possibly making stablecoins easier to use, investors are worried this could cut into the profits of these payment giants.

It’s a real challenge to their business model and why their shares have taken a hit.

The Genius Act aims to create a clearer regulatory framework for stablecoins, which could speed up their adoption by major retailers and financial firms.

If passed, it would make it easier for companies like Walmart and Amazon to issue their own stablecoins, potentially bypassing traditional payment networks like Visa and Mastercard.

This threatens these card companies’ transaction volumes and fee revenues.

At the same time, big banks like JPMorgan, which already has its own stablecoin called JPM Coin (JPMD), could benefit by gaining wider acceptance and clearer rules.

The Act could help JPMorgan expand its stablecoin usage beyond internal transfers, putting it in direct competition with both traditional card networks and new merchant-issued digital currencies.

So, while the Genius Act challenges Visa and Mastercard, it may boost JPMorgan’s stablecoin ambitions.

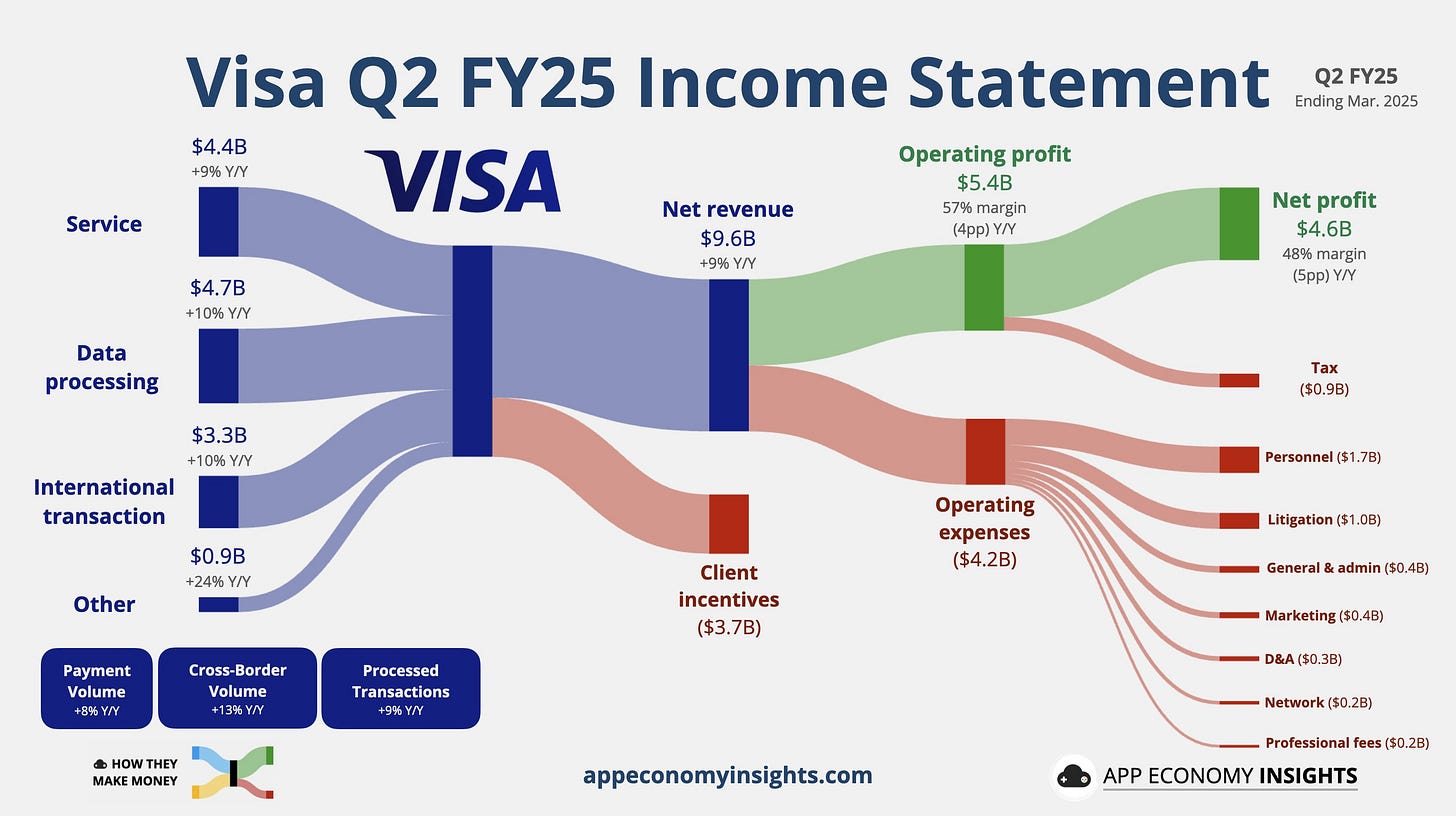

What is their business model?

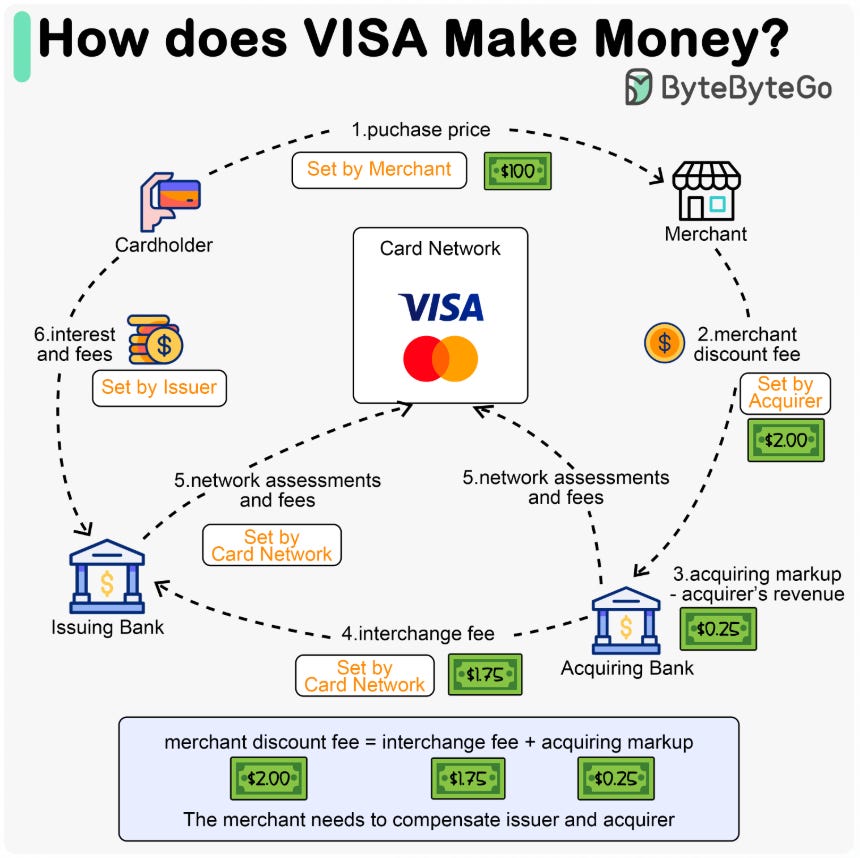

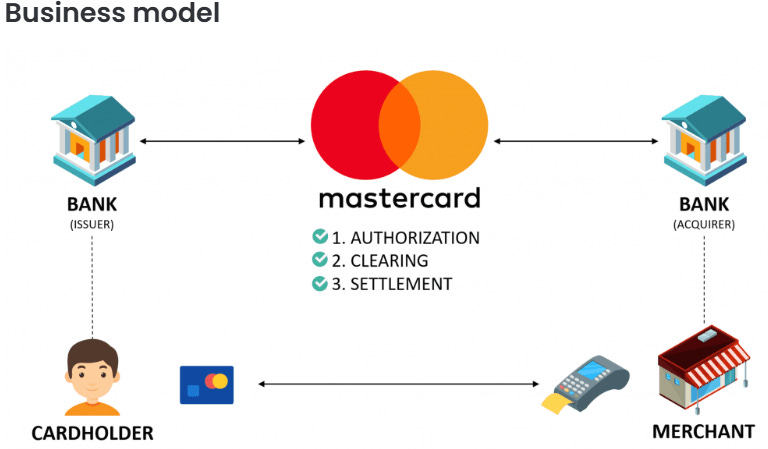

Visa and Mastercard operate as payment networks - they don’t issue credit cards themselves or lend money.

Instead, they connect banks, merchants, and consumers, enabling electronic payments around the world.

Their main revenue comes from fees charged on each transaction processed through their networks. These include:

Interchange fees: Paid by merchants’ banks to card-issuing banks, a portion of which is shared with Visa or Mastercard for facilitating the transaction.

Assessment fees: Charged directly to merchants’ banks based on transaction volume.

Service fees: For additional products like fraud protection, data analytics, and payment processing tools.

Because their revenue depends on transaction volumes and dollar amounts flowing through their networks, anything that reduces card usage - like merchants adopting alternative payment methods or stablecoins - poses a risk to their business.

Business model simplified:

Time to buy?

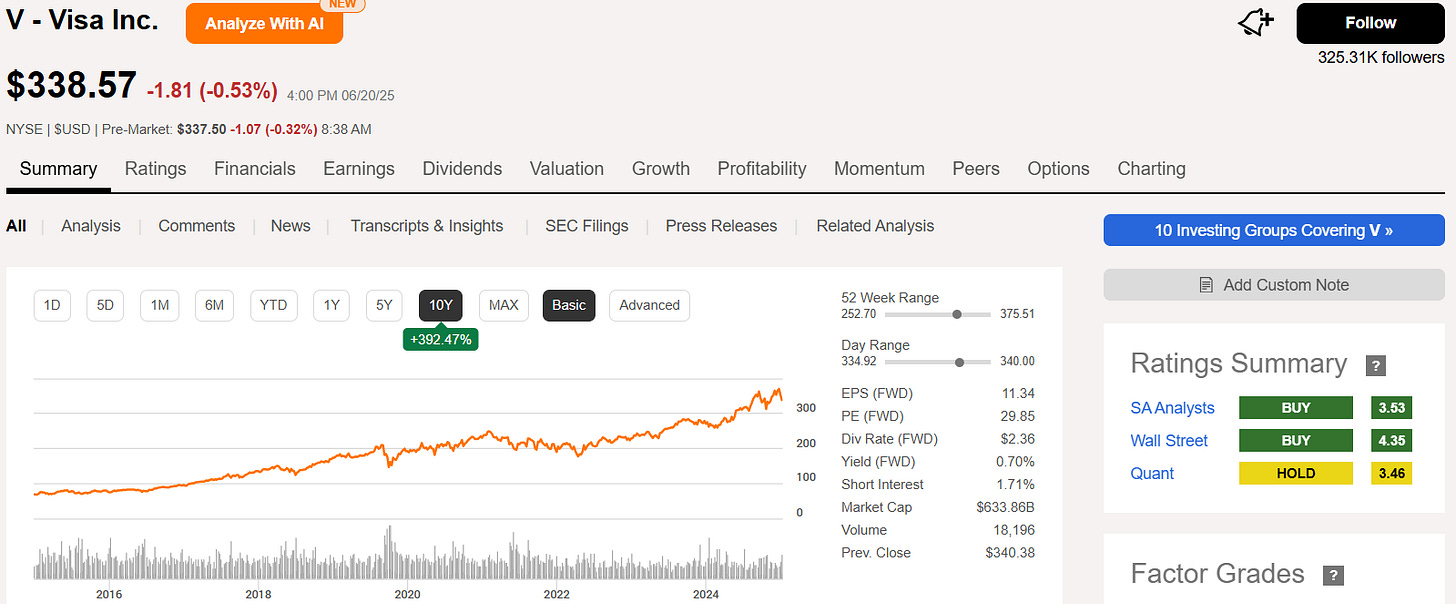

Visa (V)

Visa have massively outperformed against the S&P 500 over the last 10Y.

Their revenue was also up 9% in their latest quarter vs prior year.

They have also outperformed in their last 3 quarters (vs analyst expectations), and expect double-digit EPS growth in the next 4.

We note a reasonable valuation signal as both yield and forward P/E are not too dissimilar from the 5Y average.

We also note this from the blue tunnel methodology below.

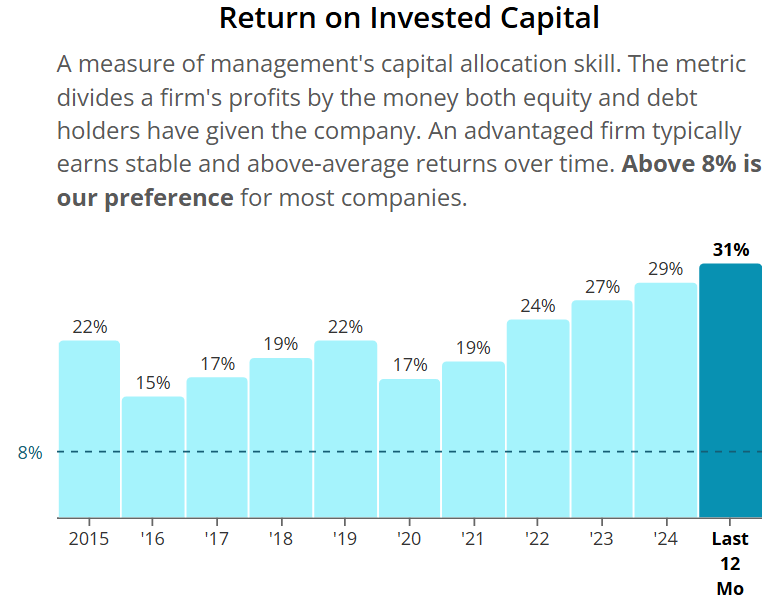

ROIC is consistently very high.

Margins are phenomenal - one of the best in the whole S&P 500.

And an incredibly strong balance sheet as we can see Net Debt to EBITDA sits at 0.26.

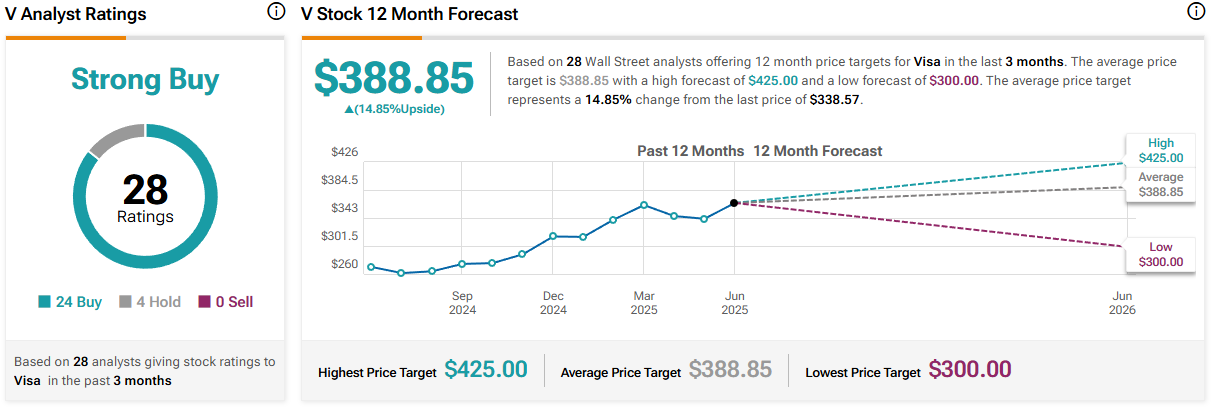

As per below, Wall Street see 15% upside over the next 12 months.

Visa is offering a 10% Margin of Safety at $341.

Visa is offering a 15% Margin of Safety at $322.

This is based on a growth rate to the free cash flow moving forwards at 10%.

Mastercard (MA)

Mastercard have massively outperformed against the S&P 500 over the last 10Y.

Their revenue was also up 14% in their latest quarter vs prior year.

They have also outperformed in their last 4 quarters (vs analyst expectations), and expect EPS growth in the next 4.

We note a reasonable valuation signal as both yield and forward P/E are not too dissimilar from the 5Y average.

We also note this from the blue tunnel methodology below.

ROIC is consistently very high.

Margins are fantastic!

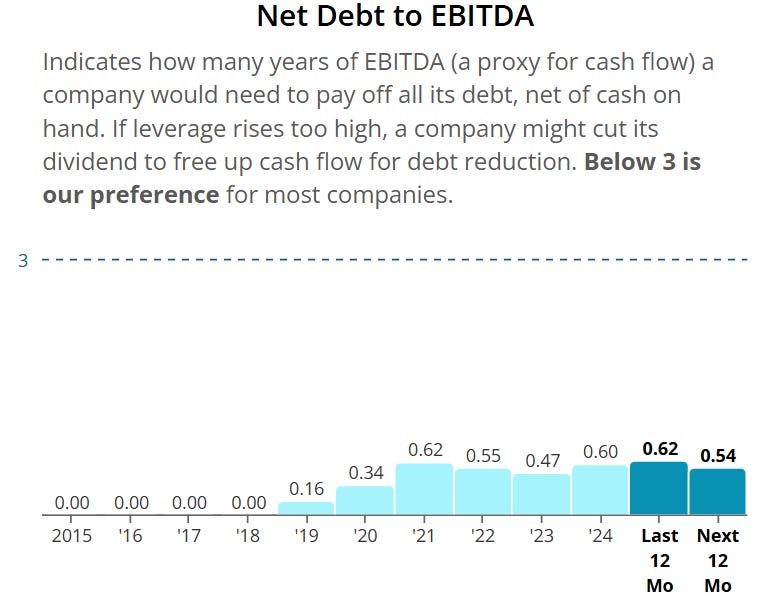

Another excellent balance sheet.

As per below, Wall Street see 20% upside over the next 12 months.

Mastercard is offering a 5% Margin of Safety at $517.

Mastercard is offering a 10% Margin of Safety at $489.

This is based on a growth rate to the free cash flow moving forwards at 12% (higher rate used for MA over V as the growth of the company reflect this).

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 96,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.

Visa and Mastercard rarely dip together without a deeper signal. Do you think this move reflects a structural shift in payment rails?