Why The First $100k Is The Hardest!

You're Then 1/4 Of The Way To A Million!

Charlie Munger

In the 1990’s a young man asked Charlie Munger at the Berkshire Hathaway meeting what his best advice was for someone trying to create wealth.

Charlie’s famous response was:

“ The first $100,000 is a bitch, but you gotta do it. I don’t care what you have to do - if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that you can ease off the gas a little bit”

Why does Charlie Munger place so much emphasis on the first $100,000? - Let’s find out!

Getting To Your First $100,000

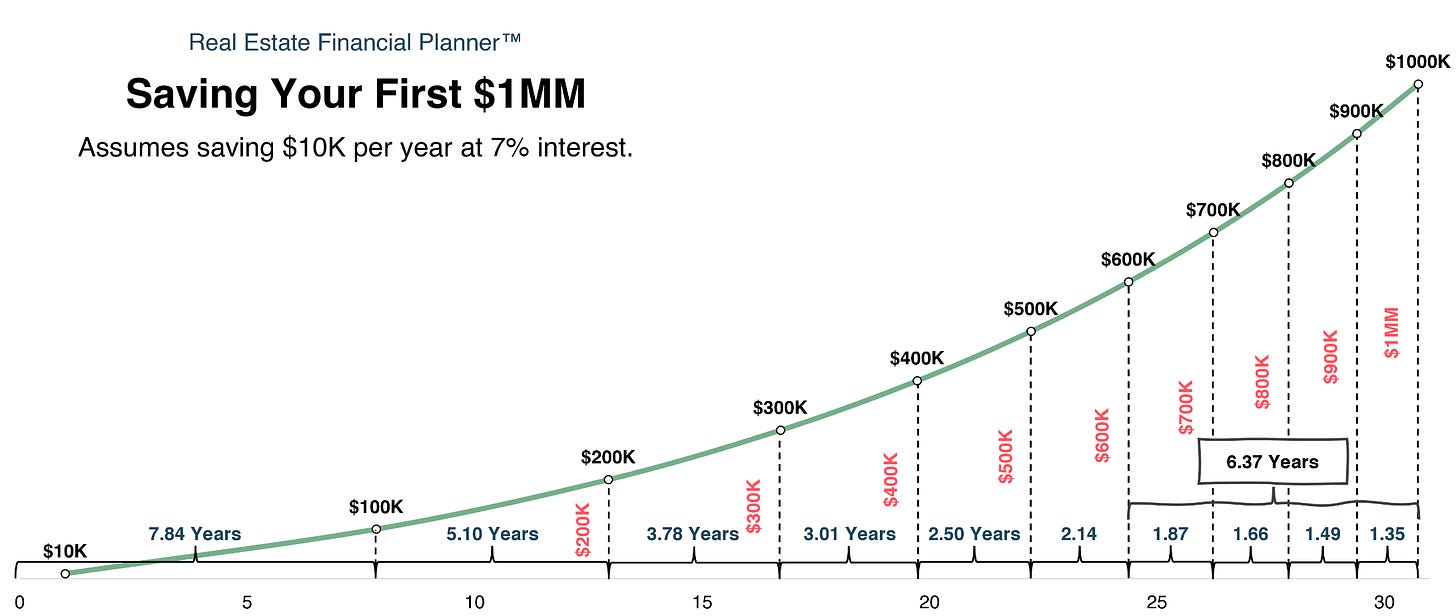

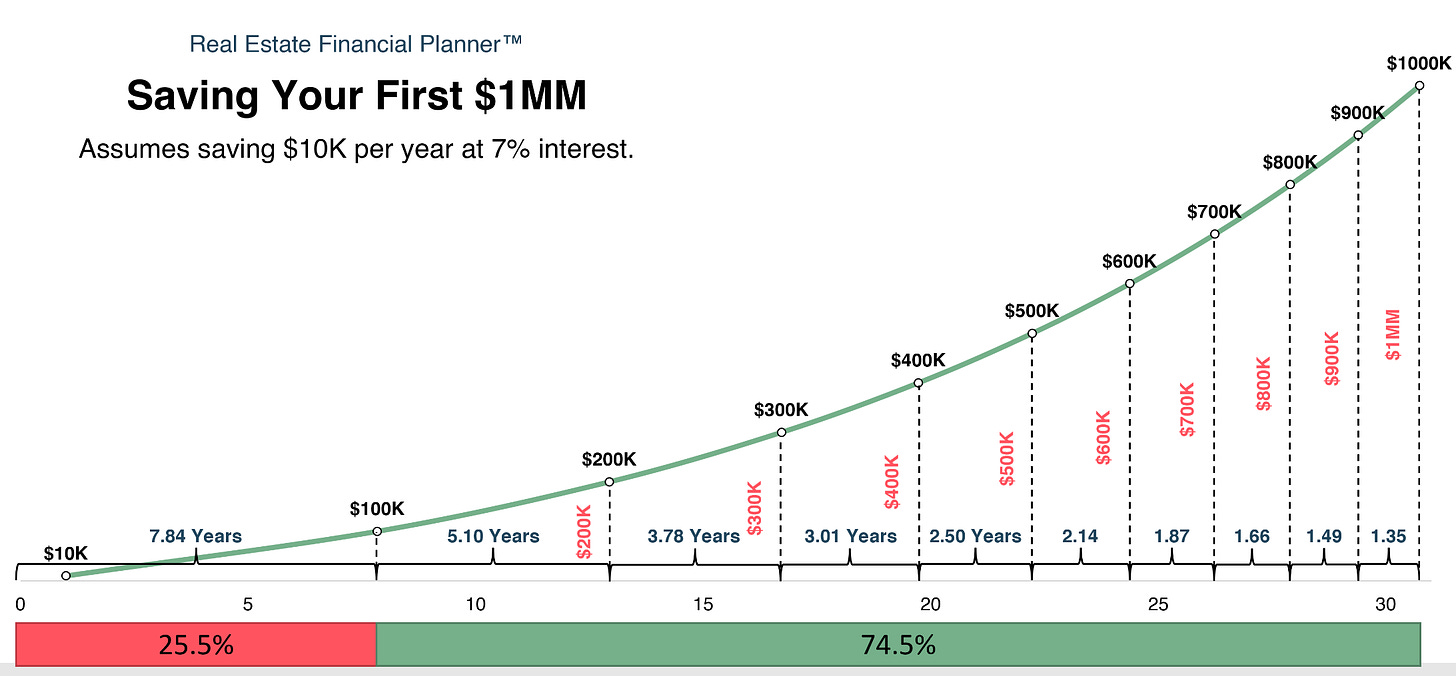

We are going to use the following assumptions:

A savings rate of $10,000 a year

A 7% return on your investment (S&P 500 has returned between 8-10% over the last 40 years, so we can be more conservative here and also deduct management fees)

As we can see below it would take us 7.84 years to save up our first $100,000. We are about to show you why the first $100,000 is the hardest and longest.

Getting To $200,000

As we can see below getting to the next $100,000 mark will take us 5.10 years, that is 2.74 years quicker than the first $100,000, and if you like percentages that is 35% quicker!

Arriving At $500,000

The point to take from the above graph is that every $100,000 after the first becomes increasingly quicker to obtain.

The reason for this is compounding.

The first $100,000 took 7.84 years.

The second $100,000 took 5.10 years.

The third $100,000 took 3.78 years.

The fourth $100,000 took 3.01 years.

The fifth $100,000 took 2.50 years.

What’s interesting here is that the additional $10,000 you are investing each year becomes less important and instead the 7% return you earn becomes more and more important, here’s why:

The first $100,000, you contributed towards that 7 years of $10,000 which totals $70,000 of the first $100,000. This equates to 70%.

The first $200,000, you contributed 12 years of $10,000 which totals $120,000 of the $200,000. This equates to 60%.

The first $3000,000, you contributed 16 years of $10,000 which totals $160,000 of the $300,000. This equates to 53%.

The first $400,000, you contributed 19 years of $10,000 which totals $190,000 of the $400,000. This equates to 48%.

The first $500,000, you contributed 22 years of $10,000 which totals $220,000 of the $500,000. This equates to 44%.

Getting To $1,000,000

Now for an incredible fact - the last $400,000 (going from $600,000 to $1,000,000) would take you 6.37 years. Now remember it took you longer to earn just the first $100,000 (7.84 years).

So it has taken you less time to earn four times as much when you get towards the end.

Conclusion

So we can see what Charlie Munger is referring to when he explains that the first $100,000 is the hardest and why it is so vitally important that you must get there as quick as possible and through whatever (legal) means you can.

As we can see below getting to your first $100,000 would take you 25.5% of the time whilst it would take 74.5% of the time to get to the remaining $900,000.

The table below shows exactly how long it takes to save up each $100,000 on your way to $1,000,000.

What If I Save More Or Less?

The table below shows the number of years it would take you to save for your first $1,000,000 on a 7% return rate contributing between $1,200 a year to $30,000.

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.

In today’s newsletter we have used information from RealEstateFinancialPlanner.com

Additional Information

If you would like to read the incredible tribute that Warren Buffett gave to Charlie, essentially calling him the ‘Architect’ of Berkshire Hathaway, you can read it here along with Warren’s letter to the Berkshire shareholders:

https://www.berkshirehathaway.com/letters/2023ltr.pdf

Thank you for the comprehensive article! Love it!