Buy The Dip On These 2 Undervalued Stocks?

+ Market Update

Market Latest

As this year rapidly comes to an end, when we look at the year so far, the S&P 500 is up a respectable 22.46%.

As we can see, more often than not, the S&P 500 ends the year up in the green.

Focusing on this week, more than one-third of the S&P 500 companies have reported Q3 results.

Approximately 75% of them have beaten Wall Street profit expectations, compared with the five-year average of 77%.

Tech stocks climbed higher on Friday which helped lift the Nasdaq to a new intraday high, while the broader market closed out a losing week.

Both indexes (S&P 500 and Dow industrials) ended their six-week winning streaks.

The majority of stocks last week faced some of the worst periods they have seen in 2024.

Biggest losers last week included:

Danaher (DHR) down 11%

International Business Machines (IBM) down 8%

McDonald’s (MCD) down 8%

Tractor Supply (TSCO) down 8%

Lockheed Martin (LMT) down 8%

Zoetis (ZTS) down 7%

S&P Global (SPGI) down 7%

Verizon (VZ) down 6%

Keurig Dr Pepper (KDP) down 6%

There were many more too.

Notable News

NYSE Extending Trading Hours

NYSE announced on Friday that they are planning to extend trading to 22 hours a day and will be filling plans with the SEC (Securities Exchange Commission).

Starbucks Announced Preliminary Results

On Tuesday Starbucks announced preliminary results for their earnings which is taking place this Wednesday after hours.

Key Takeaways:

Suspends FY 2025 outlook

10% drop in foot traffic in North American stores

Raises dividend by 7%

EPS $0.80c vs $1.03 expected

Revenue $9.1bn vs $9.38bn expected

McDonald’s quarter pounders linked to E. Coli

On Tuesday, the Centers for Disease Control (CDC) announced that an E. Coli outbreak was linked to MCD quarter pounders which so far has led to 10 hospitalisations and 1 death.

Tesla Earnings

The market clearly liked their earnings as they were up 25%, key takeaways included:

EPS $0.72c vs $0.58c expected

Revenue $25.18bn vs 25.37bn expected

Margin improvement noted

More affordable models of Tesla to be released in first half of 2025

Earnings This Week

Possibly the biggest earnings week is taking place next week:

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 56,000:

Fear and Greed Index

Last week we sat at Extreme Greed, and now we are very close to the border of Greed/Neutral.

We’ve mentioned it before but do remember sentiment from investors can change rapidly and with big catalysts taking place next week we could be in for a very rocky period.

2 Undervalued Dividend Stocks

Let’s dive into 2 stocks we like that have been beaten down recently and have significant upside over the next 12 months according to Wall Street analysts:

Coca-Cola FEMSA (KOF)

Coca-Cola FEMSA (KOF), is the largest Coca-Cola bottler in the world in terms of sales volume.

Headquartered in Mexico City, it operates as a joint venture between FEMSA (Fomento Económico Mexicano, S.A.B. de C.V.), a prominent Mexican multinational beverage and retail company, and The Coca-Cola Company.

Coca-Cola FEMSA manages the production, distribution, and marketing of Coca-Cola beverages, as well as other non-alcoholic drinks in many Latin American countries and parts of the Philippines.

KOF is up 55% over the last 5Y and has marginally outperformed the S&P 500 in this period.

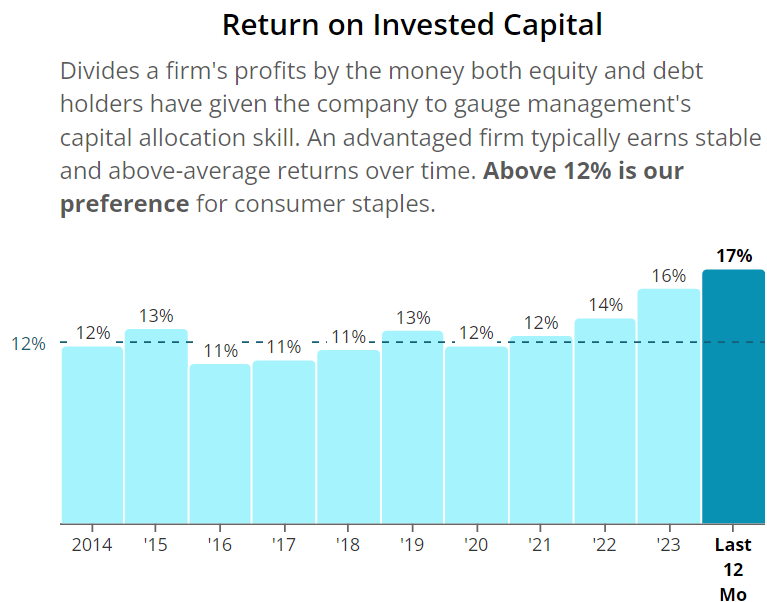

The ROIC is above the minimum we like to see for this consumer staples industry with 17% on a trailing twelve-month basis.

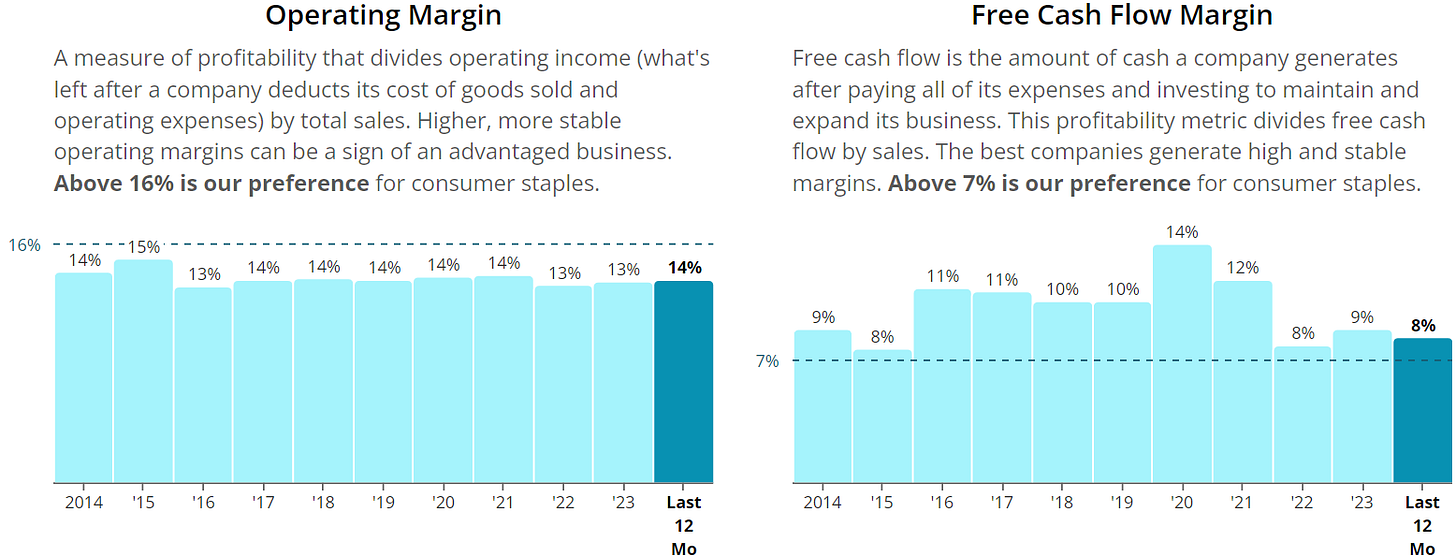

There operating margin, while lower than the 16% we want to see, has been very consistent at the 13-15% level on a year on year basis.

The FCF margin looks good above the 7% minimum, 8% on a trailing twelve-month basis.

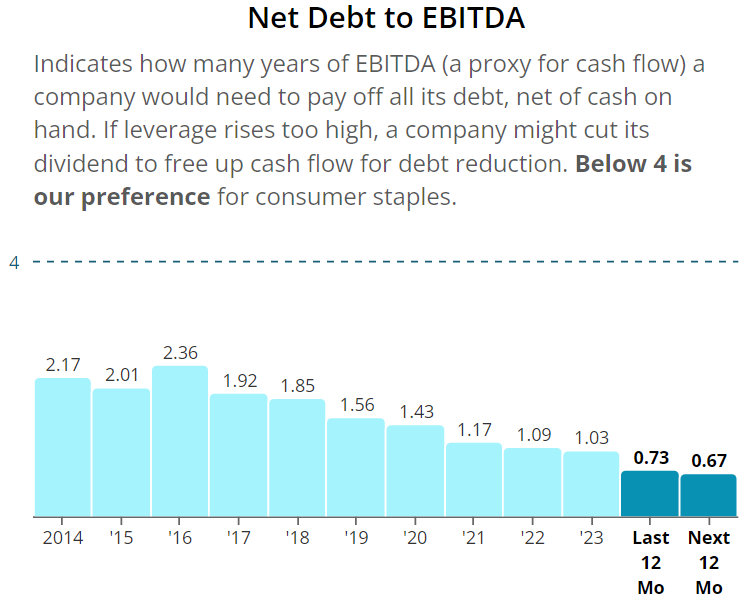

Excellent Balance Sheet, with Net Debt to EBITDA lowering every single year, sitting at 0.73 on a TTM.

As per below, Wall Street see 30% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $132

So, in conclusion for KOF, we see around a 35% margin of safety around the $86 mark with Wall Street indicating 30% upside.

Applied Material (AMAT)

Applied Materials, Inc. is an American multinational company and one of the world’s leading suppliers of equipment, services, and software for the semiconductor, display, and related industries.

Founded in 1967 and headquartered in Santa Clara, California, Applied Materials plays a crucial role in the design and manufacturing of chips and advanced display technology, providing essential solutions for the production of smartphones, computers, televisions, and other digital devices.

AMAT is up 235% over the last 5Y and has significantly outperformed the S&P 500 in this period.

Dividend growth is very strong with an average of 12% increase on a year-on-year basis over the last 10Y.

ROIC looking very very good, 31% on a trailing twelve-month basis.

We see operating efficiency with margins increasing over the last 10Y from 17% to 29%.

FCF looking very strong and consistently too.

Excellent Balance Sheet, with Net Debt to EBITDA very low consistently, sitting at 0 on a TTM.

This means it would not even taken Applied Materials, one day to pay off all of their debt net of cash on hand.

As per below, Wall Street see 30% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $237

So, in conclusion for AMAT, we see around a 20% margin of safety around the $189 mark with Wall Street indicating 30% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $30 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Conclusion

We have just gone through 2 Companies that we believe could be considered as high quality undervalued stocks in the market right now to consider in the portfolio.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.