Warren Buffett’s Final AGM?

Big Moves, Cash Hoard, and What Comes Next

Introduction

Every May, thousands of investors descend on Omaha for one reason: to hear Warren Buffett and Charlie Munger (in spirit) break down the state of Berkshire Hathaway.

The 2025 Annual General Meeting didn’t disappoint.

From unexpected portfolio shifts to sharp takes on the economy, Buffett delivered another masterclass in long-term thinking.

Whether you missed it or want the key takeaways distilled - this recap covers what matters: the performance, the buys and sells, and the subtle signals that might shape markets for months to come.

1. Berkshire's Performance Snapshot

A strong market showing but mixed signals under the hood.

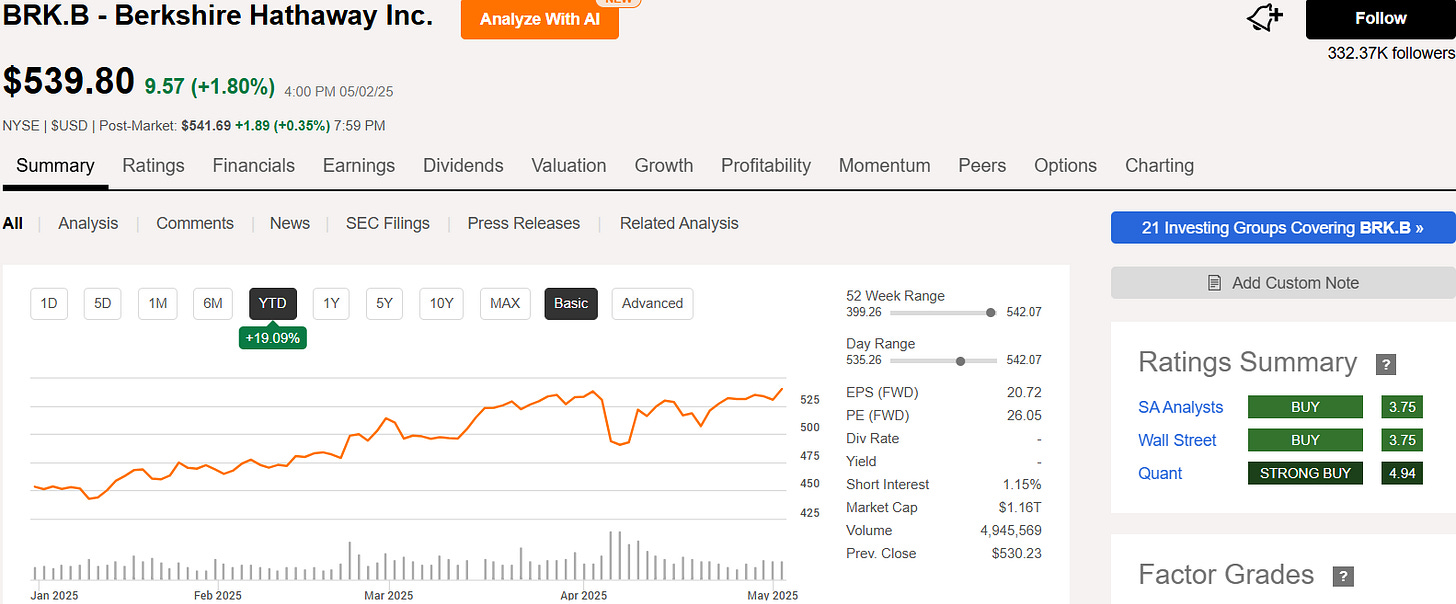

Stock Performance vs. S&P 500 (YTD 2025):

Berkshire Hathaway Class B shares ($BRK.B) hit an all-time high of $542 heading into the AGM, up approximately 19% year-to-date, massively outperforming the S&P 500.

Which is down around 3% over the same period.

Investors continue to reward Berkshire’s resilience and fortress balance sheet amid market uncertainty.

Operating Business Highlights:

Despite the stock’s climb, operating earnings fell 14% to $9.64 billion in Q1 2025.

A breakdown of the key segments:

Insurance (GEICO & Reinsurance): A notable drag this quarter, with a $1.1 billion underwriting loss driven by catastrophic events, including California wildfires.

BNSF (Rail): Continued to underperform, hit by lower freight volumes and fuel costs. Revenue and profits both declined year-over-year.

Berkshire Hathaway Energy: Delivered stable results, though regulatory headwinds continue to weigh on long-term visibility.

Manufacturing, Service, and Retailing: This group held up relatively well, though growth has slowed, reflecting broader macro softness.

Cash Position Update:

Berkshire’s legendary war chest is now bigger than ever.

The company ended Q1 2025 with a record $147.4 billion in cash and equivalents, and total liquidity (including short-term Treasuries) sits at a staggering $347.7 billion.

Buffett noted that while they'd love to put the cash to work, current valuations simply aren’t offering attractive enough opportunities.

“We’re not seeing anything that makes us want to part with our cash… but that can change fast.” – Warren Buffett

2. What Buffett Bought/Sold

Few new plays, but conviction remains high in select bets.

No Major New U.S. Positions Revealed (Yet):

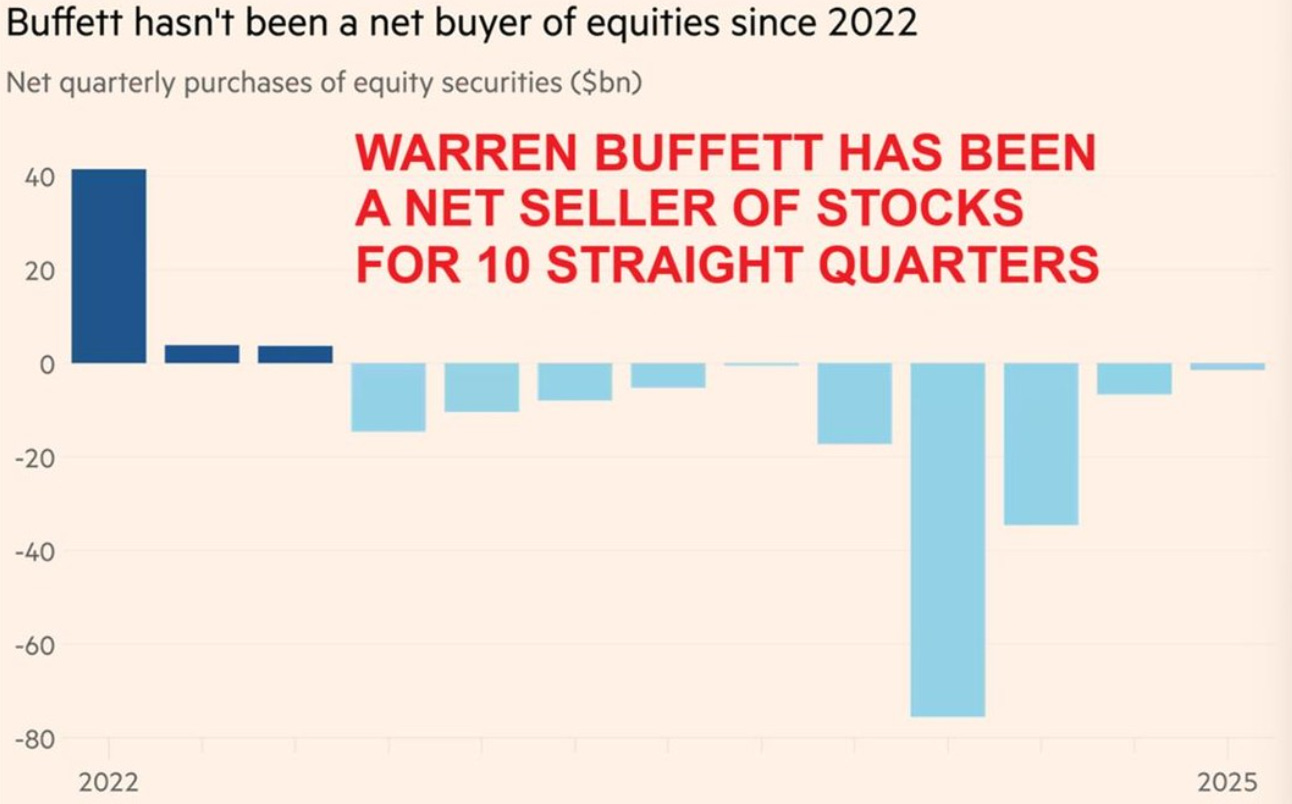

Despite Berkshire’s record $347.7 billion in liquidity, Buffett didn’t unveil any big new U.S. stock purchases at the meeting.In fact, Berkshire was a net seller of equities in Q1 2025, offloading $4.68 billion worth of stocks while purchasing just $3.18 billion - a continuation of the company’s cautious streak, marking the 10th straight quarter of net selling.

“The opportunities have to be significant. And right now, they’re not.”

Canada on the Radar:

Still, Buffett did hint at one area of interest - Canada. While not disclosing details, he suggested Berkshire is actively evaluating a potential investment north of the border:“We do not feel uncomfortable in any way shape or form putting our money into Canada. In fact, we’re actually looking at one thing now.”

Reaffirmed Commitment to Japanese Trading Houses:

Buffett once again endorsed Berkshire’s substantial positions in Japan’s five major trading houses - Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo — now holding about 8.5% of each.These sprawling conglomerates, involved in everything from commodities to energy to shipping, continue to impress Buffett with their capital discipline and broad-based earnings.

“They’re the kind of businesses we could hold forever.”

No Share Buybacks Again:

Notably, Berkshire did not repurchase any of its own shares for the third consecutive quarter - another reflection of Buffett’s disciplined stance in a market he views as fully priced.Patience Over Action:

While Q1 didn’t bring flashy new positions, the message was clear: Berkshire isn’t afraid to wait. When deals are scarce, sitting on a pile of cash is the strategy.“We’re not seeing bargains… and we’re not afraid to wait.” – Warren Buffett

3. Buffett’s Commentary

Buffett reflects on market dynamics, AI, and succession plans for the future.

Buffett Announces Retirement and Succession Plan

During the AGM, Warren Buffett, at 94, announced his intention to step down as CEO of Berkshire Hathaway by the end of 2025.

He named Greg Abel, currently Vice Chairman overseeing non-insurance operations, as his successor. Buffett expressed full confidence in Abel's capabilities, emphasizing that the company's culture and investment philosophy would remain intact.

He also stated his intention to remain available in an advisory capacity post-retirement.

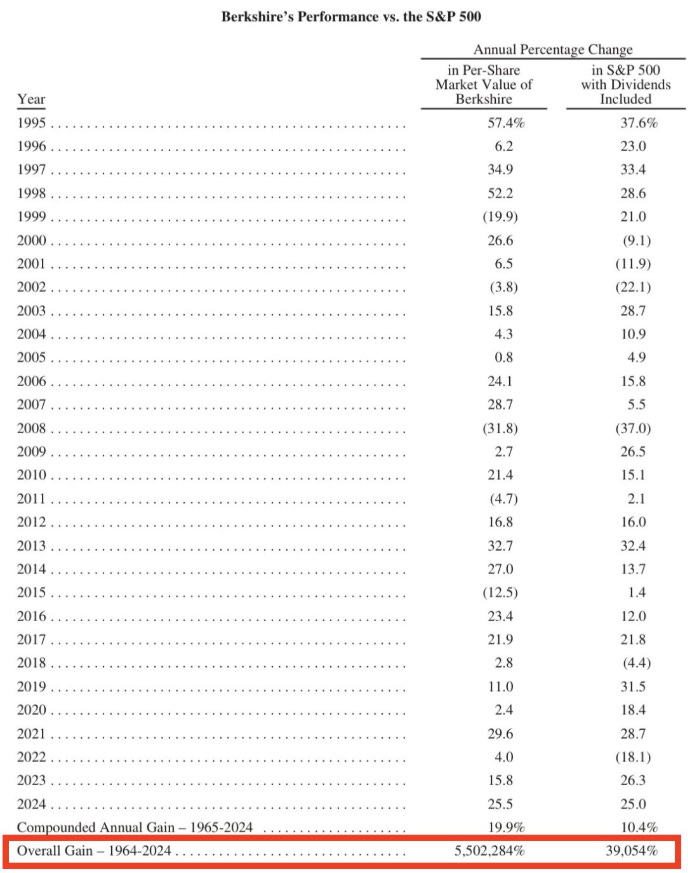

Since 1964, Berkshire Hathaway has returned over 5,500,000%.

That's 5.5 million percent.

A $10,000 investment in 1964 would be worth $550 million today.

This compares to a ~39,000% return in the S&P 500.

Buffett has outperformed the S&P 500 by over 140 times.

Market Valuations:

Despite the impressive performance of Berkshire’s stock, Buffett continued to express caution about the broader market. He described current valuations as high, making it difficult to find meaningful opportunities at a good price. He emphasized that Berkshire is in no rush to deploy its massive cash reserves unless a truly attractive investment emerges.Interest Rates & Inflation:

When asked about the ongoing inflationary environment and the Federal Reserve's interest rate policy, Buffett acknowledged the headwinds from high interest rates, noting they have a broad impact on corporate profits and investments. While he didn’t express concern about the immediate future, he emphasized the unpredictable nature of inflation and interest rates.Artificial Intelligence (AI):

Buffett remains cautious about the impact of AI on the economy and investing landscape. While he acknowledged its potential, he warned that the technology could lead to new forms of scams and fraud, drawing comparisons to the destructive potential of nuclear weapons. Buffett’s cautious stance on AI is grounded in its uncertain long-term societal implications, even as he recognizes its immediate utility in sectors like finance and healthcare.

“AI is something we don’t understand as well as we should… but it will be impactful, for good and bad.”

Trade Policy & Global Relations:

Buffett took the opportunity to comment on the state of international trade and global relations, particularly with the U.S.-China tensions. He stressed that trade should never be weaponized and emphasized the importance of maintaining strong, mutually beneficial relationships between countries.

“Trade shouldn’t be a weapon. The world depends on cooperation, not conflict.”

4. Final Thoughts

Berkshire remains the patient investor in a volatile world.

Warren Buffett’s 2025 AGM was filled with the same wisdom and humility that has made him one of the most respected investors of all time. Despite the remarkable cash reserves and a robust stock performance, Berkshire Hathaway continues to play the long game, sticking to its tried-and-true principles of value investing, patience, and risk aversion.

The Cash Pile is Not a Signal to Buy at Any Price:

Buffett made it clear that Berkshire’s mountain of cash is not an indication that they’re about to dive into any deal. Instead, it serves as a buffer against high valuations and market uncertainty. His message was simple: if the right deal comes along, Berkshire will be ready, but it won’t overpay to deploy cash into the market at inflated prices.A Cautious Optimism on the Economy:

While he expressed concern about high valuations, inflation, and interest rates, Buffett remained cautiously optimistic about the economy. He acknowledged the resilience of the U.S. economy but warned that businesses need to be prudent in their expectations for growth, especially in an environment of rising costs and interest rates.Staying True to the Buffett Playbook:

In a world increasingly driven by short-term market swings, Berkshire’s long-term focus remains its key differentiator. The company’s diversified portfolio, emphasis on cash, and cautious investment strategy have allowed it to weather market storms while avoiding the pitfalls that can trap other investors.

"The stock market is a device for transferring money from the impatient to the patient." – Warren Buffett

As we look forward, Berkshire Hathaway is well-positioned to continue its track record of success - guided by Buffett’s timeless wisdom and Greg Abel’s capable leadership.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 90,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.